Weekly Energy Update (July 13, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Falling U.S. inflation is raising hopes that the Fed’s tightening cycle is coming to an end. That has lifted oil prices, triggering a breakout above the recent trading range.

(Source: Barchart.com)

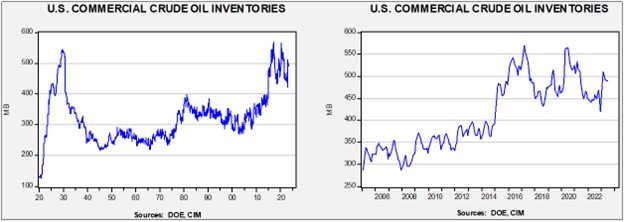

Commercial crude oil inventories rose 5.9 mb, well above the 0.1 mb draw forecast. The SPR fell 0.4 mb, putting the total build at 5.5 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.3 mbpd. Exports fell 1.8 mbpd, while imports fell 1.4 mbpd. Refining activity rose 2.6% to 93.7% of capacity.

(Sources: DOE, CIM)

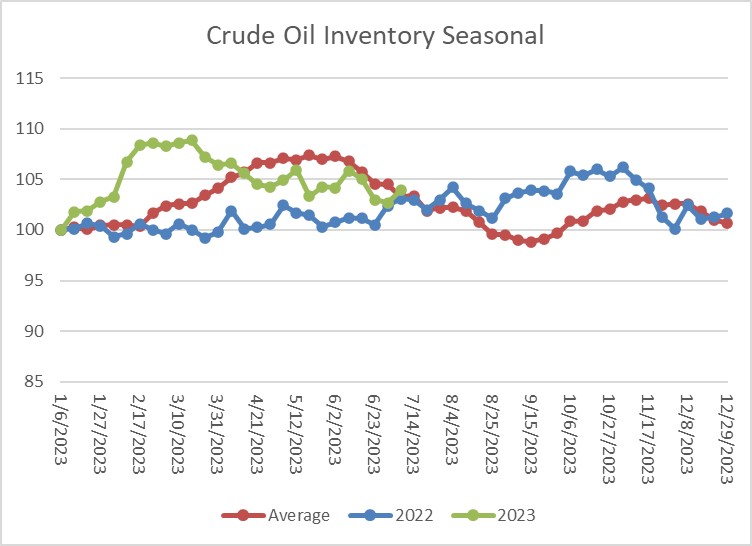

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. This week’s build is contraseasonal; current inventories are in line with seasonal levels.

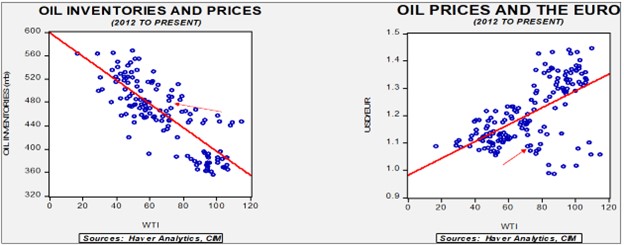

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $59.77. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

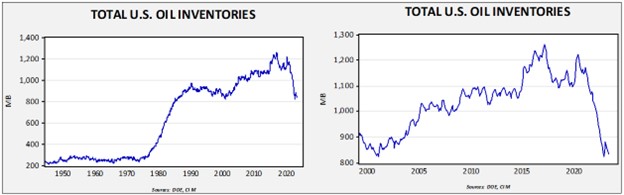

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $94.27.

Market News:

- China has made a concerted effort to improve energy security. Increasing its imports from Russia and making aggressive diplomatic and investment actions in the Middle East are all part of this goal. It should be noted that domestic production is also increasing.

- China has increased residential natural gas prices in a bid to reduce demand.

- Hot weather continues. In the U.S., 6 million Americans are in areas of extreme heat. Phoenix is threatening to break its previous record of 18 days with 110+ F temperatures. Miami has also seen temperatures near that level and has suffered through 30 consecutive days of heat indexes over 100 F.

Geopolitical News:

- As sanctions erode on Iran, Tehran is boosting exports, thwarting the Kingdom of Saudi Arabia’s efforts to lift prices.

- Iraq is becoming increasingly important in Tehran’s sanction busting.

- Venezuela has seen sanctions gradually erode as the world adjusts to the war in Ukraine. The country is using expanding oil exports to pay down debt.

- Russia tends to view Central Asia as its near abroad. We have noted that recently China has been challenging Russia for this region. Reports suggest that the Prigozhin mutiny has led the “stans” to further distance themselves from Moscow.

- Rob Malley is a long-time diplomat that specializes in Iran. He was the Iranian envoy (the U.S. doesn’t have formal relations with Iran) for the Biden administration and was involved in the JCPOA talks. He has been relieved of his duties as the FBI investigates his handling of classified materials. However, there is growing speculation he may be a spy for Iran.

- Last week, we noted that the U.S. Navy had thwarted efforts by Iran to seize vessels. Apparently, this action wasn’t enough to keep Iran from trying again as the IRGC has now seized a tanker in the Persian Gulf. Meanwhile, Indonesia has seized an Iranian tanker thought to be engaged in an illegal oil transfer.

- Iran is said to be increasing cyberattacks against Western targets.

- There is increasing evidence that Iran is trying to attack Israel directly via Hezbollah.

Alternative Energy/Policy News:

- Although car dealers are tending to hold less inventories these days, reports suggest that EV inventories are becoming rather bloated. Current inventories are at about a 92-day supply, twice the industry average. Sales have picked up, but supply is outpacing demand with probably the biggest issue being price. Also interesting is that hybrid inventories are only 44 days.

- Chinese automakers are targeting the U.S. Chinese EVs are a threat to the U.S. market due to their lower costs.

- Mercedes-Benz (MBGYY, $19.86) is the latest automaker to adopt the Tesla standard for charging connectors. The company joins five other firms, including General Motors (GM, $39.77) and Ford (F, $15.10), in adopting this standard.

- The IEA has released its first report on minerals critical to the energy transition. There is an expanded race to secure key metals involving governments, commodity firms, and automakers.

- The energy transition can’t occur without mining and smelting. Although such activities are generally acceptable in the abstract, they become problematic when they occur close to home.

- The IEA has published an update on the progress made toward zero emissions.

- The seabed is a controversial region for gathering these critical minerals. Island nations and China are keen to develop this source, while European nations are trying to restrict the effort. Meetings on this issue are underway in Jamaica.

- Climate problems are becoming a challenge for insurers. The U.S. system of state regulation may not be suited to respond.

- Biofuel makers are starting to consider bamboo as a source. The plant grows rapidly and could become a reliable source for ethanol. We note that on the West Coast biofuels are displacing distillate fuels.