Weekly Energy Update (January 20, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

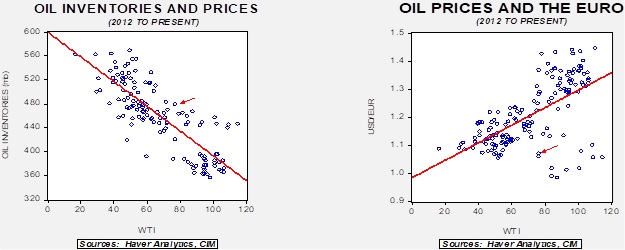

Crude oil prices are trying to base but so far have failed to break above resistance at around $80 per barrel.

(Source: Barchart.com)

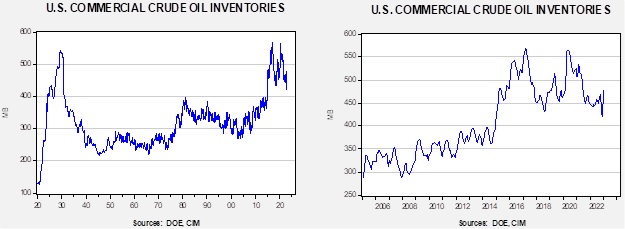

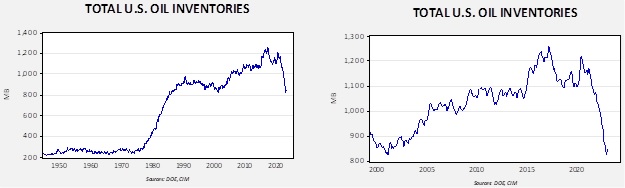

Crude oil inventories rose 8.4 mb compared to a 2.0 mb draw forecast. The SPR was unchanged, the first time since the reporting week of May 20, 2022. The unusually large build was caused by slower than expected recovery in refinery operations.

In the details, U.S. crude oil production was unchanged at 12.2 mbpd. Exports rose 1.7 mbpd, while imports rose 0.5 mbpd. Refining activity rose 1.2% to 85.3% of capacity. The Christmas cold snap closed in a significant level of refining activity, and the industry is slowly recovering.

(Sources: DOE, CIM)

The above chart shows the seasonal pattern for crude oil inventories. Last week’s jump in inventory means we are starting the year off with well above average inventory injections. The chart does show that the usual seasonal pattern was not followed last year. This is because the average still reflects the restrictions on U.S. oil exports whereas there isn’t much of a discernable pattern to this data now that exports are allowed.

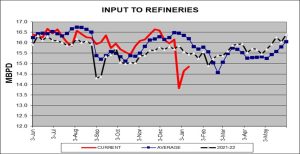

Th chart below shows the sharp drop and partial recovery in refining operations. Usually, we do see some refinery maintenance this time of year, which will end in early February. Thus, we may not see a full recovery in refinery operations until later in the quarter.

(Sources: DOE, CIM)

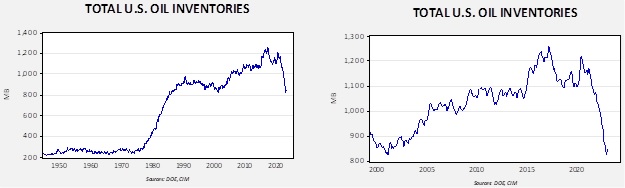

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. For the next few months, we expect the SPR level to remain steady, so changes in total stockpiles will be driven solely by commercial adjustments.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $107.07.

Market News:

- As the government’s SPR sales begin to wind down, the potential for higher prices has increased. We do expect a resumption of sales if oil prices threaten $100 per barrel, but it is unlikely that we will see another large sale just because prices are high. We believe that the SPR sale was an underappreciated bearish factor last year, and if we are correct, an end to selling will likely be more bullish than expected.

