Daily Comment (April 7, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

After yesterday’s strong market action, investors are again in risk-on mode based on optimism that the coronavirus pandemic may be peaking. We report on all the key developments relating to the virus as well as building pressure for a cut in oil production and Chinese use of the pandemic as cover for more mischief in the South China Sea.

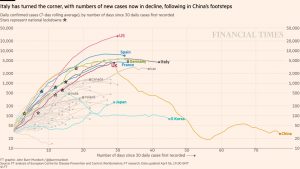

COVID-19: Official data show confirmed cases have risen to 1,362,936 worldwide, with 76,373 deaths and 292,188 recoveries. In the United States, confirmed cases rose to 368,449, with 10,993 deaths and 19,919 recoveries (though the recovery data is lagging). Here is the chart of infections now being published by the Financial Times:

Virology

- For the first time since January 20, there were no reported deaths from the coronavirus in China (though it’s important to remember the country is suspected of seriously underreporting its experience with the virus). Of the 32 new infections reported in the country, all were in patients arriving from overseas. As shown in the chart above, multiple key countries are now showing the “bend in the curve” that suggests the rate of infection is slowing, even if the peak in deaths is probably still in the future.

- President Trump continues to press for widespread use of the antimalarial drug hydroxychloroquine to prevent coronavirus infections.

- That suggests Trump is taking the advice of international trade advisor Peter Navarro rather than top pandemic advisor Dr. Anthony Fauci, who has asserted that the small studies to date on the drug’s effectiveness are “at best, suggestive.”

- India said it is now willing to start exporting hydroxychloroquine again, but with restrictions. According to the foreign ministry, it will focus its shipments on neighboring countries that have few alternatives to Indian supplies and countries where the virus outbreaks are the worst.

- Scientists are starting to investigate whether people’s genetic variations explain why some of the infected have only slight symptoms, while others get much more sick and die.

Real Economy

- In a new poll, 73% of Americans said the pandemic has reduced their family’s income, with 24% saying their income has been cut “very significantly.” In the poll, conducted in late March, 71% of respondents said the pandemic had affected their personal or business activities, including travel and investments. In a similar poll conducted in February, only 13% said the same. The new poll also showed 62% were avoiding public places, 48% were changing or cancelling travel plans, and 35% were putting off a large purchase.

- Facing a continued rise in Japanese cases, Prime Minister Abe has declared a state of emergency that will give governors in seven prefectures the power to request business closures to increase social distancing.

- Philippine President Rodrigo Duterte has approved the extension of a community quarantine across the island of Luzon until April 30.

Financial Markets

- Goldman Sachs (GS, 158.23) has published a new analysis showing companies in the S&P 500 Index will cut their stock repurchases by half this year compared with last year, weakening a key prop for stock prices as they shore up their balance sheets.

- In the debt markets, continued downgrades by the major ratings firms have tripled the total value of “fallen angel” bonds (corporate obligations that previously were considered investment grade) to more than $120 billion in just the last few weeks.

U.S. Fiscal Policy Response

- In a reminder of how the crisis is affecting government power over the economy, President Trump said 3M Company (MMM, 140.70) has succumbed to his pressure to import more than 166 million N95 respirators from its factories in Asia to supplement the 35 million per month that the company produces in its U.S. facilities. The deal will require the company to divert much of its foreign mask production from its Asian customers to the U.S., though it will still be allowed to export some respirators to Canada and Latin America.

U.S. Monetary Policy Response

- Launching yet another new program, the Fed said it is working with the Treasury Department to create a facility offering term loans to banks and other lenders to finance their participation in the new Payroll Protection Program (PPP) being run through the Small Business Administration. The financing, to be backed by the lenders’ PPP loans, aims to increase the amount of loans the banks can make.

- The program is separate from the Fed’s new Main Street Lending Facility, which will help businesses that are too large to qualify for help from the SBA programs and too small to receive aid from lending facilities the Fed is creating for large, highly rated corporations.

- Together with the half-dozen other new lending and debt-buying programs launched by the Fed to support the economy, the new PPP financing program marks an enormous socialization of U.S. debt. In the short term, the programs offer an important cushion for private-sector obligations. They’ve already helped stabilize debt markets, at least for favored sectors. In the longer term, they could morph into the substitution of public-sector debt for private-sector debt, as during the Great Depression and World War II. Therefore, the programs will likely have a significant impact on issues ranging from the federal debt burden to economic growth and income equality.

Foreign Fiscal Policy Response

- EU finance ministers are meeting later today to hammer out a financial aid program for Italy, Spain, and other bloc members that have been hard hit by the virus crisis. EU Economy Commissioner Gentiloni is pleading with member states to forget their past fights and rally behind an ambitious plan, including joint debt to fund economic support and reconstruction. Hard-hit members like Italy and Spain complain the proposals on the table are insufficient, while creditor countries in the north, such as Germany and the Netherlands, continue to resist mutual obligations.

- Along with the state-of-emergency declaration, Japanese Prime Minister Abe announced a new economic support package amounting to ¥39 trillion ($357 billion).

Political Fallout

- As Prime Minister Johnson continues to fight the virus in intensive care, Cabinet Office Minister Michael Gove today declined to say whether full executive authority has been given to Foreign Secretary Dominic Raab, who is the prime minister’s designated stand-in as first secretary of state. That suggests the British political system is unsure about how much power Foreign Secretary Raab really has.

- Poland’s right-wing Law and Justice Party last night used the coronavirus crisis to ram through a series of major electoral system changes, just weeks ahead of the May 10 presidential vote.

Global Oil Market: Ahead of Thursday’s virtual meeting between OPEC, Russia, and other major oil producers to address the Saudi-Russia price war, Saudi Arabia and its OPEC partners are warning that global storage capacity will soon be completely full and prices could fall further. The warning aims to put pressure on Russia and other major producers, including the U.S. and Canada, to cut output on Saudi terms in order to support prices.

United States-China: The U.S. State Department has issued a statement condemning China for using one of its coast guard ships to ram and sink a Vietnamese fishing boat in a disputed area of the South China Sea last week. The incident suggests China is again trying to assert its sovereignty over the region while the world’s attention is diverted by the coronavirus pandemic.