Weekly Energy Update (January 14, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

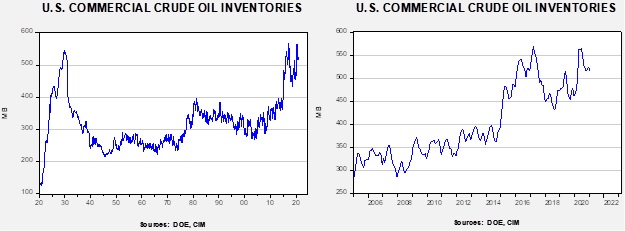

Here is an updated crude oil price chart. Prices are continuing to march higher.

Commercial crude oil inventories fell 3.2 mb, in line with industry forecasts.

In the details, U.S. crude oil production was unchanged at 11.0 mbpd. Exports fell 0.6 mbpd, while imports rose 0.9 mbpd. Refining activity rose 1.3%.

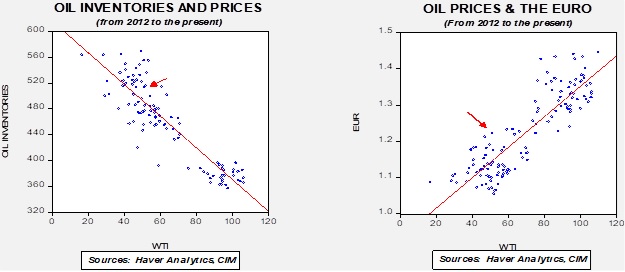

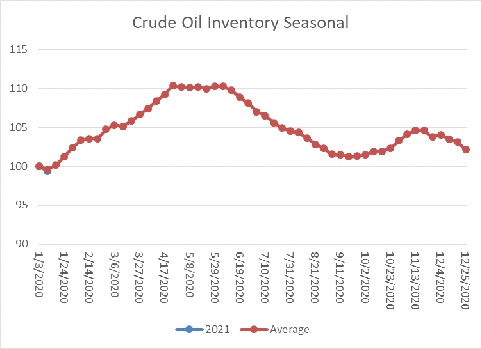

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline was typical, but we are about to embark on a period of rapid seasonal increases. If we follow the seasonal pattern, inventories will rise about 10% into mid-April. That situation should be factored into the current price but the anticipated rise in stockpiles isn’t a positive for the market.

Based on our oil inventory/price model, fair value is $46.25; using the euro/price model, fair value is $71.97. The combined model, a broader analysis of the oil price, generates a fair value of $57.68. The wide divergence continues between the EUR and oil inventory models.

The DOE has released its Short-Term Energy Outlook. For the most part, the government is looking for mostly steady prices this year. The most uncertain element of their forecast is U.S. production. Their forecast calls for 11.0 mbpd; we have doubts that this level will be achieved due to environmental/policy issues we discuss below.

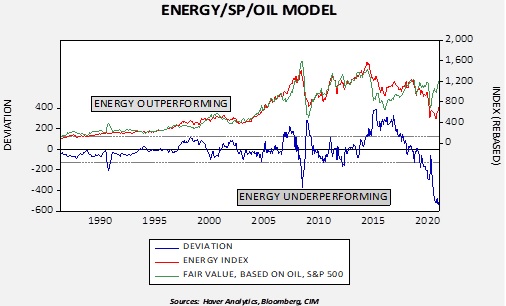

One energy theme we are watching with great interest is the divergence between the price of energy commodities and their underlying equities.

This chart shows a model of the S&P Energy Sector Index relative to WTI and the S&P 500. For the past 18 months, energy equities have underperformed relative to not just overall equity values but to oil prices as well. Although the index has shown signs of recovery, note that it is still not outperforming overall equities and oil prices.

It is normal for the underlying equities to exhibit at least some degree of sensitivity to commodity prices. Changes in commodity prices send signals to companies in the industry; for example, rising prices let producers know that conditions are favorable to increase output. Obviously, falling prices indicate the opposite. However, the decision to change production levels is affected by more than just the price of the commodity. It is also affected by interest rates, regulation, the availability of capital, infrastructure, and expectations of the future. To some extent, the last item may be the most important. If companies see a rise in prices as being mostly temporary, they may not react.

