by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning. Equity markets are mostly treading water this morning, and Chair Powell will speak later today. Interest rates are also mostly steady, but commodities are mixed as oil and gold are lower while grains are higher.

In today’s Comment, we start our coverage with a recap of yesterday’s state and local elections. Next is our update on the situation in Gaza. A roundup of economic and financial news follows. China is next on the docket, and we close with our international overview.

Elections: Democrats generally did well last night. Meanwhile, budgets and AI are background issues.

- Going into last night’s elections, there was a general level of concern among Democrats due to recent adverse polling. However, for the most part, the party outperformed expectations.

- Abortion continues to bring out voters for Democrats. Ohio voters chose to put abortion access into the state’s constitution, for example.

- Governor Beshear was re-elected in Kentucky, a deeply red state.

- In Pennsylvania, voters supported Democrats in local elections despite weak poll numbers in that state for President Biden.

- In Virginia, Democrats gained control of the statehouse, thwarting Governor Youngkin’s goal of a Republican takeover. This loss may dim his national aspirations.

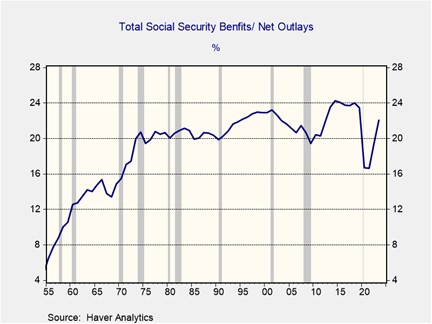

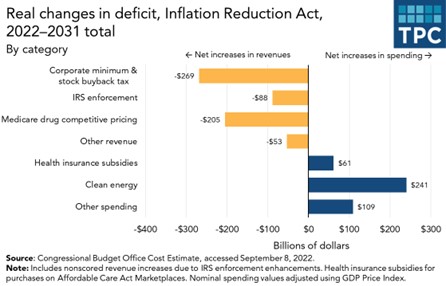

- The House GOP can’t seem to agree on a plan of action to deal with the fiscal budget. One idea being floated is a series of continuing resolutions, essentially creating a series of “fiscal cliffs.” To some extent, the budget talks have an air of “rearranging the deck chairs on the Titanic” in that the deficit is spiraling in an unsustainable path, and there is little evidence either party is paying attention.

- We are about a year away from presidential elections, and there are reports that AI generated videos are becoming indistinguishable from real ones, which means that video disinformation may become just about impossible to control. Not only does this create conditions where political operatives can generate mayhem, but it also gives foreign actors outsized influence. We have been monitoring this issue for some time, and the speed of development has been surprising. It is unclear how this will affect elections next year, but this factor adds to an already unsettling political environment.

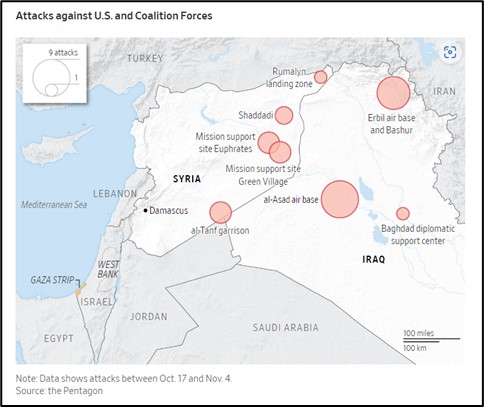

Gaza: IDF has entered Gaza city, and the U.S. is warning Israel against taking control of Gaza.

- According to reports, Israeli forces have entered Gaza City. This battle will be difficult for the Israelis, since in general terms, defense is easier than offense. Complicating matters further is that urban warfare is difficult, and Hamas is well prepared for this attack with a well-established tunnel system. We would expect the conflict to become bogged down from this point forward.

- The U.S. is warning Israel that it probably isn’t a good idea to occupy Gaza. Given how rapidly this situation is evolving (it was a month ago that Hamas attacked Israel), it appears that the Netanyahu government hasn’t sorted out what its plans are. We note that SoS Blinken downplayed the notion of occupation. The fact of the matter is that there are no good solutions to this situation which is why the government is struggling with a plan.

- Arab states are increasing their calls for a ceasefire. China and Russia are echoing these calls in a bid to improve their status in the region.

