by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities are off to a great start, and Ravens quarterback Lamar Jackson was crowned MVP for the 2023 season. Today’s Comment analyzes the potential impact of CPI revisions, Yellen’s nonbank lender warning, and the geopolitical boost for chipmakers. Don’t miss the rest of our comprehensive report that includes economic and domestic updates, with expert insights on these key trends.

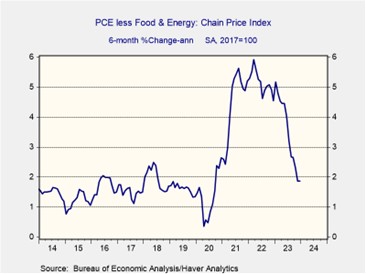

CPI Revisions: A potential upward revision to the CPI might dampen expectations of a rate cut in the first half of the year.

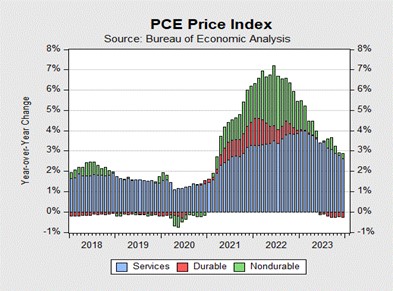

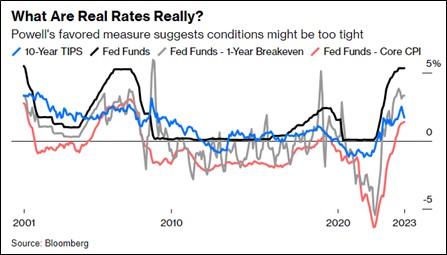

- The Bureau of Labor Statistics will release its updated seasonal adjustment factors for monthly inflation data later today. Investors will be closely watching these changes for any hints about when the Federal Reserve might consider easing interest rates. While past revisions have typically been minor, last year’s adjustments revealed that inflation hadn’t cooled as quickly as initially reported, raising concerns about the Fed’s policy path. Fed Governor Christopher Waller warned that another upward surprise may undermine the committee’s confidence in the Fed’s progress on inflation.

- However, it is quite probable that the revisions may reveal inflation to have been lower than the initial estimate suggested. Upon closer examination of the non-seasonally adjusted data, it becomes evident that while inflation experienced acceleration at the beginning of the year, prices plunged significantly into deflation by year-end. The sharp fluctuation suggests the previous year’s price movements could have varied widely in both directions, signaling that revisions may not be as bad as some fear.

- While the CPI reigns supreme in popularity thanks to its early release, it’s not without its limitations. A potential revamp would undoubtedly trigger market fluctuations, but it’s crucial to acknowledge the index’s shortcomings. The current methodology heavily weights shelter costs, which react slowly to economic changes, and ignores potential consumer substitutions toward cheaper alternatives. Therefore, it’s important to remember that the Federal Open Market Committee (FOMC) prefers the Personal Consumption Price Index (PCE) as a more accurate inflation gauge. So, while an upward revision to the CPI might grab headlines, its impact on the FOMC’s commitment might be less significant than initially perceived.

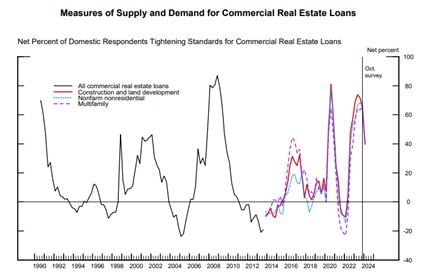

Yellen Concerns: Treasury Secretary Janet Yellen is paying close attention to the mortgage lending industry, even as she maintains a positive economic forecast.

