by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] The weekend news was dominated by tropical events in the U.S. and the Far East, and the travails of SCOTUS candidate Kavanaugh. In addition, there were a plethora of retrospectives across the media focusing on “10 years after the crisis.” Here are the other items we are watching today.

Trade: It appears that President Trump will announce sometime this week that China will be hit with tariffs on another $200 bn in goods.[1] Instead of a 25% rate, it appears the U.S. will start with a 10% rate. We would expect China to retaliate in equal measure.[2] From there, we will be watching to see if conditions escalate. Last week, there was a glimmer of hope for a reopening of talks between Washington and Beijing. However, China is indicating that it will not join talks if the U.S. signals new tariffs.[3] Emerging equities fell on this news. Industrial metals,[4] a likely target of tariffs, are under pressure this morning as well.

India disappoints:[5] Last week, the Modi government indicated it was developing a strategy to arrest the decline in the rupee. The market has found the measures wanting; essentially, the government plans to put import barriers in place on “non-essential imports” but hasn’t detailed the exact list.[6] This plan is a high-risk strategy. Not only will it upset trading partners in a period when the U.S. isn’t going to give India a pass on trade impediments, but the likely outcome is higher inflation. It does appear the Modi government is trying hard to avoid the most effective response, higher interest rates, with elections looming next year.

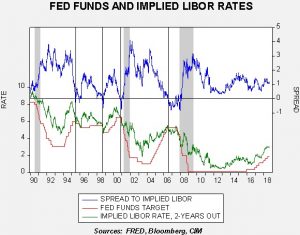

A new Fed president: The San Francisco FRB announced that Mary Daly has been appointed as the new president of the San Francisco FRB, effective October 1. Daly has been director of research at the bank since 2017 and succeeds John Williams, who became the president of the New York FRB. Her focus area is labor economics. However, the most interesting part of her appointment, at least to us, is her academic background, most notably at the undergraduate level. Her MA is from the University of Illinois (Champaign-Urbana) and Ph.D. is from Syracuse. However, her undergraduate degree is from the University of Missouri—Kansas City in economics, philosophy and psychology. UMKC along with the Levy Institute at Bard College are, by our estimation, the leading schools for heterodox economics. This is where neo-Marxists, Modern Monetary Theorists (MMT) and neo-Keynesians dwell. We have been paying very close attention to MMT and think it may become the intellectual construct for the next major development in economic policy. In other words, in the next equality cycle, MMT will be how large fiscal deficits are justified. Daly will be a voter the rest of this year but not at the next meeting. In her place, KC FRB President George has been acting as the alternate voter and, given that George is perhaps the most hawkish member of the board, she will surely vote to raise rates at the upcoming meeting. The December vote might be more contentious. However, Daly would need an excess of ego strength to dissent against a rate hike in her first vote. Fed fund futures are indicating a near 80% chance of a 2.50% upper target for the policy rate at the December meeting, suggesting another rate hike is highly probable.

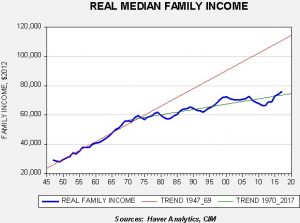

A couple of weekend thoughts: First, Adam Tooze is a historian who currently teaches at Columbia University. He has published a number of well-regarded histories and his most recent is on the Great Financial Crisis.[7] We spent part of the weekend listening to numerous podcasts where he discussed his book. Although we haven’t read it yet, it will go on the list. But, one of the thoughts we had as we listened to the podcasts and read various “where were you” retrospectives on the crisis was how the impact of this event may not be past us. Think of it this way…there could have been discussions and analyses 10 years after the 1929 Crash but they would not have captured the crisis that WWII brought. We should be careful about thinking that the last decade may be the final story of how the world financial system recovered; simply put, the story may not be over yet.

Second, we have been thinking a lot about the amplitude shifts coming out of the political system. Our founding fathers created a system that was designed to prevent sudden shifts in policy. Checks and balances and the requirement of a supermajority in the Senate were all put in place to temper changes, make them more gradual and reduce the odds of a sudden shift in policy. Since WWII, we have been steadily eroding these measures. The superpower role created the need for a stronger executive; the presidency is now described as “imperial.”[8] We have recently weakened the power of the filibuster; although this measure has slowed progress it also forces lawmakers to make changes that are palatable to opponents. Without the filibuster, we now have two legislative houses that are almost identical.

What this could mean is that we will be facing a future where changes in government mean massive changes in policy. One party passes infrastructure spending only to have a change in government halt the projects. One party passes tax changes only to see them reversed by the next administration. It could become even more radical; a party could try to expand or reduce the number of judges on the Supreme Court to undermine changes brought by the previous administration. If this becomes the norm, not only will American democracy become dysfunctional, but it seems hard to imagine how businesses could make rational investment decisions. Although neither of these factors affect the markets today, it is something we are watching.[9]

[1] https://www.wsj.com/articles/trump-to-announce-new-tariffs-on-200-billion-in-china-goods-1537040325

[2] https://www.wsj.com/articles/china-weighs-skipping-trade-talks-after-u-s-tariff-threat-1537115334

[3] https://www.axios.com/trump-tweets-mnuchins-credibility-china-trade-talks-4c450538-b6c7-4c5c-94df-fdd98643a15b.html

[4] https://www.ft.com/content/70917a9a-ba67-11e8-94b2-17176fbf93f5

[5] https://www.ft.com/content/54ece0f8-ba2c-11e8-94b2-17176fbf93f5

[6] https://www.ft.com/content/1ce01368-b83f-11e8-b3ef-799c8613f4a1

[7] https://www.amazon.com/Crashed-Decade-Financial-Crises-Changed/dp/0670024937

[8] https://www.amazon.com/Imperial-Presidency-Jr-Arthur-Schlesinger/dp/0618420010

[9] https://www.axios.com/2020-democrats-rebels-restorationists-080c9e81-c961-4b20-8c96-103c45ed0905.html