Tag: AI

Asset Allocation Bi-Weekly – The Great Silver Short Squeeze (January 20, 2026)

by Thomas Wash | PDF

There is perhaps no market force more fearsome than a true short squeeze. In our increasingly digitized financial world, a perilous gap often emerges between “paper” positions and physical reality. A short squeeze occurs when entities that have sold a promise to deliver an asset, be it a stock, a commodity, or a derivative, are forced to purchase the actual underlying asset to meet that obligation. This triggers a frantic scramble for limited supply, compelling short sellers to bid against each other and driving prices exponentially higher. We witnessed how this dynamic can unleash chaos during the GameStop episode, and now, compelling evidence suggests the same pressures are mounting in the physical metals market.

Prices for gold, copper, platinum, and silver have rallied sharply in recent weeks. The advances in gold and copper appear structurally sound, underpinned by persistent central bank accumulation and robust industrial demand, respectively. Silver typically takes its directional cue from gold but tends to exhibit greater volatility. However, the current price increase appears to be at least partially driven by a deepening supply deficit. Investors are increasingly concerned that “paper” silver obligations vastly outpace available physical holdings, which has driven the price up nearly 200% over the past year as market participants scramble for remaining inventory.

Rumors of silver price manipulation have persisted since a major bank’s conviction for distorting the market. Between 2008 and 2016, the bank engaged in “spoofing” — a deceptive practice where futures orders are placed with no intent of execution to manipulate prices. Although the bank was hit with a massive fine and began accumulating a large silver inventory, critics remain skeptical about whether their market behavior has truly changed.

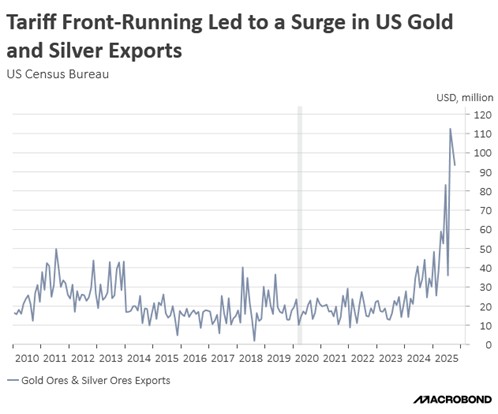

While long-term speculation surrounds the bank case, recent market volatility is more directly tied to shifting trade policies. Since President Trump’s “Liberation Day,” a surge in precious metal stockpiling has been occurring as corporations and financial institutions brace for new tariffs. Initially focused on gold, the momentum shifted to silver following its US designation as a critical mineral in November, which led to speculation that it could soon face tariffs. This demand intensified significantly when China began restricting export licenses, further straining global supply.

The danger of a commodity short squeeze lies not only in skyrocketing prices, but in the risk of a market panic. As long as firms can meet their delivery obligations or offer a cash settlement for the amount, volatility remains largely insulated within the commodities sector. However, when liquidity dries up, the results can be catastrophic. Historically, the missed margin call by the Hunt Brothers in 1980 triggered a wave of financial instability, much like how the 2021 GameStop squeeze necessitated a multi-billion dollar rescue of Melvin Capital by Citadel and Point72 to prevent a broader market collapse.

Thus far, the financial system shows no overt signs of distress. JPMorgan, often viewed as the institution most vulnerable to a liquidity run in a silver crisis, remains stable and has successfully navigated the persistent market pressures of early 2026. While the current short squeeze may prove transitory, volatility is expected to return if the White House formally expands import tariffs to include silver, which could further add to the global shortage.

Unlike the speculative “meme-stock” volatility of GameStop or the regulatory driven collapse of the 1980 Hunt Brothers crisis, silver appears positioned for a price consolidation. While recent price action has been aggressive, the metal retains its core appeal as a safe-haven asset and a hedge against currency debasement amid ongoing Fed uncertainty. Crucially, silver’s fundamental support is now bolstered by an inelastic industrial demand; its role in high-efficiency semiconductors, AI infrastructure, and the global solar transition creates a “valuation floor” that was absent in previous speculative cycles.

Note: There will be no accompanying podcast for this report.

