Author: Rebekah Stovall

Asset Allocation Weekly (June 18, 2021)

by the Asset Allocation Committee | PDF

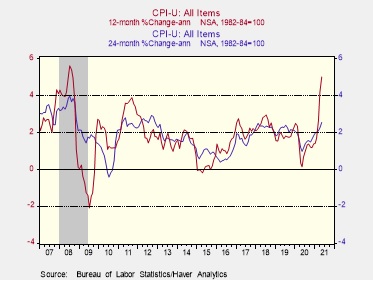

As the global economy begins to recover from the coronavirus, we’ve been warning that the apparent surge in price inflation may not be all that it seems. Inflation is usually calculated as the percentage change over one year. Since many consumer prices stagnated or fell at the start of the pandemic a year ago and only recently started to recover, “base effects” alone make it look like inflation is extraordinarily high. In fact, the May consumer price index (CPI) was up 5.0% from one year earlier, marking its biggest annual gain since mid-2008. To look through the unusual pandemic distortions and see where the trends really are, we’ve begun to focus more on the two-year rate of change. As shown in the chart below, a comparison of the CPI in May 2021 versus the CPI in May 2019 would imply an average annual rise of just 2.5% over the last two years. That’s still elevated compared with the recent past, but it’s only half as big as the inflation rate calculated over one year.

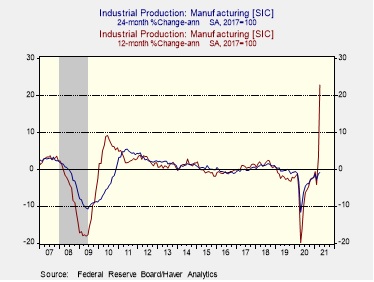

We’ve been arguing that these base effects will drop out of the calculation and result in more moderate inflation readings later this year, but the same can be said for many other economic indicators, even if they aren’t typically calculated on a year-over-year basis. For example, the Federal Reserve’s index of manufacturing production for April (latest available data) was up an astounding 22.8% from April 2020. However, that largely reflects base effects related to last spring’s sharp drop in output followed by a more recent recovery in production. If we compare output in April 2021 to the output in April 2019, the average annual increase over the last two years comes to -0.9%. In other words, factory production these days is actually a bit less than it was before the pandemic.

