by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

The Hamas attack on Israel did lift oil prices earlier this week, but markets are mainly taking a “wait and see” approach to prices so far.

(Source: Barchart.com)

(Source: Barchart.com)

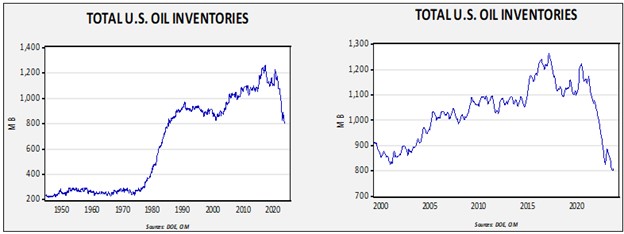

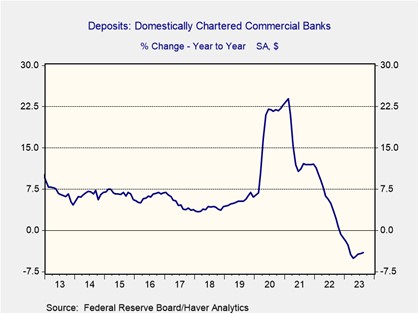

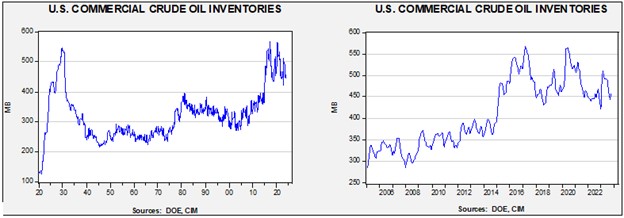

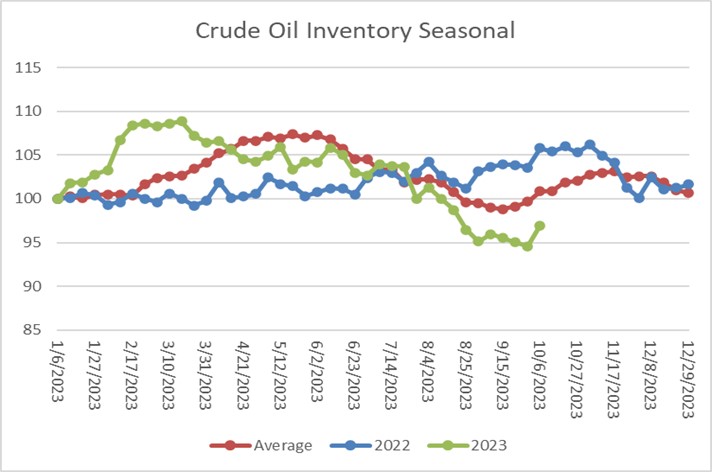

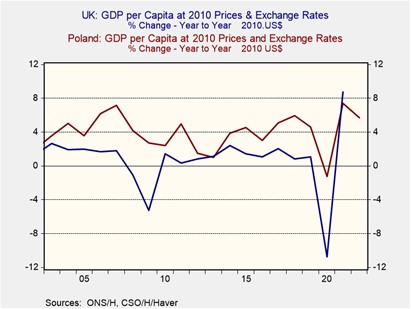

Commercial crude oil inventories jumped 10.2 mb compared to forecasts of a 0.4 mb draw. The SPR was unchanged, which puts the net draw at 10.2 mb.