Asset Allocation Bi-Weekly – #154 “America’s AI Buildout and Its Market Risks” (Posted 1/12/26)

Asset Allocation Bi-Weekly – America’s AI Buildout and Its Market Risks (January 5, 2026)

by Thomas Wash | PDF

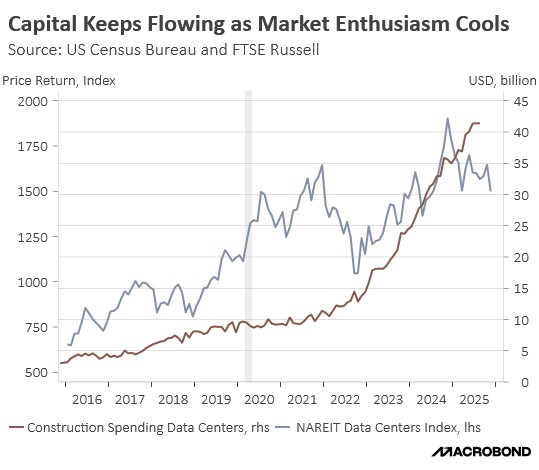

The construction of data centers has come to define the US economic narrative of 2024 and 2025. This unprecedented buildout reflects the urgent need to adapt national infrastructure to the rapid proliferation of artificial intelligence (AI). While the surge in investment has provided a powerful boost to economic activity, it has also sparked growing concerns that the boom may be veering toward excess. The sheer scale of spending — financed by a rising mix of cash and leverage — has begun to crowd out other sectors, leaving the broader economy increasingly exposed to any slowdown in AI momentum.

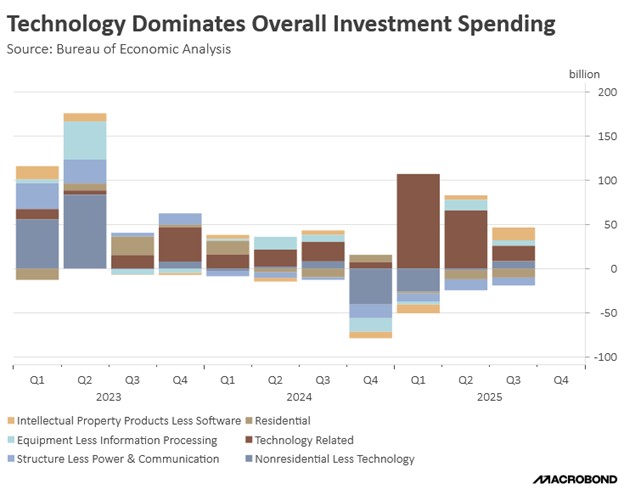

In 2025, a renewed wave of AI investment played a critical role in stabilizing growth amid escalating trade uncertainties. During the first quarter, fixed investment spending acted as a key buffer, offsetting a pronounced deceleration in household consumption and other cyclical sectors as sentiment softened. Technology-related investment expanded at an annualized pace of nearly $100 billion in the first three months of the year, which eclipsed the roughly $25 billion increase in personal consumption and lifted total fixed investment growth to approximately $50 billion. In effect, AI infrastructure became the economy’s primary growth engine at a moment of mounting fragility elsewhere.

This divergence between investment in technology and broader economic activity was not a first quarter anomaly. Rather, it marked a sharp acceleration of a trend that first emerged in late 2023. The catalyst was the so-called “ChatGPT moment,” which triggered a dual-track surge across financial and physical capital. Beyond inflating valuations in AI-adjacent equities, the breakthrough ignited a historic infrastructure race as firms scrambled to build the computing capacity required to meet surging demand. What began as a technological inflection point quickly evolved into a macroeconomic force.

Over the last two years, data center construction has become one of the largest sinks for global liquidity, and the scale of these projects has pushed even the largest technology firms toward their financial limits. According to Apollo Global Management, hyperscalers are now reinvesting roughly 60% of operating cash flow into capital expenditures — the highest level on record. To sustain this pace, companies have increasingly turned to debt financing, opting to preserve balance sheet flexibility while locking in relatively favorable long-term borrowing costs to fund infrastructure with multi-decade horizons.

While debt financing has fueled the tech sector’s expansion, it has inadvertently strained other parts of the economy. As financial institutions concentrate their lending on AI infrastructure, affordable capital has become increasingly scarce for other sectors, producing a “crowding out” effect that is now impacting Main Street. In 2025, a rising number of non-tech firms were forced into bankruptcy. These businesses cited a toxic combination of rising input costs and tightening credit conditions as the primary drivers of their insolvency.

Moreover, this lack of diversification has left the financial system and the broader economy susceptible to shifts in AI sentiment. While current data centers operate at high capacity, mounting evidence suggests that the pace of construction may far exceed sustainable demand, leading to fears of speculative overcapacity. These concerns have fundamentally called into question the credit quality of the debt issued to fund these projects, as investors worry that the underlying cash flows may not materialize in time to service these record-breaking obligations.

Signs of caution are already emerging. In December 2025, IBM CEO Arvind Krishna warned that the economics of the AI infrastructure race may prove untenable, estimating that the industry would require nearly $800 billion in annual profits merely to keep pace with interest obligations. At the same time, Blue Owl Capital’s withdrawal from a planned $10 billion data center project in Michigan underscored a shift in lender sentiment. As financing partners grow more wary of high leverage and uncertain returns, speculation is rising that the data center boom could face a reckoning within the next two years.

