Author: Rebekah Stovall

Asset Allocation Weekly (February 12, 2021)

by Asset Allocation Committee | PDF

Jan Tinbergen was a Dutch economist, the first to win the Nobel Prize for economics[1] for his work on applied dynamic models of economic processes. Perhaps his most important contribution to economic policy is the penning of the Tinbergen Rule, which states that policymakers need an equal number of policy tools for each policy goal. If policymakers violate the Tinbergen Rule, they can leave a policy goal unaddressed. Of course, there are circumstances where two goals are solved with one policy tool, but that does require some degree of good fortune. Relying on luck is usually not a solid plan.

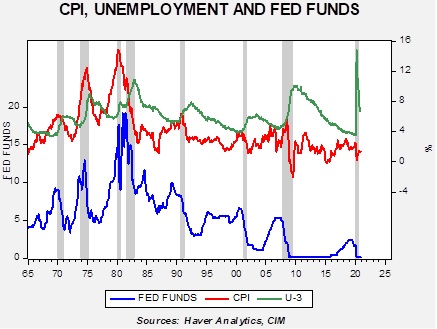

The classic case of the Tinbergen problem is the use of monetary policy to meet both inflation and full employment targets.

This chart shows the unemployment rate and CPI on the upper part of the graph and fed funds on the lower part. History shows that the FOMC mostly pays attention to inflation when setting policy and only reacts to rising unemployment when recessions occur. To some extent, the unemployment rate only rises when a recession is imminent, which is the idea behind the Sahm Rule. From 1965 into the early 1980s, there was a clear “whipsaw” in policy. Rapidly rising inflation tended to lift the fed funds rate. As unemployment began to rise, policymakers faced a dilemma—do they cut rates to help the economy but risk higher inflation, or do they focus on inflation and risk rising unemployment?

Since the early 1980s, this dilemma has mostly been resolved. Inflation has been low and mostly steady, which allows for the FOMC to focus on unemployment. And, the inflation problem was mostly fixed by regulatory policy; globalization and deregulation reduced price pressures, meaning that policymakers had two tools—interest rates combined with globalization and deregulation—to deal with two policy goals, low inflation and full employment. Thus, the Tinbergen Rule was satisfied.

However, these two goals are not the only ones that the FOMC and other policymakers are concerned about. Financial market stability is another one. Clearly, we have seen the impact of regulatory policy changes on monetary policy.

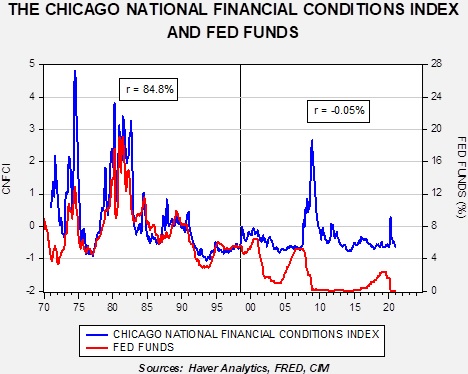

This chart shows the National Financial Conditions Index, created by the Chicago FRB, and fed funds. From the early 1970s into mid-1998, the correlation was very close. In fact, one could argue that the FOMC either adjusted policy to financial stress levels, conducted policy with little regard to stress, or actually targeted stress as a policy tool. Because the financial system was generally more regulated until the late 1990s, Fed policymakers worried less about financial conditions. But, since Gramm-Leach, which essentially created conditions where commercial banks could freely operate in the non-bank financial system, the FOMC has clearly shifted the relationship on monetary policy and financial conditions. Now, the Fed finds itself in a situation where financial conditions are mostly immune to the policy rate. When a financial crisis emerges, it seems to require aggressive easing and accommodative policy for extended periods to bring calm back to the markets.

Lately, the Fed has faced criticism from commentators arguing that persistently low rates and balance sheet expansion have contributed to financial excesses. Although we would agree with these comments, it should be noted that the Fed is facing a Tinbergen problem. It has only one policy tool, interest rates, to reduce unemployment and maintain financial stability. Raising rates would likely contract the P/E but there is little reason to expect that increased rates would reduce unemployment. What the Fed needs is an additional policy tool, something akin to Glass-Steagall, to reduce the liquidity available for the purchase of financial assets. Since that outcome isn’t likely, we expect financial assets to remain supported.

