Daily Comment (July 14, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment begins with a discussion about a possible shift in Fed policy. Next, we give an update on the latest stories surrounding artificial intelligence. Lastly, we end the report detailing the possible ramifications of the breach in the price cap on Russian oil.

Doves Take the Wheel: After months of wishful thinking, traders are now more confident than ever that the Federal Reserve is close to ending its hiking cycle.

- Producer price data released by the Bureau of Labor Statistics on Thursday showed that supply price pressures are easing, similar to the recent report on consumer price inflation. The Producer Price Index (PPI) rose 0.24% from the prior year in June 2023, which is much lower than its peak of 12.5% in March of last year. In fact, the June report showed that supplier prices slowed to their lowest rate in nearly three years. This could lead to a slowdown in consumer price inflation, as firms will have an easier time maintaining margins without having to raise prices for their goods or services.

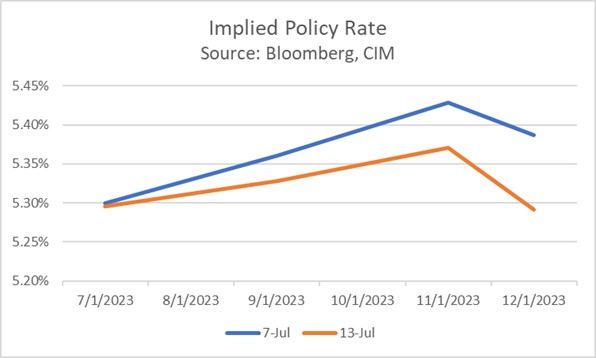

- Markets cheered the Federal Reserve’s apparent victory in its inflation fight. The S&P 500 closed up 0.9% on the day, while yields on 10-year Treasury notes fell to a two-week low. Additionally, speculation over monetary policy weighed on the U.S. dollar index, which fell to its lowest level in more than a year. The positive report led traders to downgrade their expectations for the number of rate hikes left for the rest of 2023. Currently, overnight index swaps are pricing in one remaining increase from the Fed, down from the two hikes forecast a week ago.

- Despite the investor reaction to the economic statistics, the Fed may still keep interest rate hikes on the table. The year-over-year change in core inflation is still well above the central bank’s 2% inflation target. Federal Reserve Board member Christopher Waller seized on this fact to justify the possibility of two additional rate hikes for the year. However, there appears to be a dovish tilt in the Fed, which is likely to worsen with the recent departure of St. Louis Fed President James Bullard. As a result, it is possible that the next rate hike could possibly be the last of the year.

Pushback Against AI: Excitement over the rapid advances in artificial intelligence (AI) is being tempered by growing concerns about its potential risks.

- The Federal Trade Commission is investigating ChatGPT over claims that it has the potential to harm consumers. The technology has been accused of generating misinformation that has caused harm, and of distributing copyrighted work without the consent of the owners. Meanwhile, China released its highly anticipated regulatory framework for AI that is designed to ensure that the chatbots are able to stay true to core socialist values. Similar to what the FTC wants to accomplish, Beijing’s restrictions look to ensure that generative AI technology is publishing reliable information. However, the Chinese government’s framework also goes further, placing restrictions on the types of topics that chatbots can discuss and the way that they can interact with users.

- In related news, there is growing concern that artificial intelligence (AI) will lead to major job displacements in the future. On Thursday, Hollywood actors joined screenwriters on strike as they advocate for greater protection against the growing use of AI technology. The backlash was in response to an AI proposal to scan and use images of actors in perpetuity. As depicted in the first episode of the most recent season of Netflix’s Black Mirror, workers in the entertainment industry fear that their likeness and work will be used without their permission. Over the last few years, AI has been used to de-age actors, help generate movie trailers, and even bring back the voices of late performers.

(Source: Variety)

(Source: Variety)

-

- AI was used to digitally enhance the picture above to make Will Smith look younger.

