Asset Allocation Weekly (August 4, 2017)

by Asset Allocation Committee

Two weeks ago, we detailed our expectations for a weaker dollar. If we are correct, one of the potential effects could be inflation. A weaker dollar has two price effects. First, it directly raises import prices. Second, it gives pricing power to domestic firms competing with imports as price pressures should dissipate as import prices rise. The Federal Reserve has struggled with continued low inflation rates as the Phillips Curve models have consistently overestimated inflation. Perhaps dollar weakness will come to the FOMC’s rescue and lift price levels, allowing the Fed to raise its policy rate.

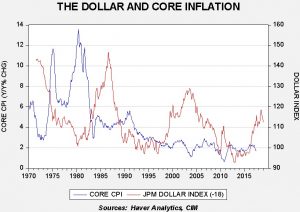

This chart shows the yearly change in core CPI with the JP Morgan dollar index, which is advanced 18 months. A cursory view of the chart does suggest that a rising dollar seems to depress inflation, while a falling dollar seems to have the opposite effect. And, the idea that the dollar’s impact takes place over time is consistent with theory. This is because foreign firms will initially try to maintain market share by holding prices steady and face margin compression in a weak dollar period and will only move prices higher over time. The opposite tends to occur during periods of dollar strength as domestic firms attempt to maintain their market share.

However, as much as our eyes see the above pattern, the statistical impact is actually rather weak. The correlation is only a mere 5%. There are clearly other factors that are keeping core inflation low; we believe the long-term effects of deregulation and globalization play a much more important role. Thus, as we discussed two weeks ago, the dollar should have an important impact on foreign equity performance but probably only a modest effect on core inflation.