[1] Strictly speaking, there is no Nobel Prize for economics. Its official title is the “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.” He shared the prize with Ragnar Frisch.

Weekly Energy Update (February 11, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

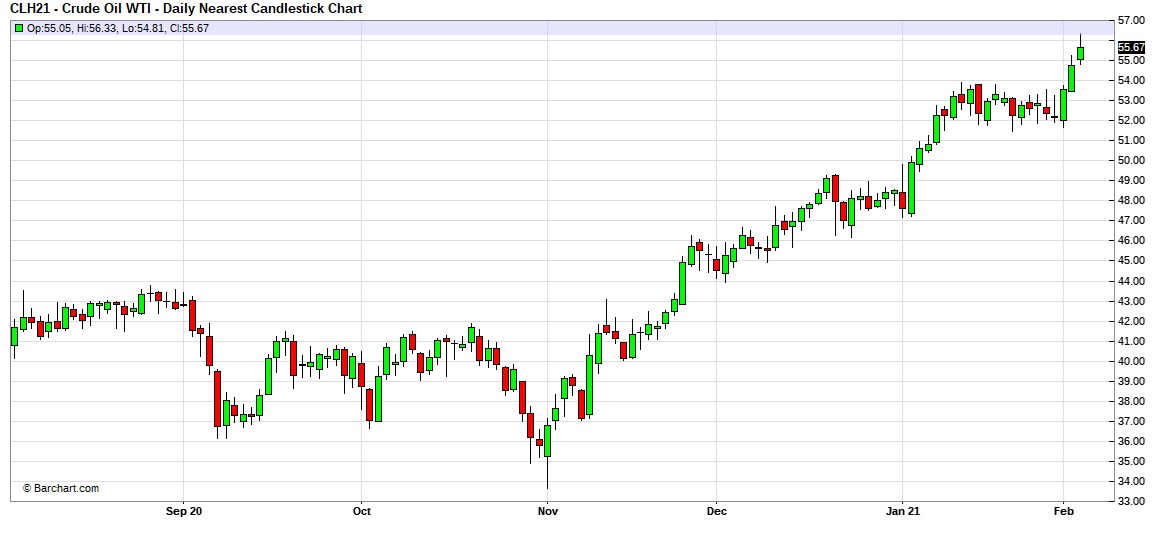

Here is an updated crude oil price chart. Prices continue to rise.

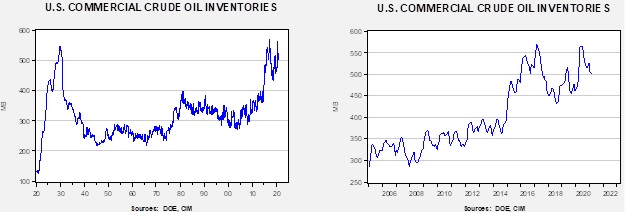

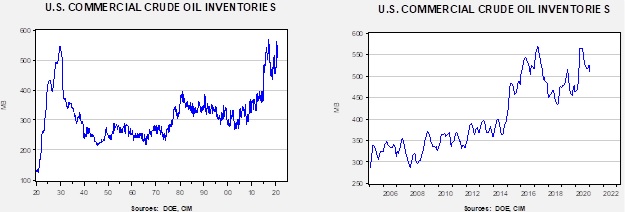

Crude oil inventories fell 6.6 mb when a draw of 0.8 mb was forecast. The SPR fell 0.2 mb, meaning the draw in commercial inventories was 6.8 mb.

In the details, U.S. crude oil production rose 0.1 mb to 11.0 mbpd. Exports fell 0.9 mbpd, while imports declined 0.7 mbpd. Refining activity rose 0.7%.

