Daily Comment (July 13, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment begins with our thoughts about the better-than-expected inflation report. Next, we explain how tight policy abroad may impact domestic economies. Lastly, the report discusses how tensions within NATO may not necessarily doom the military alliance.

Inflation Cools: Investors are hopeful that the positive CPI report will convince the Fed to hold off on further rate hikes.

- The year-over-year change in the consumer price index fell to its lowest level since March 2021. According to the Bureau of Labor Statistics, the price paid for consumer goods rose 3.1% from a year ago. Meanwhile Core CPI, which excludes energy and food, rose 4.8% in the same period. The deceleration in prices has led to speculation that the Fed may be nearing the end of its hiking cycle. As a result, the dollar weakened against the EUR, JPY, and GBP. Nonetheless, Fed officials still seem wary of abandoning their inflation fight.

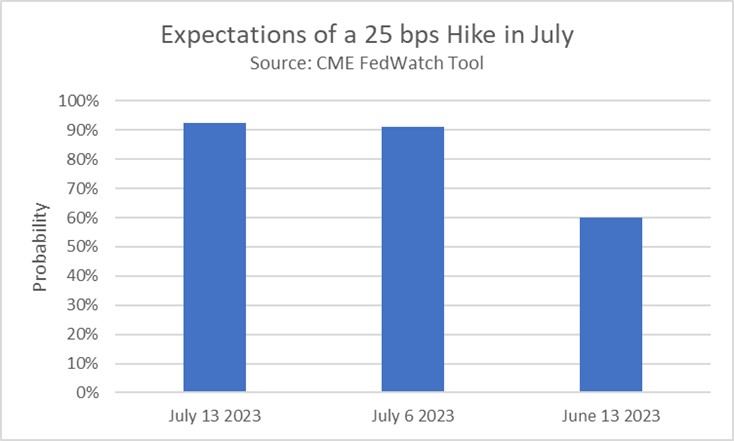

- Despite the positive reading, some policymakers still want the Federal Reserve to push forward with rate hikes. On Wednesday, Richmond Fed President Thomas Barkin insisted that inflation remains too high. Meanwhile, his Minneapolis counterpart, Neel Kashkari, argued that the central bank needs to succeed in bringing inflation back to target before it can declare victory. The hawkish remarks from Fed officials may explain why Fed futures contracts were virtually unaffected by the surprise in the inflation report. The CME FedWatch Tool shows that 30-day Fed futures contracts are pricing in a rate hike at the end of month.

- The path toward 2% inflation is likely to be a slow and bumpy ride. The Cleveland Fed expects headline inflation to reaccelerate in July by rising from a year-over-year change of 3.0% to 3.3%. While monthly inflation has been volatile, ranging from 0.1% to 0.5% in the first six months of the year, annualized inflation has risen at a more consistent pace of 3.5%. That said, an average monthly change of 0.16% is consistent with the Fed’s target of 2%. The central bank’s ability to achieve its target will likely be related to its ability to bring down shelter price inflation which represents nearly a third of the index and remains well above its historical average.

Everybody Else: Speculation that the Fed may be close to ending its inflation fight has led to a focus on other central banks.

- Investors expect central banks in advanced economies to take a more hawkish stance in the coming months. The Bank of Canada raised interest rates to their highest level in 22 years on Wednesday, and the European Central Bank and the Bank of England are both considering additional rate hikes. There is also speculation that the Bank of Japan will end its yield-curve-control program later this year. The expectation of a possible narrowing interest differential between the United States and other advanced economies led to a broad decline in the U.S. dollar, with the U.S. Dollar Index falling to its lowest level since April 2022 following the release of the June CPI report.

- The effects of persistent central bank tightening are starting to impact the real economy. The U.K., for example, is on the cusp of a mortgage crisis due to rising borrowing costs. Typically, British homeowners borrow at fixed two- or five-year rates and then remortgage at a fixed or variable rate afterward. Hence, the brunt of the tighter monetary policy will likely be felt by more households over the coming months. Additionally, higher interest rates in the eurozone will hinder countries from preventing an economic slowdown within the bloc. The region fell into a technical recession in Q1 of this year.

- That said, we currently do not see any signs of an imminent financial meltdown. The quick response by policymakers during the U.K. pension crisis in 2022, as well as the regional bank turmoil in the U.S. earlier this year has shown that central banks are better prepared than they were in the previous decade. Consequently, this may mean that central bankers are more willing to keep policy tighter for longer. If we are correct, this should lead to an increase in bond yields, especially if there is a notable increase in inflation volatility.

Intergroup Tensions: Ukraine’s recent success has not been enough to get NATO members on the same page as to the best way to tackle threats from China and Russia.

- Although there was some progress at the summit in Vilnius, NATO leaders failed to articulate a clear vision for foreign policy going forward. The meeting led to Turkey’s acquiescence to allow Sweden to proceed with its application to join NATO, and to an agreement to repair its relations with Greece. This is likely related to backroom dealings between Turkey and other NATO members and reflects Turkey’s growing importance within the alliance. Yet, the group failed to elaborate on Ukraine’s path to joining NATO. The communiqué stated that Ukraine belongs in NATO but implied that the country needs to meet certain conditions before it can be admitted.

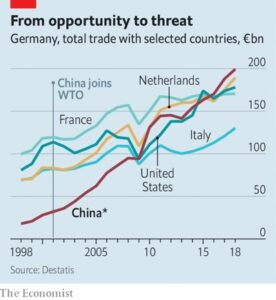

- Strains within the NATO alliance were also made apparent outside of the summit, especially regarding China. U.K. security officials scolded their American counterparts for not adequately addressing Chinese spying. It was revealed earlier this week that Chinese hackers gained access to emails of government officials. Meanwhile, other countries within the military group remain uncertain in how to address Beijing. On Thursday, Germany released a statement acknowledging its concerns about China’s growing assertiveness in the Indo-Pacific. However, the statement did not provide any details about how Germany plans to “de-risk” from its dependence on the world’s second-largest economy. Last year, Germany’s total trade with China was nearly $300 billion.

- Strains within NATO may become worse as economies begin to slowdown, but it is unlikely that the group will fracture. The bright spot of the war in Ukraine is that it reminded members of the importance in maintaining the military bloc. As a result, we expect that there will be increased coordination and cooperation between NATO members, which could come in the form of boosted weapon sales and investment, as well as the broadening of trade relations. This should be favorable for defense and aerospace firms. So far this year, XAR ETF, which tracks aerospace and defense stocks, has outpaced the S&P 500, excluding tech, 11.48% to 8.24%, respectively.