Daily Comment (May 28, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning! Global equities are steady to higher this morning after a continued strong march higher. We update the COVID-19 situation; the U.S. death toll now exceeds 100k. We discuss the Hong Kong/China situation. The Beige Book was released yesterday. We are monitoring hostilities on the China/India border. The EU creeps closer to a Eurobond. The weekly energy update report will be out tomorrow as the DOE data was delayed due to Monday’s holiday. Here are the details:

COVID-19: The number of reported cases is 5,716,271, with 356,131 deaths and 2,367,292 recoveries. In the U.S., there are 1,699,933 confirmed cases, with 100,442 deaths and 391,508 recoveries. For those who like to keep score at home, the FT has an interactive chart that allows one to compare cases and fatalities between nations, scaled by population. Here is an Axios map showing state infection rates.

Although we are seeing the media roll out headlines as the U.S. crosses the 100k fatality level, it should be noted that the U.S. uses a reporting method similar to Belgium, where doctors can assign the cause of death on either a test or symptoms. If nations are reporting fatalities on tests alone, it is highly likely they are underreporting virus deaths. Comparing overall death rates to normal death rates is probably a better way to estimate actual fatalities, but no method is perfect. The bottom line is that focusing on a particular number isn’t necessarily a true picture for comparison purposes.

The virus news:

- The good news:

- Two city-states that were able to handle the virus well were Singapore and Hong Kong. Both managed to keep the virus away from the elderly and both were aggressive in testing. Denmark is another nation that has performed well; it was aggressive early in implementing lockdowns and has been the first to reopen. So far, the reopening has gone well.

- Given the importance of testing, the slow response of testing and the lack of accuracy has been a problem. Companies are aggressively working to create more rapid, accurate tests. This development will be critically important during autumn to distinguish between seasonal influenza and COVID-19.

- Merck (MRK, 77.55) is working on an anti-viral designed to force the virus to mutate rapidly and kill itself.

- Sometimes showing action is just as, or more important, than actually doing something. Thus, expect companies to make a great show of disinfecting that may or may not provide much safety.

- Another clinical trial for a vaccine has begun in Australia.

- The bad news:

- One issue we have been watching for a while is that COVID-19 may become endemic, meaning it really never goes away. Many infectious diseases have this characteristic, even when a vaccine is available. We still see outbreaks of measles, mumps, pertussis, etc. Thus, learning to live with it may simply be part of life going forward. That doesn’t mean constant lockdowns, but it does mean the precautions for preventing the spread of the virus could become part of life.

- International hackers are pinging U.S. research facilities to steal medical research on treatments and vaccines. This development shows (a) the potential nations see in being the first to provide treatment, and (b) worries that “vaccine nationalism” may prevent them from getting a new treatment in a timely fashion. Vaccine nationalism is also on the minds of pharmaceutical companies.

- Brazil continues to suffer from rising COVID-19 fatalities.

The policy news:

- Although the GOP has been cool on additional stimulus, Majority Leader McConnell is apparently talking about another round of spending in the next month or two.

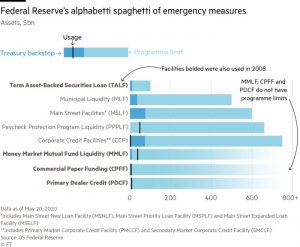

- We do know that the Fed’s balance sheet has been expanding at a historic pace. However, it should be noted that the actual drawing of available facilities has been rather light. This shows the power of announcement effects. Once participants realize the Fed will prevent a liquidity squeeze, they are more willing to engage in normal business.

- NY FRB President Williams, in an interview yesterday, said the Fed is “thinking very hard” about yield curve control. This would mean the Fed would set rates for the entire Treasury curve. If the Fed moves toward funding fiscal activity, such control will likely be necessary.

- The EU is moving toward a limited Eurobond to fund virus recovery. The EU has proposed a €750 billion fund to support recovery, part of a larger effort, that will be funded by a special EU bond serviced by a series of special taxes. The “frugal four” remain cautious, but Germany’s support for the measure could cajole them from a veto. The selling points are that the bonds (a) are special purpose and not for general fiscal activities, and (b) have their own services flows. But it is a mutual debt instrument and may move the EU toward a true Eurobond, a bond that funds fiscal operations backed by the full faith and credit of the EU.

The finance news:

- Although LIBOR continues to be used, policymakers are moving to end the life of the benchmark. The alternative, the Secured Overnight Financing Rate (SOFR), will be its replacement. We will be watching to see when the CME moves the Eurodollar futures to the SOFR futures as the “finishing touches” of the process. This shift will require millions of loan documents to be repapered to the new rate. Here is the timeline.

- Bullion banks took a hit on their hedging when futures prices rose above the cash price of gold. Bullion banks usually hedge their positions by shorting futures, which usually trade at a discount to the cash prices to cover the interest cost. During the March turmoil, investors piled into futures contracts, driving the futures price above the cash gold price. In response, banks have backed away from hedging in the futures markets.