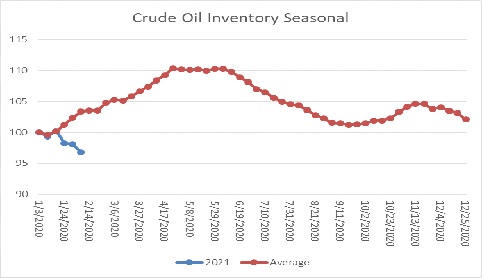

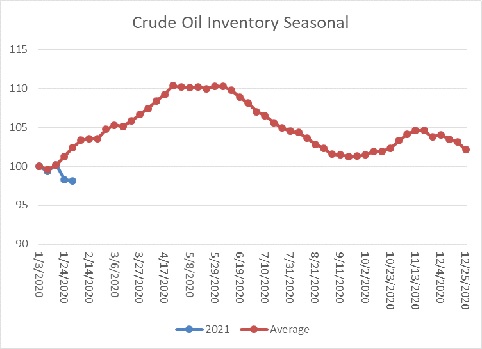

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline is contraseasonal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. If we were following the normal seasonal pattern, oil inventories would be 27.1 mb higher.

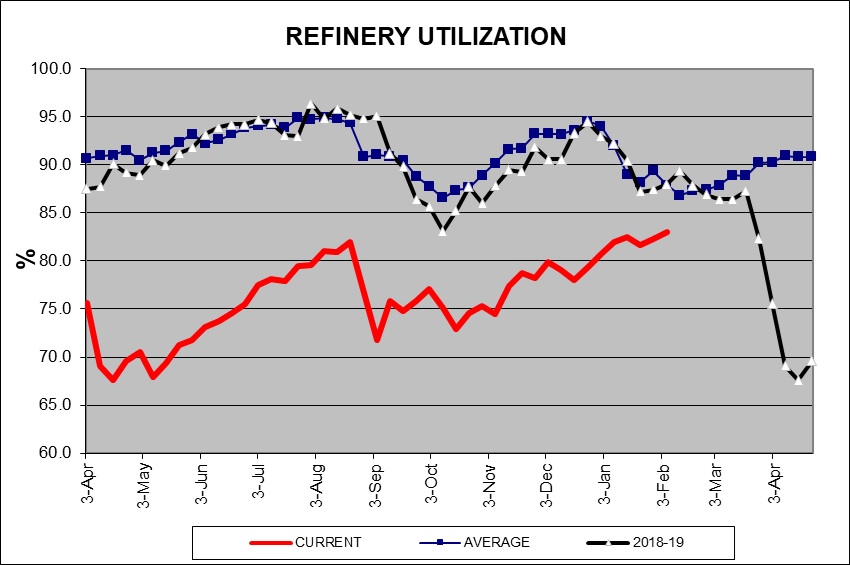

A key factor in this unusual pattern is that refinery operations are not showing signs of maintenance.

Refinery utilization usually falls into the new year and is troughing now. Instead, we are seeing continued strength as the industry is preparing for stronger demand later this year.

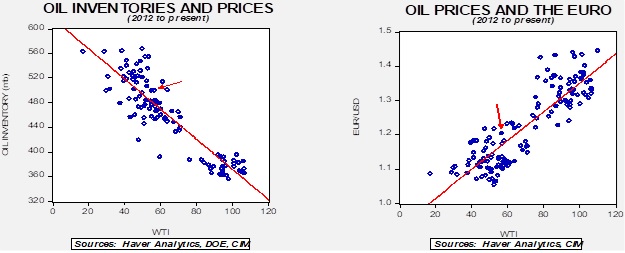

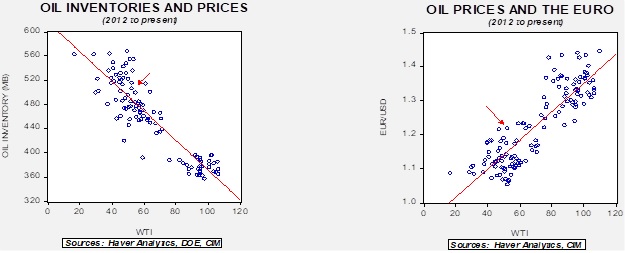

Based on our oil inventory/price model, fair value is $50.63; using the euro/price model, fair value is $68.06. The combined model, a broader analysis of the oil price, generates a fair value of $58.20. The wide divergence continues between the EUR and oil inventory models.

