by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT]

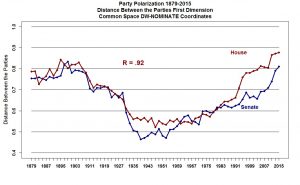

What’s wrong with the market? Yesterday’s equity market action was quite disappointing. After a strong opening, prices steadily declined then slumped into the close. There appeared to be two catalysts. First, the Commerce Department announced it was going to restrict exports to a Chinese chip company on national security grounds.[1] Second, it appears the Trump administration is planning to implement another round of Chinese tariffs after the G-20 meeting.[2] The president promised to put tariffs on the remaining imports from China if there is no movement from the Xi government on U.S. trade concerns. According to reports, if nothing toward this goal emerges at the G-20, the administration will move forward in early December. Fears of a trade war with China, especially one focused on technology, are putting this sector under pressure.

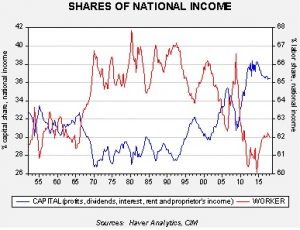

This chart shows the relative performance of the Technology Select Sector SPDR ETF (XLK, 66.94) and the S&P 500 SPDR ETF (SPY, 263.69) over the past five years. The chart is rebased and indexed. The technology sector has dramatically outpaced the overall equity market over this period but is falling rather rapidly now. The problem for the technology sector is that deglobalization is a significant threat to the margins of these companies. And so, if trade pressures continue, new leadership will need to emerge.

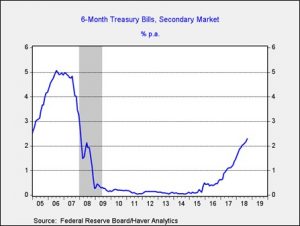

At the same time, we also note that long-duration Treasuries didn’t rally, despite the weakness. We suspect this is due to fears surrounding monetary policy. In other words, if the Fed is continuing to tighten, it will have an adverse effect on interest rates.

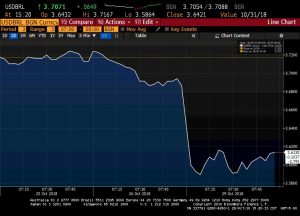

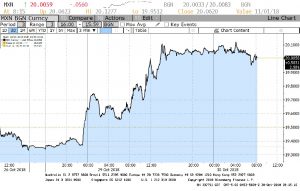

AMLO fears: Mexican President-Elect Andres Manuel Lopez Obrador stated that he will abandon a project to build an airport in Mexico City; construction on the airport started in 2015. The decision was made following the results of a voluntary nationwide poll in which only a few people showed up. The project has been criticized for being costly and unfriendly to the environment. Investors interpreted AMLO’s decision to withdraw from the project as a sign that he may not honor contracts. As a result, the Mexican peso fell against the dollar.

More on Merkel: Although the chancellor has indicated she intends to stay for the rest of her term in office, this is probably wishful thinking. If she goes, who would be her successor?[3]

- Annegret Kramp-Karrenbauer: The 56-year-old former PM of Saarland and current secretary general of the CDU would be Merkel’s favored replacement. She has been dubbed the “mini-Merkel” by the German media. Kramp-Karrenbauer is apparently well liked by both the left and right of the CDU. Her support for traditional family values is a plus for the right-wing constituency, while championing the minimum wage and workers’ rights makers her popular with the leftists in the party.

- Jens Spahn: As the current health minister, the 40-year-old is considered a strong critic of the chancellor. If Kramp-Karrenbauer is the “mini-Merkel,” then Spahn is the “anti-Merkel.” Spahn, who is openly gay, opposes Merkel’s immigration policy, fearing that an influx of Muslims will lead to a more homophobic society.

- Armin Laschet: The 57-year-old current PM of North Rhine-Westphalia is pro-immigrant and a supporter of the EU. He is seen as a key ally of Merkel in the immigration fight. The province he governs is the most populous in Germany, which might count for boosting his experience.

- Fredrich Merz: The 62-year-old former member of Parliament is currently a private businessman and lawyer. He is considered a social conservative and an economic liberal. At one point, at the turn of the century, he was considered a rising star in the CDU but concluded that Merkel’s growing power would prevent him from rising further. Thus, he decided to go into business.

What we find interesting in this entire list is that no one seems like a clear replacement. All of these “front runners” suffer from serious flaws. They are either too close to Merkel’s unpopular immigration policy, or, if they oppose it, are likely too young to grab power. It should be noted that this is by design. One of the key political faults of leaders in parliamentary systems that have no limitation on terms is that they tend to avoid creating lines of succession, fearing that it will remove them from power “prematurely.” As a result, when the moment of exit arrives, these leaders usually leave their party in a difficult position. The U.S. actually had this problem with President Roosevelt; his selection of Harry Truman as running mate was done in part to discourage anyone in the government from ousting him due to failing health. He purposely prevented his vice president from knowing important policy actions and thus Truman was thrust into power without the proper background when Roosevelt died. Fortunately for the U.S., Truman turned out to be a pretty good president despite these handicaps. We would not be surprised to see an unknown emerge to challenge Merkel in the next few months.

Our biggest concern over Merkel stepping down is the power vacuum it will create within the EU. If we were advising the Italian government, we would tell them to push back hard against the EU on the budget issue and threaten to leave over it. Without Merkel’s guidance, it is quite likely the EU leaders will cave to Italian demands.

[1] https://www.commerce.gov/news/press-releases/2018/10/addition-fujian-jinhua-integrated-circuit-company-ltd-jinhua-entity-list

[2] https://www.bloomberg.com/news/articles/2018-10-29/u-s-said-to-plan-more-china-tariffs-if-trump-xi-meeting-fails

[3] https://www.ft.com/content/65792054-db69-11e8-8f50-cbae5495d92b