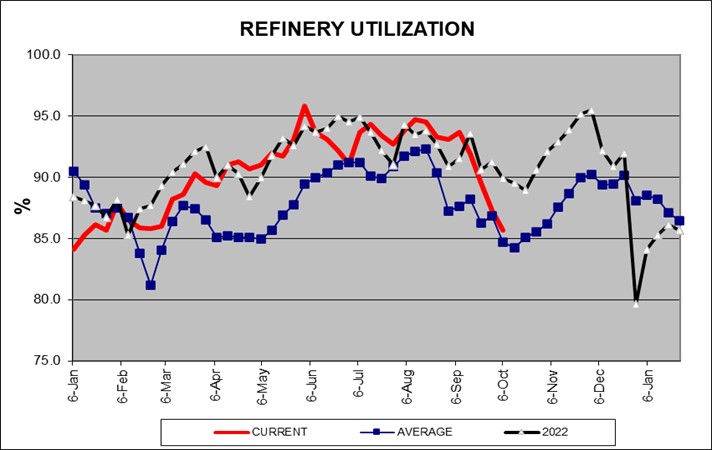

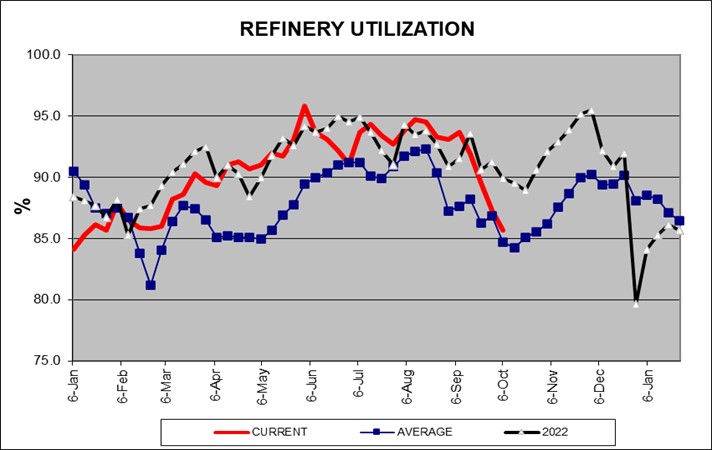

In the details, U.S. crude oil production has jumped 0.3 mbpd to 13.2 mbpd; we have suspected for some time that the DOE was undercounting production, which has led to large “adjustment” plug numbers. Exports fell 1.9 mbpd, while imports rose 0.1 mbpd. Refining activity fell 1.6% to 85.7% of capacity. We are clearly heading into the autumn refinery maintenance period which should reduce oil demand.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

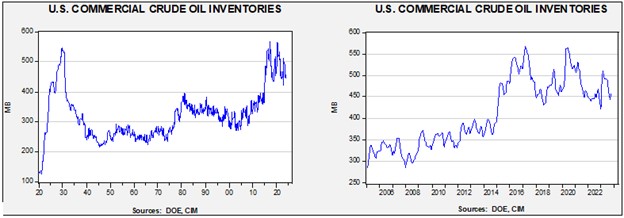

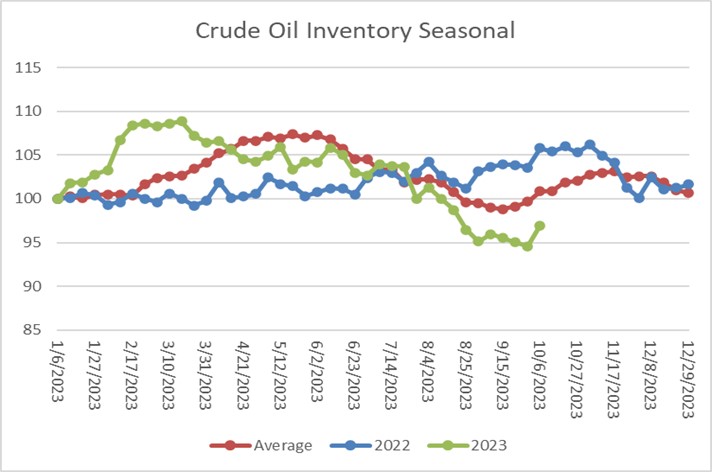

The above chart shows the seasonal pattern for crude oil inventories. Last week’s jump in inventories is consistent with seasonal patterns and represents some “catch up” to the recent stockpile declines. With refinery operations slowing, further increases in inventories would be expected. At the same time, as the chart below shows, we should be near the trough of the seasonal maintenance period and demand should start rising soon.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

