Asset Allocation Bi-Weekly – Weak Capital Investment by State and Local Governments (June 5, 2023)

by the Asset Allocation Committee | PDF

The standoff between the Biden administration and congressional Republicans over raising the federal debt limit has prompted us to think more deeply about some important longer-term issues regarding U.S. public spending. As we discuss in this report, a key problem is that one particular type of government investment has only grown weakly in recent decades. The apparent underinvestment has big implications for economic growth and inflation.

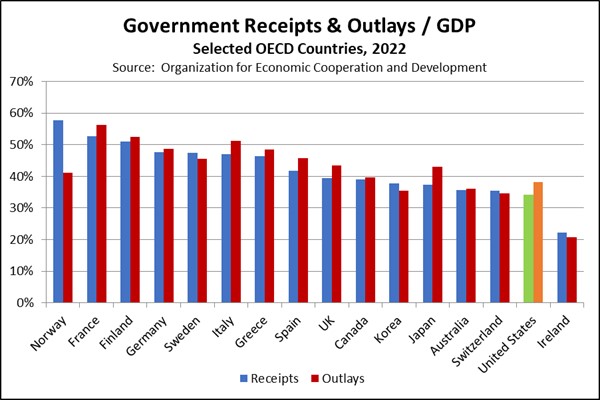

Despite the political rhetoric, government intrusion into the U.S. economy is rather modest compared with other countries. Looking at the total government sector (federal, state, and local), U.S. public receipts totaled 34.1% of gross domestic product in 2022, and outlays totaled 38.2%, leaving a deficit of 4.1%. As shown in the chart below, those shares were lower than in most of the other advanced nations in the OECD. However, they were high compared to historical U.S. levels. For example, federal receipts alone equaled 19.6% of U.S. GDP in 2022, close to their highest share since the 1950s. Federal outlays equaled 25.1% of GDP, modestly exceeding the pre-pandemic peak of 24.3% set during the Great Financial Crisis in 2009.

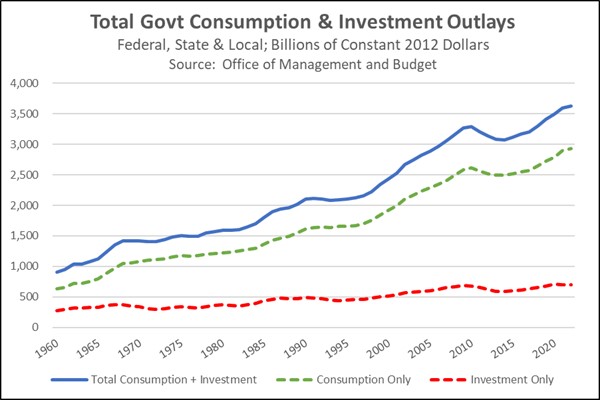

Economists assign government spending to three different classes: consumption (for example, buying pharmaceuticals for the local VA hospital or paying for the services of police officers), investment (broadening an interstate highway or buying a printer for a court), and transfers (Social Security or Medicare benefits). In this report, we focus on government consumption and investment, which together totaled $4.448 trillion in 2022 and is treated as a component of GDP. As shown in the chart below, government consumption spending has been much bigger than investment spending for decades. Since 1960, each type has risen at an average annual rate of 1.9% after stripping out inflation. However, what the overall growth rate of 1.9% doesn’t show is that U.S. public-sector investment looks quite different depending on whether you’re looking at federal civilian investment, federal defense investment, or state/local investment.

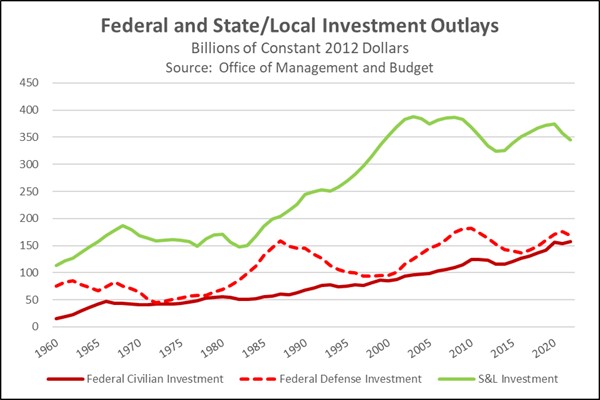

Federal outlays on civilian facilities and equipment grew smartly at an average real rate of 3.8% per year from 1960 to 2022. This spending grew especially fast from 1960 to 1980 as the federal government expanded its social programs. During that period, federal nondefense investment grew 6.5% per year compared with annual GDP growth of 3.4%. This spending has since slowed and is now growing at roughly the same rate as GDP. In contrast, federal investment on defense projects like expanded military bases or new ships has grown at a rate of just 1.3% per year since 1960. From 1960 to1980, it fell at an average rate of 0.4% per year, reflecting the end of the initial phase of the Cold War and the termination of the Vietnam War. Defense investment then jumped 1.7% per year in 1980-2000 and 2.6% per year in 2000-2022 because of factors such as President Reagan’s military buildup and the War on Terror.

As shown in the chart, investment by state and local governments is bigger than all federal investment combined, but after growing quickly from 1960 to 2000, these outlays have been trending downward for the last two decades. That’s important because state and local governments are responsible for the bulk of the economy’s basic infrastructure, including roads, highways, bridges, airports, water and sewer systems, and publicly owned facilities for power generation and transmission. Sluggish investment in this type of infrastructure can be a problem because it leaves the economy with less capacity to grow. Weak investment in infrastructure can also lead to bottlenecks in times of rising demand, thereby pushing prices higher, creating more inflation, and encouraging higher interest rates. In many of our recent publications, we have warned that the fracturing of the world into relatively separate geopolitical and economic blocs will prompt companies to adopt shorter, less efficient supply chains, which will likely boost inflation and interest rates over time. Separate from the fiscal squabbles at the federal level, our analysis in this report suggests that if state and local governments continue to underinvest in basic infrastructure, there could be even more upward pressure on inflation and interest rates, further undermining bond returns in the coming years.