Daily Comment (July 18, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news that the U.S. is sending more military forces to the Middle East to counter Iranian mischief there. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a warning from the International Energy Agency that Europe remains vulnerable to energy shortages and price hikes, and news of a deal that will postpone the day when U.S. companies will face higher taxes from the OECD-brokered agreement on minimum corporate tax rates.

United States-Iran: As Iranian forces ramp up their harassment of ships in the Persian Gulf, the U.S. has decided to deploy advanced F-35 fighter jets, additional F-16 fighter jets, and an additional Navy destroyer to the region. While the move is likely to help deter Iran from trying to seize more foreign tankers, it will also raise the risk of an accidental confrontation that would boost energy prices and slow economic growth around the world.

- Iran’s recent aggressive harassment in the region is partly a result of the U.S.’s effort to shift its military power out of the region and to focus more on Great Powers like China and Russia.

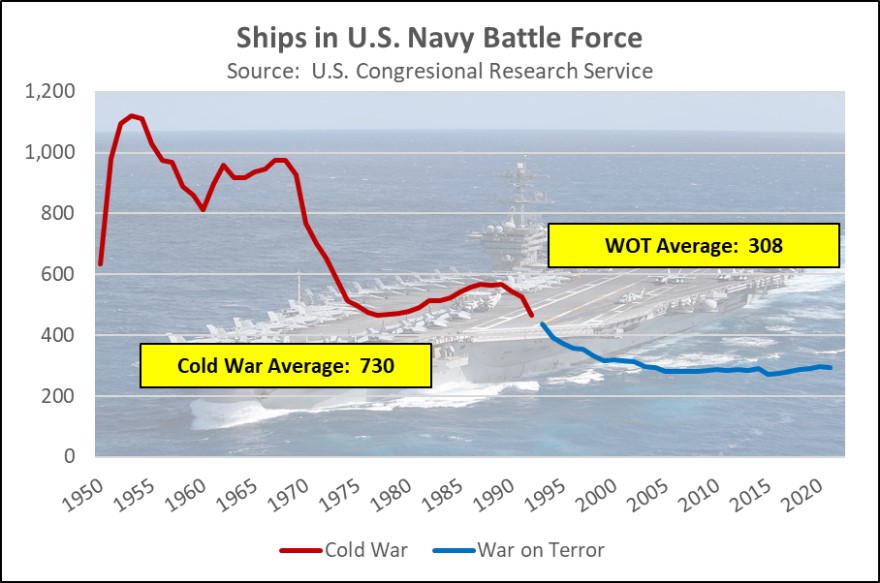

- It also reflects the shortage of U.S. Navy ships available to deploy to the Middle East. Throughout the War on Terror and its immediate aftermath, the Navy’s combat force, currently at about 294 ships, has been only a fraction of its size during the Cold War.

China-Russia: The Chinese and Russian navies this week are holding joint exercises in the waters that separate Japan from Russia and South Korea. The maneuvers are further evidence that the countries are increasing their military cooperation to bolster their ability to project power internationally. Even though Russia’s ground forces are still mired in their disastrous invasion of Ukraine, the country’s naval forces remain quite capable and can offer synergies to the world-leading Chinese navy. As the China-Russia bloc increases its effort to project power globally, tensions with the West are unlikely to ease significantly.

China: In recent days, Zhejiang province has cleared its website of recent data which showed a jump in cremations after President Xi ended his strict Zero-COVID lockdowns late last year. The data had shown that cremations in the province jumped to 171,000 in the first quarter of 2023, compared with first-quarter readings of just 99,000 in 2022 and 91,000 in 2021. The figures had been widely discussed on social media as evidence that lifting the pandemic restrictions so suddenly caused a surge in excess deaths.

- It appears that the data was wiped off Zhejiang’s website because the implied jump in deaths is an embarrassment to the government.

- The move is also a reminder that rising deaths and sickness from the coronavirus could be adding to the other headwinds that are slowing China’s economic recovery, including weak exports, high corporate debt, worsening government intrusion into the economy, and consumers trying to rebuild their finances after the pandemic lockdowns.

Russia-Ukraine War: The Saudi and Turkish governments are reportedly trying to broker a deal to repatriate Ukrainian children taken to Russia and held in children’s homes or adopted by Russian families. According to the reports, officials in Kyiv and Moscow are compiling lists of the thousands of children moved to Russia since President Putin’s invasion of Ukraine, as part of the mediation process. That points to at least some measure of cooperation and raises hopes for a return of the seized children.

European Union: The International Energy Agency warned that even if Western Europe’s natural gas storage facilities are 100% by this winter, the agency’s modeling shows the region could still face shortages and price spikes if the winter is cold and Russia shuts off its remaining exports. The EU’s gas storage currently stands above 80% of capacity, nearly 20% above the previous five-year average.

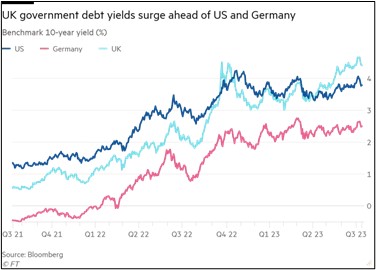

United Kingdom: Sticky consumer price inflation and the likelihood of further interest-rate hikes by the Bank of England have pushed U.K. government bond yields well above those of other major developed economies. At this writing, 10-year Gilts today are trading to yield 4.370%, versus 3.977% for Australian obligations, 3.774% for U.S. Treasurys, and 2.405% for German bonds. The surge in U.K. yields illustrates the risk in longer-maturity U.S. bonds, which could be repriced lower if investors swing around to the idea that U.S. inflation will be higher and more volatile in the future.

U.S. Corporate Tax Policy: The Treasury Department yesterday struck a deal with the Organization for Economic Cooperation and Development that will give U.S. companies an extra year, until 2026, before they will face higher foreign taxes under the OECD-brokered global agreement on minimum corporate taxes. The deal also preserves favorable treatment for U.S. tax credits.

U.S. Telecommunications Industry: The Wall Street Journal’s recent series on the telecom industry’s use of lead-sheathed cables helped crush the shares of major incumbents such as AT&T (T, $13,53) and Verizon (VZ, $31.46) yesterday. Those two companies and several smaller firms suffered sharp declines in their stock price as Congress looks set to get involved and investors begin to expect major regulatory issues and mitigation costs. The firms’ stock prices have also been hurt by their high debt levels in the face of rising interest rates, the slowing real estate market, and the end of the 5G technology roll-out.

U.S. Consumer Spending: Despite today’s data showing a rise in June retail sales, new analysis from Bank of America (BAC, $29.40) shows that renters have been pulling back their spending on credit cards, even as home owners are still slightly increasing theirs. The figures suggest that renters are reacting to the rent inflation of the last couple of years, while the many homeowners who have locked in low mortgage rates are still able to boost their spending.