- The EU is facing an increase in terrorist violence, likely in response to the conflict in Gaza. Extremist activity in the U.K., Belgium, Germany, and France has been reported. The violence appears to be having an impact on immigration policy (see below in International Roundup).

- One of the factors that may have triggered Hamas’s attack was normalization between Israel and Saudi Arabia. The Abraham Accords, for the most part, ignored the Palestinian situation and the fact that Arab states signed on suggests that the Palestinians were not a key factor in relations. Initially, Riyadh backed away from normalization talks. However, there are reports the Saudis are still interested in making a deal. If talks go forward, it suggests that the Palestinians have very little leverage in the region.

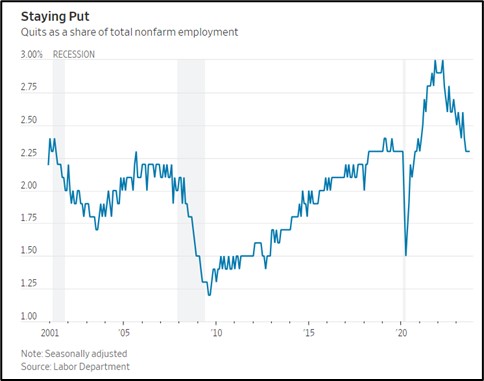

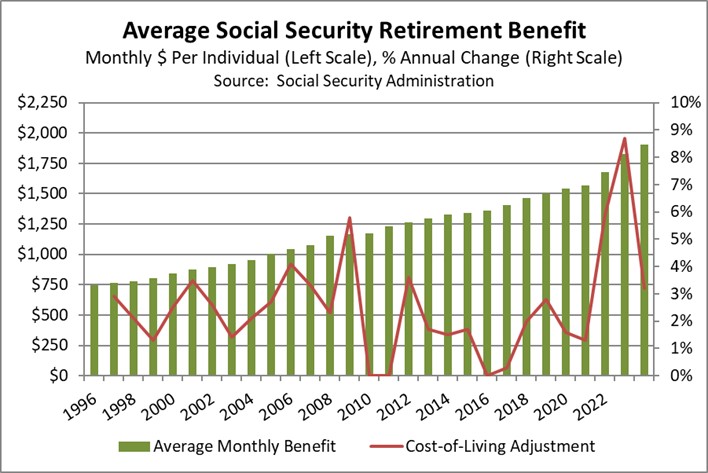

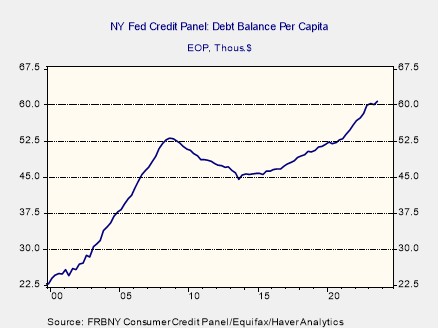

Economic and Financial News: The NY FRB’s household debt data was released yesterday, showing an uptick in borrowing. Commodities are mixed: oil is lower, while beef and grain prices are rising.

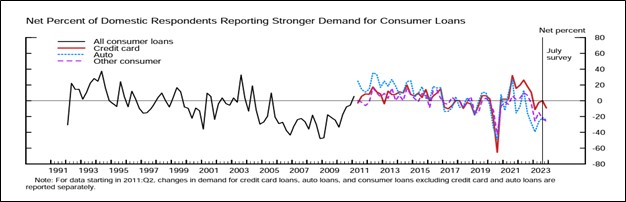

- The NY FRB household debt data showed a modest rise in Q3. The debt balance per capita is just above $60k.

- Company reports are hinting that consumer spending may be slowing down. If so, economic activity will likely also decline.

