by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

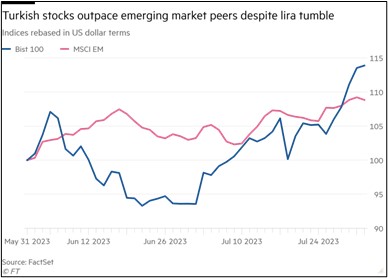

Oil prices are challenging the upper end of the trading range but so far have failed to breakout above that level.

(Source: Barchart.com)

(Source: Barchart.com)

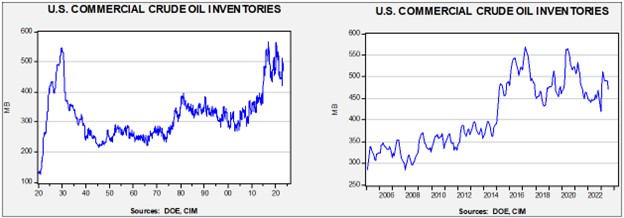

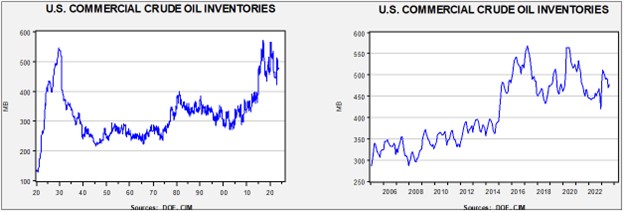

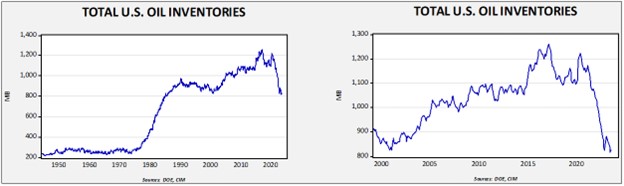

Commercial crude oil inventories rose 6.8 mb, well above the 3.0 mb build forecast. The SPR rose 1.0 mb.

In the details, U.S. crude oil production jumped 0.4 mbpd to 12.6 mbpd. The adjustment factor, which is a plug number to make the supply balance sheet “balance,” has been high in recent weeks. We suspect the DOE had been undercounting barrels and thus has adjusted production higher. Exports dropped 2.9 mbpd, while imports were unchanged. Refining activity rose 1.1% to 93.8% of capacity.

(Sources: DOE, CIM)

