Author: Amanda Ahne

Bi-Weekly Geopolitical Report – Posen vs. Pettis (February 26, 2024)

by Bill O’Grady | PDF

Michael Pettis is a professor of finance at Guanghua School of Management at Peking University in Beijing and a nonresident senior fellow at the Carnegie Endowment for International Peace. He is a well-known analyst of China’s economy and financial system. Adam Posen is currently the president of the Peterson Institute for International Economics. He has worked for numerous central banks, including the New York Federal Reserve and the Deutsche Bundesbank. He was a member of the Bank of England’s Monetary Policy Committee from 2009 to 2012.

Posen and Pettis have differing views on what ails the Chinese economy. Which view is correct is important in instituting a fix for China’s economy and establishing what response the US and other nations should take toward China. In this report, we will outline the respective positions of both Posen and Pettis on China’s economy and discuss who we believe is more correct. The latter issue is crucial. If Posen is correct, the answer may be as simple as removing Chinese President Xi from office and returning to the policies that preceded him. If Pettis is correct, fixing the issues will be far more challenging.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify | Google

Daily Comment (February 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the state of play between the US and China in the important new industry of generative artificial intelligence (AI). We next review a range of other international and US news with the potential to affect the financial markets today, including developments touching on global nickel and natural gas markets and some notes on the US financial markets.

China: Just a week after US generative AI firm OpenAI released its Sora text-to-video product, Chinese leaders and technology researchers are reportedly panicking over the realization that China has fallen years behind the US in the technology, rather than being the global leader as previously thought. In a sign of the panic, the government has already ordered 10 state-owned firms to serve as “national champions” to push forward Chinese progress in generative AI, although it has not yet released the names of those firms.

- Chinese researchers had long thought that the country’s vast trove of available data, engineering talent, and government support would give it a leg up in developing the large language models that underlie generative AI.

- It now appears that Western firms also have sufficient data and talent to make strides in the technology. Perhaps just as important, reports suggest the US government’s clampdowns on selling advanced semiconductors and other technology tools to China for national security purposes have also been impeding Chinese progress.

- Beijing’s frustration at falling behind in the AI race and facing ever more restrictions on US technology will likely continue to fuel US-China geopolitical tensions, with negative long-term consequences for firms doing business in China or trying to sell to China.

- Nevertheless, the growing US clampdown on sending advanced technology to China is having a positive impact for some companies in the near term. As the US clampdown is expected to further crimp the sale of semiconductor manufacturing equipment to China, it appears that Chinese firms are ramping up their purchases of chipmaking machinery, driving strong revenue and profit growth at companies like Dutch giant ASML and Japan’s Tokyo Electron.

Indonesia: The chief executive of French miner Eramet, Christel Bories, has warned that Indonesia’s low-cost nickel producers will wipe out their global rivals in the next few years, cementing the country as the world’s dominant producer of the metal, which is vital to electric car batteries. Importantly, Bories said Indonesia’s low costs, which in part reflect government policies, will lead to mines elsewhere being shut down and/or governments having to offer subsidies to keep them open and ensure alternative supply sources.

Qatar: Complementing recently announced investments aimed at increasing the country’s natural gas production, on Sunday the government announced new investments in its liquified natural gas export infrastructure. Taken together, the government said the investments will boost Qatar’s total LNG output capacity by some 85% by the end of the decade.

- The new export capacity mostly aims to feed the growing Asian market, where countries are shifting away from coal for electricity generation because of environmental concerns.

- Amid signs the US may cap its LNG export potential to bottle up fuel supplies and keep domestic prices low, Qatar’s new capacity cut has positioned it to boost its global market share in the lucrative trade in the future.

Israel: To fund the massive military spending associated with its war against Hamas in Gaza, the Israeli government has announced it will issue about $60 billion in sovereign bonds this year, freeze government hiring, and increase taxes. However, those numbers assume that the 300,000 or so troops mobilized at the start of the war last year will continue to be demobilized and can return to their civilian jobs. According to Finance Minister Rothenberg, the number of mobilized troops still serving has fallen to about 60,000 and should decline to 40,000 or less by late March.

- As we have argued frequently in the past, rising geopolitical tensions are likely to boost defense budgets around the world in the years to come. That process is already happening, albeit rather slowly.

- If tensions escalate further, as we think is possible, higher defense spending will require tradeoffs. For example, governments around the world will likely have to consider slashing civilian budget programs. Israel’s increased borrowing, hiring freeze, and tax hikes suggest those kinds of initiatives are also likely to be considered in other countries.

European Union: Thousands of farmers from Belgium and beyond have converged on Brussels today in a mass demonstration seeking more support from the EU. The protests, which have included blocking major streets and roads with farm equipment, have gotten enough attention that European Commission ministers are recommending an increase in funding for the EU’s Common Agricultural Policy subsidy program, which already costs some 60 billion EUR per year.

US Politics: In the Republicans’ South Carolina presidential primary election on Saturday, former President Trump handily beat former UN Ambassador and former South Carolina Governor Nikki Haley by approximately 60% to 40%. Based on those results, Trump takes all the state’s delegates to the Republican National Convention in the summer. Nevertheless, Haley vowed to stay in the race. The next primary is in Michigan on Tuesday.