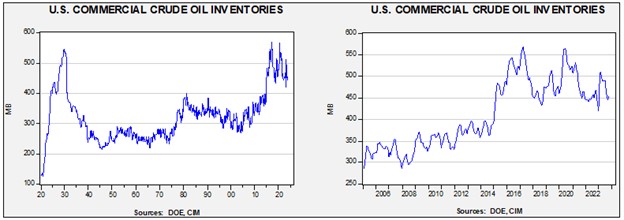

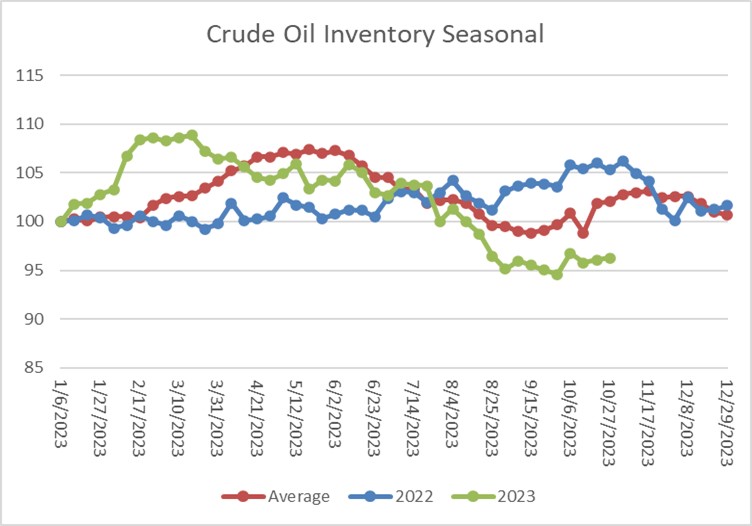

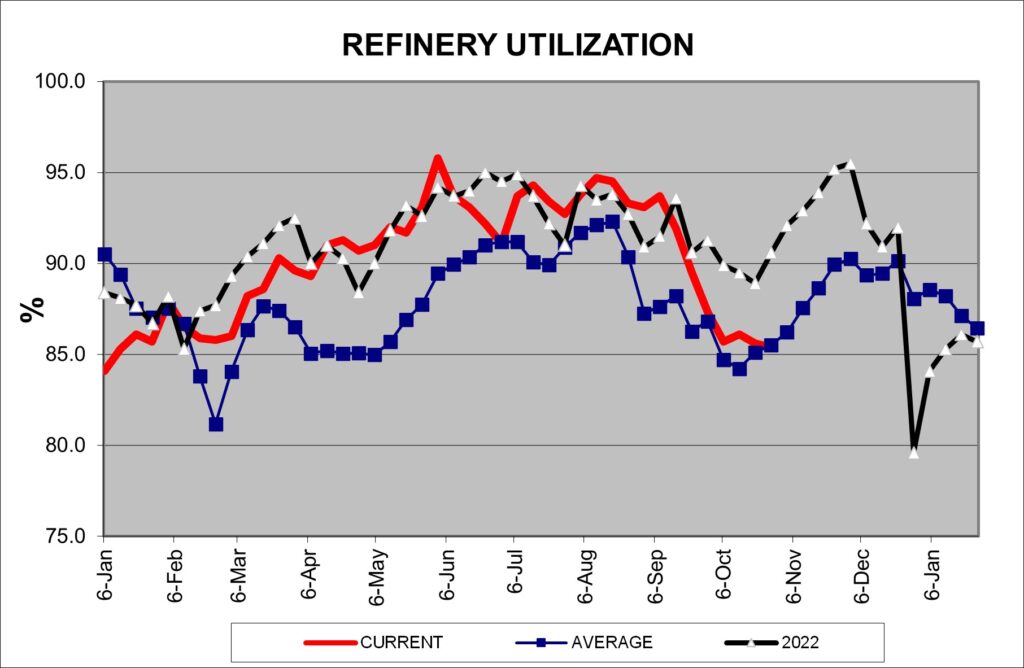

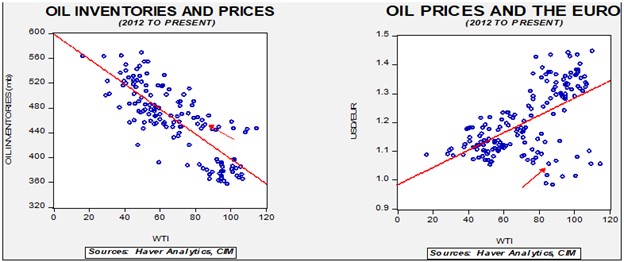

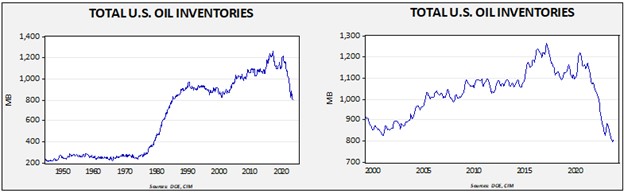

- Oil prices have declined to the levels last seen before the Gaza event. Although there are worries that the conflict will spread, every day that passes with the war staying in Gaza, the fears clearly dissipate.

