by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning. It’s a risk-off day so far, with global equities falling. Some of this appears to be some well-deserved profit taking in the wake of a strong equity rally. The FOMC meeting ended yesterday. We examine what they announced and other policy developments. There may be a thaw in Brexit talks. We update the latest on China. Our usual commentary on COVID-19 is available along with some reports on vaccine development and a global rise in new infections. Precious metals prices have been strong (they are higher this morning); we look at recent internal issues caused by a disruption of supply flows. The Weekly Energy Update is available. Here is the information:

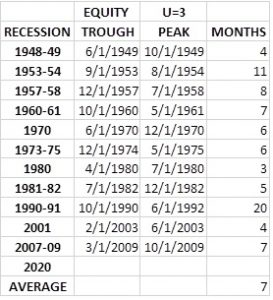

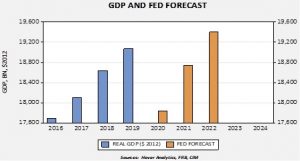

Policy news: The FOMC meeting ended. There were no surprises in the statement. The Fed kept rates unchanged and didn’t signal any adjustments to QE or other programs. The tone of the statement was very cautious; the committee clearly wanted to convey a sense that the downturn is still a major risk to American citizens and that monetary policy will remain easy for the foreseeable future. The statement was approved by all the voting members of the committee. Because this was a meeting on the quarter, the FOMC released economic projections. It’s forecast for this year’s GDP is -6.5%, with a 5.0% reading in 2021 and 3.5% in 2022.

Their forecasts suggest that the recovery won’t end until sometime in 2021; the level of GDP will remain below the 2019 peak for the next two years. Consequently, the forward guidance from the Fed is no change to the policy rate is expected until 2022, based on the median dot. In other words, the Fed is now engaging in forward guidance, signaling that rates will stay low for at least the next 30 months.

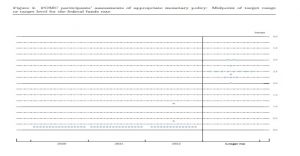

There were three other items of note. First, although there was no mention in the statement about yield curve control, Chair Powell noted the committee did talk about it in the meeting in response to a question in the press conference. Second, there was no discussion about negative interest rates, although two St. Louis FRB economists suggested it might be necessary in order to boost the economy back to its long-term trend. There is an argument to be made for negative rates.

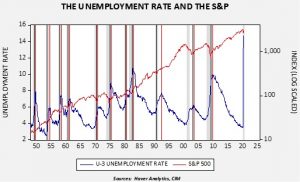

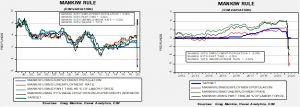

These charts show the Mankiw rule variations. Regular readers will recognize this rule as an offshoot of the Taylor Rule, which attempts to estimate the Fed funds target based on inflation and economic slack. The difference is in the measure of slack. Taylor used the difference between GDP and potential GDP. The latter number is not directly observable. Mankiw substituted the unemployment rate. We added three other measures of labor slack. The chart on the right highlights the current situation; three of the four variations of the Mankiw rule are in negative territory, with the employment/population ratio model suggesting Fed funds should be 5.65%. We don’t expect the Fed to deploy negative policy rates. Negative rates would wreak havoc on the non-bank financial system and probably end money market funds as a financial instrument. Third, Powell was asked about the problem of creating overvalued asset markets through easy monetary policy; Powell, in line with his predecessors, made it abundantly clear that he does not see how the Fed could raise rates and potentially hurt workers by trying to contain an asset bubble. The ramifications are obvious; Fed policy will continue to support asset prices.

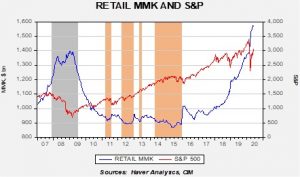

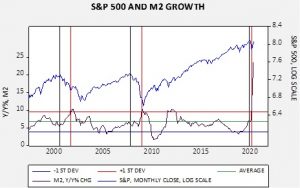

To put what the Fed has done in context, compare the S&P 500 to the policy response. This chart looks at the yearly growth rate of M2 and the S&P. We have taken the average growth rate of the money supply and one standard deviation bands over the period 1959—2020. The black vertical lines show the month end peak of the S&P; the red lines show how long it took the Fed to lift money growth above the standard deviation line after a bear market ensued. In 2000, it took 13 months; in 2007, 14 months and this time, four months. Additionally, in the previous two episodes, once the standard deviation line was hit, money growth promptly fell. Compare that behavior to the current cycle; not only is money growth running in excess of 20%, more than two standard deviations above the average, the time to reach that level has been very short. Simply put, policy support is extreme and accounts for much of the rally in stocks. There was nothing heard yesterday that makes us believe that policy stimulus will be removed anytime soon. If anything, there could be more actions in the pipeline.

In terms of market reaction, equities initially rallied on the statement but retreated during the press conference. We didn’t see anything particularly bearish, so the decline is probably profit taking. Precious metals prices jumped. The dollar initially fell but did recover after the press conference ended. Interest rates also fell. Our view is that (a) policy will remain easy but (b) the Fed remains reluctant to take more radical steps (yield curve control, deliberate dollar depreciation, negative interest rates) without additional deterioration in economic conditions.

In other policy news, Treasury Secretary Mnuchin indicated that he believed more fiscal action would be necessary to boost the economy, especially to small businesses. The U.S. is proposing additional spending to bolster the semiconductor industry; this is partly to offset the costs of separating from China. The U.S. is expanding its price fixing investigation of the poultry industry.