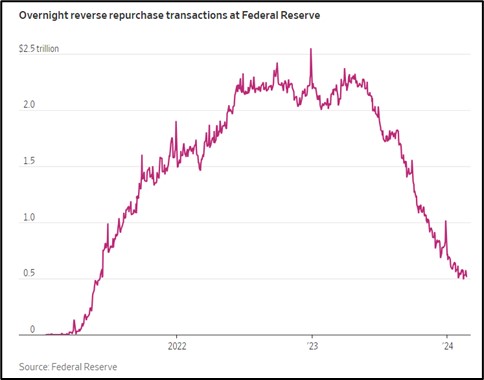

US Bond Market: An article in the Wall Street Journal today highlights just how sharply financial companies have pulled back from parking overnight funds in the Federal Reserve’s reverse repo facility. After hitting a peak of more than $2.5 trillion around the beginning of 2023, total positions have recently receded to only about $500 billion. The volume of funds parked in reverse repo is considered a ready pool of money available to buy Treasury bills, so the decline in participation has raised concern about waning bill demand and rising interest rates.

US Stock Market: As a reminder, Amazon.com joins the Dow Jones Industrial Average today, in a move precipitated by Walmart’s implementation of a 3:1 stock split to make its shares more accessible to small investors. The Walmart stock split will also happen today.

Daily Comment (February 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities have simmered down since Thursday’s rally. Meanwhile, prospective college football players will not have to wait long to join their teams, as official signings will occur before title games. In today’s Comment, we delve into the reasons behind the markets’ resilience amidst Europe’s technical recession, explore the complexities surrounding commercial real estate issues, and offer insights into what US allies stand to gain from the ongoing chip war between the United States and China. As usual, we end our report with a summary of international and domestic releases.

What Recession? The Euro Stoxx 50 set a new record on Thursday as data showed that the regional economy is already starting to recover.

- While European economic data suggests a bumpy recovery is taking hold, the path varies across the continent. The eurozone’s composite purchasing manager index (PMI) rose from 47.9 to 48.9 in February, exceeding expectations of 48.5, according to S&P Global. However, the picture is more nuanced. France’s PMI saw a significant jump to 47.7 from 44.6, indicating expansion. Conversely, Germany’s PMI unexpectedly dipped to 46.1 from 47.1, falling below the expected 47.5 and suggesting contraction. This divergence highlights how the impact of the recent economic slowdown varies significantly across countries, with some weathering the storm better than others.

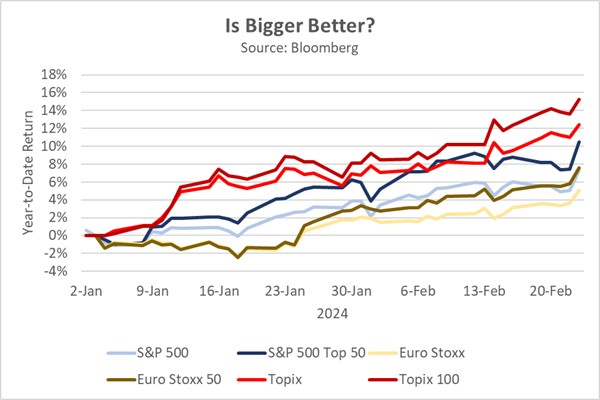

- Intriguingly, markets seem to be overlooking the recent weak economic data. Even though several European nations, including Germany, entered technical recessions earlier this year, stock markets have enjoyed a strong start. The Euro Stoxx 50 Index boasts an impressive gain of almost 8% so far this year, closely trailing the S&P 500 Top 50 Index’s rise of 9.5%. The apparent disconnect between economic data and European market performance is not unique to the region. Despite facing similar economic challenges, Japan’s Topix 100 Index has also seen a remarkable surge of over 15% in the first quarter of this year.

- Several global stock markets are experiencing a “top-heavy” trend, with large companies driving overall gains disproportionately. This investor preference for large-cap stocks stems from their perceived stability during economic uncertainty, further fueled by mixed signals from central banks on future interest rate cuts. The persistence of this trend depends on the severity of the anticipated downturn. If the expected shallow recession in Japan and Europe materializes, the current trend might continue. However, a deeper downturn could force investors to seek “safer havens” in government bonds, potentially leading to a shift away from large-cap stocks.

CRE Problem Persists: Banks are racing against time to find solutions as hundreds of billions of dollars in office space loans approach maturity.

- January saw a dramatic surge in commercial real estate foreclosures, fueled by the brutal combination of high-interest rates and low occupancy rates. This “double whammy” squeezed borrowers, making it nearly impossible for many to keep up with payments, resulting in 635 foreclosures across the US. This spike highlights the significant challenges that lenders face in helping borrowers adapt to the harsh reality of higher interest rates, where the “extend and pretend” strategy is no longer viable. The increasing number of troubled CRE loans has raised concerns among regulators, with figures like Treasury Secretary Yellen and Fed Vice Chair Brainard closely monitoring the situation, fearing the potential spillover effects on the broader economy.

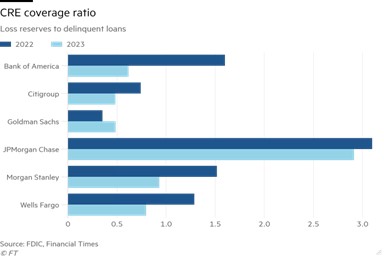

- A recent Barclays study revealed a significant link between bond spreads for regional banks and their risk profile. It found that 85% of the difference in bond spreads between regional banks can be explained by two factors — the weighted average rating factor (WARF), and their exposure to CRE as a percentage of their total capital. Despite their perceived stronger financial position compared to smaller banks, a recent report revealed that the bad property debts of larger banks now exceed their reserves for potential loan losses. This raises concerns about their ability to withstand potential shocks in the commercial real estate market.