Geopolitical news:

- China has suffered severe environmental degradation caused by its rapid industrialization. General Secretary Xi has made environmental improvement a priority. We note that he has brought Xie Zhenhua back into government as a special envoy for climate issues, a move designed to send signals to Washington that the country is willing to cooperate on this shared concern.

- The Biden administration has removed the Houthis, the key rebel group in Yemen, from the U.S. terrorism list. However, that doesn’t mean the Houthis are now in the clear. The State Department indicates that the group will continue to be under scrutiny.

Alternative energy/policy news:

- If there is one factor to watch in terms of environmental regulation, carbon pricing is probably the key. Until, as a society, we price carbon, the ability to manage climate policy is hamstrung. Why? Because putting a price on carbon will unleash the power of markets on this problem. As David Hume realized, there is only one force in the universe that can control self-interest, and that is self-interest. In other words, what makes markets so powerful is that it forces interests to align and compete, leading to efficient outcomes. This is the basis of capitalism. Once a price for carbon emissions is established, markets will rapidly adjust. However, this efficiency isn’t without consequences. There will be great pain inflicted on some industries (fossil fuels, in particular) and excellent opportunities in others. The price we are watching for is $100 per ton by the end of the decade.

- Europe is leading the charge on climate policy, trying to establish itself as the standard. This plan is a way to increase its influence.

- Part of carbon pricing will lead to the push for low carbon emission energy (which is why we keep reporting on nuclear). Another element of this process is what we like to refer to as the swap of drilling for mining; in other words, to reduce fossil fuel consumption we will need to use more metals and less oil and gas. That means mining companies, which use lots of energy, will need to source cleaner fuels.

- With the potential for change, there is a corresponding push to mitigate or transfer the costs of adjustment. Especially driven by ESG concerns, companies are trying to advertise that they are taking climate change seriously. At the same time, they are also trying to avoid or affect government regulation that would actually require significant changes.

- The Fed has indicated that climate change will be an element to bank oversight.

- Rapid increases in battery storage are allowing for wind and solar energy to become increasingly viable replacements for coal and natural gas for electricity production. For automobiles, the “holy grail” of batteries is solid state lithium, which would allow for greater capacity and faster charging.

- We are also continuing to watch what may be the most significant competitor to EVs, hydrogen/fuel cell vehicles. It appears the most likely use of these vehicles will be in large semi-trucks.

View PDF

Confluence of Ideas – #19 “The 2021 Geopolitical Outlook” (Posted 2/9/21)

Weekly Geopolitical Report – The U.S.-China Balance of Power: Part IV (February 8, 2021)

by Patrick Fearon-Hernandez, CFA | PDF

(Note: Due to the Presidents’ Day holiday, our next WGR will be published on February 22.)

This multi-part report aims to assess the current balance of power between the U.S. and China and what that implies for how the competition may play out in the coming years. Part I gave a comprehensive overview of each side’s key interests and goals. In Part II, we provided a head-to-head comparison of the Chinese and U.S. armed forces. Part III compared Chinese and U.S. economic power, mostly in terms of the leverage that China and the U.S. gain from importing enormous amounts of goods and services from other countries and providing investment capital abroad. This week, in Part IV, we describe the two countries’ relative diplomatic positions around the world. We’ll wrap up this series two weeks from now with a deep dive into the associated opportunities and threats for U.S. investors.

Asset Allocation Weekly – #26 (Posted 2/5/21)

Asset Allocation Weekly (February 5, 2021)

by Asset Allocation Committee | PDF

The residential real estate market has made a strong recovery over the past year. Virtually all areas of housing, including home prices, starts, and ownership are showing signs of strength. Let’s start with prices.