- It is our position that the SPR will never be refilled to its +600 mb level last seen before the recent sales. The structure that the Biden administration has put in place to buy oil makes it very unlikely that purchases will occur.

- The IEA is warning that the reopening of China will lift global oil demand to a new record.

- The Kingdom of Saudi Arabia (KSA) is kicking off investment into the mining sector, likely to diversify its economy away from oil and gas just in case demand for these products fall as green energy expands. The $15 billion starter fund should boost mining investment and will likely support the sector.

- Saudi Arabia, due to cost structure and low emissions from production, believes it will be the last oil producer standing, even as the world moves away from fossil fuels.

- In another effort to diversify its energy sources, one that will be most controversial, the KSA has indicated that it will use its domestic uranium to complete the nuclear fuel cycle. In theory, doing so could give the country the wherewithal to develop nuclear weapons. Given the advanced status of Iran’s program coupled with uncertainty surrounding the U.S. security guarantee, this claim could further raise risks in the region.

- The history of oil is littered with “we are running out” narratives. Daniel Yergin’s The Prize is perhaps the best history of the industry, and at several junctures, the accepted wisdom was that the age of oil was ending because all the fields had been tapped. What history shows is that supply shortages lift prices, increasing not just exploration activity but also new technologies. Since oil was discovered in 1859, this cycle has been in place. Thus, when the Financial Times runs a story about the end of shale, we take it with a bit of skepticism. In some respects, the story might be right if current conditions remain in place, but, those conditions probably won’t last. The FT story and the EIA’s short-term forecast for production are predicated on prices staying about where they are. However, as we have noted, if we assume around a 200 mb decline in commercial stockpiles, which would have occurred had it not been for the SPR draw, we would be looking at $135 per barrel for crude oil. Prices at that level will probably change behaviors. Supply issues, such as the lack of workers, capital constraints, regulatory constraints, etc., remain, but all these can be overcome with higher prices.

- There is an old adage in markets that “nothing cures high prices like high prices.” In market theory, price is a signal, and high prices tell consumers to conserve, but more importantly, they reward suppliers who bring product to market. As prices rise, especially in Europe, we are seeing a notable increase in exploration and development activity in the eastern Mediterranean. Large natural gas fields are being discovered in a difficult geopolitical environment. Offshore fields south of Cyprus have brought the involvement of Turkey, Greece, Israel, Lebanon, and even indirectly, Hamas. Although there has been some degree of cooperation, deep divisions remain; for example, Turkish and Greek vessels routinely threaten each other. Government instability can also upend agreements, but high prices will make it more likely that these obstacles will be overcome and will improve the supply situation in Europe and the Middle East.

Geopolitical News:

- The oil price cap is having a modest impact on Russian oil revenue. It is estimated that Russia has lost $172 million of revenue per day, cut from the typical $688 million per day. So, the loss is notable, but as designed, is not enough to completely cut off oil supplies.

- India remains an aggressive buyer of Russian crude oil. Chinese shippers are moving Russian oil to Asia.

- At Davos, participants are worried that it may be next to impossible to run the global economy without access to Russian oil, gas, and basic minerals. Without Russia, prices for these commodities will be much higher.

- Italy announced an effort to develop energy ties to Africa. In some respects, this is nothing new as Eni (E, $31.44), Italy’s energy champion, has had ties to Africa, especially to Libya. However, the company is now planning to expand ties to numerous other African nations in a bid to move away from Russia as an energy source.

- China and Australia have been at odds over the latter’s call for an international investigation over the origins of COVID-19. The dispute led to a decline in Chinese imports of Australian commodities. However, there does appear to be a softening of Beijing’s stance as China has lifted its ban on coal imports.

- Conoco-Phillips (COP, $120.16) is in talks to sell Venezuelan oil in the U.S. to recoup losses tied to Caracas’s decision to expropriate the company’s assets in 2007. We do note that Venezuela has halted oil exports (likely a temporary situation) as it tries to gain control over its exports. To avoid sanctions, Caracas has used numerous intermediaries to sell oil. One of the problems with using such resources is that they can be either unreliable or costly. As Venezuela “comes out of the cold,” it is trying to end its use of intermediaries, which should mean more revenue for the Maduro regime.

