Daily Comment (April 10, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the latest on the big leak of classified U.S. intelligence documents that was discovered late last week. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including increased military tensions surrounding Taiwan, big new strikes in the U.K., and news that the EPA will soon propose strict new emissions rules for U.S. vehicles.

U.S. National Security Leak: U.S. officials continue to investigate the big leak of classified Pentagon documents onto social media sites late last week. Over the weekend, additional documents were posted, some dealing with topics beyond the U.S. efforts to help Ukraine defend itself against Russia’s invasion. The FBI is now investigating who had access to the leaked documents, which appear to be briefing slides prepared for the Joint Chiefs of Staff. The postings on social media show the hard-copy documents were folded and unfolded before being photographed, which would suggest that they were secretly taken out of a secure location. Although at least one of the photographs was altered to put Russia in a better light, identifying markings on the documents could help identify the culprit. One possibility is that there is a Russian mole at the Pentagon. Another possibility is that the culprit is a Russian sympathizer with access to officials high up in the Pentagon bureaucracy, or perhaps someone opposed to certain aspects of U.S. foreign policy, such as providing more aid to Ukraine.

- One document shows that the U.S. was secretly listening in on communications between top South Korean national security officials late last year when President Yoon Suk-yeol was considering whether to sell 155-mm artillery ammunition to the U.S. to replenish supplies that Washington had sent to Ukraine.

- The report showed Foreign Secretary Yi Mun-hui warned his boss, National Security Adviser Kim Sung-han, that if the ammunition were later re-sold to Ukraine, it would violate official South Korean policy not to provide lethal military goods to countries in active hostilities. Yoon ultimately approved the sale on the condition that the U.S. military would be its “end user.”

- Both Yi and Kim later resigned for unclear reasons, suggesting they may have been forced out for pushing back against the deal.

- If so, it would suggest Yoon went out on a limb politically to support the U.S. In turn, that would underline how much Yoon has prioritized cooperation with the U.S. as he seeks to further cement South Korea into the evolving U.S. geopolitical bloc and prepare for a potential conflict with China.

China-Taiwan-United States: China has launched a series of military drills near Taiwan to express its anger at Taiwanese President Tsai’s visit to the U.S. and her talks with House Speaker McCarthy in California last week. The Chinese military said on Saturday that the drills would aim to test its ability to “seize control of the sea, air and information” in the area, and that they would involve a wide range of naval, air, missile, and electronic-warfare assets. Nevertheless, the drills appear to be somewhat smaller and less threatening to Taiwan than the exercises China launched last summer after former House Speaker Pelosi visited the island itself.

China: Ten Chinese companies had their initial public offerings today, marking the first batch of IPOs under a new set of listing rules for Shanghai and Shenzhen. The average first-day gain for the new stocks was 96%, suggesting the rules still aren’t producing an efficient market for new listings.

Saudi Arabia-Yemen: A Saudi delegation has arrived in Yemen to begin negotiations with that country’s Iranian-backed Houthi rebels. The development is one result of the recent Chinese-brokered rapprochement between Saudi Arabia and Iran. Saudi Arabia’s involvement in ending Yemen’s civil war could also help ease tensions between Riyadh and Washington.

United Kingdom: The British government continues to face big, disruptive strikes by public sector workers who are seeking higher pay. Tomorrow, junior physicians plan to launch a four-day walkout across England for a 35% pay hike. Meanwhile, passport workers last week launched a five-week strike, and additional strikes are feared in education after teaching unions recently rejected the government’s offer of a 4.5% pay rise and a £1,000 one-off payment.

Brazil: Now that leftist President Luiz Inácio Lula da Silva is back in power, a radical agrarian rights group known as the Landless Workers’ Movement said it expects to step up its use of “land invasions,” where it illegally occupies rural land to assert control over it and push out private owners. Increased land invasions would be a threat to Brazil’s important agribusiness sector and could touch off increased political tensions within the country.

U.S. Environmental Regulation: Next week, the Environmental Protection Agency reportedly plans to propose extensive new limits on vehicle tailpipe emissions in order to push U.S. auto makers toward making and selling more electric-vehicles. The stringent new rules are expected to apply to model years from 2027 to 2032.

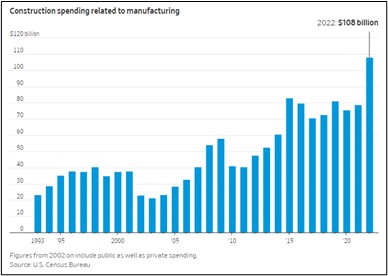

U.S. Manufacturing Industries: New analysis shows U.S. manufacturing capacity last year grew at its fastest rate since 2015, driven by the extensive new construction of factories and related facilities. The increase in factory construction is consistent with our belief that deglobalization, the fracturing of the world into relative separate geopolitical and economic blocs, and increased international tensions will all tend to drive a new period of re-industrialization in the U.S.