Daily Comment (January 9, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Financial markets are taking on a clear risk-on bias; equities continue to lift, bonds, gold and oil are struggling. Here are the details:

Ceasefire: As we noted yesterday, Iran launched missiles against U.S. bases in Iraq. The attack was a mere pinprick, with no casualties reported. At the time of our publishing, the White House hadn’t officially responded, but in a press conference President Trump made it clear that he viewed the Iranian action as tolerable and no further military response was necessary. To some extent, the Iranian missile attack almost seemed choreographed. The U.S. knew the action was coming and moved troops out of harm’s way. The Iranian media is claiming numerous casualties, suggesting that Iran felt it had to respond but didn’t want to start a war. The “needle” Iran is trying to thread is to appear strong but avoid a direct military conflict with the U.S. We will be watching to see how successful they are in their quest.

For the time being, equity markets are getting just about everything they could want. A war in the Middle East has been avoided. Monetary policy is accommodative. The Phase One trade deal with China appears to be on its way. All this good news doesn’t mean that there aren’t concerns but in the immediate term, conditions for equities are clearly favorable.

United States-Iran-Canada: Although it looks like the U.S. and Iran are stepping back from any military conflict, it may be important to keep an eye on the airliner crash that killed 176 people in Tehran just hours after Iran’s retaliatory attack on U.S. bases in Iraq yesterday. According to Ali Abedzadeh, the chief of Iran’s aviation agency, the plane was on fire before it hit the ground, and investigators remain open to the possibility that it was hit by a projectile or explosion. That could give Iran an opening to accuse the U.S. of bringing down the plane. Indeed, given that Iran has likely been chastised by the assassination of Gen. Soleimani, we would now expect it to redouble its political pushback against the U.S. in the Mideast. Pressuring Iraq to expel U.S. forces will be a top focus, but it also might be helpful for Iran to create suspicions that the U.S. had reverted to terrorism. Such suspicions could also help drive a wedge between the U.S. and key allies like Canada, since over 60 of those killed in the plane crash were Canadians.

China: Although China’s headline CPI remains elevated at +4.5%, pork price increases finally appear to be slowing. Pork prices rose 97% in December, down from 110% in November. PPI continues negative, but only down 0.5%. Overall, the inflation situation in China remains a concern but the momentum does appear to be heading in a positive direction. Car sales in China fell again, down 7.4% from last year, at 20.7 mm units. The new respiratory virus we mentioned yesterday is apparently a coronavirus. This virus type is best known for causing the common cold. The bad news is that it is a new virus; the good news is that it doesn’t seem to spread via human to human contact.

Taiwan-China: In the run-up to Taiwan’s presidential election on Saturday, Foreign Minister Wu said that if incumbent President Tsai Ing-wen wins as expected, she plans to pursue a “sustainable, predictable and peaceful relationship” with China. The statement is being seen as an olive branch to Beijing, which could help solidify the president’s status as frontrunner in the race and help calm market concerns about future confrontation.

Brexit: The EU and U.K. are starting the process of trade talks. The British stance appears to be attacking trade by individual market rather than by building a grand bargain. By moving piecemeal, negotiators can continue to make progress and can likely go beyond the 2020 deadline if enough progress is made. However, there are a couple of dangers in this plan. First, by not working in a unified fashion, loopholes could develop that will be unforeseen during talks and second, there is the potential to become unexpectedly stuck on an issue that becomes contentious. Still, this looks like the best plan available given the short time frame.

At the same time, Bank of England Governor Carney said central bank officials are considering a new round of monetary stimulus “to reinforce the expected recovery in U.K. growth and inflation.” The threats of a delayed trade deal and looser monetary policy have combined to push the GBP sharply lower.

World Bank: The World Bank issued its global GDP forecast for 2020; it is looking for a modest rise to 2.5%, up from 2.4% in 2019. Trade concerns are a key factor in weakening growth. This forecast represents a downgrade of 0.2% from those made earlier in 2019.

France: Today left-wing trade unions are staging their fourth mass demonstration against President Macron’s proposed pension reform. Several unions have been on strike since early December, and even the moderate Confédération Française Démocratique du Travail is urging its 600,000 members to take part in a protest on Saturday. The strikes and protests come despite a series of government concessions. If Macron can consolidate the pension system and raise the retirement age as planned, the French budget would likely see big savings and the economy would probably get a boost. However, it remains unclear whether Macron will be successful.

Spain: Socialist Party leader Sánchez was finally sworn in as prime minister yesterday, after his coalition with the radical-left Podemos Party gave him a two-vote majority in parliament. That may seem like a fragile hold on power, but the Spanish constitution says a prime minister can’t be brought down by a no-confidence unless an absolute majority of legislators votes for an alternative candidate. Given Spain’s fractured parliament, that is seen as quite difficult. For now, Sánchez will be in a decent position to push his agenda of increased government spending, reforming labor laws to bolster unions and negotiating with Catalonia over its place in the republic. We think that will be positive for Spanish stocks in the near term.

The Chamber: Tom Donohue, the CEO of the chamber of commerce, will deliver a speech today, where he is expected to support issues like climate change legislation and infrastructure investment. He is also expected to support immigration liberalization. As the GOP becomes increasingly populist, the divergence seen between the party and the chamber reflects the fact that populism isn’t business friendly.

Energy update: Crude oil inventories rose 1.2 mb compared to an expected draw of 3.0 mb.

In the details, U.S. crude oil production was unchanged at 12.9 mbpd. Exports fell 1.4 mbpd while imports rose 0.4 mbpd. The rise in stockpiles was unexpected.

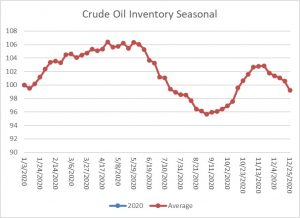

This chart shows the annual seasonal pattern for crude oil inventories. Because this is the first week of the year and the data is indexed to that week, the current reading and average are both equal to 100. As the chart shows, oil inventories usually rise into late spring and then decline significantly into late summer. Last year, this pattern was disrupted to some extent because of exports.

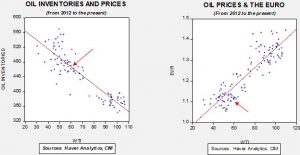

Based on our oil inventory/price model, fair value is $63.59; using the euro/price model, fair value is $51.74. The combined model, a broader analysis of the oil price, generates a fair value of $55.39. We are seeing the divergence between dollar and oil inventories narrow as dollar weakness persists. Given the level of geopolitical risk, prices have not moved significantly above the inventory fair value price, although the combined model would suggest a richly valued market. With inventories poised to rise seasonally and tensions seemly easing, softer prices are more likely in the coming weeks.