Daily Comment (August 24, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy Friday! Markets are fairly quiet this morning. Here is what we are watching today:

Powell speaks: The Jackson Hole meeting is underway. Chair Powell will start speaking around 10:00 EDT. We don’t expect anything other than “steady as she goes,” meaning at least one more tightening this year and probably two. We will be watching for White House tweets in response.

Trade: Talks with the U.S. and China ended with a whimper.[1] We didn’t expect any progress and it doesn’t appear that any was made. Thus, we are on track for an additional $200 bn in new tariffs in the coming weeks. Meanwhile, the expected announcement of a NAFTA deal with Mexico did not occur but negotiations have been extended into the weekend, which means a deal is still possible.[2]

China and Taiwan: After Mao captured the Chinese mainland, Chiang Kai-Shek took what remained of his Nationalist government and took control of Taiwan, an island off the coast of mainland China. For years, the Nationalists maintained that they were the legitimate government of all of China, calling Taiwan the Republic of China (ROC); in fact, its legislature maintained seats for legislators that represented mainland constituencies for years. Mao called the mainland the People’s Republic of China (PRC). What both the Nationalists and Communists held in common was that Taiwan is part of China, not a separate nation. After Nixon normalized relations with the Communists on the mainland, diplomatic strategic ambiguity became the order of the day. The U.S. defended Taiwan but didn’t dispute whether Taiwan was part of China. It supported eventual unification. For the U.S., “eventual” might have meant never. For China, “eventual” meant soon. That ambiguity has existed since the early 1970s and all parties have generally benefited. Taiwan has prospered and increased its links to the mainland. A hot war has been avoided. The U.S. can say it protected Taiwan. But, it should be remembered that this entire diplomatic edifice rests on strategic ambiguity, a condition where all parties say the same words but mean something entirely different.

Over time, the number of nations that have diplomatic relations with the ROC has dwindled. The following nations currently have diplomatic ties with the island:

Belize (1989); Guatemala (1960); Haiti (1956); Honduras (1965); Kiribati (2003); Marshall Islands (1998); Nauru (1980–2002, 2005); Nicaragua (1990); Palau (1999); Paraguay (1957); Saint Kitts and Nevis (1983); Saint Lucia (1984–1997, 2007); Saint Vincent and the Grenadines (1981); Solomon Islands (1983); Swaziland (1968); Tuvalu (1979); and Vatican City (the Holy See) (1942).

El Salvador is the latest nation to sever relations with Taiwan, the third this year. However, the White House has criticized the move,[3] indicating the U.S. has “grave concerns” about the PRC using economic inducements to encourage the Central American nation to end its ties with the ROC. Taiwan and its status is the one issue that could trigger a hot war with China. Rising tensions over the ROC along with trade disputes are concerns we are watching ever more closely.

A new PM in Australia:[4] PM Turnbull is out—PM Scott Morrison[5] is in. Morrison, the former treasury minister, is considered “safe” by financial markets. The AUD did rally modestly on the news. Morrison is from the moderate end of the Liberal/National Party. We offer our congratulations but would strongly recommend he not unpack. It appears conservative members of the party are furious that their candidate, Peter Dutton, didn’t get the PM job.[6] Although there is great concern over growing partisanship in the U.S. and Europe, Australia is clearly not immune to similar pressures.[7]

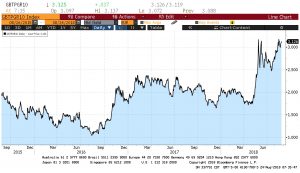

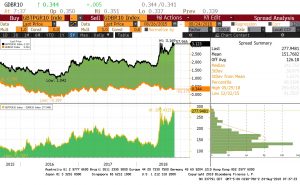

Backdoor intervention? Italy is rapidly becoming the next major threat to Eurozone stability. Unlike the PIIGS that caused problems earlier in the decade, Italy’s economy is big enough that a major financial crisis could spell the end of the Eurozone. Italy is fighting EU rules on immigration.[8] It is also planning a fiscal budget very likely to break Eurozone rules. In light of these tensions, Italian bond yields have been rising. The chart below shows the Italian 10-year sovereign.

As this chart shows, since the summer elections, bond yields have been rising. And, it’s pretty much entirely an Italian issue as German yields have been steady, widening the spread.

Here’s where it gets interesting. According to the Italian PM, Giuseppe Conte, President Trump has offered to buy Italian bonds to support prices and hold down yields.[9] It isn’t clear how this would work, exactly. The Treasury could instruct the NY FRB to buy Italian bonds but it is important to note that this is no different than how currency intervention works. The U.S. could expand the Fed’s balance sheet and have it buy the bonds or, conceivably it could buy the bonds for the Treasury. But, in any case, from a currency perspective, it would be buying euros and selling dollars. The U.S. rarely intervenes in a currency market. The signal it would send is very strong and would likely trigger a strong reaction in the currency markets. In addition, it would directly circumvent the Eurozone’s rules on fiscal restraint.

We suspect this was an off-hand comment. But, it does appear the Italians are taking it seriously. If implemented, it could not only push the dollar lower, but it would almost certainly cause a major crisis for the Eurozone. Germany has dominated the Eurozone since its inception; U.S. intervention would represent an outside power “tipping the scales.”

[1] https://www.ft.com/content/fa72e338-a71c-11e8-926a-7342fe5e173f?emailId=5b7f8649face1c00043303e0&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[2] Ibid.

[3] https://www.reuters.com/article/us-china-usa-taiwan/china-seeks-domination-us-says-after-el-salvador-dumps-taiwan-idUSKCN1L90AA

[4] https://www.ft.com/content/bf7cf842-a729-11e8-8ecf-a7ae1beff35b?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[5] https://www.smh.com.au/lifestyle/scott-morrisons-relentless-rise-to-power-20160418-go8qty.html?utm_source=POLITICO.EU&utm_campaign=4d12a31ebe-EMAIL_CAMPAIGN_2018_08_24_04_40&utm_medium=email&utm_term=0_10959edeb5-4d12a31ebe-190334489

[6] https://www.afr.com/opinion/rightwing-liberals-threaten-to-tear-scott-morrison-apart-20180823-h14e7m?utm_source=POLITICO.EU&utm_campaign=4d12a31ebe-EMAIL_CAMPAIGN_2018_08_24_04_40&utm_medium=email&utm_term=0_10959edeb5-4d12a31ebe-190334489 and https://twitter.com/workmanalice/status/1032822849403142144?utm_source=POLITICO.EU&utm_campaign=4d12a31ebe-EMAIL_CAMPAIGN_2018_08_24_04_40&utm_medium=email&utm_term=0_10959edeb5-4d12a31ebe-190334489

[7] https://www.ft.com/content/6d64dc98-a6b9-11e8-8ecf-a7ae1beff35b?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[8] https://www.politico.eu/article/eu-calls-emergency-migration-meeting-as-italian-interior-minister-matteo-salvini-toys-with-resignation-president-sergio-mattarella/?utm_source=POLITICO.EU&utm_campaign=4d12a31ebe-EMAIL_CAMPAIGN_2018_08_24_04_40&utm_medium=email&utm_term=0_10959edeb5-4d12a31ebe-190334489

[9] https://www.ft.com/content/3b841b10-a765-11e8-8ecf-a7ae1beff35b