by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] There is an escalation between India and Pakistan, and a summit in Hanoi. Futures markets suffered a technical glitch and stopped trading for several hours overnight.[1] Here is what we are watching this morning:

India v. Pakistan: There has been an escalation of tensions between India and Pakistan. During the past week, over 40 Indian paramilitary operatives were killed by militants in the disputed Kashmir region. The militants are thought to be supported by Pakistan. India responded with an aerial attack into Pakistani territory; it isn’t clear how effective the attack was, but it showed that the India Air Force could penetrate Pakistani air space without much trouble. However, this morning, Pakistan claims it shot down two Indian fighters and apparently has one of the pilots in custody.[2] Tensions between the two countries are nothing new. Periodic clashes occur with great frequency. There is always a concern about these clashes because both nations possess nuclear weapons and can likely deliver them.

We don’t think this current situation will escalate;[3] neither do the markets, otherwise we would be seeing flight to safety buying in gold, the dollar and Treasuries. But, that doesn’t mean this situation isn’t instructive. One interesting trend is that Islamabad isn’t getting support from anyone. The U.S. has offered support to India[4] as has the EU.[5] Even China, perhaps Pakistan’s closest ally, instructed both sides to restrain themselves.[6] Simply put, the developed world is against the use of stateless proxies for policy goals; they can’t be completely controlled and offer the sponsoring nation a degree of deniability that makes them dangerous.

We wonder if these attacks were not tied to the upcoming Indian elections. The brass in Pakistan likely prefer PM Modi as a foil. He has been struggling against an insurgent Congress Party and the military in Islamabad could fear that a Modi loss would deescalate tensions between the two nations and undermine the support for defense spending. By giving Modi a crisis, he gets to look like a leader and it may boost his reelection chances.

The summit meeting: President Trump and Dear Respected Comrade Kim are meeting in Hanoi today. We do not expect any breakthroughs, although the outlines of a deal are emerging. We suspect Trump would allow North Korea to keep its nuclear program in return for giving up its ICBMs. This would make North Korea a nuclear threat to its near neighbors but not to the lower 48 (however, the range of North Korea’s intermediate-range missiles would include Alaska and Guam).[7] Although one can see the logic in Trump’s position if this does become U.S. policy, it could trigger a regional nuclear arms race by prompting Japan, which is a threshold nuclear state, to develop its own deterrent. At the same time, moving to normalize relations with North Korea will unsettle Beijing, which has used the Hermit Kingdom as a buffer state. If the U.S. and North Korea develop better relations, China will be displeased.

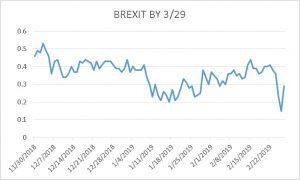

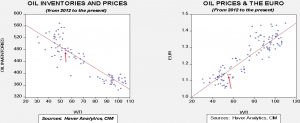

Brexit: There isn’t a whole lot new to report, but there is some background on why PM May has reversed her position. The government has ascertained that both the public and private sectors are woefully underprepared to sever relations with the EU and the economy would almost certainly suffer a nasty disruption if a break were to occur at the end of March.[8] Votes on her plan or an extension will ensue next month and the odds that her plan gets more support are increasing as Brexiteers are beginning to realize that a hard Brexit isn’t going to be allowed to transpire. Instead, the vote on March 12 is becoming a choice between May’s deal and indefinite delay. Faced with that prospect, Brexit supporters may grudgingly decide that May’s plan is better than no exit.

Another interesting bit of information has emerged on the EU/U.K. post-agreement talks. Apparently, EU bureaucrats sit in on the meetings and write confidential minutes to distribute to member nations. As often happens, these summaries have leaked and confirm what we have long suspected—nothing happens in these meetings.[9] The EU isn’t going to change anything and thus the U.K. will need to act if an adjustment is going to occur.

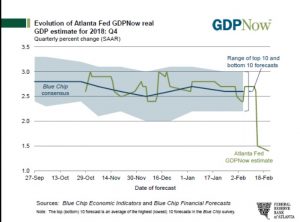

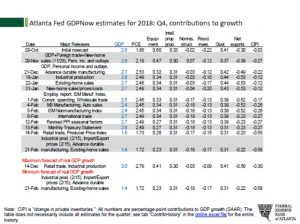

Powell to Capitol Hill: Chair Powell went to Capitol Hill. There were no real surprises. He gave ample reasons why policy will remain on pause, which was clearly telegraphed by other statements and speeches.[10] He did warn of the fiscal deficit, but this has been a nearly constant theme of Fed chairs for decades. After all, fiscal expansion can complicate monetary policy; if the former leads to an overheated economy then the Fed has to play the role of spoiler and tighten monetary policy. Nevertheless, there is no inflationary evidence that current deficits are a problem.

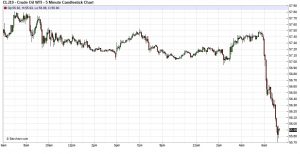

Nigerian elections: Incumbent President Buhari has apparently won reelection in a poll that was marred with violence and a low turnout.[11] We recently profiled these elections in a WGR.[12] As we noted in our report, it is unlikely the opposition will accept the results peacefully, which may support oil prices.

Zarif resigns, Rouhani rejects: Iran’s foreign minister, Javad Zarif, offered to resign earlier this week.[13] President Rouhani refused to accept the resignation.[14] So, for now, Zarif will remain at his post.

