by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] In an upset perhaps even exceeding Truman/Dewey, Donald Trump, a real estate mogul with no military or government experience, defied polls and betting sites, winning the Electoral College vote last night. Although there are still some states that have not officially declared their results, Trump has secured 276 electoral votes, exceeding the 270 needed to secure victory. Here are our thoughts:

The Political Impact

The establishment is deaf: In our taxonomy of the American political system, we recognize two categories and four blocs. These are the establishment category and the populist category. Within the establishment, there are two blocs, the rentier/managerial and the entrepreneurial/ disruptor. Populists break down into left-wing and right-wing populists. After WWII, the Roosevelt coalition was built on the rentier/managerial and right-wing populists. That coalition began to break down in the mid-1960s due to attempts to include the left-wing populists and the inability of the economy to cope with inflation. The Reagan coalition was the establishment category; they all agreed on deregulation and globalization for economic policy and wooed the populists on social concerns. This coalition was less stable than the Roosevelt coalition because it relied on center-right or center-left political leaders to sway populists (the so-called “base”) to their positions. The 2008 Financial Crisis signaled the end of Reagan’s coalition. We are still trying to figure out what will emerge.

However, what is clear is that the populist classes won’t be satisfied with just social policies. They want economic policies they favor, which will likely mean a retreat from globalization and deregulation. Obama’s 2008 victory was completely misinterpreted by the establishment and the political pundits (and perhaps by the president himself). In 2008, voters thought they were getting Bernie Sanders—instead, they got another establishment president. Offered the same choice in 2012, they simply opted for the familiar. However, the 2016 election was clearly a signal of revolt; Sanders nearly won and Trump shocked the political world by beating a well-funded and experienced group of GOP candidates. We still believe that if Sen. Warren had run, she would have won decisively. The electorate wants a populist that will create an economy to help the bottom 80% of households. Expect to hear the pundits state that “this wasn’t Trump’s win but Hillary’s loss.” We strongly disagree; although Clinton was a flawed candidate, the issue wasn’t her inability to campaign, it was that she didn’t have a message that resonated. Remember, the electorate didn’t get what it wanted with Obama; it wanted a populist. Instead, it got a center-left establishment figure from the rentier/managerial category. Clinton’s decision to run as a continuation of Obama’s legacy was a mistake.

This is also why the polls and betting sites performed so poorly. Polls can’t deal with preference falsification and betting sites are skewed by the size of the bets. This is the third significant polling failure in the past six months. Trump, Brexit and the Colombia referendum on FARC were all missed badly by the polling industry.

What do we get with Trump? We believe a president has his greatest power in the first 18 months of his first term. Once the midterms loom, the attention of Congress shifts and little gets done. Usually, the president’s party loses power at the midterm (although this might not occur in 2018 due to the high number of Democrats up for election in the Senate) and little moves forward afterward. We believe that immigration will top Trump’s agenda, with trade a close second. Ending Obamacare will come next. Fourth on the list will be fiscal spending with an emphasis on infrastructure. Any openings on the Supreme Court will be filled with conservatives; there will be at least one opening and, given the ages of the justices, perhaps more. These will consume political capital and attention. Tax reform is down the list and will likely be less radical than currently proposed. We would expect cuts in corporate taxes and no increases in tax rates on upper income households, but the cuts currently outlined probably won’t occur or will be less aggressive. Elements of the GOP establishment will try to put tax changes at the forefront; we don’t expect their efforts to succeed.

Who is Trump’s cabinet? Under normal circumstances, GOP figures would be lining up to take positions after being out of power for eight years. However, Trump alienated much of the intellectual figures on the right. Thus, he will have a smaller pool from which to derive his advisors. For Secretary of State, former House Speaker Gingrich or Sen. Corker are likely choices. Former Ambassador John Bolton is a possibility, although he would be out of step with Trump’s isolationist leanings. Treasury will likely go to Steven Mnuchin, a vet of Goldman Sachs. Defense will probably go to Sen. Sessions. Lt. Gen. Flynn should get a national security post. Former NYC Mayor Giuliani will likely become Attorney General. Wilbur Ross could get Commerce Secretary. Ben Carson or Florida Gov. Scott have been mentioned for Health and Human Services. Harold Hamm is thought to have the inside track on Energy Secretary. Myron Ebell has the inside on EPA, although he might be too controversial. It isn’t clear who will get Chair of Economic Advisors. Finally, there are reports that Reince Priebus could get Chief of Staff.