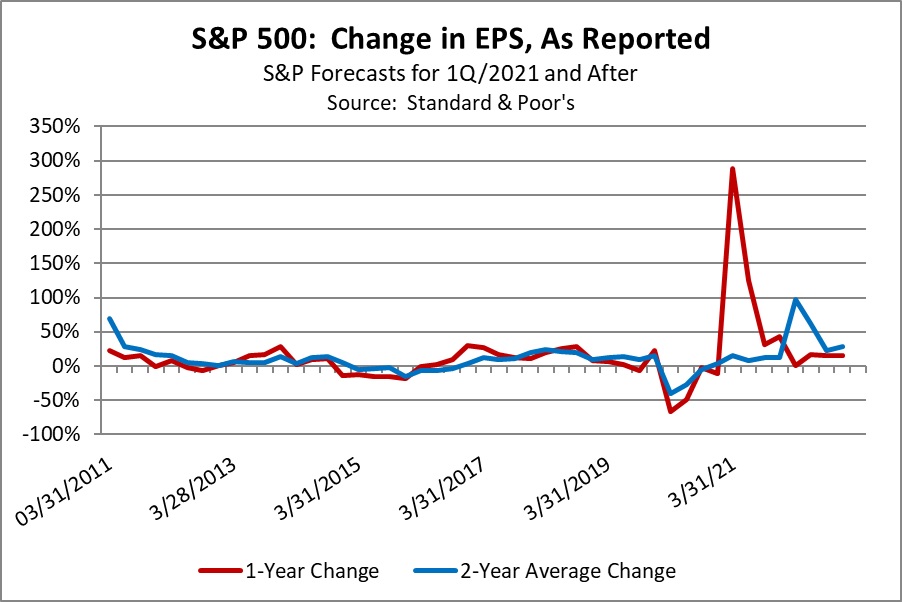

The concept of base effects may be especially important for stock investors as they look at corporate earnings. In the first quarter of 2021, earnings per share (EPS) on the S&P 500 index will be up approximately 288.1% year-over-year, but that’s only because of the sharp drop in profits at the outset of the pandemic followed by a recovery in recent quarters. As shown in the chart below, the expected EPS of $46.10 would only represent an average annual gain of about 14.7% over the last two years. That’s better than the average annual EPS growth of about 8.4% over the last couple of decades, but it’s still weaker than the average gain of 16.2% over the most recent five years. In sum, investors should be mindful of the big distortions that the pandemic has caused in all kinds of economic and financial data. Looking at the two-year average changes may help investors gauge the true state of affairs more accurately. While we still think equities can perform well in the near term, the gains may be much less dramatic than might be implied by just the year-over-year earnings growth.

Weekly Geopolitical Report – The Geopolitics of the Colonial Pipeline Ransomware Attack: Part I (June 14, 2021)

by Bill O’Grady | PDF

On Thursday, May 6, 2021, hackers attacked the Colonial Pipeline, capturing data by infiltrating the company’s business software. In response, the company closed its 5,500-mile pipeline to assess the damage and protect critical infrastructure. Eventually, the company paid the ransom and service was restored.

Although a criminal event usually doesn’t have geopolitical ramifications, this one did, in our opinion. The attack brought down a pipeline that connects refineries in Texas and Louisiana that provide petroleum products as far north as New Jersey. The situation highlighted the vulnerabilities of critical infrastructure, the nature of criminal ransomware enterprises, the role of cryptocurrencies in criminal transactions, and the problems of scale in criminal activity.

In Part I of this report, we will begin with an overview of the attack followed by reflections on organized crime. We will also deal with the attractiveness and growth of ransomware. Comments about the firm involved in the attack, Darkside, will follow. Part II will discuss why this cyberattack was a serious mistake. The subsequent discussion will focus on the parties that were adversely affected by this event and we will close with market ramifications.

Asset Allocation Weekly – #41 (Posted 6/11/21)

Asset Allocation Weekly (June 11, 2021)

by the Asset Allocation Committee | PDF

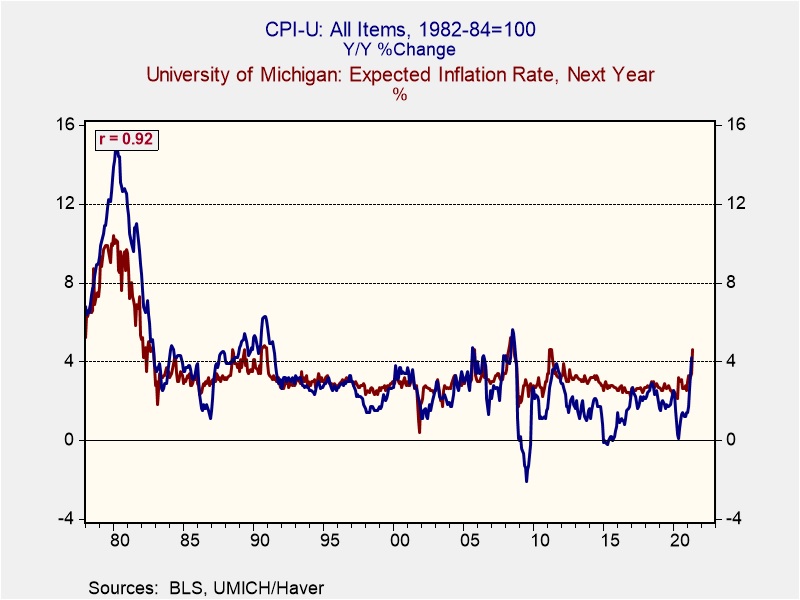

In May, respondents to the University of Michigan’s monthly Consumer Sentiment Survey said they expect consumer prices to rise at an average rate of 4.6% per year over the next half-decade—the highest level of inflation expectations in 12 years. In this report, we discuss why inflation expectations are rising, what the rise might mean for future inflation, and the impact it may be having on financial markets.