In overseas policy news, the ECB is apparently considering creating a “bad bank” that would absorb bad loans across the EU caused by COVID-19. This approach allows for the loan to be worked out, and cleans up the balance sheet of the bank that held the bad debt. Amazon (AMZN, 2647.45) will face anti-trust charges from the EU over its treatment of third party sellers.

Brexit and trade: Michel Barnier, the EU chief negotiator for Brexit is asking for flexibility on the issue of a “level playing field.” The EU has been worried that the U.K. would become a low regulation “Singapore on the Thames” that would undermine EU trade regulations. Thus, the EU has held a rather hard line on not giving Westminster such arrangements. The fact that Barnier is asking for some wiggle room suggests that the EU is starting to bend. Why the change? Probably because nations, like Ireland, which would be hurt badly by a hard Brexit, want to avoid that outcome.

China: Here is what we are watching:

- China has been allowing the CNY to weaken in response to increased U.S. pressure. As long as capital flight remains contained, we expect Beijing to continue to weaken its currency.

- Despite the looming new security law, protests continue in Hong Kong.

- For some time, China’s high debt has been a worry. Although there is evidence of increasing stress caused by the global downturn, so far, we are seeing informal methods, such as quiet restructurings and debt service postponement, to avoid outright default and bankruptcy.

- The U.S. is maintaining military pressure on China. The S. Navy has deployed the USS Ronald Reagan and the USS Nimitz, two aircraft carrier groups, to the Asia/Pacific area. The USS Theodore Roosevelt was in port at Guam, dealing with an outbreak of COVID-19. However, according to reports, it is back at sea, giving the U.S. three carrier groups in theater. This is a show of force that will not go unnoticed by Beijing.

- China’s auto sales rose 14% in May, the second straight month of recovery.

- Issues of inequality are not just a concern in the West. China’s high levels of inequality have caught the attention of it’s leaders as well.

- In the aftermath of the end of Hong Kong’s “one country, two systems” model, relations with the U.K. have clearly deteriorated. It has now moved to the point where it is affecting U.K./China trade.

- And finally, one of the deep social problems facing China has come from its one-child policy. The CPC rigorously enforced a policy of only allowing one child per family in a bid to slow population growth. The program did what it was designed to do; China’s population growth slowed and for a number of years, it benefited from a falling dependency ratio. However, such benefits, absent of high levels of immigration, could not be sustained. Now, China’s dependency ratio is rising (and from the wrong end—its elderly population is rising much faster than its child population) and it has gender distribution problems. Due to many families being restricted to one child, steps were often taken to ensure that the only born was male. As a result, China now faces a demographic problem; it’s getting older and it has too many males relative to females. Despite easing one-child restrictions, Chinese couples seem reluctant to have larger families. So, one academic in China has offered a solution—polyandry, where women take on multiple husbands.

COVID-19: The number of reported cases is 7,397,349 with 417,109 deaths and 3,478,385 recoveries. In the U.S., there are 2,000,464 confirmed cases with 112,924 deaths and 533,504 recoveries. For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases across nations using similar scaling metrics. And Axios has its map of the U.S. showing infection trends by state. There are now 15 states with a Rt>1, which means that infections are rising at a faster rate.

Virology:

- There are several vaccine candidates that are being tested this summer. Here is a listing of all the vaccine candidates, the firms or schools involved in their production and where each is in the process of testing or development. Russia has embarked on a crash program to develop a vaccine.

- Although we are seeing some areas in the U.S. with rising infections, there does not appear to be any move to return to lockdowns. This development suggests that political leaders have concluded that the negative effect on the economy outweighs the medical risk. This isn’t unique to the U.S., foreign governments are taking similar positions.

- Iran is reporting a new surge in infections.

- It is looking increasingly likely that the recent death of Burundi’s president was caused the COVID-19. If true, Pierre Nkurunziza would be the first head of government felled by the virus.

- European leaders are under fire for their management of the pandemic. PM Johnson has seen increased criticism. Sweden, who’s leaders took a more relaxed position on social distancing, are also coming under fire. On a more constructive note, EU leaders are looking at developing a more continental approach to dealing with the pandemic.

- In something as unusual as a pandemic, there are always unexpected outcomes. One that has emerged is that COVID-19 has apparently crushed the price of coca due to a collapse in the narcotics trade. Some of the drop is due to borders closing; other factors are the loss of chemicals needed for processing. However, for now, the pandemic has succeeded in doing something years of policy have failed to achieve.

- China is denouncing a Harvard study that suggests the virus was circulating in Wuhan at the end of the summer of 2019. Confirmation would suggest that Chinese officials were either unaware or covered up the evidence and it reflects badly on the government. At the same time, the EU is accusing China of conducting a disinformation campaign on its handling of the pandemic. Much of the narrative is being spread through social media.

Commodity news: Gold prices have been strong in recent months, helped by global uncertainty. The pandemic has boosted demand as well. What has been unexpected is the flows of gold to New York. Although there are lots of ways to buy gold, including physical purchases and ETF’s, perhaps the most sophisticated way to buy the metal is to take delivery on a long futures position. The delivery can be kept at the Comex vault and can be sold into the futures market at any time. It is a very low-cost way of transacting a gold purchase. Banks do something similar with their gold holdings. Most physical gold is held in London and Zurich, but most of the futures trading occurs in New York. Most of time, this isn’t a problem; the spread between the futures price and the physical product is small. However, over the past few months, demand for gold has increased and because shipping has been disrupted due to the pandemic, the spread between futures and cash gold widened. This forced banks, who were long the physical and short futures, to charter airplanes to deliver gold to the Comex in lieu of making margin calls. In other gold news, Russia has been increasing its exports of gold; the country is the third largest producer of gold. In other commodity news, rice prices are rising due to global demand and likely some precautionary inventory purchases.