by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It’s July 31st, the Feast Day of St. Ignatius of Loyola, the founder of the Society of Jesus (Jesuits). Here is what we are watching:

BREAKING: CHINA SEEKING NEW TRADE TALKS TO DEFUSE TRADE WAR. EQUITIES RISE ON NEWS.

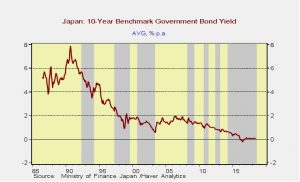

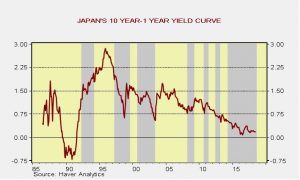

BOJ: The BOJ has spoken and not much has changed.[1] The bank will continue to peg the JGB 10-year at 0.0% with a variation tolerance of 20 bps, which is double from the previous policy. But, overall, the bank still intends to keep the rate at the long end near 0%. The BOJ will offer some relief to banks in the form of lowering the level of reserves that are charged with a negative interest rate. It also extended forward guidance, indicating that low interest rate levels will remain “for an extended period of time.” Finally, the BOJ buys equity ETF as part of its assets and it intends to buy more of the Topix-linked instruments and less of the Nikkei-linked instruments; the former is considered a broader based index and thus will be less distorting to the equity markets. Globally, long-term interest rates fell while the JPY depreciated.

Oops, I did it again: The Washington Post is reporting that U.S. spy agencies have evidence that North Korea is working on a new missile factory.[2] Pyongyang made a show of dismantling another site[3] recently but this new development suggests the country is still working on building a nuclear deterrent. We note that SoS Pompeo recently admitted that North Korea may have a uranium-enrichment facility near Kangson Station.[4] Although the U.S. and North Korea held talks, the Hermit Kingdom is continuing to develop its nuclear weapons and delivery systems. That doesn’t mean it won’t stop at some point but it is clear that North Korea views the summit as the start of negotiations and little more. The risk is that President Trump concludes he has been “had”; if that occurs, look for escalating tensions.

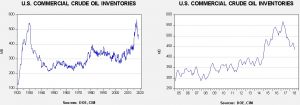

Iran talks? Yesterday, President Trump agreed to meet with Iran’s leaders “without preconditions.” This offer probably won’t go anywhere but it does suggest the president is following a similar tactic he used with North Korea, which was to threaten and then agree to talks. The problem, as noted above, is that talks with North Korea haven’t changed its behavior on its nuclear weapons program. In addition, the Iranian and North Korean government structures are quite different. Kim Jong-un can generally act unilaterally and policy can change rapidly as a result. Iran is much more complicated. Although Supreme Leader Ayatollah Khamenei has a great deal of power, he cannot act unilaterally. In fact, the real power in Iran may lie with the Iranian Republican Guard Corp, which would oppose talks. Iran has indicated it will not join any new talks before the U.S. rejoins the nuclear deal that the U.S. withdrew from in May. We don’t see this going anywhere unless Iran can get the U.S. to postpone the implementation of sanctions during negotiations. That concession will likely be the necessary component if the Trump administration is serious about talks.

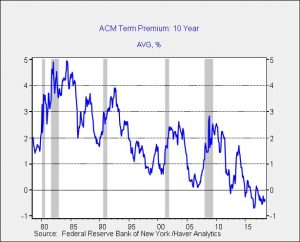

The Fed: The meeting ends tomorrow. No rate hike is forecast. The only item of interest will be the statement, which probably won’t tell us anything. Even so, in light of Q2 GDP, we would not be surprised to see a statement that focuses on strong growth, which would bolster the argument for raising rates. However, that would mostly confirm the current expected policy path, nothing more.

BOE: We expect the BOE to raise rates 25 bps on Thursday. That move is well discounted but still may be modestly bullish for the GBP.

Another tax cut? SoT Mnuchin has indicated the administration is considering whether it can change the definition of an asset’s cost for determining the cost basis when calculating the capital gains on an asset.[5] The proposal is to adjust the cost basis by inflation. Here’s a quick example. Assume a wealthy investor buys $100k of stock in January 2000. He sold it last month for $200k. He would be taxed at a 20% long-term capital gains rate on the $100k gain, paying $20k in taxes. If we use overall CPI to adjust the cost basis, it rises to $149,282.58, lowering the capital gain to $50,717.42 and the tax liability to $10,143.48.

The key issue is whether or not the Treasury can make this change unilaterally, without legislation from Congress. In the early 1990s, the Bush administration sought a legal opinion on the issue and the opinion concluded that Congress could not be bypassed.[6] A couple of thoughts. First, such a move would be popular with the GOP establishment (and although they would feign opposition, the Democrat Party establishment would like it, too) but would not do anything to fire up the base. Thus, it may be that this is a Kudlow/Mnuchin ploy to cut taxes that didn’t originate from the president. If so, it may not have legs because it won’t do much for the GOP in November. Second, this would be more complicated than it looks. For example, it would reduce the value of donated stock to charities. It would further increase the value of capital gains over dividends and interest and make stock buybacks more attractive. In the short run, we would likely see a flurry of asset sales; after all, if an administration can unilaterally change the cost basis calculation, it can change back just as easily. This may not be anything but it would be a short-term boost for equities if the idea gains traction.

[1] https://www.ft.com/content/45b4fe28-946f-11e8-b67b-b8205561c3fe

[2] https://www.washingtonpost.com/world/national-security/us-spy-agencies-north-korea-is-working-on-new-missiles/2018/07/30/b3542696-940d-11e8-a679-b09212fb69c2_story.html?utm_term=.460dc2b4a386

[3] https://www.38north.org/2018/07/sohae072318/

[4] https://thediplomat.com/2018/07/exclusive-revealing-kangson-north-koreas-first-covert-uranium-enrichment-site/

[5] https://www.nytimes.com/2018/07/30/us/politics/trump-tax-cuts-rich.html