Inflation expectations are the proverbial boogie man of economics. Rising inflation expectations can put upward pressure on interest rates and prices, and they can cause consumer confidence to plummet. In the 1970s, rising inflation expectations became a self-fulfilling prophecy. Fearing higher prices, consumers would stock up on goods, which led to persistent inventory shortages. The lack of inventory induced firms to raise prices. The rise in prices increased the cost of living, which encouraged workers to demand more pay. This increase in pay would then be used to stock up on goods, thereby restarting the cycle. This phenomenon is often referred to as the wage-price spiral.

To bring down inflation and inflation expectations, Federal Reserve Chair Paul Volcker set short-term rates so high that they caused a double-dip recession in 1980 and 1981. Although Volcker was successful, the memory of what it took to control inflation expectations remains forever ingrained in the minds of those who had to live through the process. Keeping inflation expectations anchored is therefore considered critical to the Federal Reserve’s mandate of maintaining inflation at around 2% annually.

One reason for optimism regarding inflation expectations today is that they have historically fluctuated in line with the Consumer Price Index (CPI), as shown in the chart below. Inflation expectations can act more like a gauge of consumers’ present experience of inflation than a predictor of future inflation. In April, the two most important U.S. inflation gauges were both showing price increases well above the Fed’s target and far in excess of the average experience in recent years. The CPI was up 4.2% year-over-year, and the price index for personal consumption expenditures was up 3.6%. However, this high level of inflation is largely related to the recovery in prices from their early-pandemic lows one year ago. It can also be attributed to several other factors, such as pent up consumer demand, supply chain disruptions, and unprecedented fiscal stimulus. Importantly, all these factors are likely to be transitory, so today’s inflation and inflation expectations will probably moderate over time.

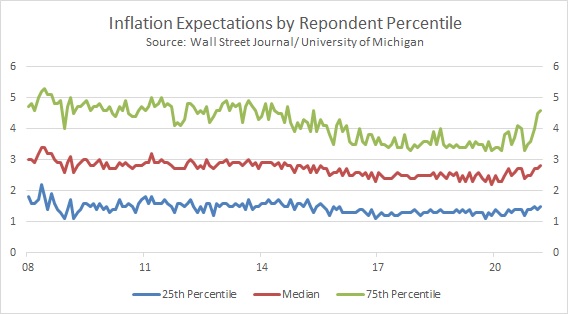

Furthermore, over the last 10 years, inflation expectations have routinely overshot actual realized inflation, sometimes by more than 2%. This upward bias may be due to a few survey respondents having a disproportionate impact on the overall report. In the latest surveys, for example, inflation expectations surged among those in the 75th percentile (i.e., the 25% of respondents with the highest expectations). As shown in the chart below, expectations rose more modestly among those in the 50th and 25th percentiles, suggesting that realized inflation in the next few years may not be as bad as some consumers fear.

That being said, high inflation expectations have shown up in the financial markets. The yield spread between the nominal five-year Treasury note and the five-year Treasury inflation-protected security (TIPS), also referred to as the five-year breakeven rate, has widened to a 16-year high. Although the spread has eased over the last few days, it does show that investors have begun pricing in higher inflation. Of course, economic theory would suggest that unanchored inflation expectations should result in rising yields of longer-duration bonds. However, this time around, yields are likely to be capped by factors such as the high level of household saving. This large holding of savings has also pushed down the velocity of money, thus reducing inflationary pressure on the economy. As a result, we suspect the rise in the breakeven rate may be an overreaction to recent reports and would caution against hastily jumping to conclusions regarding inflation. Although inflation expectations are a concern, it is important to note that these expectations need to be sustained over a long period of time before they translate into actual inflation.

Weekly Geopolitical Report – Taiwan and the Risk of Deglobalizing the World’s Semiconductor Industry: Part II (June 7, 2021)

by Patrick Fearon-Hernandez, CFA | PDF

This series is written as a corollary to our recent multi-part WGR series titled “The Geopolitics of Taiwan,” published last month.[1] In Part I of this report, we showed how Taiwan and the Taiwan Semiconductor Manufacturing Company (TSM, $111.85) represent a key vulnerability in the global computer chip industry. In short, the U.S.-China geopolitical rivalry threatens to cut off Taiwan and its most advanced chip manufacturer, Taiwan Semiconductor Manufacturing Company (also known as TSMC), from some of their key markets, suppliers, and capital sources. In this second and final part of the series, we will discuss the economic and financial implications if Taiwan and the company are indeed forced to deglobalize and join either a U.S. or Chinese economic bloc.

