by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] Populist candidates in both France and the Netherlands are seeing their polling numbers deteriorate. In France, Marine Le Pen is holding at around 26% support, which is a statistical dead heat with Emmanuel Macron. She was leading by up to seven points last month. Mostly her support has held around 25%, but Macron has seen his numbers improve to close the gap. Second round polls continue to show that Le Pen will gain about 42% of the vote, not enough to win the election. In the Netherlands, Geert Wilders’s Party of Freedom has slipped to second place at 23%, behind the center-right People’s Party for Freedom and Democracy, led by Mark Rutte, at 25%. Wilders was polling in the mid-30s in early January.

In light of Brexit and the Trump win, there are concerns about the reliability of polling. The last Brexit polls were 48%/46% in favor of remain; the outcome was 52%/48% in favor of leaving. The RealClearPolitics average poll two days before the U.S. election was 46.8% for Clinton and 43.6% for Trump. The actual outcome was 48.2% for Clinton and 46.1% for Trump. The poor performance of the polls seems to be due to a number of factors. The demise of land lines has made telephone polling more difficult and sampling errors appear to be higher. There is also some evidence of preference falsification, where voters may tell pollsters they are voting for a candidate they actually don’t intend to vote for.

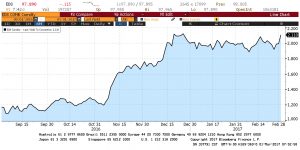

While there is great concern about the French vote, Macron holds a 30-point margin over Le Pen in runoff polls. Although we saw an eight-point swing with Brexit, a 30-point swing to give the vote to Le Pen would be massive. Again, we wouldn’t necessarily count Le Pen out; after the initial vote next month, we could see conditions change in the runoff. Macron is essentially running as a candidate without a party. He is somewhat inexperienced and could make a political mistake. But, from where we are now, it seems more likely that Le Pen will not win the presidency. If she loses, we would expect a short-term rally in the EUR.

The Dutch elections are more certain. Although Wilders could still win a plurality, none of the other parties will be willing to join him to create a government. Still, if his party gets 30% of the vote, it will either force a “grand coalition” of center-left and center-right parties or force the center-right to cobble together a coalition of small conservative parties. Either situation will likely be unstable and lead to ineffective governments.

All this suggests the Eurozone will continue to deal with high levels of political uncertainty going into the German elections in the fall. We would not be shocked to see the current Italian government fall. Given the high level of dissatisfaction in Italy with the Eurozone, an election there could lead to a serious disruption of the single currency. So, for now, we expect the EUR to struggle due to political conditions.