Still, the outlook is not uniformly pessimistic. Despite the economy’s growing reliance on AI-driven investment, there is little evidence of an imminent downturn. Consumer spending remains resilient, business sentiment is showing tentative signs of improvement, and early gains in AI-enabled productivity are beginning to diffuse beyond the technology sector. These dynamics suggest that meaningful opportunities persist for investors, even as the initial speculative fervor surrounding AI fades.

In this environment, diversification is prudent. A strategic pivot toward value-oriented equities offers a way to reduce exposure to concentrated AI risk while maintaining participation in broader economic growth. Such a shift may entail a modest sacrifice in short-term upside, but it provides a critical safeguard should the AI infrastructure cycle prove less durable than current investment levels imply.

The accompanying podcast for this report will be delayed until later in the week.

Asset Allocation Bi-Weekly – What Catch-Up Economic Reports Say About the AI Boom (December 8, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

Now that the federal government’s record-breaking shutdown over budget issues has ended, agencies have been releasing batches of delayed economic reports. In some cases, officials have warned the reports may never be released, given that statisticians can’t go back in time and collect certain data. The prime examples of that are the consumer price index and the monthly unemployment rate, which is based on a nearly real-time survey of households. Nevertheless, other reports are coming out now, and even though we have written up some of them with a quick, concise analysis in our Daily Comment, we think it would be useful to provide a more in-depth analysis of some of these catch-up reports, along with their implications for investors. We will focus on the recently released data for August construction spending and September durable goods orders, which together show a nuanced impact from today’s big boom in artificial intelligence (AI) investment.

August construction spending rose modestly by a seasonally adjusted 0.2%, following a similar gain of 0.2% in July and a 0.5% rise in June. Private residential construction spending jumped 0.8%, accelerating from its July gain of 0.7% and marking its third straight monthly increase. In contrast, August public works spending was flat. Even more interesting, August spending on private nonresidential construction fell 0.3%, after a decline of 0.5% in July. In fact, this proxy for commercial construction has only posted two monthly gains (of 0.1% each) over the last year. Total construction spending in August was down 1.6% from the same month one year earlier, with public works spending up 1.8% but private residential outlays down 1.5% and private nonresidential outlays down a whopping 4.3% (see chart on next page).

Given all the news stories about artificial intelligence firms spending massively on data centers, cooling equipment, and other AI infrastructure, some investors might be surprised at the recent relative weakness in commercial construction outlays. What explains this weakness? In large part, the problem appears to be that the big AI boom hasn’t been enough to offset this year’s anemic corporate investment outside the AI sector. One reason for that has probably been the uncertainty over US trade policy this year, which has discouraged some new investment despite the lucrative tax incentives in this year’s “Big, Beautiful” tax and spending bill. We think that another likely reason has probably been the weak consumer spending by lower-income households.

Separately, September durable goods orders rose by a seasonally adjusted 0.5%, marking their second straight monthly gain but slowing from their increase of 3.0% in August. Of course, durable goods orders are often driven by transportation equipment, where just a few airliner orders can have a big impact. September durable goods orders excluding transportation rose 0.6%, marking their fifth straight monthly increase and accelerating from their rise of 0.5% in the previous month. Finally, the durable goods report also includes a proxy for corporate capital investment. In September, non-defense capital goods orders ex-aircraft rose by 0.9%, after similar gains of 0.9% in August and 0.7% in July. Overall durable goods orders in September were up 9.6% year-over-year, while durable orders ex-transport were up a more modest 4.6% and non-defense capital goods orders ex-aircraft were up 5.3%.

The chart below shows the year-over-year change in non-defense capital goods orders ex-aircraft since just before the Great Financial Crisis (GFC). The chart does show how this proxy for corporate capital investment has strengthened over the last couple of years. All the same, the annual growth in this spending is decidedly modest compared with the booms that occurred after the coronavirus pandemic, in the late 2010s, and in the years right after the GFC. Coupled with the relative weakness in commercial building discussed above, this data points to overall weakness in commercial equipment spending and is further evidence that most firms have become quite cautious about new investment, at least for the moment. Headwinds from policy uncertainty and weakness in some consumer sectors have weighed not only on building activity but also on equipment investment.