[1] See WGR, “The Geopolitics of Taiwan: Parts I (5/3/21), II (5/10/21), and III (5/17/21).”

As of the date of this report, certain Confluence Investment Management LLC strategies are invested in Taiwan Semiconductor Manufacturing Company (TSM). Opinions, estimates, and forward-looking statements included in the report are as of a certain date and subject to change without notice. This report is published for informational purposes and is not an offer or solicitation to buy or sell any security. Past company performance is no guarantee of future results.

Asset Allocation Weekly (June 4, 2021)

by the Asset Allocation Committee | PDF

(Due to staff vacation schedules, there will not be an accompanying podcast and chart book this week. The multimedia offerings associated with this report will resume next week, June 11.)

Over the past five years, the United Kingdom has been the backwater of investment attraction. Much of the investor indifference originally stemmed from Brexit and the ensuing drama that unfolded. Recent issues associated with COVID-19, particularly the error-plagued early responses, have depressed asset flows further. As evidence, among developed countries, the United Kingdom registered the lowest five-year annualized return through the end of last year. Investor indifference has led to attractive fundamentals for British companies relative to those in the rest of the world, particularly versus U.S. counterparts. The operative question, therefore, is whether the U.K. will continue to be an investment pariah, or will the conclusion of the Brexit saga soothe investor concerns?

The first issue is obviously the current status of Brexit. While we have written on issues faced by the United Kingdom as an outgrowth of Brexit, we note that these will be borne out over an extended period of time. The recent approval of the EU-U.K. Trade and Cooperation Agreement (TCA) by the European Parliament, while still requiring further details between the two sides, sets an essential framework for business practices. Though the TCA doesn’t place Brexit fully in the rearview mirror, the ring fence is now narrower than at any point since the vote in June 2016.

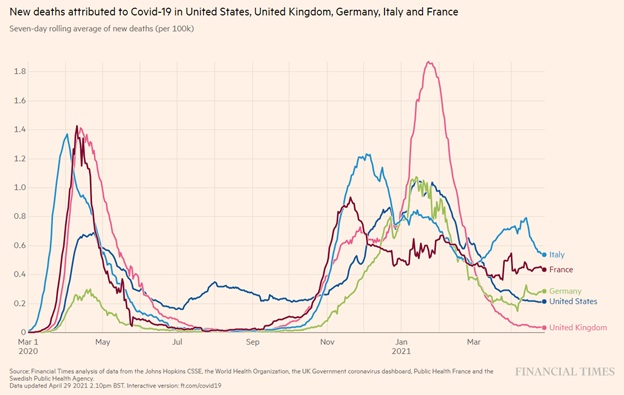

Combined with the resolution of trade, U.K consumer demand is expected to bounce back in the second quarter. Such demand expectations have driven the IMF to upgrade its growth forecast for the U.K. to 5.3% this year and 5.1% in 2022. Adding credence to the argument for strong growth is progress registered against COVID-19. Although Britain blundered in its early response to COVID-19, as noted previously, recent data are much more optimistic for the British populace.

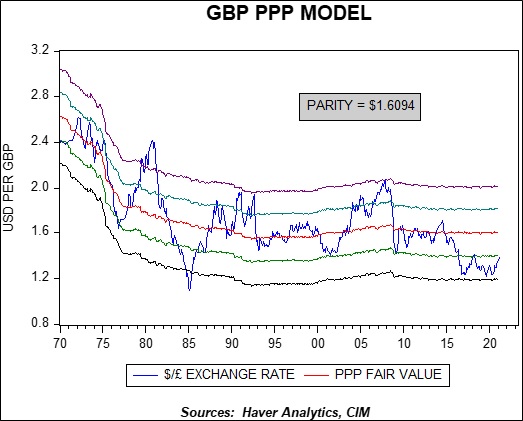

A further attraction for U.S.-based investors is the valuation of the British pound versus the U.S. dollar. Our estimates of fair value place the pound at more than one standard deviation below parity. An increase in the value of the pound would be a tailwind for U.S.-based investors.