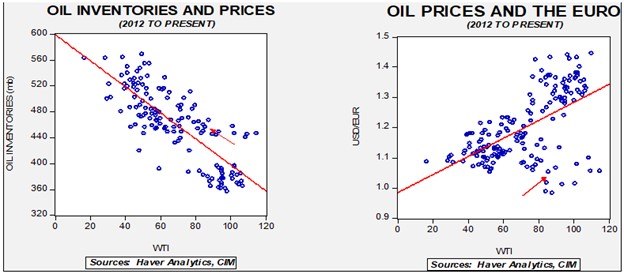

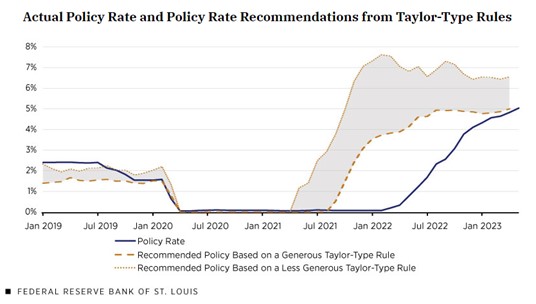

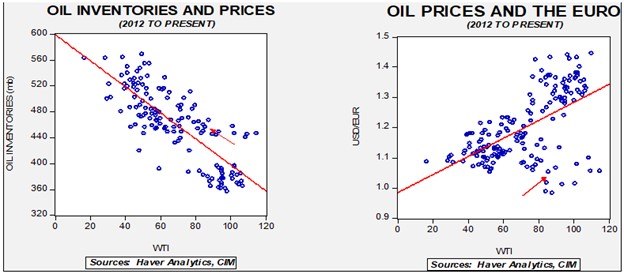

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $72.52. However, given the level of geopolitical risk in the market, we are not surprised that oil prices are well above this model’s fair value.

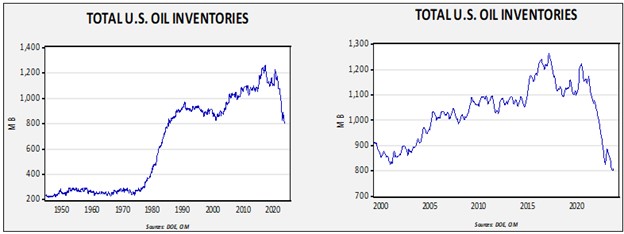

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $93.83.

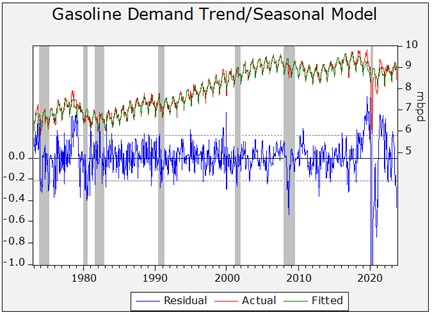

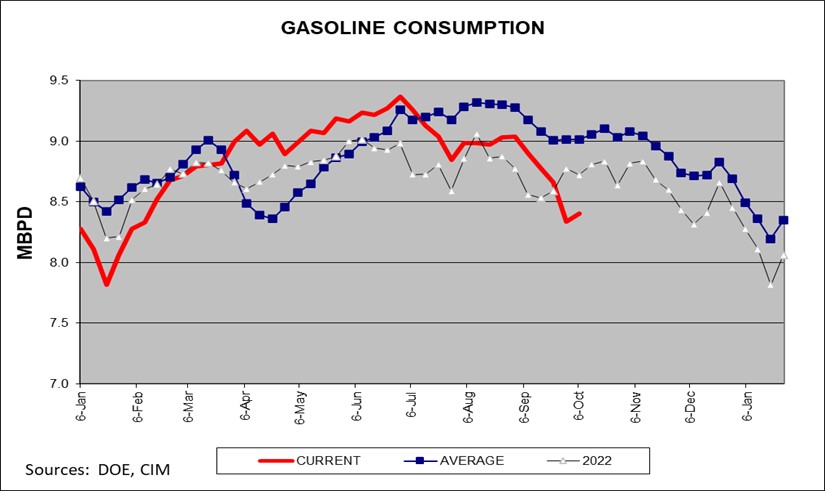

What’s Happening to Gasoline Demand?