- The Federal Reserve’s response to this financial challenge hinges on its assessment: Is it a liquidity squeeze or a broader refinancing issue? If the Fed perceives a liquidity shortage, it might use previous measures like temporary support to prevent bank runs. Alternatively, if it sees a wider refinancing challenge, lowering interest rates could improve the negotiating power of borrowers. However, both approaches present potential drawbacks. The most recent FOMC meeting minutes showed that policymakers believe that there are ample reserves in the financial system, suggesting a potential openness to rate cuts. However, Fed officials’ recent comments indicate that the committee does not plan to do so anytime soon.

Chip Wars: The US is showing that it would like to involve its allies as it battles China for AI supremacy.

- Following months of anticipation, the US government has begun allocating funds from the 2022 CHIPS and Science Act. On Thursday, South Korean semiconductor manufacturer SK Siltron secured a $544 million loan to expand its Michigan plant, marking a significant step in bolstering domestic chip production. The report comes several days after it was announced that GlobalFoundries received a $1.5 billion grant as it looks to help expand its facility in Malta, New York. It is widely expected that Taiwan Semiconductor Manufacturing Company and South Korea’s Samsung will also want to take part in the program.

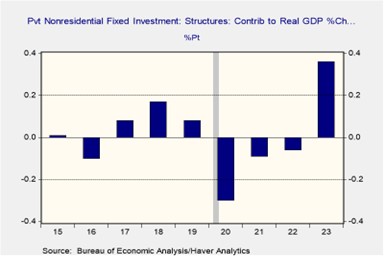

- Increased government funding for critical industries, like advanced manufacturing, points to a potential shift toward prioritizing domestic production. This trend is bolstered by a significant surge in investments for building and upgrading manufacturing infrastructure in 2023, marking the highest contribution to economic growth in over a decade. This push isn’t limited to semiconductors; initiatives like the Inflation Reduction Act have fueled investments in electric vehicle manufacturing, further emphasizing the government’s preference for producing goods that are more forward-looking as it readies to take on China.

- Despite challenges in developing its domestic electric vehicle industry, the US holds a potential advantage in semiconductors due to its long history of designing advanced chips. Recent government initiatives leverage this strength to help the US maintain its global leadership and strengthen partnerships with allied nations. This could, in turn, benefit US-aligned technology firms through increased collaboration and trade opportunities. Notably, Japan is strategically positioning itself to capitalize on this trend, as evidenced by its recent partnerships with American companies like Rapidus and Micron, aiming to revitalize its own chipmaking capabilities.

Other News: The first commercial flight to the moon landed on Thursday. This mission not only signifies the United States’ triumphant return to the lunar surface after half a century, but also hints at the potential resurgence of another era of space exploration akin to a modern-day space race. The US and China are collaborating on addressing debt concerns in developing nations, showcasing a continued effort to manage tensions despite ongoing disagreements. Meanwhile, the South Carolina primary on Saturday could solidify former President Donald Trump’s lead in the Republican nomination race.

Daily Comment (February 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Markets are buoyant after a stellar earnings report from Nvidia, while Messi returns to action as the reigning Ballon d’Or winner. In today’s Comment, we discuss our reservations about the Magnificent Seven, give our reaction to the latest Fed minutes, and explain why Japan continues to capture the attention of investors. As usual, our report concludes with a summary of domestic and international data releases.

Magnificent Seven: Despite past solid performances, Big Tech valuations may face pressure as investors worry about their ability to sustain growth and meet audacious earnings targets.

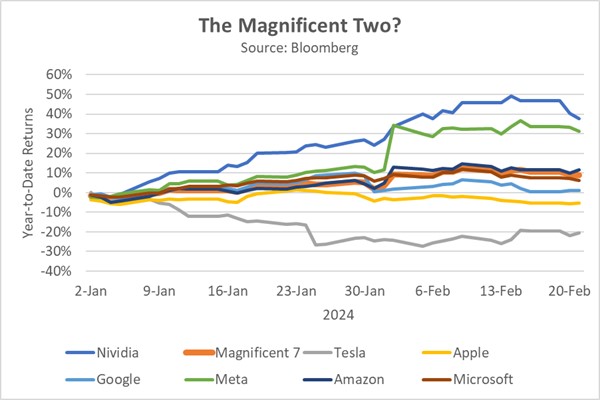

- Chipmaker Nvidia reported stronger-than-expected earnings, indicating that AI hype still has momentum. The company announced that it made $22.1 billion revenue in the three month period ending in January. This surpassed estimates by $1.7 billion and sparked optimism for a $24-billion current quarter, driven by resurgent chip demand. The news comes after a stellar year with Nvidia’s stock surging 240% in 2023 and 40% year-to-date and is likely to buoy the broader tech sector as investors seek to avoid missing out on further gains made in the AI space.

- While the Magnificent Seven experienced strong overall growth to start the year, it wasn’t evenly distributed, potentially fueling investor concerns. Meta and Facebook surged the most, exceeding 30% growth in the first two months, while Apple and Tesla’s stock prices dipped during the same period. This disparity highlights investor skepticism towards stocks lacking robust earnings to justify their valuations. Currently, these Magnificent Seven stocks trade at a hefty 40.1 times earnings, nearly double the S&P 500 average. The high valuation suggests that these firms may not be able to sustain their current pace for the rest of the year.