Although there is uncertainty surrounding the long-term fallout from Brexit, the prospects for the U.K. over the next few years appear favorable and valuations among the unloved U.K. equities are certainly less stretched than their U.S. counterparts. While we find U.K. large cap stocks to hold appeal for more moderate risk thresholds, U.K. small cap stocks hold even more appeal for aggressive investors on a range of valuation measures relative to small cap U.S. equities. Since small cap companies are often less integrated into the global economy, they should be less adversely affected by a strengthening pound.

Asset Allocation Weekly – #40 (Posted 5/28/21)

Asset Allocation Weekly (May 28, 2021)

by the Asset Allocation Committee | PDF

Gold moved steadily higher from the late summer of 2018 into last August. Prices declined toward 1,700 into March but have been recovering since. In this report, we will update our views on the metal.

We have been holding gold in our asset allocation portfolios since 2018, although we have diversified our commodity holdings by adding a broader commodity ETF alongside our gold position. When we looked at gold in March, we noted that there was a divergence between the short- and long-term fundamental factors.

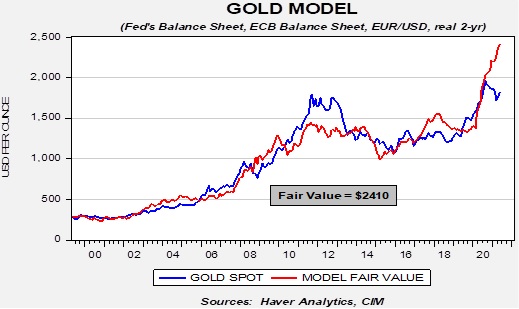

The long-term outlook for gold remains positive. Our basic gold model, which uses the balance sheets of the Federal Reserve and the European Central Bank, the EUR/USD exchange rate, and real two-year T-note yields, along with the U.S. fiscal deficit relative to GDP suggest that prices are significantly undervalued and have become more so since March.

At the same time, like in March, there are several short-term factors that are less bullish than our long-term model. One of these is longer-duration interest rates.

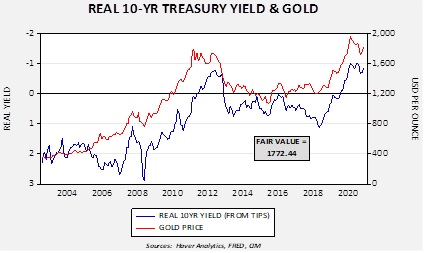

This chart shows the real 10-year yield derived from the TIPS spread against Treasuries. The real yield is inverted on the chart scale. Note that recently the real yield began to decline (become more negative). Regressing the relationship generates a fair value of 1,772.44, which is $55.79 higher than our last update. This fair value is below where gold is trading now. In addition, we have seen gold flows into exchange-traded products merely stabilize, which is inconsistent with the recent rally in gold.

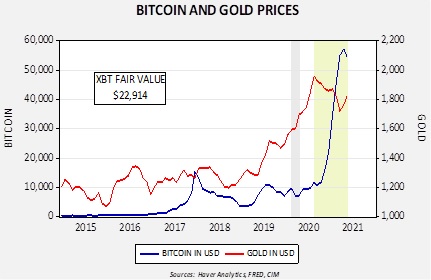

In our last update, 10-year T-note yields were rising steadily. The rise has stopped, and yield levels have consolidated. Our 10-year T-note yield model is projecting a fair value yield of around 1.75%. The stall in yields has played a role in lifting gold prices. However, the most important factor may be the recent decline in bitcoin.

Cryptocurrencies share a similar characteristic with gold; they both provide store of value. Although they are somewhat positively correlated since 2015 (+66%), since August 2020 (shown in light green on the chart), gold and bitcoin are inversely correlated to the tune of 89.1%. This change of sign suggests that the two are now seen as competing products and, until recently, bitcoin was the clear winner. The recent turnaround probably reflects regulatory concerns surrounding bitcoin. Cryptocurrencies are often used in ransomware attacks and other criminal activity. The high-profile Colonial Pipeline event has raised concerns about the inability of police to trace bitcoin payments. If regulators clamp down on bitcoin, investors will likely return to gold for protection against inflation concerns.