Asset Allocation Weekly (January 22, 2021)

by Asset Allocation Committee | PDF

In Charles Dickens’s novel A Tale of Two Cities, he writes, “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair…” The paradox was designed to illustrate the different experiences of people living prior to the French Revolution. In this week’s report, we discuss the paradoxical nature of this recovery. Specifically, we focus on how consumer behavior may not be indicative of consumer sentiment. We conclude by discussing how the Biden administration might structure policy to accelerate the recovery and how this direction could affect financial markets.

Even though this recession may have had a different origin than previous ones, this recovery appears to be telling a similar story. With few exceptions, the higher income classes have consistently outperformed the bottom income classes. For example, employment for high-income individuals has returned to pre-pandemic levels, while employment for low-income individuals is not only below pre-pandemic levels but has fallen in recent weeks. It is highly likely that this discrepancy has contributed to the confidence gap between low- and high-income households.

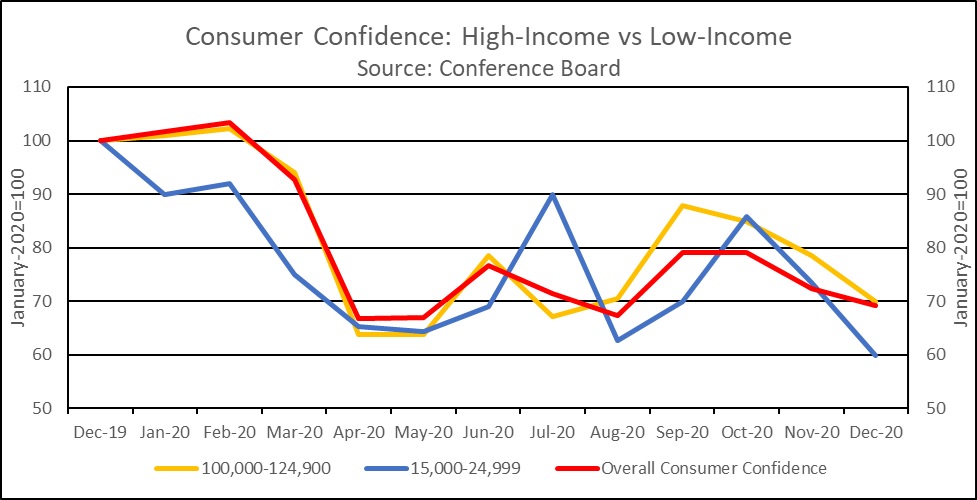

The chart above shows the level of consumer confidence for high-income and low-income groups and the overall consumer confidence index since the start of the pandemic. According to this chart, confidence among low-income groups has routinely lagged high-income groups. This lag may be due to high-income groups having better information. For example, the sharp increase in July may be related to the previous month’s hiring. This notion is further supported by the steep decline in the following month as rising cases in July resulted in a slowdown in hiring. It is also worth noting that this lag isn’t typically picked up in the overall index. Hence, the overall index seems to mask pessimism of the low-income group. This phenomenon is consistent with previous cycles as low-income individuals are typically the last to benefit when the economy enters into expansion territory.

That being said, there appears to be a mismatch between current sentiment and the present situation. The share of low-income households reporting an improvement in their financial situation from a year ago was elevated throughout 2020, while the share of high-income households sunk. This is likely due to a combination of high-income workers being forced to take pay cuts and low-income households receiving generous benefits in unemployment. This trend is also mirrored in the flow of funds data in which the top 1% of households has seen a larger increase in checking deposits compared to the bottom 40% of households. The boost in income for low-income individuals has likely supported domestic consumption as they are the only group spending more now than before the pandemic.

In a post-COVID-19 recovery, President Biden and his economic agenda should be aware that low-income households will likely suffer during the initial months of the economic expansion and refrain from fiscal tightening. One of the biggest mistakes the Obama administration made was prematurely declaring that the economy had recovered. In fact, the austerity that occurred during Obama’s second term likely created conditions for the GOP sweep in 2016. To prevent a repeat of this mistake, the new administration will likely need to focus on those the economy has left behind, specifically low-income workers. This likely means there will be more focus on jobs and less on tax reform.

Going forward, we expect that additional stimulus will be able to support consumption growth as the recovery gathers momentum. The low-income households that receive the money will likely be able to find immediate use for the funds, which will benefit consumption and related companies. Meanwhile, as the economy moves from recovery to expansion, it is likely that the top 1% will begin moving their savings into equities and other assets. Nevertheless, it generally takes a year after an economy enters expansion before employment returns to pre-recession levels. Hence, a great recovery for some people may still be a stressful recovery for others, so policymakers should keep that in mind when deciding whether to withdraw stimulus.