- Investors may be drawn to companies with strong market positions and future growth potential, but these companies are possibly running out of steam. In the AI chip market, Nvidia holds a significant share with its H100 GPUs, and has even caused supply chain challenges for major players like Tesla, as reported by the company. However, concerns are rising about the ability of Big Tech, including Nvidia, to consistently deliver blockbuster earnings growth in the future especially given their rich valuations. This may explain why META has decided to pay out its first dividend. Nevertheless, we recommend keeping a close eye on the technology sector as broader economic factors and company-specific news could impact their valuations in the coming months.

Fed Speaks, Market Reacts: Markets have digested the Fed’s reluctance for aggressive rate cuts in 2024, but uncertainty lingers due to policymakers’ conflicting views on future monetary policy.

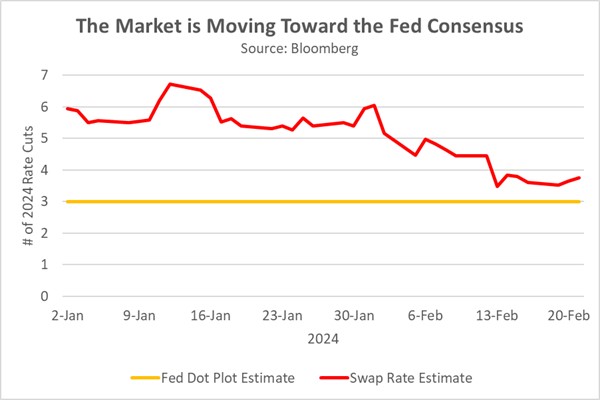

- Federal Reserve officials expressed hesitancy to cut interest rates soon unless they see more progress, according to the January 30-31 meeting minutes. While officials acknowledge inflation’s move toward the 2% target, concerns about persistent economic momentum and the risk of overly restrictive policy have divided the board. Additionally, there was a broad consensus that there are enough reserves to meet bank needs. On Wednesday, Richmond Fed President Thomas Barkin and Governor Michelle Bowman reiterated their concerns, urging patience as recent economic data showed that a lot of upside inflation risk remains.

- The Fed’s latest remarks significantly diminished the market’s expectation of a rate cut at the upcoming March meeting. At the start of the year, investors anticipated that policymakers could slash rates up to seven times, expecting the central bank to pivot to protect the economy from slowing down. However, sentiment began to change following the Federal Reserve’s January 30-31 meeting, during which Powell suggested that a rate cut in the upcoming meeting was unlikely. The latest swap rates suggest that investors believe that the Fed may cut three or four times this year, which is in line with the Fed’s median projection.

- Maintaining current interest rates for an extended period could complicate the Fed’s pursuit of a soft landing, as recent meeting minutes reveal. While policymakers expressed confidence in the overall economy, concerns emerged regarding the sustainability of recent growth, primarily driven by volatile factors like net exports and inventory investment. The minutes explicitly labeled these factors as “offering little signal for future growth,” highlighting their limitations as economic indicators. Further, rising bank loan-loss provisions suggest potential credit deterioration later in the year. Although we do not expect a recession this year, we believe that the risk is elevated.

Japan is Back! The Nikkei 225 index hit a new high for the first time in over 34 years as investors begin to embrace the new normal.

- The recent resurgence of the Japanese stock market, once a global powerhouse in the 1980s, is fueled by a confluence of factors, including improvements in corporate governance, a shift from deflationary to moderate inflation, and a complex geopolitical landscape. The bounce began after the Tokyo Stock Exchange started its campaign to raise corporate valuations and was supported by the Bank of Japan, which has been reluctant to raise rates as a way of encouraging firms to test its pricing power. Furthermore, the lackluster performance of China’s stock market has led investors seeking regional alternatives to turn to Japan.

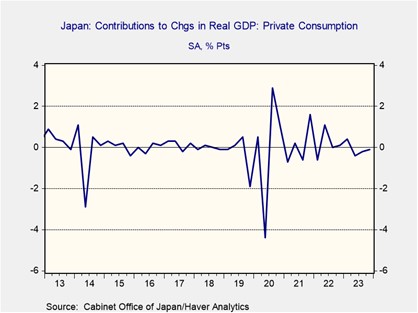

- Echoing 2023’s performance, Japan’s stock market has again outpaced many of its global counterparts in the first few months of 2024. However, uncertainty remains regarding the sustainability of this trend. The Nikkei 225 index currently boasts a 16% year-to-date gain, significantly exceeding the S&P 500’s 5.0% rise and even surpassing the broader MSCI World Index’s 3.6% increase. While foreign investors divesting from China may have fueled some of the initial gains, their return is uncertain and contingent on China’s rebound. Additionally, tepid results from upcoming union wage negotiations could challenge the narrative of Japan’s shift away from deflation, especially as the country flirts with recession.

- The stock market’s strong performance despite Japan’s economic downturn creates a puzzling disconnect, fueling concerns about market sustainability. Weakening consumer spending, a key factor in the slump, could complicate ongoing union negotiations. Companies might resist wage increases, challenging the optimistic narrative that Japan has finally escaped its multi-decade deflationary period. This could prompt investors to re-evaluate their bullish stance. However, a relatively cheap currency presents an opportunity for Japanese exporters. If leveraged effectively, it could boost earnings and support the export-driven growth strategy, potentially mitigating concerns about sustainability in the long run.

Other News: President Trump’s unveiling of his VP shortlist — comprising Tim Scott, Ron DeSantis, and Vivek Ramaswamy — underscores his mounting confidence as the frontrunner for the Republican nomination, signaling a potential rematch with President Biden. In a display of bipartisan unity, lawmakers engaged in discussions with Taiwan’s President-elect to reaffirm Washington’s steadfast support for the sovereign island. Meanwhile, the US government has committed billions of dollars to replace cargo cranes, previously manufactured by China, at ports — a significant indication of its strategic divergence from its Indo-Pacific rival.

