by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

The mixed-to-higher tenor of risk assets so far today is understandable given the mixed news on the coronavirus. U.S. infections continue to moderate, but there has been little discernible progress on a new pandemic relief bill. Separately, Joe Biden announced yesterday that Senator Kamala Harris of California will be his running mate. We provide a brief comment on that choice below.

COVID-19: Official data show confirmed cases have risen to 20,372,619 worldwide, with 743,344 deaths and 12,609,775 recoveries. In the United States, confirmed cases rose to 5,141,879, with 164,545 deaths and 1,714,960 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Moderna, Inc. (MRNA, 68.97) said it has reached an agreement to provide the U.S. government 100 million doses of its experimental coronavirus vaccine in exchange for more than $1.5 billion, with an option to provide an additional 400 million doses. With the Moderna deal, the U.S. has now agreed to spend more than $9 billion for shots from a number of different drug firms. It has also invested in vaccine research and development, as well as supplies like vials and syringes. The deals aim to accelerate the rollout of any vaccines that ultimately get approved, so they could help hasten an improvement in the crisis.

- Skepticism continues to roll in regarding the coronavirus vaccine approved by Russian regulators, which we discussed in yesterday’s report. For example, German Health Minister Jens Spahn said in an interview with Deutschlandfunk radio that for people to be able to trust such a vaccine, it’s important to do extensive tests and make them public before the product is licensed, but that hasn’t been done in the Russian case.

- According to Spahn, “It can be dangerous to start vaccinating millions, if not billions of people, too early, because that would likely kill off the [public] acceptance of vaccination if it goes wrong…And so, I’m very skeptical about what’s happening in Russia.”

- Spahn’s concerns echo other statements that scientists have made regarding a risk that many people won’t trust the new vaccines enough to get their shots.

- Despite a continued moderation in overall U.S. infections and deaths, some states continue to see rising caseloads. Many rural, sparsely populated localities in the Midwest are also seeing surging cases now after largely escaping the virus earlier.

- In a worrisome sign that refrigerated food could be a vector for transmitting the coronavirus, New Zealand authorities are investigating whether the country’s first locally acquired cases of COVID-19 in more than 100 days were spread by refrigerated freight imported from overseas.

- Officials are looking into the sudden emergence of the disease in four Auckland family members. One of the four worked at a cold storage facility that is now being tested for traces of the virus.

- In mid-June, after a new outbreak in Beijing was traced to a large seafood and vegetable market, authorities detected the virus on cutting boards used to prepare imported salmon. Chinese officials downplayed the risk of transmission through refrigerated food at the time, but the New Zealand experience could spawn new concerns (no pun intended). Of course, there is also some possibility that China could have planted the New Zealand infections as a way to revive concerns about a refrigerated food vector and deflect attention from China’s poor management of the virus when it first surfaced last year.

- The Big 10 and Pac-12 Conferences have voted to postpone college football and other fall sports due to the pandemic. With two of the five most powerful leagues punting on fall and some winter sports, the rest of college football’s major conferences will now be under pressure to postpone their seasons as well, even if that deprives schools of a major source of revenue. The only consolation was that the leagues said they will keep open the possibility of playing the sports in the spring.

Economic Impact

- Moody’s Analytics has estimated that state and local budget shortfalls would total roughly $500 billion over the next two fiscal years if no federal relief is provided. According to the analysis, that would shave more than three percentage points off U.S. gross domestic product and cost more than four million jobs.

- The analysis echoes our concern that sharp revenue declines could force state and local governments to slash spending so far that they would offset the fiscal stimulus provided by federal spending. We discussed this concern in detail in our Asset Allocation Weekly from August 7, 2020.

- As a reminder, whether to provide significant financial assistance to state and local governments remains one of the sticking points as the White House and congressional Democrats continue wrangling over the next coronavirus relief bill.

- Nursing home operator Genesis Healthcare (GEN, 0.7564) has warned it could face bankruptcy within 12 months unless the government provides more help to meet its pandemic-related losses. According to the company, a dearth of new residents and far higher staffing costs have clouded its financial outlook and raised “substantial doubt” about its ability to operate.

- The news shows that the industries taking the brunt of the pandemic aren’t limited to just travel, hospitality, and leisure. Some types of healthcare firms have also been severely impacted.

- With operators facing financial challenges, many could have trouble paying their rent. Healthcare REITs that own senior living and nursing home properties could therefore also face weaker prospects in the near term.

U.S. Policy Response

- As the White House and congressional Democrats remain at odds over the next pandemic relief bill, a Labor Department official admitted to several shortcomings in President Trump’s order providing federal disaster relief funds to states so they can provide $300 per week in extra unemployment benefits. According to the official, the extra money is likely to take a couple of weeks to reach workers and funding could be exhausted just a month and a half later.

United States: As our readers probably know by now, presumptive Democratic presidential candidate Joe Biden has chosen Senator Kamala Harris of California to be his running mate. The pick allowed Biden to fulfill his promise to choose a woman, which will likely resonate well with that key constituency. In addition, Harris’s status as the daughter of Indian and Jamaican immigrants could well resonate with Blacks, Asians, and even Hispanics, many of whom are either immigrants or first-generation citizens. Progressive groups have also recently been warming to Harris, though her background as a California attorney general and prosecutor will likely help Biden blunt accusations by the Trump campaign that the ticket is too left-wing.

United States-China: As if to confirm the Trump administration’s concern about data security breaches by Chinese video-sharing app TikTok, an investigation by the Wall Street Journal found the app skirted a privacy safeguard in the Android operating system in order to collect unique identifiers from millions of mobile devices. The data allows the app to track users online without allowing them to opt out. The news will play into the hands of the administration’s China hawks, who have been working to cement a tough-on-China policy no matter who wins the November election (see this week’s WGR, which describes that effort in detail).

China: Faced with growing pushback from the U.S. and other Western democracies, President Xi has delivered a series of speeches rolling out a new macroeconomic strategy focused on domestic demand. The evolving strategy prioritizes domestic consumption, markets, and companies as China’s main growth drivers. Investments and technologies from overseas, though still desirable, would play more of a supporting role.

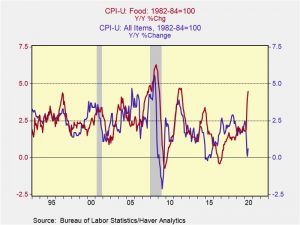

Beijing is on alert for flooding as China struggles with a series of severe weather events that are driving up food prices and threatening its economic recovery from the coronavirus.

Belarus: Mass protests against last week’s rigged reelection of President Lukashenko continued for a third straight night as news emerged that opposition candidate Svetlana Tikhanovskaya’s video calling for demonstrators to disband and accept the results was made under pressure from the Belarusian intelligence services before Tikhanovskaya fled to Lithuania yesterday. Separately, EU Foreign Affairs Chief Josep Borrell warned that the bloc is “reassessing” its relationship with Belarus and could impose sanctions for its anti-democratic behavior.