Daily Comment (October 16, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Equities have rebounded this morning due to expectations of strong earnings, and Treasury yields are also trending upward as it appears tensions are easing with Saudi Arabia and China. Below are the stories we will be following throughout the day:

Khashoggi death: On Monday, CNN reported that Saudi Arabia was preparing to backtrack on claims that it had nothing to do with Khashoggi’s disappearance. According to the report, the kingdom is willing to admit that Khashoggi was killed by rogue agents looking to interrogate him, echoing a claim from President Trump earlier that day.[1] If this report were true, the statement would allow for a bit of face-saving by all three parties involved—Saudi Arabia, the U.S. and Turkey. Saudi Arabia would avoid condemnation from the West, the U.S. would not feel pressure to punish Saudi Arabia and the Turkish government would not be perceived as weak for backing down from Saudi Arabia. Prior to this report, Saudi Arabia faced backlash from businesses in the form of withdrawals from its flag-post convention nicknamed “Davos in the Desert.” Meanwhile, the U.S. and Turkish economies could be strained if Saudi Arabia decides to lower its oil production in response to being reprimanded for the suspected killing. At the moment, it is unclear whether the president will take action in the event that Saudi Arabia publicly admits Khashoggi died in its custody, although it is rumored that Treasury Secretary Mnunchin may soon withdraw from the summit. Oil prices fell in response to a possible de-escalation of tensions with Saudi Arabia.

Chinese de-escalation: It appears the U.S. may be softening its tone with China prior to the G20 summit, where the two sides are expected to meet. A currency report to be released by the Treasury Department is expected to contradict the president’s claim that China is a currency manipulator. In addition, Defense Secretary Mattis contradicted claims that the U.S. is trying to contain China. That being said, we do not believe either assertion made by the Treasury Department or the defense secretary is a genuine reflection of the beliefs of the president or members of his administration. Secretary Mattis was reportedly on a plane to Southeast Asia when he made the comments; the trip to Southeast Asia is widely perceived as the U.S. cozying up to countries within the region to counter China’s military assertiveness in the South China Sea. We do believe the softer rhetoric could serve as an olive branch but we would not be surprised if the tone switches days prior to or on the day of the summit. President Trump has been known to stir up controversy prior to trade meetings to keep his opponents off balance and create a more favorable negotiating environment for his team. We will continue to monitor the situation.

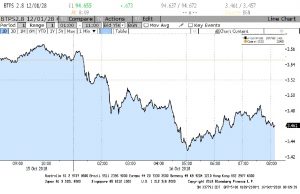

Italian budget: The Italian government was able to submit its budget to the EU prior to Monday’s midnight deadline. It now awaits approval from the European Commission. If the deal is approved, which many have speculated that it won’t be, it would ease worries of a possible clash between Italian populists and the EU. A more likely scenario would be that the budget is rejected due to Italy breaking its commitment to reduce its deficit, at which point the EU and Italy would be at a standoff. There have been fears that a hawkish response from Brussels could embolden populists to push for a Eurozone exit, but those concerns were calmed after Italian Deputy Prime Minister Luigi Di Maio ruled out the possibility. Yields on Italian 10-year bonds have fallen following the budget submission, suggesting the market expects a reasonable compromise between the EU and Rome. The two sides are due to meet on Thursday.

[1] https://www.reuters.com/article/us-saudi-politics-dissident-report/saudi-arabia-preparing-to-admit-khashoggi-was-killed-cnn-idUSKCN1MP2DD