The economic news:

- The Fed’s Beige Book confirmed what we all have seen—economic activity is down significantly. However, there is evidence in some districts that conditions are starting to stabilize. The districts of Cleveland, New York and Dallas reported that although conditions remain dire, they are not getting worse. The problems in hospitality were mentioned often. One other concern that was raised was that generous unemployment insurance, fear of infection and the lack of child care is preventing workers from returning to their jobs.

- Slow-to-arrive stimulus checks and job losses are putting millions of renters at risk of eviction. Although most state and local governments are not enforcing evictions at present, landlords will likely be forced to move quickly to evict once regulations ease unless the Fed offers landlords and mortgage companies similar relief.

The foreign news:

- SoS Pompeo warned Beijing that if it implemented its national security law, bypassing the former colony’s legislature, the S. would consider Hong Kong simply a part of China; in other words, the former colony is no longer autonomous. This would mean that any special treatment for Hong Kong would cease. Tensions over Hong Kong are escalating. The U.S. is reportedly considering sanctions on Chinese officials and companies over Hong Kong. The U.S. also has an extradition treaty with Hong Kong but not with China; if the U.S. continues to move forward with calling Hong Kong merely part of China, that treaty will almost certainly end. As expected, the National People’s Congress did approve the security law for Hong Kong.

- We continue to watch how this situation unfolds. If the U.S. moves to sanction Hong Kong’s financial system, it would isolate China and make it difficult to conduct trade and investment using dollars.

- Taiwan has indicated it will help Hong Kongers who want to move from the former colony.

- China is drafting a new five-year plan, the 14th in its history. Reports indicate the CPC is preparing the economy for decoupling from the U.S. The strategy appears to be designed to rely less on exports, which will require greater domestic consumption. To some extent, this is a major victory for the U.S. American policymakers have lectured China for years about the need to restructure its economy away from the reliance on exports. Although a series of Chinese administrations agreed in theory, restructuring the economy in practice was politically difficult. The Trump administration’s trade war with China is starting to look like it will become a longstanding policy and the severe global economic decline has made it evident that relying on exports is no longer feasible. This shift will be necessary if our expectations of deglobalization continue.

- For Xi, this decision is quite risky because the transition will almost certainly slow China’s economy, at least for a while. The tradeoff Beijing has offered its citizens is that the CPC granted strong economic growth for giving up political influence. Rising unemployment among China’s young is raising fears that this social contract will become frayed and may undermine the communist party.

- According to reports, President Trump is becoming jaded about the Phase 1 trade deal, which may lead to the return of tariffs. China is struggling with the dissonant objectives of agricultural self-reliance and meeting the import obligations of Phase 1.

- The House has sent a China sanctions bill to the White House tied to China’s suppression of the Uighurs. It is not clear if he will sign it. Although we suspect the executive would prefer to use sanctions against China for other issues, anti-China rhetoric is elevated and looking “soft” on China is not a winning strategy in the current environment.

- A congressional report warns investors that the Chinese financial system is fragile and questions American financial firms’ moves to build business relationships in China. Although the report’s claims are nothing new, the fact that the report is out now could become the basis for further actions to restrain American investment into China.

- A Canadian judge ruled that the U.S. met its legal test for extraditing Meng Wanzhou, the CFO of Huawei (002502.SZ, CNY 2.96). This means it is more likely Meng will face fraud charges in the U.S. tied to her company’s sales to Iran.

- Decoupling from China and deglobalizing will have profound effects on businesses, especially multinational firms. At a minimum, it will mean creating parallel supply chains, one for China and the other for the U.S. At worst, both countries will force companies to choose.

- As tensions rise with China, Beijing is allowing the CNY to depreciate. It is unclear how hard the PBOC is working to prevent the weakness (we will get a look when China publishes its reserves data), but it doesn’t appear that authorities are opposed to weakness. Using depreciation was expressly forbidden in the Phase 1 deal, so if China continues to use this tactic, tensions will certainly increase.

- As the ECB awaits the resolution of the court spat between the European Court of Justice and the German Constitutional Court, the central bank is preparing contingency plans for how it would operate without the Bundesbank.

India/China: There has been a long history of tensions on the Indian/Chinese border. However, because the frontier is high in the Himalayas, the ability of the two countries to conduct military operations is severely limited. Flare-ups are fairly common on the border. Recently, both sides have been increasing their military readiness around eastern Ladakah. The region is very remote and, on the ground, borders are somewhat indeterminant. New Delhi claims that China has moved fighter jets to air bases in the region. China claims that India has built new roads in the area and worries that the infrastructure would allow India to mobilize troops. History would suggest that neither side really wants a full-blown military conflict in the region due to the difficulty of conducting military operations in such harsh terrain. However, both countries have modernized their militaries and may want a skirmish to test their forces. The U.S. has offered to mediate talks to ease tensions. We will continue to monitor this situation.

Russia: Two Russian Su-35s intercepted a USN P-8A reconnaissance aircraft in the Eastern Mediterranean. The U.S. accused Russia of “unsafe, unprofessional” conduct.

Nord Stream: The Nord Stream pipeline, which would transfer natural gas from Russia directly to Germany, is back in the news. The project had been stalled due to U.S. sanctions but the arrival of a special drillship, the Akademik Tscherski, has restarted the project. The U.S. is considering additional sanctions against Germany and Russia over the project.