Daily Comment (July 12, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Equity markets have rebounded following signs that the U.S. and China will likely resume trade negotiations. Oil prices have also stabilized following the bullish EIA report—yesterday oil prices fell 7% following reports that Libya would resume shipments. Below are the stories we are following today:

NATO defense spending: Earlier today, President Trump announced that NATO members have agreed to increase defense spending, but warned that he is willing to “do his own thing” if spending doesn’t increase immediately. This announcement came after an impromptu emergency meeting was called to discuss the president’s concerns on defense spending. Yesterday, the president caused an uproar by demanding that NATO members increase their defense spending to 4% of GDP, which is double the target in the NATO agreement. At this moment, it is unclear what the president means when he says “immediately” or how much each member would need to increase its defense spending. The NATO guidelines stipulate that countries should increase their defense spending to 2% of GDP by 2024.[1]

Afghanistan review: The White House is expected to undertake a review of its strategy in Afghanistan as President Trump is reportedly frustrated with the lack of progress being made. Last year, on the advice of his advisors, President Trump agreed to deploy an additional 3,000 troops to Afghanistan in the hopes of forcing the Taliban to the negotiating table with the Kabul government. After a year, it appears there has been no progress toward achieving this goal. The president has never been in favor of the U.S. fighting international wars. As a result, this review could be a forerunner to future withdrawal from the region. We will continue to monitor this situation.

Russian arms talks: Yesterday, Reuters reported that during President Trump’s meeting with Russian President Putin they will likely discuss extending the “New Start” treaty. The treaty allows Russia and the U.S. to monitor each other’s nuclear programs to ensure that neither country is expanding its nuclear weapons program. The deal was put in place to avoid another arms race between the two countries. In the past, President Trump and National Security Advisor John Bolton have criticized the deal as being a bad deal for the U.S.; Bolton went so far as to call it “unilateral disarmament.” That being said, the fact that discussions might occur suggests that President Trump could be favoring an extension of the agreement, which expires in 2021. The two will also likely discuss North Korea denuclearization and developments in Syria.

Energy recap: U.S. crude oil inventories fell a whopping 12.6 mb compared to market expectations of a 3.9 mb draw.

The above charts show current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but are falling rapidly. We would consider the overhang closed if stocks fall under 400 mb.

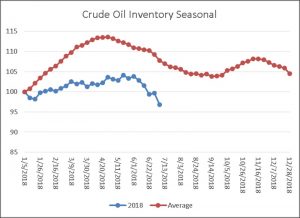

As the seasonal chart below shows, inventories are well into the seasonal withdrawal period. This week’s decrease in stocks is normal, although the amount was a stunner. If the usual seasonal pattern plays out, mid-September inventories will be 399 mb. If this level is reached, we will have absorbed the inventory overhang.

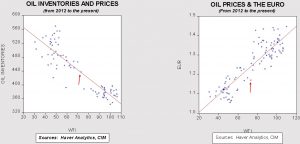

Based on inventories alone, oil prices are near the fair value price of $72.49. Meanwhile, the EUR/WTI model generates a fair value of $61.22. Together (which is a more sound methodology), fair value is $64.77, meaning that current prices are above fair value. Currently, the oil market is dealing with divergent fundamental factors. Falling oil inventories are fundamentally bullish but the stronger dollar is a bearish factor. The action to suppress Iranian oil exports has boosted oil prices, but the rapid decline in oil inventories over the past week is very supportive for prices. It should be noted that a 400 mb number by September would put the oil inventory/WTI model near $90 per barrel. Although dollar strength could dampen that price action, oil prices should remain elevated.

[1] https://www.nato.int/cps/ic/natohq/official_texts_112964.htm