by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Update on the coronavirus and the FOMC meeting begins today. Asian equity markets remain under pressure, but Europe and the U.S. are stabilizing. U.K. defies U.S. on Huawei (002502, CNY 2.99) Here is what we are watching this morning:

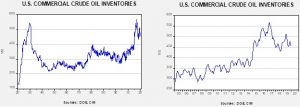

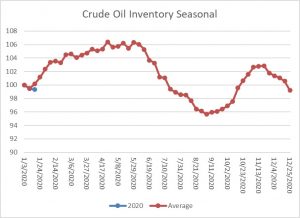

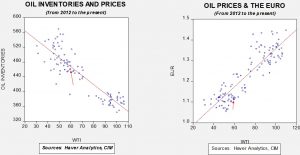

Coronavirus: The infection rate and death toll continue to mount. Infections are now over 4,500 and the death toll is over 100. Hong Kong is increasing travel restrictions from the mainland. The quarantine hospital in Beijing has reopened to deal with the Wuhan virus. In what could be a significant disclosure, the mayor of Wuhan, Zhou Xianwang, reports that rules imposed by the central government limited what could be disclosed in the early stages of the outbreak. This puts the Xi government in a bad light, suggesting it is making similar errors to the SARS crisis and exacerbating the spread of the disease. Japan reported its first domestic transmission of the virus. Meanwhile, governments are moving to evacuate citizens from Wuhan; the worry is that they may be inadvertently spreading the disease, although it would be a true “own goal” if these evacuees are not monitored closely. The CDC has expanded its travel warning to all of China. In a rather curious development, China has been receiving donations from Western firms. As the virus spreads, worries about the hit to global growth are rising as well. We suspect this event will reduce growth; the collapse in oil prices is clear evidence that market participants think so too. However, it is also important to remember that one of the functions of the financial markets is to offer a place where such events can be discounted. It is quite possible that some markets are underestimating the impact, while others are overdoing it a bit. The fact that European and U.S. equity markets are stabilizing is probably an example of properly discounting the impact of distance from the epicenter of the pandemic. What remains to be seen is if the Asian equity markets (or oil prices, for that matter) have overestimated the effect.

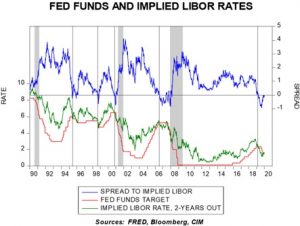

FOMC: Although no change in rates are expected, Chair Powell will almost certainly be peppered with questions in the press conference about the expansion of the balance sheet. Although the official line from the committee has been that the expansion to protect the repo market was not QE, financial markets have, thus far, ignored those directives. In other words, markets are treating this as QE4. Thus, there is a risk that if the Fed moves to withdraw the liquidity, financial markets might not take it well. It should also be noted that committee members are far from united on policy; although we suspect these divisions will lead to stasis in the short run, in the long run, it makes divining the path on policy much more difficult. However, for now, we expect the Fed to maintain steady rates and keep ample liquidity in the financial markets. Still, any hint of reducing the balance sheet may not be taken well.

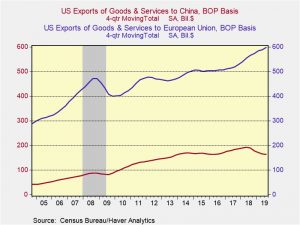

Britain: The U.K. has officially defied the U.S. and will allow a limited level of Huawei products into its telecommunications system. The Johnson government believes it can restrict the use of Huawei products and thus reduce the chances that the equipment could compromise security. This will not be taken well by Washington because the policy will likely be adopted by the rest of Europe as well. We will be watching to see what sort of retaliation will be delivered by the U.S. At a minimum, the decision could put the British on the defensive as they try to negotiate a new, post-Brexit trade deal with the U.S.

United States-Japan-South Korea-France: The “Five Eyes” intelligence-sharing alliance (the U.S., the U.K., Canada, Australia and New Zealand) has reportedly begun to coordinate with Japan, South Korea and France to better track North Korea’s missile program and sanctions busting. The “Five Eyes Plus” framework also includes Germany on issues related to the cyberthreat from China. In spite of the trade and defense budget tensions among the allies, the expanded intelligence sharing is a welcome sign that the countries can still cooperate against clear threats.

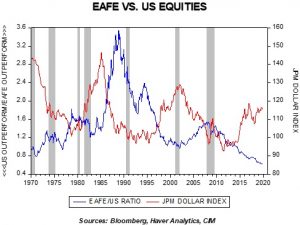

Eurozone: The ECB said six Eurozone banks have failed to meet their capital requirements, up from just one bank last year. Most concerning, the report said that because of bad business models and poor internal governance, “most significant institutions” in the Eurozone don’t even generate enough earnings to cover their cost of capital, which naturally impedes their ability to build internal capital, or raise new equity. That goes far toward explaining the weak investment performance of many Eurozone banks over the last decade. Given the prevalence of banks in the European stock market indices (and in the broader international indices as well), it also helps explain the outperformance of U.S. stocks over the same period.

Russia: Kremlin-controlled natural gas monopoly Gazprom said it will complete the NordStream 2 gas pipeline from Russia to Germany by itself, after several European firms pulled out of the project. The decision is being reported as a victory for the U.S. sanctions announced last month, which were designed to impede Europe’s increasing dependence on Russian gas. It now looks like the project will be completed anyway, which will also reduce the potential market for U.S. gas exports.

Odds and ends: Tech firms are becoming increasingly worried they will face a patchwork of regulations, so they are pushing for a global regulator; of course, a single regulator is easier to capture. The EU is warning the U.K. that it should not try to make deals with individual nations in trade negotiations. Although this is technically impossible (individual nations in the EU give up their right to make their own trade pacts) the U.K. could use threats on various industries to sway talks. The U.S. is telling the EU that if they want a trade deal, they are going to import the “boogeyman” of agricultural products, the chlorinated chicken. The ceasefire in Libya is breaking down.