by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

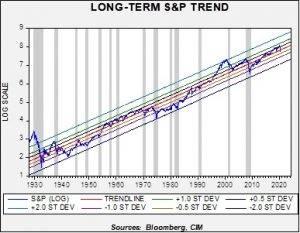

Happy Friday! It’s employment Friday, although this may be one of the most irrelevant reports ever. Since the survey is conducted around the 10th of the month, much of the jump in claims won’t be reflected in this report. But, our quick take is that the weakness was profound as payrolls plunged 701k and the unemployment rate jumped to 4.4%; we have the details below. We update the COVID-19 news. Global stocks are under pressure, while oil makes a historic rally. Here are the details:

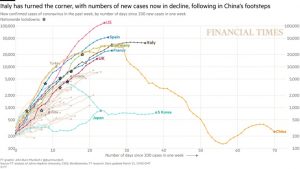

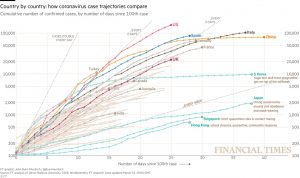

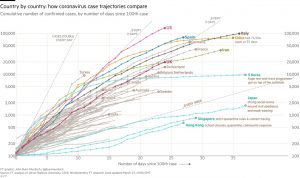

COVID-19: The official number of global cases is 1,030,628, with 54,137 fatalities and 218,771 recoveries.

The virus news:

- As the data above show, there are now over 1.0 million reported cases of the virus. We believe this is a deep undercount. A new concern has emerged: the tests for the virus may be much less reliable than we thought and could be generating false negatives. In one sense, if a person is sick and getting tested, a false negative probably won’t change their behavior. They don’t feel well in the first place, which is why they wanted to be tested. However, false negatives bring an undercount and will make the virus appear more deadly than it actually is.

- The real fix is a vaccine; although there is hope that one might emerge by autumn, more likely we will see one by H1 2021.

- NYC is looking increasingly grim. The city now has 45 mobile morgues in operation as the city’s death toll is now over 1,500.

- Critical drugs necessary to treat patients of COVID-19 are in short supply, exacerbating difficulties. Having a ventilator but lacking the drugs to sedate a user makes the device less effective.

The policy news:

- The special lending and cash distribution programs are starting to operate and the early read is not encouraging. The details of the small business loan program have not been fully determined. Community banks complained about the interest rate on the loans, so the administration lifted it to 1% instead of 0.5%. Meanwhile, distribution of virus checks may not be fully realized until September. Passing the laws to stimulate the economy was a major win, but execution is the next step and, given the scale of the programs, it will not be seamless. And, the administration has apparently eased regulations on paid leave, which could reduce its effectiveness.

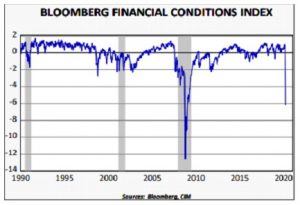

- One of the problems in managing a crisis is that it is hard to determine how intertwined an area of the market is to the entire system. If Bush administration officials had realized how important Lehman debt was to the money market sector, we doubt they would have let the firm fail. At the same time, there is always a worry that if you bail out everyone, you create moral hazard; in other words, policymakers reward bad behavior.

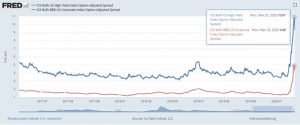

- We are seeing a dramatic spike in credit downgrades, leading to a cascade of fallen angels.[1]

The chart shows that for the month ending March 20, $32 billion has left investment grade. The past two weeks have been far worse. A net $560 billion of corporate debt has been downgraded, with $97 billion now officially fallen angels.

- The Fed’s various support programs purposely exclude high yield. Bill Dudley, the former NY FRB president, recently argued that the Fed should not include such bonds on the basis of moral hazard. We understand the sentiment but would argue that now is not the time to enforce market discipline because it is very difficult to know which debtor will trigger systemic problems and which won’t.

- We have been generally optimistic, all things considered, because of the aggressive policy response. Although we remain so, we are worried that the combination of the lack of execution and short-sighted reluctance to support all borrowers will trigger unanticipated negative outcomes. To quote the recently departed Kenny Rogers, “…there will be time enough for countin’ when the dealin’s done.”

