Asset Allocation Quarterly (Second Quarter 2020)

- The prospect of a recession in the U.S. is nearly a foregone conclusion. The depth will likely be severe, but the duration could be brief.

- Actions over the past two weeks by the U.S. Federal Reserve should help mitigate the economic crisis, potentially avoiding problems faced in past downturns.

- The stimulus package signed into law on March 27 offers further assistance for lessening the duration of the contraction.

- Our three-year forecast is for a recovery and even the potential for expansion toward the end of the forecast period.

- Risk assets, especially U.S. equities and even corporate bonds, are at attractive valuations in our view.

- Each strategy now has elevated exposure to equities with a tilt toward growth over value.

- Though long-term Treasuries have likely run their course, the use of gold as a stabilizer for the strategies remains appropriate.

ECONOMIC VIEWPOINTS

The COVID-19 virus has plunged the U.S. and global economies into a recession faster and more violently than anyone had forecasted even a month ago. Sheltering at home has ground economic activity to a near-standstill and has resulted in an astounding increase in unemployment claims and consequent business inactivity. Nearly simultaneously, the price of oil has collapsed, owing to the market share battle waged between the Kingdom of Saudi Arabia [KSA] and Russia. A third concern, that of increasing financial stress, has been addressed and potentially allayed by the recent actions of the Fed. Since the beginning of March, the Fed has responded with the following, among other measures:

- Cutting fed funds by 1.50% to 0.00%-0.25%;

- Expanding its repo operations, effectively offering an unlimited amount;

- Resuming Quantitative Easing as open-ended, announcing thee intention to buy $375 billion in Treasuries and $250 billion in mortgage-backed securities for the week of March 23 alone;

- Supporting money market funds through the Money Market Mutual Fund Liquidity Facility, allowing banks to pledge collateral they purchase from prime money market funds.

- Resurrecting the Primary Dealer Credit Facility, offering rates as low as 25 basis points to primary dealers with investment-grade debt, including municipals, and equities being used as collateral;

- Encouraging bank lending by lowering the discount window rate to 25 basis points and extending the term to 90 days from overnight;

- Relaxing regulatory capital requirements and liquidity buffers in an effort to stimulate lending;

- Establishing two new facilities to support high-grade U.S. corporations: the Primary Market Corporate Credit Facility – allowing the Fed to buy new corporate bond issues and extending loans; and the Secondary Market Corporate Credit Facility – allowing purchases of not only existing corporate bonds, but also ETFs holding investment-grade rated bonds.

These historic measures by the Fed have the potential to avoid the issues associated with most prior recessions where the financial system exacerbated the problems.

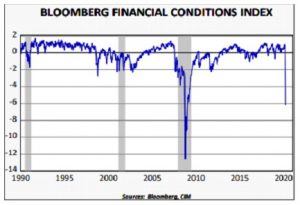

Despite the Fed’s actions, the magnitude of the impact of COVID-19 on the economy remains to be seen. Due to the lag in data reporting, many indicators won’t turn decidedly negative until reports are released in April and May. However, we have noted a sudden decline in financial conditions as measured by the Bloomberg Financial Conditions Index for the U.S., which is compiled daily and comprises eight variables.[1] The more negative the reading, the greater the level of financial stress. It clearly indicates a substantial impact from the economic inactivity inflicted by the disease.

Our forecast is for a dramatic decline in U.S. GDP recorded for the second quarter of this year, with the potential to stretch into the third and fourth quarters should a second wave of the virus assert itself in autumn. However, over the full three-year forecast period, we anticipate that a U-shaped recovery will engage, accompanied by an unleashing of pent-up demand from businesses and households awash in liquidity.

[1] The eight variables contained in the index are the TED spread, LIBOR/OIS spread, commercial paper/T-bill spread, Baa/10-Year T-Note spread, Muni/10-Year T-Note spread, swap volatility, S&P 500 and VIX.