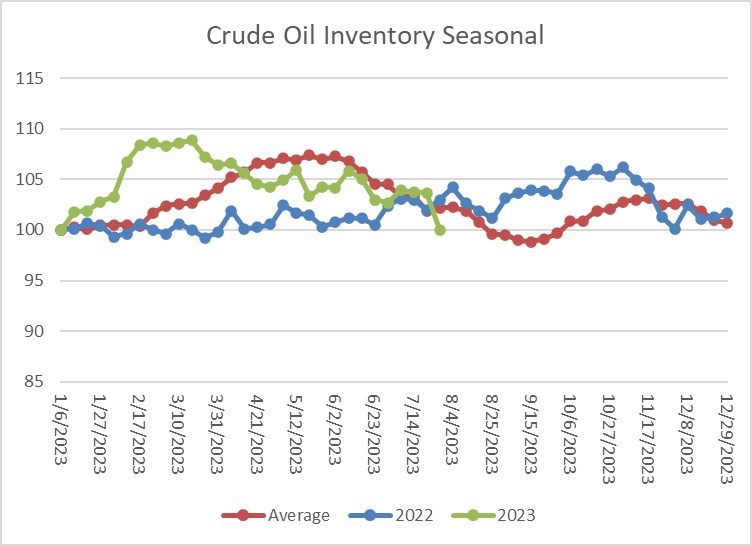

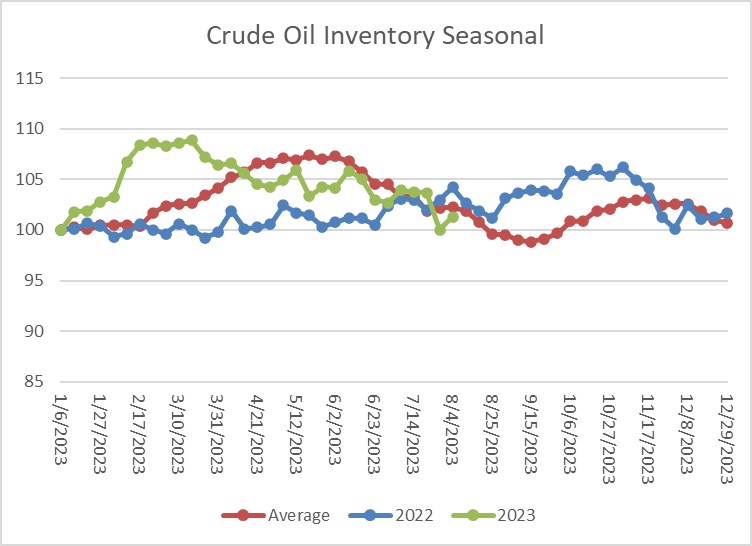

The above chart shows the seasonal pattern for crude oil inventories. Last week’s rise partly offset the large draw from the previous week. However, inventories remain a bit below their seasonal average.

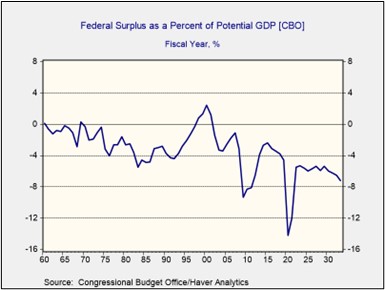

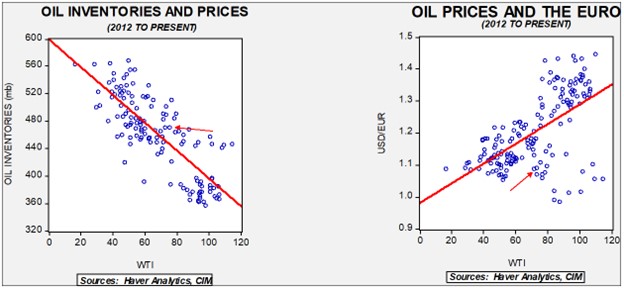

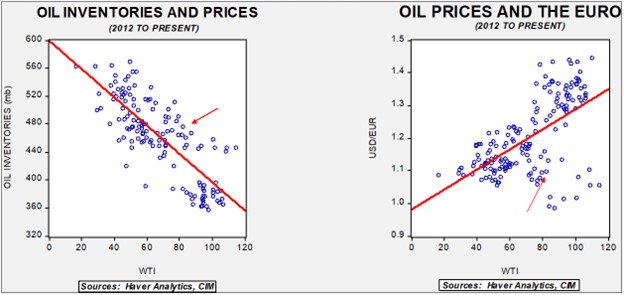

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $64.21. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

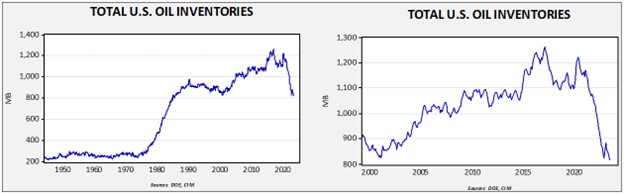

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1985. Using total stocks since 2015, fair value is $93.30.

Market News:

- Increasingly, the Kingdom of Saudi Arabia’s (KSA) oil production policy is deviating from the rest of the cartel. As we noted last week, the Saudis extended their unilateral production cut of 1.0 mbpd. Although the policy has successfully lifted oil prices, in the past, such unilateral policy has led to falling market share. It’s not clear if the Saudis believe other sources of oil would not cause a similar result, or if the goal of lifting revenue is trumping other goals.

- The U.S. oil industry is scrambling to attract engineering talent. High wages for engineers and concern about climate issues among younger workers may constrain future oil production.

- The DOE has issued its short-term energy outlook; the government is expecting modestly higher prices next year for crude oil and natural gas.

- Former VP Pence has unveiled his proposed energy policy. The goal is to make the U.S. the world’s largest energy producer by 2040.

Geopolitical News:

- Last week, Ukrainian drones attacked a Russian oil tanker for the first time. Although it doesn’t appear that any oil flows were affected, if this tactic escalates, it could further constrain global oil supplies. This action is a clear broadening of the war.

- Iran’s continued harassment of Persian Gulf shipping is leading the U.S. to explore the idea of placing armed American troops on commercial ships. Iran is putting missiles and drones on its vessels to threaten regional shipping.

- In the wake of recent hajib protests in Iran, the government is creating a fourth intelligence agency, mostly to respond to domestic unrest.