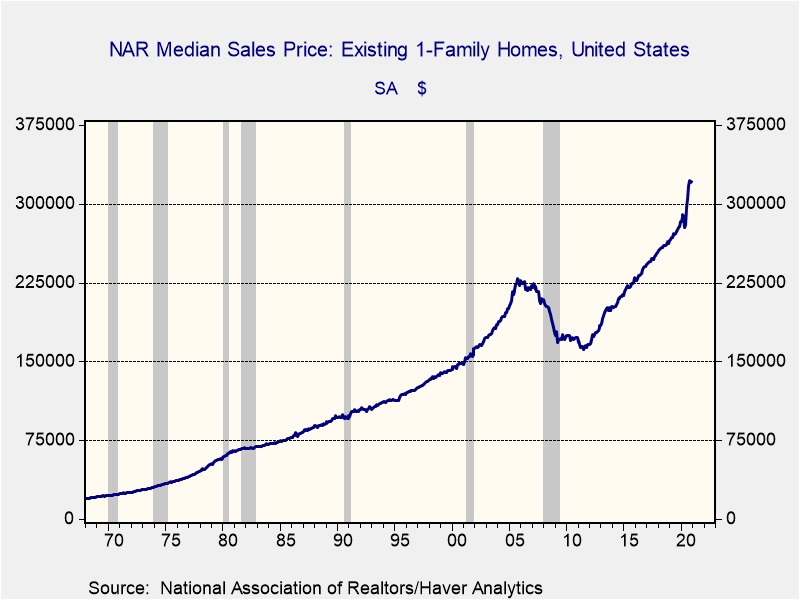

Home prices have been very strong recently. This chart shows single-family existing home sales. Over the past year, existing home prices are up 13.4%. Increases of this magnitude or higher only occur 4.8% of the time. New home prices are up as well, but not to the same degree; the median new home price is up 8.0%. Price increases of that level or higher occur abut 35% of the time.

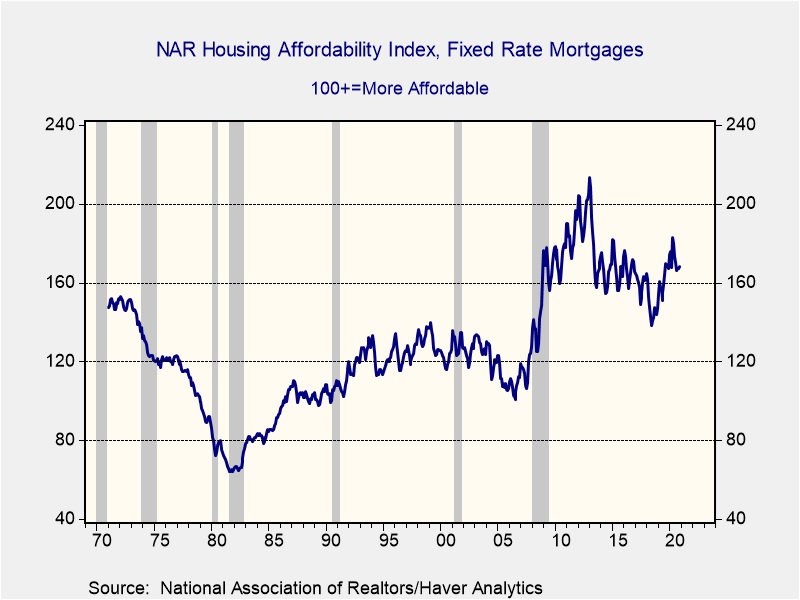

Despite this rise in prices, housing affordability remains high. A rising NAR affordability index suggests easy buying conditions. The current reading is off its recent highs but well above the levels seen in 2005.

The index combines home prices, average wages, and mortgage rates. The latter two have improved the index recently,[1] offsetting the impact of higher home prices.

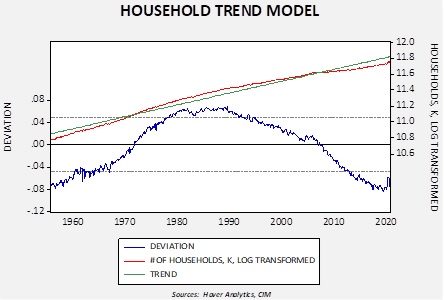

The rapid rise in household formation should provide a catalyst for continued home sales and construction.