- Last summer was dry and hot in the central U.S. These conditions create a problem for ranchers, as it forces them to buy hay to feed their animals instead of using grass, and the hay costs rise due to drought. The bottom line is that beef costs are slated to rise further. The CPI for beef was up 7% in September.

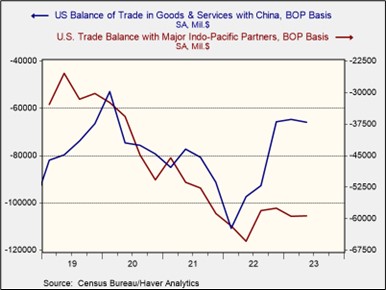

- China is increasing its purchases of U.S. soybeans; this buying is boosting soybean prices.

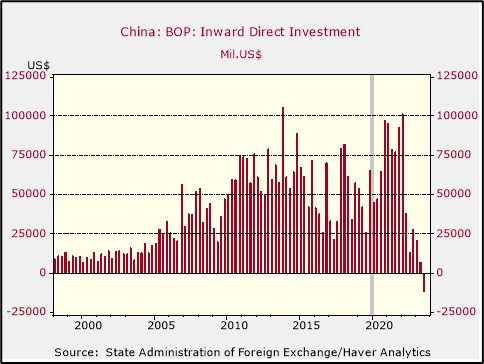

China Update: The IMF upgrades its forecasts for China’s economic growth while raising concerns over its real estate situation. Beijing is putting additional controls on the exporting of rare earths.

- The IMF raised its forecasts for this year’s growth to 5.4% from 5.0% and lifted next year’s forecast GDP to 4.6% from 4.2%. At the same time, the IMF warned that China’s housing sector remains a risk to the economy. China has boosted infrastructure spending to lift growth. We view this action as problematic, but the spending is likely better than allowing for a downturn.

- China announced new measures to control exports of rare earths, along with other major commodities such as oil and iron ore. China has been aggressively building oil stockpiles in recent months. Some of this rebuilding is taking advantage of sanctions on Russia and Iran, which have depressed prices for their crude oil. Adding controls is consistent with China’s functioning in a multipolar world.

- China is building its stockpile of semiconductor equipment prior to U.S./EU restrictions.

- Polling in China suggests some softening in hostility towards the U.S. This change may reflect the impact of recent meetings.

International Roundup: NATO and the U.S. are suspending a 1990 treaty that limited conventional forces in Europe. Portugal’s PM is out, and we include a note on immigration.

- The U.S. and NATO have formally suspended their participation in a treaty that limited conventional forces in Europe, effective December 7. This action follows Russia’s withdrawal from the treaty. The treaty was a landmark at the time, signaling a formal end to the Cold War. The pact limited troop levels and armor that could be held by NATO and the Warsaw Pact states. It also forced both parties to inform the other where troops were deployed. However, Russia suspended the treaty in 2007, and it’s unclear why NATO and the U.S. waited so long to retaliate. The slow response is an indication of policymakers’ denial of Russia’s intentions.

- PM Costa of Portugal resigned yesterday after police raided his residence as part of a corruption investigation. The president of Portugal will either need to appoint a new PM or call for elections. The probe concerns how EU funds were spent on green investments.

- Immigration has been a “hot button” issue in the EU for some time. Much of the immigration is coming from Northern Africa and the Middle East. These immigrants, mostly Muslim, have struggled with integrating into Europe and the social disruption has caused political upheaval in the EU, elevating right-wing parties. Part of the problem is that Europe is facing a demographic deficit and needs immigrants, but worries about cultural disruptions remain unsolved. As tensions have risen, individual nations in Europe are taking action, making a EU-wide policy difficult to implement. The fear is that individual states will try to force the costs of immigration onto other nations, creating fissures within the EU. At this point, we don’t see how Brussels can contain this trend, meaning that the immigration issue will likely worsen.