- In the broad spectrum of human relationships, power is an important element. In international relationships, it may be the most important factor. As we have noted in recent reports, the KSA and China have been taking numerous steps to improve relations. Part of this process has involved technological and scientific exchanges. Research from Carnegie suggests the KSA may be shaping these exchanges to its advantage; in other words, the exchange may be more beneficial to Riyadh than to Beijing.

- The mirror image of trade flows is payment flows. To make payment flows effective, both parties need financial products where excess flows can be invested. We note that China and the KSA are in talks to have ETFs cross listed, which could create reserve assets in the currencies of both nations.

- The KSA is indicating that it intends to expand investment into China.

- Russia is starting to sell oil to China via the Arctic Ocean.

- Azerbaijan and Iraqi Kurdistan are working to improve relations. This decision is raising concerns in Iran, Iraq, and Turkey. For Iran and Iraq, an independent Kurdistan is a potential threat. Although Turkey usually tries to quell Kurdish nationalism, it is friendly with Azerbaijan and would therefore likely want to peel Iraqi Kurdistan away from Iraq.

- We note that the central Iraqi government and Iraqi Kurdistan have agreed to draft a new oil law. Essentially, Baghdad is trying to solidify its control of the Kurdistan region.

Alternative Energy/Policy News:

- Fusion power is back in the headlines. One of the keys to the scientific method is repeatability. If an experimental outcome isn’t repeatable, it probably isn’t real. U.S. government scientists are claiming they have achieved a net gain in a fusion reaction for the second time. Although we doubt fusion will be commercially feasible for decades, we do note that researchers are starting on the process.

- China continues to make inroads into global auto markets. In July, the bestselling EV in Sweden was a Chinese nameplate.

- The Inflation Reduction Act created incentives to build EVs and key components in the U.S. One way this was structured was to deny consumers the tax credit if the car or batteries came from outside the U.S. or from nations without a free trade agreement with the U.S. Such restrictions create incentives for evasion. China is apparently investing heavily in South Korea’s EV battery industry, likely to create an avenue to gain access to the U.S. auto market. South Korea has a free trade agreement with the U.S.

- Chery Automotive, a Chinese SOE and the country’s ninth largest automaker, is teaming up with Huawei (002502, CNY, 2.38) to provide the operating system for some of its vehicles. The U.S. considers Huawei to be a potential conduit of information to the Chinese government, so it will be worth watching to see how Washington responds to nations importing these cars.

- A price war for EVs in China has emerged, meaning it’s cheaper to purchase electric than gasoline vehicles.

- As we have noted before, Western policymakers need to balance the goal of reducing carbon emissions with the foreign policy goal of isolating China. As this report points out, it’s a difficult tradeoff.

- It’s likely that the early adoption phase of EVs is coming to a close. If so, it means new buyers will be more discriminating in terms of price and when making comparisons to gasoline cars. That may mean that adoption will slow, and hybrids might become more prominent.

- New technology could spur expanded use of geothermal power by expanding the use of horizontal drilling to create more “hot spots” to generate power.

- As we have documented on numerous occasions, the move away from fossil fuels will entail a wholesale shift into metals. Copper, lithium, nickel, cobalt, and other metals will be needed for many of the alternatives, from windmills to solar panels to EVs. As we have also noted, China dominates many of these metals, both in their mining and processing. The West is trying to source these key inputs from areas free of China’s control. However, the task is proving difficult.

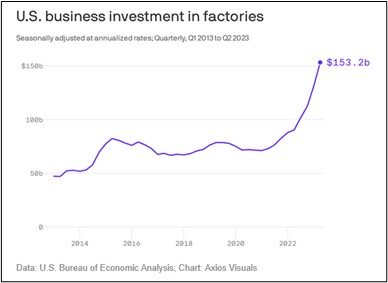

- Another recent theme we have discussed is that the joint goals of reindustrializing America (and the industrial working class) and meeting climate targets may be in conflict. Emphasizing the former will lead to higher costs, while focusing on the latter may lead to more imports which would not help the U.S. industrial sector. Balancing these policy goals is difficult, but if the leadership sides with meeting climate goals over the goals of labor, the political costs could be large.

- In the U.S., solar power additions to utility capacity are expected to grow sharply by year’s end. Meanwhile, China is investing in pumped storage in conjunction with wind and solar power. Pumped storage allows power to be provided when the sun doesn’t shine and the wind doesn’t blow.

- U.S. utilities are warning that the Biden administration’s plans to restrict carbon emissions are unworkable.

(Source: Wikimedia Commons)

(Source: Wikimedia Commons)