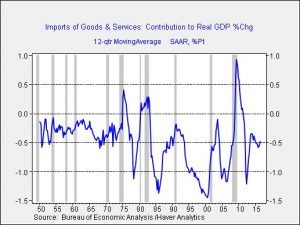

Overall themes of a Trump presidency: We look for “America First” to be the guiding principle. As we will discuss in next week’s WGR, we expect Trump to be a Jacksonian (using Mead’s archetypes), which is essentially isolationist unless provoked. Putin and Xi would be well advised not to make overt moves that make America look weak. Russian planes that buzz U.S. warships risk being shot down and Iranian vessels that harass U.S. warships in the Persian Gulf will likely be sunk. On the other hand, a steady encroachment into the South China Sea, Eastern Europe or the Fertile Crescent will be tolerated. Trump will discover that trade barriers are a bit like “whack-a-mole,” in that putting tariffs on one state means other nations try to fill the gap. Still, we expect trade barriers and “administrative guidance” against firms that have moved jobs offshore. Technology and the substitution of capital for labor will likely become the best way to control labor costs.

Market Issues

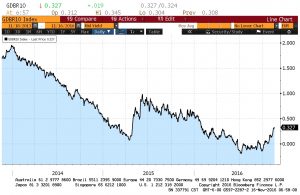

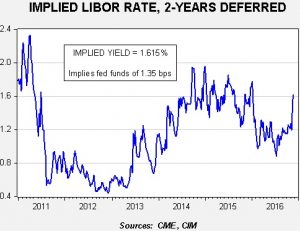

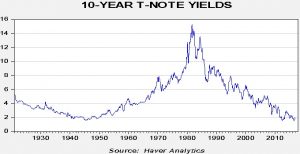

Watching the Fed: With fiscal spending likely and tax cuts possible, along with restrictions on immigration and trade barriers that will decrease efficiency, inflation becomes more likely. As we have noted before, in our opinion, globalization and deregulation were key in containing inflation. Although the latter should mostly remain in place, the former will come under threat. The key issue is the reaction of the FOMC. We have had an independent Federal Reserve since 1951, although one could argue that it was compromised by Nixon in 1971 and not restored until Volcker in 1978. Trump has been critical of Chair Yellen. It is probably safe to assume Trump would prefer accommodative policy (he just didn’t like it for Obama/Clinton). There are two governor vacancies on the FOMC that Obama never filled. Trump will likely fill these and, if/when he does, it will give us an idea of what sort of monetary policy he favors. The GOP establishment would tend to favor hawkish policies; after all, they are creditors and prefer low inflation and higher rates. However, Trump’s core supporters are populists who are debtors; they would like more accommodative policy.

Here is one of the key issues we will be closely watching—does the Fed lean against the inflationary impulses that will probably emerge from a Trump administration and risk the central bank’s independence? Or, will it bend to Trump’s position and allow reflation? Another way of putting it is this—will we get the Fed of the 1970s of Burns and Miller, or the Fed of the late 1970s of Volcker? If it’s the former, bond yields will rise, the dollar will sink and commodity prices will increase. If the Fed stands against these inflation impulses, the dollar will rise, bond yields will remain contained and commodity prices will fall. Although the outcome remains to be seen, our first impression is that we will get a version of the Burns/Miller FOMC. It’s what the bulk of the country wants.

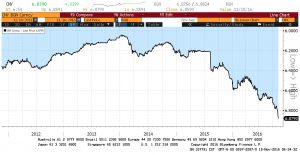

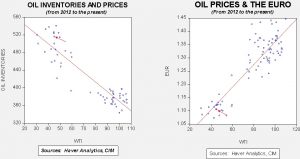

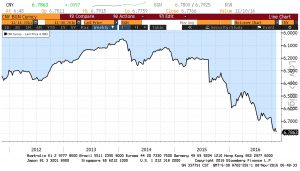

In the short run, we are seeing spiking bond yields, a mixed dollar (commodity currencies are down sharply, the yen is higher, the euro is steady), a jump in gold and lower equities (but, off their worst levels of the session). We will have more in the coming weeks on positioning but, initially, we view Trump’s policies as bond bearish (more fiscal spending) and neutral to bullish for equities (health care, materials and defense should shine). Foreign investing is much more problematic if the U.S. becomes less trade friendly. Commodity prices and the dollar will depend on the Fed.

View the complete PDF