As the “greening” of America proceeds, it is sending signals to fossil fuel energy producers and the industries that support oil and gas production. The future isn’t rosy; transportation electrification and environmental regulations suggest future demand will likely be less than what it would have been otherwise. Therefore, oil and gas companies are already in the process of adjusting to this changing market environment. Here are some of the items we noted this week:

- For years, drilling in the Arctic Wildlife Refuge has been a goal of producers and an anathema to environmentalists. The U.S. finally opened parts of the region for development and held an auction for reserves. The bidding was mostly a bust. The state of Alaska provided most of the bids. Banks have little interest in financing the project and oil companies see two problems. First, the public relations optics of drilling in the region are unfavorable. Thus, the hurdle price of investing is likely very high. Second, if oil demand is going to decline in the future, there is a significant risk that this investment could become stranded. In other words, just about the time oil starts to flow, it won’t be needed.

- Financing for oil projects is becoming difficult to find. The government is trying to force banks to fund projects, but banks are not really interested. Some of this reluctance to invest is due to credit issues. But this situation highlights one of the problems our divided political situation has caused—investing has become riskier because policy can vacillate broadly from administration to administration. Thus, for a bank, funding drilling today might be acceptable only to become a violation at some point in the future. Thus, finding financing, especially for long-term projects, has become more difficult.

- Environmentalists are focusing on pipelines. It can be difficult to stop drilling projects as these are often intrastate so state governments can facilitate production. And, trying to reduce consumption at the endpoint is a sure-fire way of becoming unpopular. This is why carbon taxes, arguably the most effective way to deal with climate change, really hasn’t gained traction. This makes pipeline policy critical. Pipelines cross multiple jurisdictions and involve the federal government, giving activists multiple venues to prevent distribution. For example, pipeline projects out of Appalachia are becoming difficult to complete. Last summer, the Atlantic Coast pipeline project was abandoned due to legal hurdles. The Mountain Valley project is due to be completed this year but is also facing litigation. The lack of pipeline capacity effectively strands natural gas projects.

- The Biden administration is expected to tighten rules on methane emissions, which will lift the cost of oil and gas production. Smaller companies are not planning on investments to reduce methane emissions or flaring, at least in Texas, which could reduce their production if new rules are adopted. However, in Kansas and Oklahoma, surveys suggest some interest, although environmental investment is still not widespread.

The bottom line is that we are likely to see supply constrained in the future due to environmental regulation and changes in investing time horizons. A similar path is emerging to what coal has seen over the past 15 years. What this means in the short run is that we are likely to see a disconnect between oil and gas equities and the price of the underlying commodity, which favors the latter. In other words, as economic recovery takes hold and demand improves, supply will be constrained by the factors noted above. If our analysis is correct, this means the prices on oil and gas will rise much higher to generate a supply response. But, in the end, the investing thesis is that owning the commodity will likely prove to be a better path than owning the associated companies.

On the alternative energy front, we are starting to see utilities invest in large-scale battery projects. Utilities are building battery storage to solve the problem that alternative energy creates—what do you do when the sun doesn’t shine, or the wind doesn’t blow? California is the home of a couple of large projects.

- We continue to monitor reports on modular nuclear reactors. Although resistance to nuclear power remains elevated, achieving significant carbon reduction without nuclear energy will be difficult without serious changes in economic and social activity. For off-grid facilities, diesel generators are the current norm. Engineers are investigating the use of small modular nuclear reactors to replace diesel for electricity.

- Texas now generates more electricity from wind than it does from coal.

- The FT editorial page is suggesting that we are approaching a tipping point on transportation electrification.

- General Motors (GM, USD, 48.78) announced the introduction of a new electric delivery van.

- Although electrification continues to grab headlines, don’t “sleep” on hydrogen. We note growing efforts to use wind energy to separate hydrogen from water. Hydrogen could be used in cars through fuel cells but could be most applicable for aircraft. Batteries are heavy, limiting their effectiveness, but fuel cell/hydrogen aircraft engines may offer nearly carbon-free flying.

In geopolitics, the controversial Nord Stream 2 pipeline appears closer to completion. The U.S opposes this project and will likely try to use additional sanctions to prevent it from opening. The blockade on Qatar was recently lifted by Saudi Arabia. Interestingly enough, Qatar has indicated that it won’t change its relations with Iran. Qatar’s Iranian ties were one of the factors behind the decision to deploy the blockade.