- For a number of reasons, Iranian oil exports are rising. We suspect that the U.S. has been quietly easing up on sanctions, but the biggest reason for the rise in exports is the simple fact that the world needs the oil.

- Iran has been a key supporter of the Assad regime. The Syrian government is dominated by Alawites, which could be considered an offshoot of Shiite Islam, making Assad a sympathetic figure. In addition, to the degree Iran can influence Iraq, the so-called “Shiite arc” ranging from Iran to Lebanon needs to include Syria in order for the arc to be completed. And so, Iran has not just supplied Syria with military support, it has also provided economic support as well. However, there are always limits to friendship. As Iran is able to sell more oil on the world market at higher prices, it has ended its practice of selling deeply discounted oil to Syria, leading to further problems for the Syrian economy.

- In a move that will not sit well in Tehran, the Iraqi PM Mohammed al-Sudani, wants an “indefinite” U.S. troop presence, ostensibly, to counter ISIS.

- Iran executed a British citizen accused of spying. Tehran’s decision has angered Westminster.

- The Iranian government is issuing new rules on the hijab. The regime wants to leave the rule in place but soften the penalties.

Alternative Energy/Policy News:

- The IEA has issued its annual report on the state of energy technology, which skews toward green energy production. There are a number of takeaways but the one that caught our attention is China’s dominance in the production of components for these products. If the West is going to develop these energy sources, a massive level of investment will be required.

- Sweden announced it has discovered a large deposit of rare earths. Rare earths are not really all that rare, although finding concentrated deposits can be a challenge. The mining of such products, however, is environmentally difficult and the processing even more so. Thus, the challenge of overcoming China in this area is, to some degree, tied to either making the process cleaner (and likely more expensive) or accepting the environmental degradation.

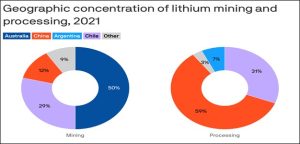

- China’s dominance in lithium is seen in the chart below.

(Source: IEA)

- As this chart shows, China’s dominance in processing rare earths and lithium is a much bigger issue than the mining of ores.

- The U.S. government is supporting lithium mining in the U.S.

- The China-based solar panel firm JA Solar (002459, CNY, 64.10) announced it will build a factory in Phoenix. The factory will produce two gigawatts of panels a year, adding to the 4.5 GW capacity already in place in the U.S. The fact that a Chinese firm is making an investment in the U.S. does indicate that Beijing is trying to keep market access to the U.S. open. Japan did something similar in the late 1980s

- One of the well-known problems of wind and solar power is its intermittency. As evidence, Chinese officials are ordering rooftop solar panels to be shut off during the Chinese New Year celebrations. The holiday will reduce demand and there are fears that solar panels will produce more power than needed.

- As part of the Inflation Reduction Act, the U.S. is supporting subsidies to EV firms. European car makers have been upset about this development, and the EU is complaining that U.S. officials are trying to woo European firms to expand their operations in the U.S. in order to acquire the subsidies. Now, Germany announced that it would support EU-wide subsidies to counter the U.S. action, something the German automakers have been calling for. In a sense, EV development is being imbedded into the industrial policies of the U.S. and EU.

- Although EVs get lots of attention in terms of reducing oil consumption in transport, efficiency gains far outpace electrics in terms of cutting demand.

- Changes in farming practices could reduce carbon in the atmosphere. Essentially, farmland could become a “carbon sink” where CO2 would be captured by plants and held in the ground. Although agriculture firms are trying to help farmers acquire carbon credits, farmers argue that the benefits from the credits are not enough yet to merit changing farm practices.