Daily Comment (February 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with an interesting development pointing to the long-term potential of hydrogen as a global fuel source. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a new Chinese threat to the developed countries’ auto industries and a surge in US retirements that has driven much of the recent expansion in the country’s budget deficit.

Global Energy Market: At the American Association for the Advancement of Science’s annual meeting last weekend, the US Geological Survey presented unpublished data indicating as much as 5 trillion tons of hydrogen exist in underground reservoirs worldwide, potentially setting the stage for it to be a key carbon-free energy source in the future. According to the data, most of the deposits are likely inaccessible. However, if even just a few percent are recoverable, it would be enough to supply the projected demand of 500 million tons per year for centuries.

- Currently, economists and analysts are focused on nuclear, solar, and wind energy to replace fossil fuels and reduce carbon emissions in the future. There has been some focus on hydrogen, but it has been modest to date.

- The new data could potentially help shift interest toward developing hydrogen as an energy source. If technologically and economically feasible, widespread adoption of hydrogen energy would likely create new investment opportunities in the future.

Global Auto Market: Chinese electric vehicle giant BYD has announced a new version of its plug-in hybrid model, the Qin Plus DM-i, priced at the equivalent of just $11,086. The firm says its strategy with the new vehicle is to accelerate the global transition from internal-combustion vehicles to EVs. With the vehicle priced below many of today’s top-selling gasoline cars, such as Toyota’s Corolla, the new BYD offering highlights the threat that low-priced Chinese cars could decimate auto industries throughout developed countries.

China-United States: At the annual Munich Security Conference over the weekend, FBI Director Wray warned that the Chinese are not only still hacking the computer systems of critical infrastructure such as electricity grids to pre-position malware for use in time of conflict, but they have increased it to a “fever pitch.” According to Wray, Chinese spies and hackers are increasingly inserting “offensive weapons within our critical infrastructure poised to attack whenever Beijing decides the time is right.”

- Wray’s comments are only the latest in a long series of FBI warnings about massive Chinese spying and hacking in the US. According to Wray, those warnings were long dismissed by corporate leaders, but they are increasingly being taken to heart as more evidence of the activity is unearthed.

- Government officials even fear that the Chinese-made cargo cranes at US ports are compromised by sensors and software that could allow Beijing to monitor or disrupt US trade. Therefore, the Biden administration will launch a maritime cybersecurity program today that will provide $20 billion from the Jobs and Infrastructure Act of 2021 to improve port security, including replacing all Chinese-made port cranes with new, US-made cranes.

- The pre-positioning of Chinese malware across US computer systems is a reminder that World War II, the last Great Power conflict, is probably not a valid template for how a potential US-China conflict would unfold. In World War II, almost all of the conflict consisted of visible, kinetic attacks: bombs being dropped, artillery being fired, etc. Much of a future US-China conflict might be invisible and non-kinetic, including electromagnetic attacks on satellites in space, malware in cyberspace, and the like.

China-Taiwan: Tensions between China and Taiwan have worsened in recent days after an incident in which two Chinese fishermen drowned while being chased out of Taiwanese waters by the island’s coast guard. In response, Beijing says it will step up law enforcement around the Kinmen archipelago, a group of Taiwanese islands that sit as close as three miles from the Chinese mainland and 100 miles from Taiwan’s main island. The stepped-up Chinese patrols have even included the boarding of a Taiwanese sightseeing boat this week.

- A potential Chinese effort to take control of Taiwan has long been a key geopolitical risk, as it would probably draw in the US, Japan, and other countries friendly to the island.

- In recent months, Chinese-Philippine tensions have increased sharply, to the point where we have thought they were the greater near-term risk. This week’s tensions between China and Taiwan are a reminder that the Taiwan Strait remains a high source of risk for investors going forward.

India: Government officials and farmer groups in recent days have failed to reach an agreement on the farmers’ demands for fixed prices on dozens of crops and debt relief, keeping alive the farmers’ threats to stage mass protests in New Delhi. Even though the popular Prime Minister Modi remains in the driver’s seat ahead of this spring’s parliamentary elections, the impasse and the tough choice between a budget-busting subsidy deal and mass protests is a political risk. In turn, that risk could potentially be a headwind for Indian stocks in the coming weeks.

France: After the government cut its forecast of 2024 economic growth to just 1.0% from 1.4% previously, Finance Minister Le Maire said national budget spending will be reduced by a further 10 billion EUR on top of the earlier cut of 16 billion EUR to keep the deficit at the targeted 4.4% of gross domestic product. According to Le Maire, the new cuts will come from reduced hiring and other operational expenses at government ministries, less foreign aid, and reductions in various subsidies. The spending cuts will likely be a further headwind for French GDP growth this year.

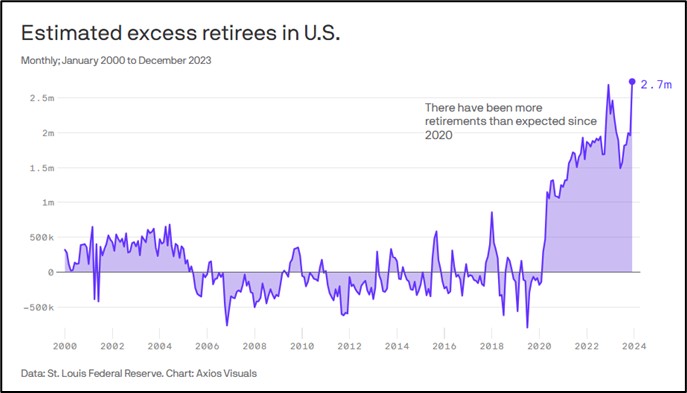

US Fiscal Policy: New analysis shows the US has about 2.7 million more retirees than predicted by a St. Louis FRB model, versus just 1.5 million excess retirees six months ago. There has also been a fiscal deficit frequently, beginning in 2008 until the onset of the COVID-19 pandemic in 2020. While the pandemic prompted millions of older workers to finally retire, this second wave of retirements was likely prompted by surging stock values. In any case, the sudden wave of new retirees is one reason why the US fiscal deficit has suddenly widened dramatically.