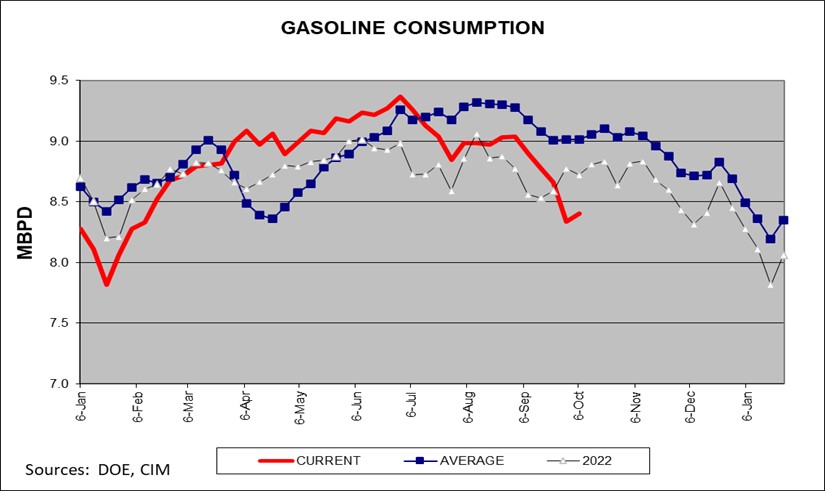

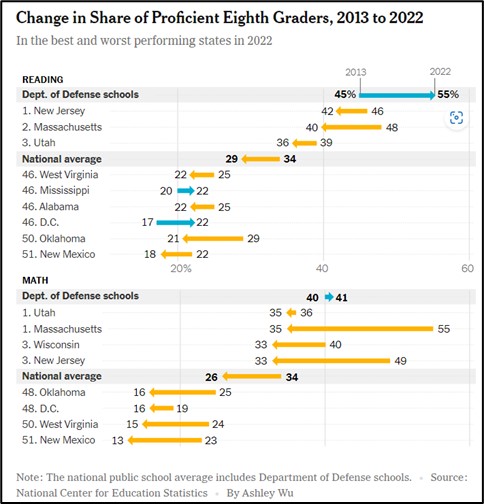

As summer came to a close, gasoline demand turned down sharply.

It isn’t unusual for gasoline consumption to decline when summer ends. Vacation season ends as school starts and, often, a seasonal decline in homebuilding activity can also hurt demand.

However, as the chart above suggests, the recent decline is rather sharp, and, more importantly, actually began during the summer.

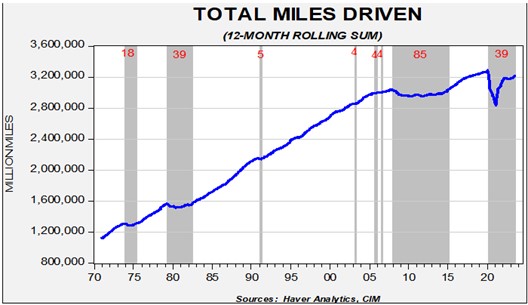

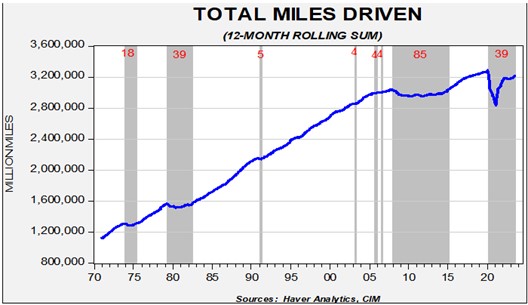

We have noted that driving activity hasn’t been the same since the Great Financial Crisis.

From the early 1980s into the crisis, gasoline demand steadily rose. Recessions didn’t generally cause significant declines, but driving activity flattened following the crisis. We did see some improvement from 2015 until the pandemic, but since the pandemic, miles driven have been under pressure. There are likely a myriad of reasons for this change. We were approaching the point where suburban sprawl had reached a limit; commutes were so long that households could no longer live further from work. The pandemic introduced more widespread work-from-home employment, which played a role. Also, social media now allows friends to “meet” without physically going anywhere. So, it makes sense that gasoline demand would be affected.

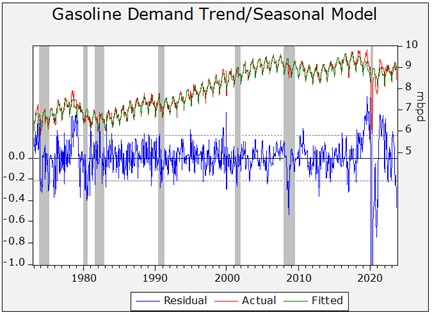

This model looks at gasoline consumption from 1973 to the present. We seasonally adjust the data and run a Hodrick-Prescott trend variable through the data. Note the plunge in the divergence[1] in the most recent data. The decline in gasoline demand suggests that something is affecting consumption. Given that gasoline consumption is usually price insensitive, this may be a warning that the economy is under pressure. Usually, when gasoline demand is this weak, a recession is underway.