League wins again: As we noted yesterday, the Five-Star Movement took a drubbing in local elections in Abruzzo over the weekend. The votes are now in from local elections in Sardinia with the same result. Right-wing populism is on the rise in Italy. The leadership of the Five-Star Movement put on a brave face[15] regarding these losses, but if this trend continues the party will be doomed, at best, to junior partnership within the coalition.

A cyber counterattack: The U.S. military confirmed that it disrupted the internet access of a Russian troll farm[16] as a signal to Russia that the U.S. is not without the capacity to retaliate against cyberattacks. We would not view this as a major disruption but more of a warning to Moscow.

A threat to tech: The Federal Trade Commission has created a task force to examine competition in the online platform industry.[17] There has been growing concern about the acquisitive nature of some of these firms and this body could build a case for anti-trust action.[18]

Confirming our suspicions:A recent study[19] shows that only Germany and the Netherlands benefited significantly from joining the Eurozone. Italy has fared the worst. We have concluded that the Eurozone has essentially allowed Germany to treat the rest of the Eurozone as colonies, creating conditions that forced other nations to absorb its imports by expanding their debt burden. This study mostly confirms that notion, although we were surprised that the Netherlands also prospered. This is why we believe that, at some point, either the Eurozone will break up or Germany will have to play the role of benevolent hegemon and become a net importer (we think the first is the more likely outcome).

View the complete PDF

[1] https://www.ft.com/content/73279334-3a32-11e9-b72b-2c7f526ca5d0?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[2] https://www.ndtv.com/india-news/air-force-pilot-missing-pakistan-claims-hes-in-their-custody-we-are-ascertaining-claims-government-2000101

[3] https://www.nytimes.com/2019/02/26/world/asia/india-pakistan-kashmir-airstrikes.html?wpisrc=nl_todayworld&wpmm=1

[4] https://www.hindustantimes.com/world-news/we-support-india-s-right-to-self-defense-us-nsa-john-bolton-to-ajit-doval/story-uuvWwXJLRm51B4Px4xU0gK.html?wpisrc=nl_todayworld&wpmm=1 and https://www.ft.com/content/329e95fe-3a39-11e9-b72b-2c7f526ca5d0?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[5] https://twitter.com/tanvi_madan/status/1100431568441614337?wpisrc=nl_todayworld&wpmm=1

[6] https://theprint.in/opinion/the-factivist/india-has-called-pakistans-nuclear-bluff-again-but-modi-cannot-become-complacent/198346/amp/?__twitter_impression=true&wpisrc=nl_todayworld&wpmm=1

[7] https://thediplomat.com/2018/05/we-need-to-talk-about-north-koreas-intermediate-range-ballistic-missiles/

[8] https://www.ft.com/content/7d973c06-39c5-11e9-b72b-2c7f526ca5d0?emailId=5c76210b18880800041f4764&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22 and https://www.ft.com/content/fe7faba2-39e1-11e9-b856-5404d3811663?emailId=5c76210b18880800041f4764&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[9] https://www.nytimes.com/2019/02/26/world/europe/brexit-theresa-may-brussels.html?emc=edit_mbe_20190227&nl=morning-briefing-europe&nlid=567726720190227&te=1

[10] https://www.ft.com/content/9fb7ffc2-39d0-11e9-b856-5404d3811663?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[11] https://www.bbc.com/news/world-africa-47380663

[12] See WGR, The Nigerian Election (2/11/2019).

[13] https://www.nytimes.com/2019/02/25/world/middleeast/javid-zarif-resigns.html?emc=edit_mbe_20190226&nl=morning-briefing-europe&nlid=567726720190226&te=1 ; https://www.apnews.com/08cb7394544947f5aa0459a2fb99fcd7?utm_source=POLITICO.EU&utm_campaign=6c8db1e66d-EMAIL_CAMPAIGN_2019_02_26_05_51&utm_medium=email&utm_term=0_10959edeb5-6c8db1e66d-190334489 ; https://www.wsj.com/articles/irans-foreign-minister-resigns-in-an-instagram-post-11551128482

[14] https://www.aljazeera.com/news/2019/02/iran-rouhani-rejects-top-diplomat-zarif-resignation-190226152426950.html?utm_source=Eurasia+Group+Signal&utm_campaign=80438cd2d4-EMAIL_CAMPAIGN_2019_02_27_12_23&utm_medium=email&utm_term=0_e605619869-80438cd2d4-134308033

[15] https://www.ft.com/content/2dc730be-39d9-11e9-b856-5404d3811663?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[16] https://www.washingtonpost.com/world/national-security/us-cyber-command-operation-disrupted-internet-access-of-russian-troll-factory-on-day-of-2018-midterms/2019/02/26/1827fc9e-36d6-11e9-af5b-b51b7ff322e9_story.html?utm_term=.70944d2e0996&wpisrc=nl_todayworld&wpmm=1

[17] https://www.ft.com/content/2801ced2-39f7-11e9-b856-5404d3811663?emailId=5c76210b18880800041f4764&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[18] https://www.ftc.gov/tips-advice/competition-guidance/guide-antitrust-laws

[19] https://www.cep.eu/fileadmin/user_upload/cep.eu/Studien/20_Jahre_Euro_-_Gewinner_und_Verlierer/cepStudy_20_years_Euro_-_Winners_and_Losers.pdf