by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Happy Tuesday! Or if not “happy,” at least things are “interesting.” U.S. oil prices yesterday not only went negative, but deeply negative. As always, we discuss the coronavirus crisis and its latest implications below, along with reports of a new government in Israel and indications that North Korean leader Kim Jong Un may be dying.

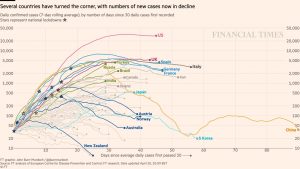

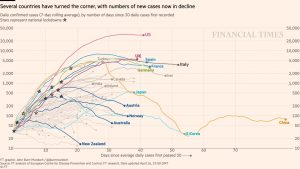

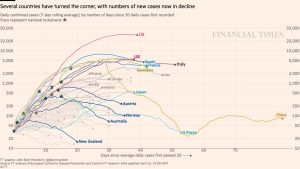

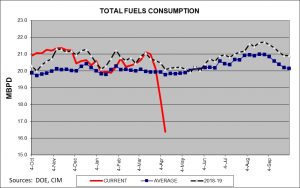

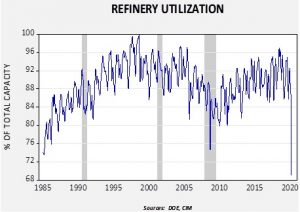

COVID-19: Official data show confirmed cases have risen to 2,495,994 worldwide, with 171,652 deaths and 658,802 recoveries. In the United States, confirmed cases rose to 787,960, with 42,364 deaths and 73,527 recoveries. Here is the chart of infections now being published by the Financial Times:

As shown, many major countries have passed the “bend in the curve” and are seeing slower case growth, but few are exhibiting sharp declines in the number of new infections.

Real Economy

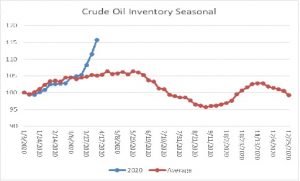

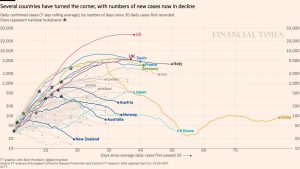

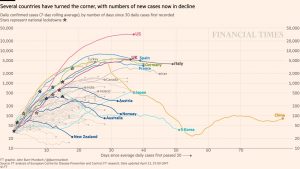

- Crude oil futures prices did something never seen before yesterday: prices fell below zero!

-

- We have seen below-zero prices in some commodity cash markets in the past. Last summer, cash natural gas prices fell below zero in some Texas markets. This situation can occur in the cash markets when it costs more to “haul the stuff away” than it is worth.

- So, what happened here? Strange things can occur at contract expiration. For nearly 16 years, I[1] worked in the futures department of A.G. Edwards, analyzing oil, foreign exchange, and fixed income futures markets from 1989 to 2005. Our policy was that if a client was in an expiring month contract five days before expiration date, they had to prove they could make or take delivery of the commodity. If the trader could not do so, the firm forced the trader to liquidate the position five days before the contract expired. We did that because it is almost impossible to know what could shift a price at expiration.

- The most obvious answer to yesterday is that there was forced selling. The most likely candidate was the United States Oil Fund ETF (USO, 3.75 -0.46). This ETF buys the nearby contract of crude oil on a rolling basis. The value of the fund comes from three sources—the interest rate from margin (they fully fund their oil purchases), the price of oil and the “roll yield.” The roll yield is the price paid on the next contract. So, if the term structure of oil futures is backward, where the nearby price is above the deferred price, at the roll when one contract expires and the next contract is purchased, there is a gain because the contract being purchased is cheaper than the one being sold. Under conditions of contango, when the deferred price is above the nearby, there is a loss on the roll yield. Needless to say, the roll yield losses will be large this time around. USO started staggering its positions; it doesn’t just hold the nearby contract alone, so its losses were not as great as nearby futures. But, it still held 25% of the nearby long open interest going into today. And so, it was likely liquidating positions into a market with no buyers.

- Could a person take advantage of this situation? In other words, “buy” May crude at -$40 per barrel and deliver it to a deferred month, let’s say, June, at +$21 per barrel. Yes, you could, IF you could (a) find storage, and (b) deliver it to the Cushing oil hub. The fact that this isn’t happening reflects the likelihood that neither of these conditions can occur with certainty or at a reasonable cost.