- The recent controversy surrounding AI is a reminder of the ongoing regulatory and political threats that the technology faces in the coming months. There is a legitimate fear that AI will begin to displace workers on a massive scale, with some estimates predicting that it could replace up to 40% of jobs in the U.S. economy. AI’s disruptive potential is likely to make it a target of politicians and regulators, who may seek to implement policies that restrict its use. As a result, investors should take into account current and potential scrutiny when deciding whether to join the recent AI craze.

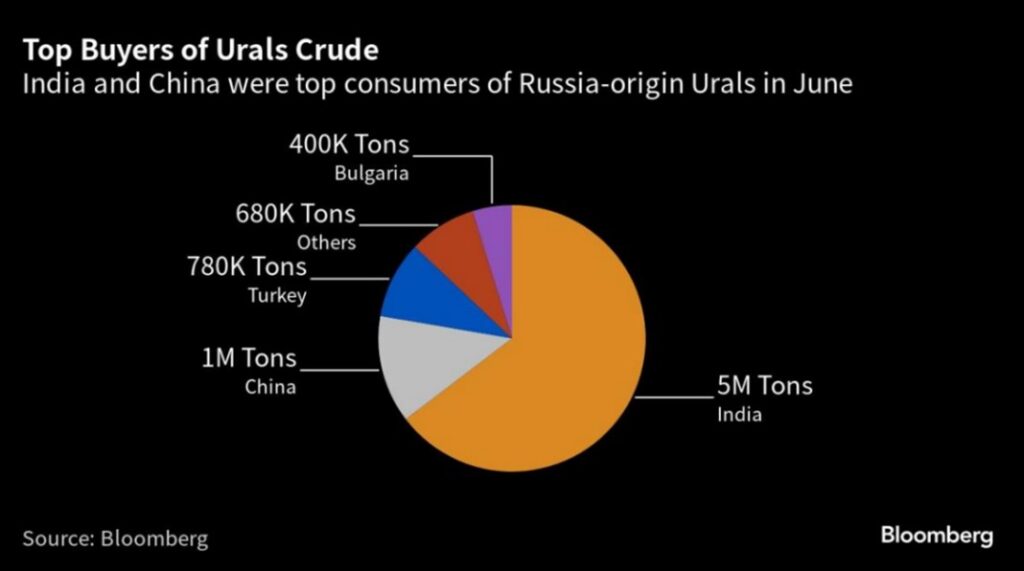

Price Cap Troubles: The price of Urals crude oil has breached the $60 per barrel cap set by the West, putting countries that continue to import Russian oil at risk of sanctions.

- The recent rise in the price of Russian oil is putting pressure on G-7 nations to enforce disciplinary actions in their efforts to cap Russian oil exports. The Western bloc imposed the cap as a way to constrain Moscow from receiving much-needed revenue for its war efforts. Recent data showed that the restrictions have been successful in limiting Russia’s ability to profit from its oil, with revenue nearly halving since last year. However, the increase in oil prices is threatening to undermine the cap’s credibility, as it suggests that Moscow may have more market power than the West realized.

- That said, it is unclear whether other countries are willing to risk sanctions to obtain Russian oil. India and China have been the biggest beneficiaries of the price target as the countries have been able to take advantage of the steep discounts. The recent breach may force buyers to consider alternatives as it is unclear whether they are willing to tolerate the headache of possible sanctions. Indian refiners are already preparing for talks with local banks over financing Russian cargoes. So far, it is unclear how China will deal with the situation.

- The breach of the $60 per barrel cap on Russian oil will provide a fresh test of the effectiveness of Western sanctions. If firms abide by the restrictions set by the G-7 countries, Moscow will need to offer steeper discounts on its oil in order to continue selling its goods abroad. This should dissuade Russia from cutting production to boost prices. If firms continue to purchase Russian oil despite the threats of sanctions, Russia could then collaborate with its OPEC counterparts to implement new production cuts, which could lead to an increase in global oil prices.