Daily Comment (April 14, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with the market’s reactions to the reduction of supplier price pressures in March and last week’s jump in unemployment claims. Next, we give our thoughts on commercial real estate and its potential threat to the economy. Finally, we focus on why we believe investors should look toward neutral countries that may not align with either the U.S. or China-led blocs.

Is It Over? The market responded positively to the mixed economic data that was released on Tuesday.

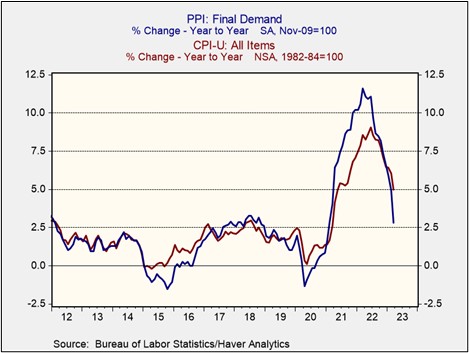

- A sharp decline in producer inflation and a steady increase in jobless claims have increased speculation that the Fed may soon pause rate hikes. The prices paid by suppliers for goods and services decelerated in March from 4.9% to 2.7%. The steep declines in trade services, transportation, and warehouse prices were the primary drivers of the slowdown. Additionally, initial jobless claims rose by 11,000 to 239,000 in the week ending April 8, the highest level since January 2022. The increase in the weekly applications for benefits could be a signal that the labor market is cooling. The combination of easing price pressures and increased layoffs could pressure the Fed to rethink its interest rate strategy.

- Investors were surprised by the economic reports released on Thursday, and equity holders responded by piling into risk assets. The S&P 500 rose 1.3% from the previous day, while the NASDAQ Composite gained 1.9% in the same period. At the same time, yield-curve inversion deepened as the data reinforced fears of an imminent recession. The yield on two-year Treasuries fell by 5 bps from 4.75% to 4.70%, while the 10-year Treasury yield dropped 21 bps from 4.50% to 4.19%.

- The latest economic releases may not be enough to convince the Fed to pause in May, but they may deter policymakers from hiking in later meetings. Although PPI is highly correlated with the consumer price index, it is unlikely that the next report will show a similar decline. The unemployment data has a similar problem. Initial claims remain too close to pre-pandemic lows to justify a shift in Fed policy. As a result, it is still highly probable that the Fed will raise its benchmark interest rate by 25 bps at its next meeting.

No Need to Fear: The regional bank crisis has fueled speculation that commercial real estate (CRE) loans may pose a risk to the overall economy; however, we have a different perspective.

- The CRE sector is risky for lenders looking to maintain healthy balance sheets following the recent bank turmoil. Bank of America reported that clients pulled $451 million from real estate stock due to concerns about the commercial property market. The massive withdrawal comes as the sector faces a series of headwinds from higher borrowing costs, work-from-home trends, and a possible recession. Other sources of liquidity, such as commercial mortgage-backed securities, may not provide much help as bond issuance is down 82% from the prior year.

- With over $1.5 trillion worth of U.S. commercial real estate debt due by 2025, the CRE sector has limited financing options. Mortgages on office spaces are particularly vulnerable as nearly a quarter of the loans are set to expire in 2023. Shadow lenders are positioning themselves to fill the void left by prudent banks. Private credit providers typically offer smaller loans at higher spreads than traditional lenders. A syndicated loan fetches about 4.5% over the secured financing overnight rate, while direct lenders receive close to 6.0%. Therefore, commercial property owners’ bottom lines will be pressured due to the increase in borrowing costs.

- The risk that CRE loans pose to the economy, though, may not be as critical as reports suggest. Regional banks do indeed provide 70% of the loans to the CRE sector, but this does not mean the sector is in imminent danger. Private lenders have the liquidity necessary to help struggling firms and may be better suited than traditional banks to take them over in the event of default. Unlike regional banks, debt funds typically have experts that understand how these companies operate. Additionally, the lack of regulation may give these lenders more flexibility to offer support for struggling property firms. The CRE sector may be poorly positioned, but its unwinding is unlikely to be as detrimental to the U.S. economy as is currently being speculated.

Nonalignment Flex: Countries that are capable of managing relationships with both the U.S. and China-led blocs may offer investment opportunities.

- Lula’s refusal to expand the U.S. ties created by his predecessor shows how Brazil can sway between blocs. On Friday, Brazilian President Luiz Inácio Lula da Silva advocated for developing countries to abandon the use of USD for trade. Latin America’s largest country by population and economy could assist in U.S. foreign policy efforts to rein in Beijing’s ambitions, as China relies on the two countries for grain exports. However, it seems Lula has no interest in antagonizing Beijing. Since his inauguration, Brazil has been pushed closer to China, much to the dismay of Washington.

- Meanwhile, India and Turkey have been able to exercise strategic ambiguity between the two blocs. Despite being a member of the North Atlantic Treaty Organization, document leaks revealed that Turkish officials had met with mercenaries from the Wagner Group to discuss weapons sales. Although no arrangement was made, the discussions show how Turkey has dual aims in this conflict. Meanwhile, India continues taking advantage of the war in Ukraine to access cheap oil. Russia’s discounted crude prices have allowed New Delhi to pressure other suppliers to slash their prices. India and Turkey’s ability to work with Russia without significant consequences from the U.S. exemplifies these countries’ viability in a fractured world.

- Neutral countries will likely be targets for foreign direct investments as the two major powers compete for influence. The strategic importance of these countries will give them greater flexibility to maintain trade ties with both blocs. Additionally, the neutral countries will likely have a much greater voice in negotiating favorable bilateral agreements as it can always threaten cooperation with the other bloc as leverage. As a result, we believe that countries capable of resisting both the U.S. and China may be attractive destinations for investments.