- Another area to watch is mortgages; defaults are almost certain to spike, and we doubt the nation would tolerate another response like we saw after the Great Financial Crisis.

- Members of the FOMC are pressing for more fiscal stimulus.

The economic news:

- As we continue to digest the incoming U.S. economic data and how it’s starting to reflect COVID-19, we think it’s important to emphasize that the March ISM Manufacturing Index released this week probably overstated the health of the factory sector. The overall index fell to 49.1 in March, only modestly below the 50 level that indicates expansion, and not dramatically weaker than the readings of 50.1 in February and 50.9 in January. The figure for March was actually above every reading from August through December 2019. The problem is that the overall figure is the average of five subindexes (new orders, production, employment, supplier deliveries, and inventories), and the subindex on supplier deliveries has been distorting the overall number for several months running. That subindex measures how long it takes for manufacturers to get their supplies delivered once they’ve placed their orders, with the idea that delayed deliveries are a sign of high demand and strong factory activity. When the subindex is higher, it means more manufacturers are experiencing delayed deliveries. The problem is that the recent high numbers for the subindex are more a reflection of supply chain disruptions from last year’s trade war and this year’s virus shutdowns rather than high demand or strong manufacturing activity. Excluding the distorted supplier delivery subindex from the calculation, the overall ISM Manufacturing Index for March would have been just 45.2, its lowest reading since May 2009. That’s additional evidence that the economy has now slipped into a deep contraction. Since the virus shutdowns are sure to keep the subindex on supplier deliveries high over at least the next couple of months, we’ll continue to focus on our adjusted measure of the ISM index to get a better sense of how the factory sector is faring.

- The chart above shows how the ISM Manufacturing Index, if computed excluding the subindex on supplier deliveries, is now at its lowest level since late in the Great Recession of 2008-2009.

- We are seeing a steady stream of reports of layoffs, buyouts, and furloughs. We are also seeing reports of wage cuts to maintain employment.

The market news:

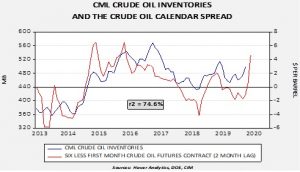

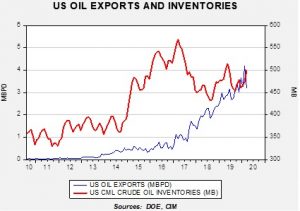

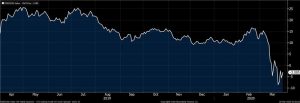

- The key market news is oil. Prices leaped yesterday on reports that President Trump had engineered a meeting of OPEC and Russia with tentative promises of production cuts. Prices are higher this morning on reports that OPEC+ will hold a virtual meeting on Monday to discuss output reductions.

- It appears the KSA is trying to get as broad of a group as possible to agree to reductions. This makes sense. The wider the agreement, the better the chances of success…with one caveat. Cartels always suffer from free riders. Although all participants benefit from output constraints, an individual member has a great incentive to cheat. We do expect some sort of deal on Monday, with promises of 10.0 mbpd of production cuts. We do not expect cuts of this magnitude to be achieved. At best, 3.0 to 5.0 mbpd is about all that can be expected, and we seriously doubt Russia will actually cut anything. Failing to make any sort of deal at this meeting would be a disaster but it would be naïve to expect that compliance will be anywhere near what is promised. This doesn’t mean a deal won’t have an impact; if the KSA doesn’t raise output to 12.0 mbpd, we probably avoid single-digit oil prices. But, even with a deal, demand destruction is still a reality and prices in the $20s will be with us for a while.

- Add this industry to others that have found fortune in the era of COVID-19.

Foreign policy:

- Russia has extended its stay-at-home order, while Brazil continues to shun such measures.

- It appears the U.S. and China have engineered a truce of sorts in their recent rhetoric battle.

- The IMF is poised to support the EM markets with a $1.0 trillion loan package.

[1] A fallen angel is an investment-grade bond that has been downgraded to junk status and can no longer be held in an investment-grade bond portfolio.