Asset Allocation Bi-Weekly – Increasing Concerns About Commercial Real Estate (April 10, 2023)

by the Asset Allocation Committee | PDF

Last month’s failure of Silicon Valley Bank (SIVB, $106.04) showed that the institution had vulnerabilities in both its assets and its liabilities. On the asset side of its balance sheet, the bank had too much exposure to longer-maturity government bonds, which depreciated sharply as the Federal Reserve aggressively hiked interest rates over the last year. On the liability side, the bank had many huge deposits from small, start-up technology firms that were burning through cash rapidly. A number of those deposits far outstripped the FDIC insurance cap of $250,000. As its deposits fell, Silicon Valley had to sell many of its bond holdings at a loss, undermining faith in the bank and spurring further withdrawals. Investors worried that other small and mid-sized banks could have similar vulnerabilities, especially if they had excessive exposure to a particular industry or type of customer.

The moves by bank regulators to insure all of Silicon Valley’s deposits and set up a special lending facility for banks facing a potential run on deposits helped calm depositors and ease investor apprehensions about the banking system. Still, the crisis has sparked concerns about what the next source of problems will be in the financial system. The focus has fallen hard on the commercial real estate (CRE) industry. A key concern is whether the crisis-driven flight of deposits from small and mid-sized banks to bigger banks and mutual funds will crimp CRE lending in the coming months. Since small and mid-sized banks provide the majority of CRE loans in the U.S., such a drop in lending could make it harder for building owners to roll over their maturing loans, which could spark defaults, push down property prices, and slow new investment.

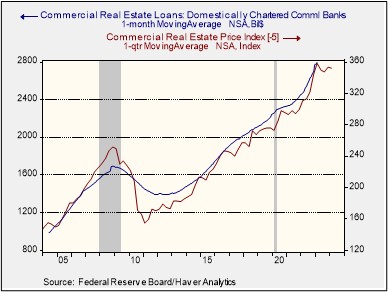

Our analysis indicates a drop in CRE lending is indeed likely. For example, the chart below shows that the volume of bank CRE loans closely tracks the Fed’s Commercial Real Estate Price Index with a lag of about five quarters, or 14 months. Since the price index hit a plateau at the end of 2021, the relationship suggests lending volumes should now be flattening out as well.

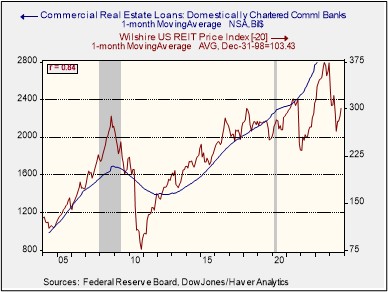

Similarly, the chart below shows that CRE lending is highly correlated with the price of real estate investment trusts (REITs), with a lag of about 20 months. Since the Wilshire U.S. REIT Price Index peaked in December 2021 and then fell precipitously, this relationship suggests CRE lending should start to fall quickly by late summer 2023.

Finally, the following chart indicates that CRE lending is also highly correlated with the volume of bank deposits, with virtually no lag at all. Even when deposit growth merely slows, as it did from 2009 to 2011, CRE loans have historically fallen. The worrisome factor is that deposits have recently been in outright decline, even though many of the deposits pulled from small and mid-sized banks ended up in large banks. Since bank deposits have already been falling for some time now, it would suggest a drop in CRE lending is now actually overdue.

In sum, these and other indicators point to an imminent fall in CRE lending. Since banks have some flexibility in how they recognize their balance sheet position, the drop in lending will probably be drawn out rather than sudden. The key question is how sharp the lending pullback will be, and an important consideration for that is what small and mid-sized bank depositors do with any funds they withdraw. If those depositors believe that regulators’ actions have stabilized the banking system and they merely shift their funds to larger banks, then overall CRE lending may not fall too much. However, if they think the banking system is still risky and therefore shift their funds into money market funds, short-term bonds, and the like, then the chance of a more painful CRE pullback would increase. Any such drop in lending could make it harder for building owners to roll over their maturing loans and could spark widespread defaults, push down property prices, and deter new investment. That would likely exacerbate any recession in the short term. In any case, the implication for investors is that it is probably still too early to begin buying REITs again.