What does all this imply for investors looking forward to 2026? In our view, this year’s policy uncertainty is likely to dissipate in 2026 as the US strikes more trade deals and key court decisions are reached. Moreover, the Federal Reserve looks set to keep cutting interest rates. If these developments encourage a catch-up in corporate investment spending beyond the AI sector, it should support some re-acceleration in economic growth. Of course, lower-income households are still likely to be husbanding their resources, and that could limit overall growth in 2026. All the same, we see reason for optimism regarding overall economic growth, which could support US stock prices.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Asset Allocation Bi-Weekly – #153 “What Catch-Up Economic Reports Say About the AI Boom” (Posted 12/8/25)

Asset Allocation Bi-Weekly – #149 “The AI Arms Race: Navigating the Divide Between Promise and Profit” (Posted 10/6/25)

Asset Allocation Bi-Weekly – The AI Arms Race: Navigating the Divide Between Promise and Profit (October 6, 2025)

by Thomas Wash | PDF

AI is arguably the most exciting investment story of our time, with discussions swirling around its potential to create new businesses, boost productivity, and drive unprecedented revenue growth. This excitement has fueled massive spending as tech firms race to capitalize on the technology’s promise. As the hype has intensified, however, a critical question has emerged: Is AI growing faster than our ability to adapt to it?

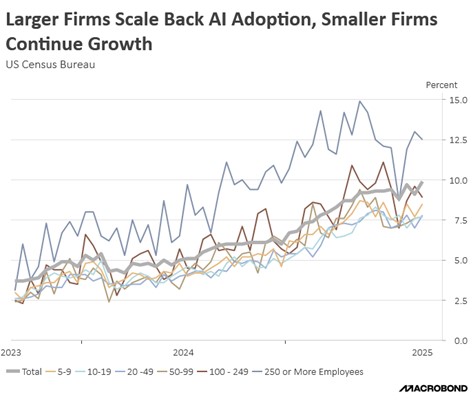

A recent MIT report, “The GenAI Divide: State of AI in Business 2025,” suggests this may be the case. The study reveals a staggering 95% of corporate generative AI pilots have failed to deliver a measurable return on investment. This poor performance is fundamentally attributed to “execution failure,” with key issues including a lack of organizational readiness and a disconnect between the technology and day-to-day business workflows. The report also found that firms using consultancy services were more successful, highlighting that effective implementation and user adoption are critical to success.

This finding aligns with a separate trend observed in a U.S. Census Bureau survey, which shows that large firms have begun to slow their adoption of AI. This indicates that the initial hype that fueled demand may be giving way to a more cautious, results-driven approach as companies grapple with the practical challenges of integrating AI into their operations.

The current spending by major tech companies on AI infrastructure suggests that while AI may be the technology of the future, they are investing as if it’s already a present-day reality. Driven by the immense computational and energy needs of training large AI models, firms like Microsoft, Alphabet, Meta, and Amazon have made the uncharacteristic decision to ramp up capital expenditures.

In 2025 alone, tech companies are projected to spend up to $344 billion on AI infrastructure, including data centers and the hardware required to run complex models. This surge marks a sharp departure from the sector’s traditionally asset-light strategy, which prioritized intellectual property over physical assets to maintain large cash reserves. The current high-stakes environment has led to a massive increase in capital expenditures (capex), often referred to as the AI “arms race,” which is rapidly drawing down the operating free cash flow of many major tech companies.

This capital-intensive trend is expected to continue, significantly aided by the passage of the One Big Beautiful Bill Act (OBBBA) in July. This legislation permanently reinstated a 100% bonus depreciation for qualified property (like computer equipment and servers) acquired after January 19, 2025. It also introduced a new, temporary allowance for 100% expensing of “Qualified Production Property.”

The significant effort to build out AI infrastructure has acted as a healthy indicator of growth across the sector, boosting revenue for numerous suppliers. Nvidia has been the most notable beneficiary, but other firms, including Intel and SAP, have also seen gains. Most recently, Oracle saw its stock jump by nearly 30% after reporting that its first quarter booked revenue included over $455 million in new business related to its cloud infrastructure, signaling strong enterprise demand for AI-enabling services.

While supplier earnings remain robust, the sector faces growing risks of over-dependence. Many key AI technology providers rely on a highly concentrated group of customers — primarily the few cloud giants — for the vast majority of their revenue, raising concerns about the concentration risk inherent in their earnings estimates.

Furthermore, concerns persist that a significant portion of AI funding is circulating within a closed loop of major companies. This occurs when cloud giants invest in smaller AI startups, which then use that capital to purchase cloud infrastructure and compute time from their investors. This circular dynamic risks distorting genuine market demand and may artificially inflate the revenue of the largest players.

Despite these concerns, we believe the current equity rally has a strong chance of continuing for the foreseeable future. The bull market, which began in October 2022, has historical precedent on its side, with average cycles lasting about five years, suggesting the potential for another two to three years of upside.

However, given the market’s heavy concentration in large cap technology, the risk of a sharp correction in these high-growth stocks is elevated. To mitigate this risk, we recommend maintaining exposure to value stocks, which can provide crucial defensive ballast to a portfolio. Value-oriented sectors typically exhibit lower volatility and have historically demonstrated greater resilience during periods of economic uncertainty or growth stock selloffs.