Asset Allocation Weekly (May 22, 2020)

by Asset Allocation Committee

Beginning in the late 1990s and becoming an even bigger issue after Dodd-Frank regulations were imposed following the Great Recession, many market participants worried that bond market liquidity would be absent in the face of a crisis. Strict regulations discouraged banks and brokerage firms from holding large inventories of corporate bonds, thereby precluding them from their former role as willing buyers in the face of a wave of selling by investors. Compounding the concerns were the sheer size of flows into traditional open-end and ETF bond portfolios. Over the 10-year period from 2009 through 2019, a total of $2.7 trillion flowed into these instruments, almost a third of which were in ETFs. Entering the fray was the popularity of risk parity funds that levered their bond holdings. Though each risk parity scheme has a nuanced approach, they all act in a similar fashion. The concerns were that when risk parity funds and individual investors rushed to exit their bond holdings, market liquidity would be absent, particularly for corporate bonds. Numerous studies and articles appeared over this time frame warning of dire consequences for bond investors, notably violent price movements due to the fact that banks and brokerage firms were no longer participating to a significant degree to assist in maintaining order to the bond market.

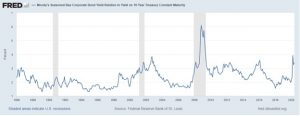

In March, the veracity of these concerns was tested as the bond market worked its way through the financial stress triggered by the pandemic. During this episode, ETFs proved their endurance by moving into the void and providing the necessary stabilization of the market. The use of creation/redemption units on the part of Authorized Purchasers [APs] mitigated the severity of the downturn, especially among investment-grade corporate bonds. As the accompanying chart illustrates, spreads for BBB/Baa-rated corporates relative to the 10-Year Treasury gapped to their widest level since the Great Financial Crisis, yet quickly repaired.

An examination by Blackrock of the trading during this critical period in its largest corporate bond ETF, the iShares iBoxx Investment Grade Bond ETF [LQD], provides evidence that not only did the activities of the APs aid in maintaining market liquidity, but the market price of LQD actually led the price discovery process. In other words, rather than the market price exacerbating the premium/discount to net asset value [NAV], the market price was the precursor of the daily NAV print. Moreover, the direction of the market price of LQD often preceded the direction of LQD’s indicative value [IV], which is the real-time estimate of its fair value, based on the most recent prices of its underlying bonds. Since LQD’s 2,169 underlying bonds trade over the counter, and therefore many may contain stale pricing, the price discovery proved invaluable to market functioning. After the dust settled, it was evident that LQD and other bond ETFs provided market pricing that was at least as good as, and oftentimes better than, individual bonds.

Although the market function provided by LQD during the period is not necessarily indicative of every bond ETF in each bond sector, it does underscore the notion that ETFs can provide the necessary liquidity during a period of crisis. The creation/redemption mechanism of ETFs allow for arbitrage opportunities and allow the supply/demand of the ETFs to achieve equilibrium with the value of the underlying bonds. In essence, ETFs are now creating most (if not more) of the liquidity previously provided by banks and brokerage firms, often doing so with greater efficiency.