- The new wave of retirements has led to a sudden rise in Social Security retirement benefits and Medicare spending.

- Comparing the year ended in January 2024 to the previous year, the excess of Social Security and Medicare outlays over Social Security and Medicare gross tax receipts expanded by $672.6 billion, accounting for fully 70% of the expansion in the federal budget deficit in the period (after adjusting for the accruals related to the administration’s proposed student loan forgiveness program and its subsequent reversal).

- Although politicians often claim the expanding federal budget deficit stems from profligate spending by the government, the deficit expansion primarily stems from the aging US population and individual baby boomers finally deciding to retire and start drawing Social Security and Medicare benefits.

US Stock Market: S&P Dow Jones Indexes announced that on-line retailing giant Amazon.com will replace Walgreens Boots Alliance in the Dow Jones Industrial Average starting on Monday. While the reshuffling was prompted by Walmart’s upcoming three-for-one stock split, which will reduce its weighting in the index, the move will help make the index more reflective of the broader, technology-dominated US equity market.

Daily Comment (February 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a range of news items related to continued economic and security tensions between China and the West. We next review a range of other international and US developments with the potential to affect the financial markets today, including an important Russian military victory in Ukraine and an important new effort to regulate one aspect of artificial intelligence in the US.

United States-China: Senior US Treasury officials have told the Financial Times that they warned Chinese Vice Premier He Lifeng that Washington and its allies will retaliate if Beijing tries to deal with its excess industrial capacity and high debt load by dumping products on the global market. The US officials said they are most concerned about possible Chinese dumping of high-technology products such as electric vehicles, lithium-ion batteries, and semiconductors.

- Like many countries that sought to develop their economies via high investment and strong exports, China held on to the strategy too long, leaving it saddled with high debt and a production base that far exceeds domestic demand.

- For countries that find themselves in that predicament, many strategies are available to bring supply back into balance with demand. For example, the US allowed a sharp depression and a dramatic write-down in asset values during the 1930s. Japan opted for a long, slow correction marked by weak asset pricing and plodding economic growth from the 1990s until very recently.

- Other countries have turned to warfare or colonialism. What Western leaders fear is massive Chinese dumping as a kind of quasi-colonialism, which would further decimate Western industries and throw legions of workers into unemployment. Increasing hints of Chinese dumping are therefore likely to further exacerbate Chinese-Western geopolitical and economic tensions, keeping alive a range of risks for investors.

European Union-China: Following on the US warning to China, the EU has opened an anti-dumping probe into Chinese state-owned locomotive and railcar maker CRRC, in what Competition Commissioner Margrethe Vestager says is a signal to domestic and foreign firms that the EU won’t hesitate to use its legal tools to fight off unfair foreign competition.

- The investigation follows on a similar probe into Chinese electric vehicles launched in September.

- The new probe shows that the EU is slowly coming around to the tough US policies against Chinese subsidies and other unfair trade practices. The move raises the risk that China will retaliate against EU firms active in China or that try to export to China.

China: On Sunday, The People’s Bank of China left its benchmark interest rates unchanged for a sixth straight month, disappointing investors who have been hoping for stronger economic stimulus measures from the government. The rate on the key medium-term lending facility was left at 2.5%, apparently to support the sagging renminbi (CNY).

- Despite the freeze on official central bank rates, major banks today implemented a surprisingly aggressive cut in their five-year prime lending rate from 4.20% to 3.95%. That was the biggest cut in the prime rate since it was introduced five years ago.

- The five-year prime rate is China’s standard for residential mortgages, so it is likely that the government guided the banks to cut the rate as a way to provide some support for the beleaguered real estate developers.

- Since many investors had been looking for stronger measures to support the economy, Hong Kong stock prices fell to start the week, but mainland stocks gained as investors caught up from the week-long Lunar New Year holiday.

Australia: Responding to China’s aggressive military buildup, the Australian government today unveiled a plan to more than double the size of the country’s navy. The government now plans to spend an additional $7.2 billion on its navy, expanding the fleet to 26 warships, including 11 new frigates and six new large vessels with long-range missile capability. The Australian navy will then be at its largest size since World War II.

- The plan is consistent with our belief that rising geopolitical tensions will boost defense budgets around the world in the coming years.

- Since rising tensions will also keep fracturing the world into relatively separate geopolitical and economic blocs, we think the result will be increased investment opportunities in areas such as defense, broad industrials, basic materials, energy, and even technology firms with strong or potential defense business.

Singapore: In a potential sign that right-wing populist ideologies may be spreading to Asia, the Internal Security Department has recently detained two youths who espoused extremist views and were reportedly planning attacks on racial minorities, lesbian and gay activists, and “woke” progressives. One of the youths, an ethnic Chinese, bizarrely espoused white supremacy. If the ideology continues to spread in Asia, perhaps driven by social media, it could risk destabilizing countries throughout the region, just as it has in Europe.

