Daily Comment (November 1, 2016)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] The big news overnight came from China, where the PMI data was better than forecast (see below). The chart below of the Caixin[1] PMI shows evidence of an improving Chinese economy.

The PMI has been improving since Q1, with a clear rise since late summer. Chinese officials have been allowing debt to rise which has boosted growth. This increase in debt does come at a cost. Today’s WSJ notes that a series of asset price jumps have occurred in a number of markets, likely due to excessive money supply growth.[2] It should be noted that other Asian markets’ PMI data was solid as well. Australia rose above the expansion line to 50.9 in October, up from 49.8 in September. The U.S. ISM data will be out later this morning.

On monetary policy, both the Reserve Bank of Australia and the BOJ made no policy moves, although the former’s statement was dovish. Still, the AUD is up this morning on the improving PMI data.

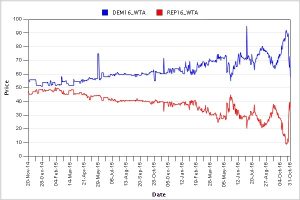

On the election front, there is some evidence to suggest the new email revelations are having an effect. Although polling has been mixed, the Iowa Electronic Betting markets have moved violently in favor of Mr. Trump.

The bets reached 90% for Clinton last week but the new information seems to have led to the obvious swing. We note that the bulk of the volume was buying Trump as opposed to shorting Clinton. Although this “winner take all” still favors Clinton, the volatility does suggest that support may not be all that solid. In other words, the race appears to be tightening with the vote merely a week away.

China appears to be close to another diplomatic breakthrough. The DOJ has been investigating Malaysia’s sovereign wealth fund; there are reports that $1.0 bn may have been embezzled by people close to the prime minister. These funds were used to buy assets, including U.S. real estate. PM Najib, angered by this embarrassment, is courting China by signaling it will buy military equipment from the country. China has made significant inroads in the Philippines and if Chairman Xi can make similar gains in Malaysia then America’s “pivot to Asia” will be in shambles.

In China, there are increasing reports that Chairman Xi is pressing to break the informal rule that members of the Standing Committee of the Politburo, the most powerful body in China, must retire by age 68. According to the Chinese media, Xi wants to elevate Wang Qishan to premier, the second most powerful position. Wang currently runs the anti-corruption campaign that has swept hundreds of officials from government. Not only would this move violate the unwritten rule, but it would also demote Li Keqiang, the current premier. Elevating Wang would boost Xi’s position and perhaps allow him to stay beyond the two five-year terms in office.

Finally, the Colonial pipeline suffered a fire near Shelby, AL overnight, cutting off much of the southeast and Atlantic states from a key source of petroleum products. Gasoline futures jumped over 10% overnight as the NY harbor is the delivery point for the CME gasoline contract. Gasoline prices soared relative to crude oil as well.

We would expect this break to be fixed within a week or two but the Eastern Seaboard will see a temporary jump in gasoline prices.

_______________________________

[1] This PMI is independent of the official PMI data. The Caixin data covers more smaller enterprises and is considered a broader measure of manufacturing activity compared to the official data.

[2] http://www.wsj.com/articles/asset-bubbles-from-stocks-to-bonds-to-iron-ore-threaten-china-1477952654