This chart shows the level of household formation on a log basis. Household formation has been declining since 1990 but has started to stabilize recently. In addition, recently the data was recovering quickly but did pull back due to the pandemic. We expect the recent bounce is a signal of faster formation as the large millennial generation begins to form households. If so, a rise similar to what was seen from 1960 to 1980 may be in store.

Finally, one of the factors that had hampered this sector was suburban sprawl. In some areas, the commutes to work had become so lengthy that workers could no longer move further away from urban centers to find affordable housing. However, the pandemic has proven, for many workers, that working from home is a possibility. As a result, workers are looking again at buying more space further “out” with the idea that instead of commuting five days a week, it may be three or less, which is more manageable.

For these reasons, the Asset Allocation Committee remains favorable toward the homebuilding and related industries, expecting them to perform well in the coming years. And, as we noted in our 2021 Outlook, if the Federal Reserve is serious about improving the lot of the bottom 90% of households, then it should keep interest rates low because this group’s largest asset is its home, and low interest rates support the price of that asset.

[1] The pandemic has pushed average wages higher because lower paid service workers have suffered larger job losses.

Weekly Energy Update (February 4, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices broke out of their recent trading range and are now well above $55 per barrel.

Commercial crude oil inventories unexpectedly fell 1.0 mb when a build of 3.0 mb was forecast.

In the details, U.S. crude oil production was unchanged at 10.9 mbpd. Exports rose 0.1 mbpd, while imports increased by 1.4 mbpd. Refining activity rose 0.50%.

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline, though small, is contraseasonal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. If we were following the normal seasonal pattern, oil inventories would be 22.4 mb higher.

Based on our oil inventory/price model, fair value is $48.37; using the euro/price model, fair value is $70.79. The combined model, a broader analysis of the oil price, generates a fair value of $58.32. The wide divergence continues between the EUR and oil inventory models.

Geopolitical news:

- The Biden administration has reportedly offered the EU its terms for allowing the Nord Stream 2 project to be completed. First, the U.S. wants the EU (read: Germany) to renegotiate its gas transit contract with Ukraine. Second, it wants to build in a shutdown mechanism on the pipeline so that if Russia cuts off natural gas flows through Ukraine, the Nord Stream 2 flows would also be suspended. It’s hard to see why the EU would accept these terms. The whole point of the pipeline is to avoid the bottleneck through Ukraine, which holds the EU hostage to Russian/Ukrainian relations. But, Germany and the EU may want to show they want to work with the incoming Biden administration and agree.

- Israel is warning that it has new plans to attack Iran’s nuclear program. Given that relations with the Arab states have improved through the Abraham Accords, the logistics of an Israeli attack have improved. We doubt Israel will act but it is a warning to the new administration that the situation in the Middle East is fluid and may become a problem.

- Although the Biden administration says it would like to return to the Iran nuclear deal signed under the Obama administration, it is unlikely that Iran would return under the previous agreement. This situation makes returning to the deal difficult. Compounding the problem is Iran’s continued development of missile technology, which was generally excluded from the original agreement.

- At the same time, the Biden administration is suspending arms sales to the UAE and the KSA. This decision includes the sales of F-35s to the former, which was made in return for its recognition of Israel; we do expect the sale to be completed at some point.

Energy industry news:

- Although hope is rising for energy shares, it is still unclear if the industry, especially shale, can woo investors back. As we note below, the future isn’t bright. Although the world will be using oil and gas for the next couple of decades, it’s likely that consumption will decline over time.

- Adding to pressure is that pipeline projects are becoming much more difficult to complete. It may be that major projects have become impossible.

- Worries about a shrinking industry led two of the supermajors, Exxon (XOM, USD, 45.63) and Chevron (CVX, USD, 87.06), to discuss a merger in early 2020. As industry growth slows, and eventually contracts, cost-saving through mergers will likely become more common.

- The earnings for oil companies in 2020 were “brutal” as the pandemic and regulation weighed on the sector. This year will be better, but not stellar.