Russia-Ukraine War: Kyiv’s forces on Saturday withdrew from the eastern Ukrainian city of Avdiivka, ceding it to the Russians after an intense, weeks-long siege. Reports indicate that the Ukrainians defending the city were not only overmatched by Russia’s vast firepower and available personnel, but were also increasingly hampered by their shortage of ammunition and other supplies. Separately, a Russian military pilot who defected to Ukraine last year has been found murdered in Spain, illustrating the brutal vengeance of the Russian intelligence services.

- Avdiivka is Ukraine’s most significant loss of territory since its unsuccessful counteroffensive last summer and the following loss of Western military aid.

- Now that the Kremlin has successfully shifted the Russian economy to a war footing, it is enjoying an increasing advantage in available equipment, ammunition, and personnel. The key question is to what extent the Russians can capitalize on their capture of Avdiivka to build momentum and start taking more Ukrainian territory.

- If the Russians successfully build on their momentum and begin to roll across Ukraine, Western politicians could potentially be galvanized to re-start their assistance to Kyiv. However, it could be too little, too late. If so, the incentive for peace talks would rise.

- In US political terms, the closer Russian forces end up from the North Atlantic Treaty Organization’s southern frontier, the more those politicians who opposed aid to Ukraine may be open to criticism for allowing an increased Russian threat to NATO. That could lead to foreign policy being a bigger part of the US electoral campaign, making it more volatile going into the autumn.

NATO-Sweden: Hungarian Prime Minister Viktor Orbán’s ruling Fidesz Party said it has scheduled a parliamentary vote next Monday on Sweden’s accession to NATO, and it plans to vote in favor. If so, Sweden will finally have the unanimous approval of all NATO members, allowing it to join the alliance. With the inclusion of Sweden and its capable military, NATO’s northern flank will be strengthened, and the Baltic Sea will become virtually a NATO lake, potentially helping to deter future Russian aggression in the north.

United Kingdom: Addressing a parliamentary committee today, Bank of England Governor Andrew Bailey said the central bank may begin to cut its benchmark interest rate even before consumer price inflation falls all the way to its target of 2%, citing encouraging signs that price pressures are falling rapidly. Despite the prospect for lower bond yields in the UK, investors appear to be encouraged by the prospect for reduced impediments on economic growth. The British pound has therefore risen 0.4% to a multi-week high of $1.2641 as of this writing.

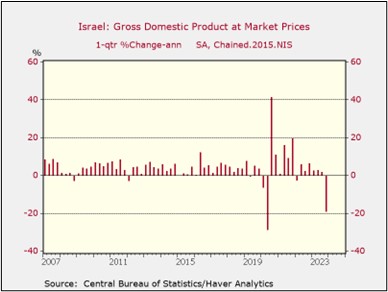

Israel-Hamas Conflict: The Israeli government yesterday said gross domestic product in the fourth quarter fell at an annualized rate of 19.4% from the same period one year earlier, far worse than expected and almost matching the rate of decline in the midst of the COVID-19 pandemic in 2020. Israel’s defense expenditure has surged since its war with the Hamas government in the Gaza Strip began on October 7, but that spending has been offset by a huge drop in personal consumption spending and private fixed investment.

US Artificial Intelligence Regulation: Late last week, the Federal Trade Commission proposed modifying a rule that already prevents the impersonation of government and business entities to also outlaw the impersonation of individuals. The proposal follows a move earlier this month by the Federal Communications Commission to ban the use of AI-generated voices in robocalls.

- These proposals show how government agencies are trying to address the risk of AI-driven scams and frauds via rulemaking, rather than waiting for a deeply polarized Congress to act.

- The rapid development of AI raises the risk that political operators or fraudsters could use deepfake video and voice for scams. For example, officials fear that people could be manipulated or defrauded using AI-generated deepfakes of their family members, friends, work colleagues, or celebrities.

US Semiconductor Industry: The Commerce Department said it will provide $1.5 billion in grants to contract semiconductor maker GlobalFoundries to expand the company’s production facilities in New York and Vermont. The award is the first under the CHIPS and Science Act of 2022, which set aside $52 billion in incentives for firms to expand their US chipmaking factories and shore up secure domestic supplies of semiconductors. The Commerce Department is expected to announce billions of dollars of additional awards in the coming weeks.

US Banking Industry: Based on recent regulatory filings, overdue commercial real estate loans at the six largest banks have now grown to 160% of the amounts the banks have set aside to cover losses on those loans, versus 90% one year earlier. As commercial property owners continue to struggle with high interest rates and increased vacancies, more loans are likely to go sour in the coming months. In turn, that will likely force banks to boost their loss reserves further, impinging on bank profits and weighing on bank stock prices.

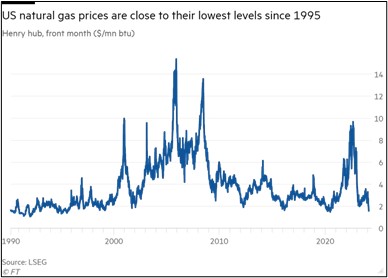

US Energy Market: US natural gas prices in recent days have fallen close to their lowest levels since 1995, reflecting weak heating demand amid the country’s warmest winter on record, surging US production, and possibly from the administration’s recent pause on liquified natural gas exports. Near futures prices for gas this morning are down 1.5% at approximately $1.59. The decline in gas prices will likely help reduce consumer price inflation in the near term, potentially helping to convince the Federal Reserve that it can start cutting interest rates.