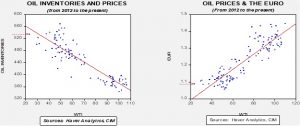

- Is the price real? If one were long May futures, the margin call would certainly be “real.” But it doesn’t reflect the economic value of oil. The June contract is a better reflection of the actual price. However, the debacle in the May contract clearly shows that oil demand is weak and supplies are excessive, and without outside action to either boost the former or curtail the latter, the June futures are likely destined to decline into the low teens. We always had doubts about OPEC and others actually curtailing output. Today will likely encourage the government to take steps to prevent a complete collapse of the U.S. oil industry. It remains to be seen what may happen, but here are some possibilities:

- If Congress approves funding, 70 mb or so could go into the Strategic Petroleum Reserve (SPR). A twist on this plan—the government could sell oil out of the SPR for export, capturing the higher price for Brent and punishing OPEC+ for not actually reducing output aggressively. The increased storage (from selling oil in the SPR now) could be used to support the domestic industry.

- The government pays oil companies to not produce oil.

- The government does nothing and the market forces production to fall to where the market clears.

- Of course, the other side of this issue is whether this is a buying opportunity in energy? It is, but not in the immediate term. At some point, enough production will be removed and demand will recover. But, if the government acts to protect producers, this process will make it more difficult to determine winners and losers. So, for now, patience is recommended.

- On a related note, Saudi Arabia and other OPEC members are reportedly considering reducing their oil output as soon as possible, rather than waiting until next month when the group’s recent production-cutting agreement with the U.S. and Russia is set to begin. The move would aim to help shore up prices, but the report quotes a Saudi official as admitting that, “it might be a little bit too late” (ya think?).

- In the meantime, global oil prices remain under intense pressure today, with Brent dropping below $20 per barrel for the first time in 18 years and the June WTI contract approaching $10 per barrel. Producing countries’ currencies, such as the Russian ruble and the Mexican peso, are likewise weakening.

- We have seen below-zero prices in some commodity cash markets in the past. Last summer, cash natural gas prices fell below zero in some Texas markets. This situation can occur in the cash markets when it costs more to “haul the stuff away” than it is worth.

- The Chinese government has reportedly approached several Asia-Pacific countries to discuss the possibility of easing border controls and allowing some “essential” business travel to resume.

- As Germany allowed some smaller retail shops to re-open yesterday, reports said visits were significantly higher than expected. The reports suggest pent-up demand could be strong when restrictions are lifted in other countries, but mass shopping could also raise the risk of reaccelerating infections.

- Separately, we continue to see signs of financial stress building up for state governments, as virus lockdowns decimate their tax revenues, while unemployment and healthcare expenses surge.

- New York and Massachusetts have already burned through more than half their unemployment trust funds, and several other states are approaching that marker.

- As provided for in federal law, New York yesterday requested a $4 billion loan from the U.S. Treasury to make sure it can keep paying benefits.

U.S. Policy Responses

- An analysis by the Financial Times shows dozens of large, publicly traded companies borrowed under the Payment Protection Program (PPP) of small business loans before its initial $350 billion in appropriations ran out last week. Public anger over the big firms crowding out needier small companies could have important political repercussions.

- Meanwhile, congressional leaders and the Trump administration are closing in on a more than $450 billion agreement that would replenish the PPP with an additional $310 billion, provide $75 billion in new funding for hospitals, and appropriate $25 billion for expanded virus testing.

- To help ease the strain on mortgage companies, the Federal Housing Finance Agency is weighing whether to allow Fannie Mae and Freddie Mac, the government-controlled mortgage-finance giants, to buy home loans that recently entered forbearance.

International Policy Responses

- Ahead of an EU summit on Thursday, leaders from the harder-hit, poorer countries continue to push for aid and deference from the richer creditor countries:

- Spanish Economy Minister Calviño called on the EU to create a €1.5 trillion coronavirus recovery fund. The fund would award grants to the bloc’s weaker countries to help them remain competitive versus states in better financial positions to fund business rescues and stimulus packages.

- Polish Finance Minister Kościński insisted that any new fiscal support program should be funded by new taxes, including a crackdown on tax havens, digital taxes, and financial transaction taxes.

- Italian Prime Minister Conte continues to push for mutual EU “corona-bonds” to fund bloc-wide recovery efforts.

- In China, even though the central bank has cut interest rates and reduced required reserve ratios, reports show banks are still reluctant to provide enough credit to small and medium firms, keeping their recovery well behind that of larger firms.

Israel: Prime Minister Netanyahu and his rival, Benny Gantz, have agreed to form a unity government, averting the prospect of a fourth election in the last year.

North Korea: Citing a U.S. official with direct knowledge, press reports say North Korean leader Kim Jong Un is in critical condition after undergoing emergency heart surgery at a private villa in Pyongan Province.

[1] This is Bill “speaking” here.