Market News:

- Despite a hot summer, EU natural gas inventories are ample. Some of this is because last winter was mild, which meant the spring and summer refill seasons began with a surplus. Now that inventories are mostly full, natural gas prices have been soft, and volatility has been low. In the past week, however, this calm has been disrupted. The Hamas incursion led to a production halt in the Eastern Mediterranean which triggered a jump in prices. In addition, it’s worth noting that there is never enough storage if the winter is cold, and so, prices could move rapidly higher if the weather dictates. Also, we note that Australian LNG workers are going on strike.

- Drought is reducing water levels in the Panama Canal; the restrictions could reduce flows of petroleum, LNG, and related products.

- Although company information is not the primary focus of this report, the recent announcement of a merger between Pioneer (PXD, $239.71) and Exxon (XOM, $105.69) will give the latter a dominant position in the U.S. shale patch. Exxon usually engages in large projects that take years to develop. By adding shale assets, it will be able to ramp up production quickly. There are two takeaways: first, Exxon must feel comfortable that the U.S. policy environment will continue to support fossil fuel production; and second, the company may have been worried about the long-term prospects for oil and therefore wanted to increase its portfolio of rapid production assets.

- U.S. oil exports reached a new record in the first half of the year.

- Artificial intelligence energy demands are enormous and will likely drive the need for more generating capacity.

Geopolitical News:

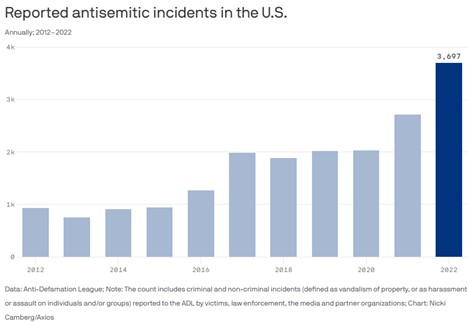

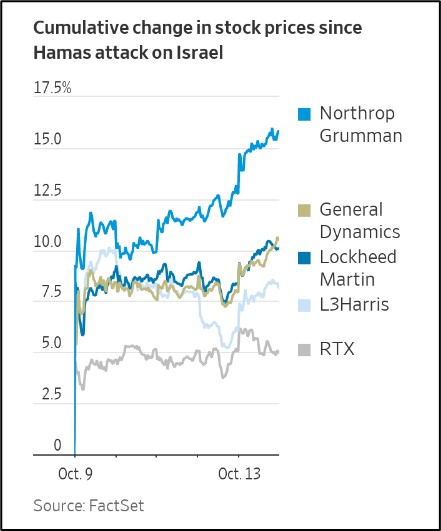

- The major geopolitical news of the week was the surprise attack by Hamas on Israel. On Sunday, Hamas, operating in the Gaza strip, launched a widescale attack on southern Israel, assaulting several towns, killing several hundred Israelis, and taking over 100 hostages. In our Daily Comment, we have covered this event. For energy markets, there are four key factors:

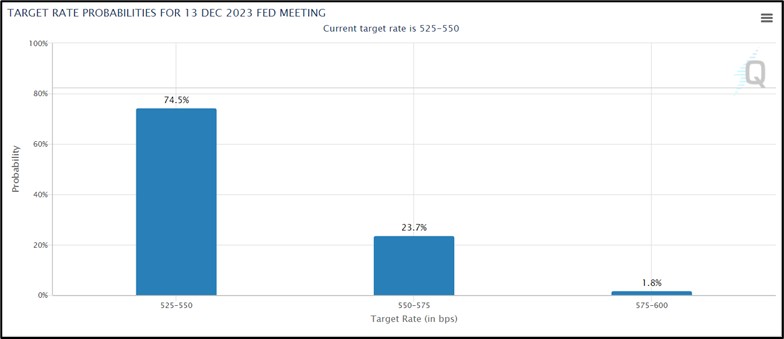

- The Saudi/Israeli normalization talks are likely dead for now. Although there was progress being made before the invasion, it would be difficult for the Kingdom of Saudi Arabia (KSA) not to show solidarity with Hamas. At the same time, the degree of restraint Israel would have to exercise to keep negotiations alive would be near impossible for the Netanyahu government. A deal that might encourage the Saudis to utilize the 2.0 mbpd of excess capacity to bring down oil prices is unlikely at this point.