STOCK MARKET OUTLOOK

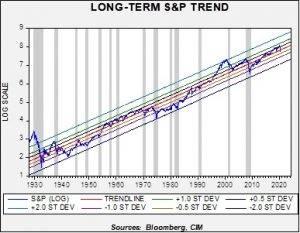

Although our near-term view is that domestic and overseas equity markets will be in search of new footing, we believe that in the absence of a policy mistake equity markets should recover over the course of our three-year forecast period. That is not to imply that in the interim all will be roses and buttercups for corporations and equity investors. The combination of the pandemic, the “oil war” between Russia and the KSA, and the global recession will naturally cripple corporate earnings. Our updated EPS estimate for the S&P 500 is $127 for 2020. A resurgence of the virus in autumn and/or a policy mistake, such as a failure to follow the $2 trillion stimulus bill with additional legislation in the event of a more severe and durable economic contraction, could plunge equity prices even lower. However, the policy responses thus far have been heartening.

The downturn may provide an opportunity for companies to write down some inflated assets, such as intangibles, and revise compensation structures to appease governance-focused institutional investors. In addition, share repurchase programs are likely to be curtailed, reducing this form of demand for shares, and in the near term, dividends may be suspended by a number of firms as they address the business impact over the next several months. However, over our forecast period, dividends are likely to become the preferred means by which to reward shareholders, thereby replacing share repurchases. Over the course of the next three years we anticipate that pent-up demand, the realignment of supply chains, and builds in corporate inventories will lead to a recovery in equity prices from today’s attractive valuations.

In summary, current pressures associated with COVID-19 and the oil war may continue to build over the next several months, placing more downward pressure on equities. However, we find valuations to be enticing, even factoring in a temporary plunge in EPS for this year. Accordingly, over our forecast period we believe that stocks hold remarkable appeal and will be viewed as such when we look in the rearview mirror in 2023.

Among U.S. equities, a tilt now exists in favor of growth over value and we increase the allocation to the quality factor focusing on profitability, earnings quality, and lower leverage. Within large cap sectors, we established an overweight to Consumer Discretionary, given expectations for performance once constrained demand from COVID-19 is revived, while maintaining the overweight to Technology and Communication Services.

In contrast, overseas developed markets hold lesser appeal, given the current and anticipated continued strength of the U.S. dollar. Until a durable catalyst for weakening the U.S. dollar becomes evident, the strategies will continue to exclude non-U.S. developed market exposure. For the more aggressive strategies, however, we find that emerging markets have largely discounted the effects of a strong dollar, COVID-19, and the oil war. Emerging markets ex-China are trading one-third lower than they were at the end of last year. Accordingly, we have introduced exposure to emerging markets in the higher risk strategies, Growth and Aggressive Growth.

BOND MARKET OUTLOOK

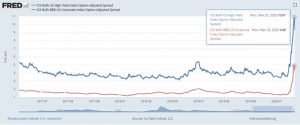

The extraordinary measures employed by the Fed have helped to ratchet down yields across the curve and thus far have effectively rescued the commercial paper and investment-grade corporate bond market. While these measures excluded the high-yield bond market, the stimulus package passed by Congress on March 27 provides the potential for remedy. Within the package is a tax carryback provision allowing companies to use losses incurred from 2018-2020 to offset profits from prior years. This may provide continued life support for a number of high-yield entities. As the chart shows, spreads for both investment-grade and high-yield corporate bonds rapidly widened over the course of the past month yet have declined over the past week due to both Fed intervention and anticipated assistance from the stimulus package.

While the Asset Allocation strategies benefited from employing long-term Treasuries as stabilizers through last quarter’s equity market turbulence, we find continued upside to be limited as there is a risk that the U.S. encounters a lift in inflation this summer from surging demand, which would pressure the long-end of the curve. The potential for an increase in rates over the full three-year forecast period encourages our substantial reduction of long-term bonds in the income-oriented strategies and their elimination from the Growth and Aggressive Growth strategies.

OTHER MARKETS

The combination of our forecast for rates and the significantly attractive pricing caused by the market decline leads to the continued exposure to REITs in the more conservative Income with Growth strategy. Although the office/retail segment will obviously struggle this year, the more diversified pool of REIT enterprises including data storage, cell towers, and timber lessens the impact retail and office formerly held.

We retain the prior elevated allocation to gold given its ability to offer a potential hedge against geopolitical risk. In the more risk-seeking strategies of Growth and Aggressive Growth, gold is complemented by small positions in silver, which we find can magnify the advantages of gold. Another potential advantage of silver is that roughly half of its demand is from industrial uses, which can be supportive of its price during an economic recovery.