Asset Allocation Weekly (January 15, 2021)

by Asset Allocation Committee | PDF

Rare events can be difficult for financial markets to accommodate. In general, prices in financial markets, which are the sum of estimates about the future, take a while to settle on the impact of something that doesn’t happen often. The recent pandemic, 9/11, the Great Financial Crisis, etc. are all examples of rare events. Rare policy events are also important and often are reactions to geopolitical, medical, or market disruptions.

It appears that we are seeing a rare event now. And, it’s not the pandemic, although it was a policy reaction to it. There is evidence to indicate that we are seeing currency debasement, a situation where the central bank increases available cash to the economy well in excess of what is needed to facilitate the purchase of goods and services.

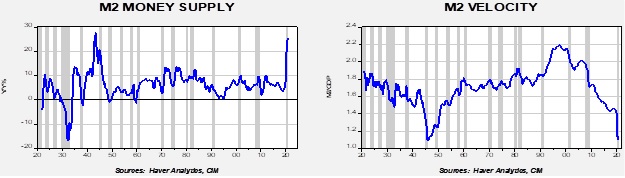

The chart on the left shows the yearly growth in the M2 money supply, while the chart on the right shows M2 velocity, which is calculated by dividing the money supply by nominal GDP. One of the tenets of monetarism is that sound monetary policy will yield steady velocity. Rising velocity can signal inflation if real GDP isn’t growing. Major declines in velocity are generally caused by excessive money growth.

Excessive money growth is defined as currency debasement. Monetarism would argue that currency debasement will yield inflation. But that outcome isn’t necessarily true. It all depends on where the excess liquidity finds a home. Determining the path of this excess liquidity is, arguably, the prime task for the next few years.

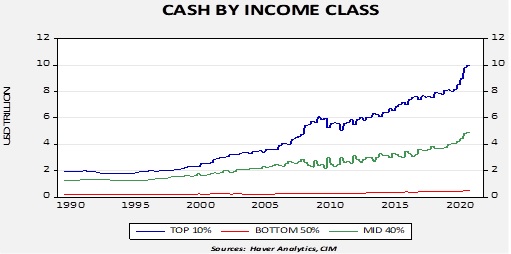

One important clue as to where this liquidity will travel is, who holds it? The Federal Reserve’s Distributional Financial Accounts offer a clue.

This chart shows the total cash holdings[1] based on income class. The top 10% hold about 65%, the middle 40% hold around 32%, and the bottom 50% hold the remaining 3%. Not only is most of the cash held by the richest Americans, but they have been increasing their holdings, as the above chart shows.

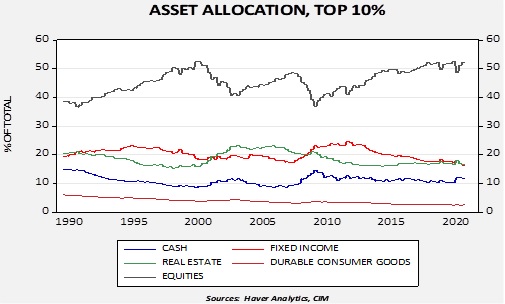

The asset allocation of the top 10% is heavily allocated in equities. The lower classes have the majority of their assets in real estate. Although we don’t know for sure where the cash held will go, it’s a safe bet that it will go somewhere. After all, the whole point of currency debasement is that cash is losing value. In the absence of inflation, the likely path will be into other assets. Since the bulk of the cash is held by the top 10% of households, it’s a reasonable assumption that the most likely path will be into equities.

In future reports, we will elaborate on why, at least for the next year or so, inflation is less likely to become a problem. But one key reason is that most of the liquidity is held in the wealthiest households and these households tend to use their excess liquidity on financial assets.

[1] Cash is the total of checking, time, and money market deposits along with allocated cash holdings of life insurance.