by Bill O’Grady and Thomas Wash

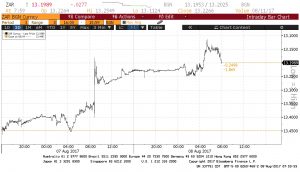

[Posted: 9:30 AM EDT] It’s not quiet today. There is a lot of news, almost all geopolitical. We are seeing modest “flight to safety” in financial markets this morning, with equities in retreat while Treasuries, gold, the Swiss franc and Japanese yen move higher. We don’t expect any equity pullbacks to be all that meaningful, beyond a normal correction. The U.S. economy is far from a recession and there is ample liquidity, so, barring a geopolitical event, a correction probably remains a buying opportunity. Although this is a reasonable base case, the potential for a tail event is also elevated.

North Korea: Yesterday, a number of media outlets reported that North Korea has successfully miniaturized a nuclear device into a warhead, meaning it is probably now a member of the nuclear club in that it has a deliverable nuclear weapon.[1] The Defense Intelligence Agency has concluded that not only has North Korea overcome the hurdle of building a warhead, but it probably has 60 nuclear weapons. Although this estimate may be at the high end of the confidence band, it still suggests that the threat of a nuclear North Korea is no longer a future theoretical problem. President Trump responded with unusually harsh language,[2] threatening “fire and fury” from the U.S. The U.S. possesses overwhelming force; North Korea’s 60 warheads are up against 6,800 American warheads. In addition, the U.S. has three delivery options and far more experience in nuclear war. So, American presidents are usually more understated in their comments because they can be. The problem with these comments is that they may be misinterpreted by Kim Jong-Un as a precursor for war. We note that SOS Tillerson tried to walk back some of the rhetoric today by suggesting there are no imminent threats. North Korea has responded by suggesting it is targeting Guam. Anderson AFB has a significant number of strategic air assets, including B-52, B-1 and B-2 bombers along with support aircraft; taking out that airbase would reduce the direct threat to North Korea. On the other hand, it would likely trigger a massive U.S. response, especially if a nuclear weapon is deployed. We still put the probabilities of war at a low level but they are rising. If North Korea with nukes is intolerable, as American presidents have indicated, some sort of response would seem to be necessary. What that response will be in reality remains to be seen. We do note that the latest reports on U.S. carrier groups indicate that none are in theater. Thus, we are at least two to three weeks away from mobilizing forces for military operations against North Korea.

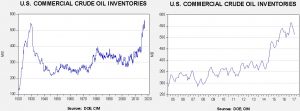

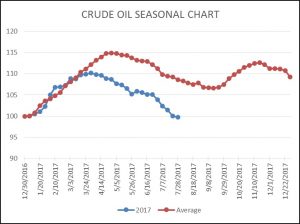

Maduro’s growing problem: There are increasing reports of dissention within the Venezuelan military. So far, the government has been able to control the military but it does appear that an increasing number of units are engaging in mutinous actions. The Chavez government armed civilian groups in the cities, which could act as a counterforce to a coup. On the other hand, these civilian groups are probably no match for regular soldiers. Sadly, the existence of these armed civilian groups could mean that a coup evolves into broad civil conflict. The history of Latin America is littered with military coup solutions to chaotic civilian governments, so such an outcome in Venezuela would not be a shock. So far, we haven’t seen any noticeable disruption to oil flows.

Zuma survives: Yesterday, we reported that President Zuma of South Africa was facing his sixth no-confidence vote. And, because this one was a secret ballot, the odds were higher that he might be ousted. In fact, it appears that 24 ANC members did vote against their president, but it wasn’t enough to lead to a failure of his government. It will be interesting to see how Zuma handles these defections but, for now, it looks like he will survive.

[1] https://www.washingtonpost.com/world/national-security/north-korea-now-making-missile-ready-nuclear-weapons-us-analysts-say/2017/08/08/e14b882a-7b6b-11e7-9d08-b79f191668ed_story.html?utm_campaign=New%20Campaign&utm_medium=email&utm_source=Sailthru&utm_term=.bf8beede2be1

[2] https://www.nytimes.com/2017/08/08/us/politics/trumps-harsh-language-on-north-korea-has-little-precedent-experts-say.html?emc=edit_mbe_20170809&nl=morning-briefing-europe&nlid=5677267&te=1