- Broader normalization among the Arab states is also uncertain at this time. Generally speaking, these states are issuing “both sides” types of statements and calling for a curtailment of violence.

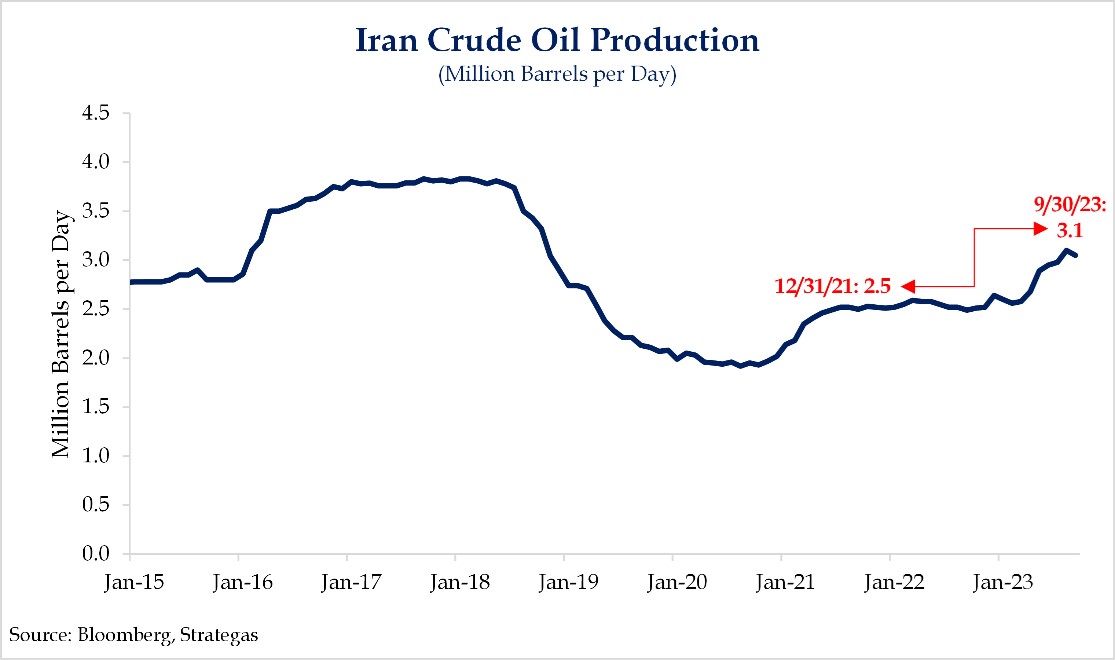

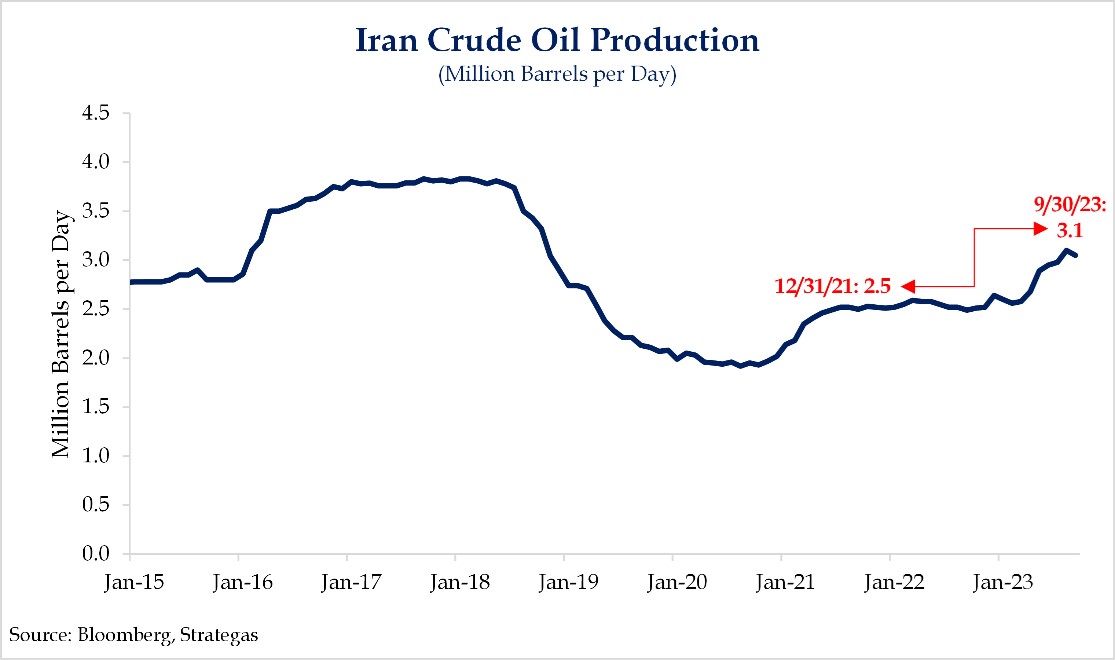

- If Iran is held culpable for supporting Hamas’s attack, some level of Israeli (and perhaps U.S.) retaliation is probably unavoidable. Although the retaliation could be covert by focusing on cyber-attacks and special operations, such low-key strikes might not be politically sufficient for Israel. After all, this event is being described as Israel’s “9/11.” A direct attack on Iran would almost certainly roil the oil market and send prices higher. If Iranian crude shipments were forcibly curtailed, it would not be a surprise if Iran closed off the Strait of Hormuz. We expect the U.S. to tread carefully in blaming Iran, but the evidence thus far seems to support its involvement. We do expect the U.S. and Europe to try to prevent a widening of the conflict as a broader war would bring the risk of higher oil prices. So far, Iran is claiming no role in the attack, which contradicts accounts recently detailed by the WSJ. Our expected playbook on Iran is for increased sanctions, which will likely include freezing the recently unfrozen $6.0 billion of Iranian assets. At the same time, expect to see reports that confirm Iran was not directly involved in the actual attack.

- This attack may stunt natural gas development in the eastern Mediterranean. The projects could be vulnerable to attack, and even if the current facilities can be secured, geopolitical risks could affect future investment.

- As we have noted in recent reports, there is some evidence that Iran may have penetrated upper levels of the Biden administration. The Hamas attack could raise concerns about the administration’s recent actions to improve relations with Iran.

Alternative Energy/Policy News:

- Nio (NIO, $8.53), a Chinese car company, is losing $35k per car. China’s ability to subsidize these losses makes the country a formidable competitor in this area. As we have noted in recent reports, China appears to be targeting the EU for its EVs, and Brussels is increasingly concerned about Chinese dumping and the potential damage to Europe’s auto industry.

- The stigma against nuclear energy is slowly weakening in Europe as the need for electricity and the appeal of no carbon emissions make the source increasingly attractive.

- Kenya is emerging as a major leader in geothermal power. It plans on generating half of its electricity from this clean source.

- Perhaps the most important metal in the energy transition is copper. Battery metals will change as technology changes, but, to date, no one has developed an electrical conductor as price efficient as copper. Unfortunately, existing mines are faced with a reduction in productivity as ore concentration declines. Thus, new mines will be necessary in order to boost output; however, it has been difficult to fund and approve new projects.

- Heat pumps are an efficient, yet controversial, method for heating and cooling. The problem is that they don’t work well in extreme temperatures. In the case of Germany, the government has been forcing homeowners to use heat pumps when they would prefer not to. As the IEA points out, though, improving efficiency is an important part of reducing energy consumption.

- Technology has become an issue in recent union contract negotiations. For example, part of the demands of the Hollywood writers included protection against AI-derived scripts. The UAW is worried that EVs will reduce the number of autoworkers required to build cars and, at the same time, the union fears battery factories are increasingly being sited in right-to-work states. The new technology is a threat to UAW jobs and the current strike is trying to address these issues.

[1] We have truncated the residual data to reduce the chart distortions from the pandemic.

View PDF

(Source: Barchart.com)

(Source: Barchart.com)

(Sources: DOE, CIM)

(Sources: DOE, CIM) (Sources: DOE, CIM)

(Sources: DOE, CIM)