Asset Allocation Bi-Weekly – #114 “Who Wants US Treasurys” (Posted 2/20/24)

Asset Allocation Bi-Weekly – Who Wants US Treasurys? (February 20, 2024)

by the Asset Allocation Committee | PDF

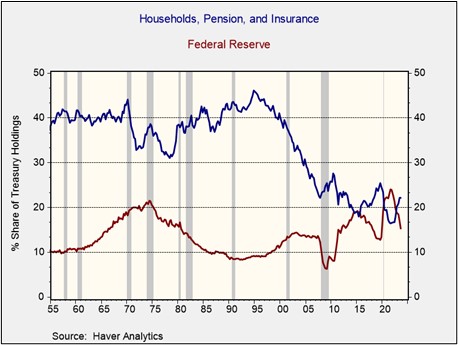

Before August 2023, the Treasury’s quarterly refunding rarely raised eyebrows. Investors readily snapped up US debt, and announcements were largely ignored by markets. However, Fitch Ratings’ surprise downgrade of the US credit rating from AAA to AA that month, just days after a $6 billion increase in the planned quarterly debt issuance, sparked investor concerns. Now, the question looms: Will there be enough demand to absorb the growing supply of US debt?

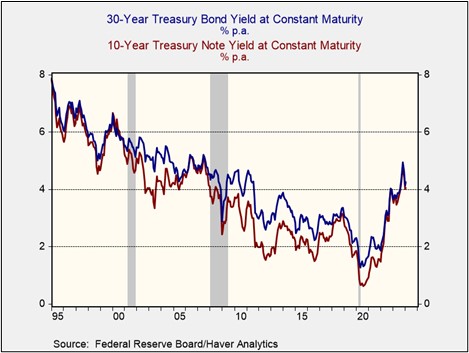

The downgrade by Fitch triggered a sharp rise in Treasury yields, especially long-term yields, which hit their highest levels since 2007. The 10-year and 30-year benchmarks spiked to multi-decade highs, reflecting lukewarm participation at Treasury auctions. Higher borrowing costs and weak auction participation sent the S&P 500 Index tumbling. In response to the market’s negative reaction, the Federal Reserve signaled an end to its hiking cycle and a potential cut in policy rates for the coming year, and the Treasury Department tilted its borrowing toward shorter-term maturities.

While the coordinated efforts of the Fed and Treasury successfully reduced borrowing costs and improved overall risk appetites, investors remained uncertain about the government’s plans to finance its burgeoning debt. This year, $8.9 billion of US Treasury bonds will mature, while the budget deficit is expected to be $1.4 trillion, meaning there will be $10 trillion of bonds coming to the market. Additionally, the Congressional Budget Office projects that the deficit could expand to $2.6 trillion by 2025. This leaves a gaping hole in financing, and without a significant change in market conditions, it is unclear who will step up to buy these bonds.

The US Treasury market boasts a unique blend of buyers, each with distinct goals. Central banks, the guardians of global monetary systems, buy Treasurys to secure their reserves and stabilize currencies. Similarly, pension funds prioritize stable, long-term income to fulfill their liability obligations. For the Fed, Treasurys become instruments of monetary policy, influencing interest rates and economic activity. Asset managers diversify their portfolios with these secure assets, reducing risk and volatility. Even households directly participate in holding a portion of the national debt, seeking a safe place for their investments.

The Fed’s shift toward tighter monetary policy in 2022 and 2023 reshaped the allocation of Treasurys. By not rolling over its maturing Treasury holdings, the Fed is now absorbing less of any new supply. Simultaneously, interest rate hikes have incentivized some corporations and foreign central banks to moderate their holdings, creating a demand gap. Households, pension funds, and insurance companies have stepped in to fill this gap, becoming the primary buyers of Treasurys. However, the central bank’s recent suggestion that it will phase in monetary easing later this year introduces uncertainty about who will buy debt going forward.

The high concentration of interest-sensitive investors like households, pension funds, and insurance companies in the bond market raises concerns about the potential impact of future interest rate cuts. Lower short-term rates typically decrease the appeal of risk-free assets like long-term bonds, potentially dampening demand. Households seeking higher returns in an accommodative monetary policy environment may consider diversifying into riskier assets. However, while pensions and insurance companies hold a significant portion of Treasurys, their demand for longer-term bonds is limited by their need to match their obligations.

Historically, broker-dealers have played a key role in stabilizing markets by absorbing available assets, but they face constraints that limit their ability to act as the buyer of last resort when the Fed doesn’t step in and provide liquidity. Broker-dealers, unlike central banks, hold limited inventory as they are primarily focused on facilitating client transactions rather than large-scale asset purchases. This limited capacity restricts their ability to absorb significant volumes of assets during periods of stress. To compensate for the inherent liquidity risk involved in holding large inventories, broker-dealers would require higher premiums, therefore pushing up yields on Treasurys.

With limited demand from traditional buyers putting pressure on long-term Treasury yields, concerns have risen that the Fed may need to intervene to prevent higher borrowing costs for businesses and consumers. Yet, policymakers remain reluctant to increase the balance sheet due to inflation concerns. Chair Powell reiterated during the January FOMC press conference that the committee will discuss slowing QT at their March meeting, suggesting that the committee is not ready to stop reducing its balance sheet.

While potential rate cuts and future reductions could increase demand for Treasurys, limited impact on yields is expected due to persistent inflation concerns and lukewarm investor sentiment. Given the continued supply-demand imbalance, we believe short-to-intermediate-term securities offer a more attractive risk-reward profile compared to long-duration bonds due to their lower interest rate sensitivity and potentially higher returns.