- It is important to note that commodities are priced based upon current supply and demand fundamentals with less regard for future market conditions. In other words, the price of oil a decade from now doesn’t have a major impact on current crude prices. But it does affect energy equities, which discount the future. Thus, the outlook for future oil demand is bearish for energy equities, but paradoxically it is actually supportive for oil prices because less investment means supplies will fall, likely faster than demand contracts.

- The only commercial carbon capture program closed, oddly, due to low oil prices. The program sold the carbon dioxide it pulled from burning coal to oil producers to enhance oil production (CO2 injection is one method to enhance oil output). When oil prices fell, it was no longer economical to operate the plant. Carbon capture has been one hope the fossil fuel industry has to maintain the industry in a low carbon world. Unfortunately, thus far, the programs have failed to deliver.

Alternative energy/policy news:

- General Motors (GM, USD, 52.48) announced it would phase out gasoline and diesel fuel vehicles by 2035, the first major automaker to create a hard timeline to offer a fully electric line of vehicles. It is not clear whether other automakers will follow, but if governments start to back this decision, the future of oil in transportation is facing a serious threat.

- Although the new administration is moving quickly to establish climate change regulation, the energy industry is responding, trying to slow the rollout.

- The oil and gas industry is trying to make common cause with the farm belt. After all, the electrification of transportation will curtail the use of ethanol and reduce the demand for corn. Unfortunately for oil and gas, the industry has undermined the use of ethanol by supporting the EPA’s exemptions for meeting the mandate for ethanol demand. It is expected that the Biden administration will not be as generous in granting exemptions. When a refiner can’t use enough ethanol to meet the mandate, it must buy Renewable Identification Numbers (RINs) to fulfill the mandate. The prices of RINs have been rising since summer. Farm groups have been upset by the wide use of exemptions which undercut the demand for corn ethanol.

- The Trump administration used the Commodity Credit Corporation (CCC) as a conduit for aid to farmers affected by the China trade conflict. This use was outside of the original mandate of the CCC, which was created during the Great Depression to support commodity prices. The Biden administration wants to continue to use this broader mandate, perhaps using the CCC funding to support a carbon bank, paying farmers for absorbing carbon by the crops they plant.

- In the waning days of the Trump administration, the OCC ruled that banks could not exclude industries from lending simply based on the industry itself. The Biden administration has reversed this ruling, which means that banks can decide not to make loans to oil and gas firms.

- The Fed is expected to support environmental lending as part of its regulatory mandate.

- Fund managers are getting into the act as well.

- Although the new administration has tried to make the point that expansion of jobs in solar and wind will offset losses in fossil fuels, the numbers don’t support the claim.

- The EU is creating a body to foster the development of batteries.

- The “hottest” area of batteries is solid state. Solid state batteries will charge faster, have greater range, and last longer than the current arrays. China claims it is making progress toward the commercialization of such a battery. Despite the hopes, it will probably take years before the technology is developed and commercialized.

- A problem for “green” energy is that much of it requires rare earths in construction. Rare earths production is mostly controlled by China, but the Pentagon is trying to support non-Chinese mining and processing by awarding contracts to firms.

- The other fuel we are watching is hydrogen. Although most of the focus is on batteries, a competitor would be fuel cell cars fueled by hydrogen. The process of extracting hydrogen from water offers the most promise but is still far too expensive to be practical. However, there is continued progress on this front.

View PDF

Weekly Geopolitical Report – The U.S.-China Balance of Power: Part III (February 1, 2021)

by Patrick Fearon-Hernandez, CFA | PDF

In Part II of this report, we provided a head-to-head comparison of U.S. and Chinese military power. Obviously, military power is the ultimate source of coercion that one country can use to influence others. During non-conflict times, however, countries tend to use less violent means of influence. One of the most important such peaceful sources of power is economic. This week, in Part III, we examine the relative economic power of the U.S. and China, mostly in terms of the leverage they gain from importing enormous amounts of goods and services from other countries and providing investment capital abroad. Next week, Part IV will describe the relative diplomatic positions of the two countries around the world. Finally, Part V will dive into the associated opportunities and threats for U.S. investors.