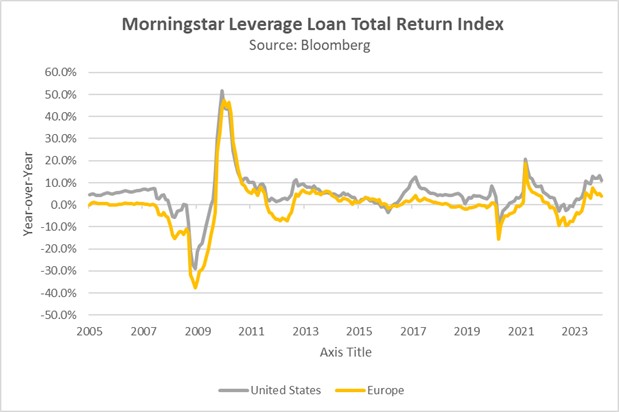

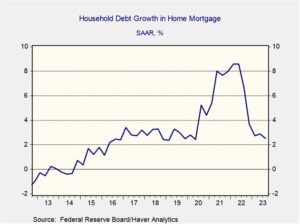

- During her Senate Finance Committee testimony, Secretary Yellen flagged concerns about the increased vulnerability of nonbank mortgage lenders during economic downturns. She emphasized their reliance on short-term, volatile funding sources compared to traditional banks’ access to stable deposits and emergency Fed facilities. This dependence, she argued, amplifies their risk of failure, potentially disrupting borrowers and destabilizing the broader financial system. Her testimony aligns with a growing effort among regulators to strengthen oversight on such institutions, aiming to mitigate the risks they pose and prevent future financial crises.

- Nonbank lenders have witnessed significant growth in recent years, partially fueled by their ability to offer loans to borrowers with lower creditworthiness, a segment often underserved by traditional banks who tightened their lending standards during the same period. This has allowed them to significantly outpace their bank and thrift counterparts in loan originations. According to Standard & Poor’s Global Market Intelligence, nonbank lenders accounted for a staggering 50.9% of mortgage loans issued in 2022. However, their rapid growth and sizable market share raise concerns about potential risks to the broader financial system.

- Secretary Yellen’s testimony highlights potential systemic risks beyond commercial real estate. While rising interest rates have slowed mortgage growth, they’ve also fueled a concerning increase in risky lending practices. Strengthening regulatory oversight of nonbank lenders could mitigate these risks, but we would expect significant resistance from these firms. While current indications suggest limited default risk among households, tightening monetary policy could elevate this risk in the future. That said, this talk about nonbank lenders is an example of how regulators are trying to extend their reach into the shadow banking market.

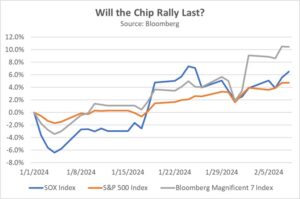

Global Chip War: Chipmakers are back in vogue as investors look for semiconductors to make a recovery and the US and China look to compete in the space.

- Governments are pouring money into bolstering their domestic chipmaking capabilities, spurred by geopolitical competition and supply chain concerns. The US “CHIPS and Science Act” offers subsidies to entice companies like Intel, TSMC, Samsung, and Texas Instruments to build fabs domestically. China presses on toward self-sufficiency in advanced chipmaking, defying US export restrictions. This week, news emerged that the country’s leading chipmaker is making headway in developing 5-nanometer chips. While not as miniaturized as the West’s 3nm chips, this achievement underscores the potential of China’s investments in the field.

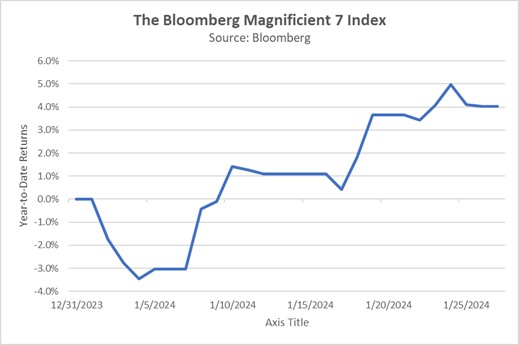

- Chipmakers may find solace in intensifying competition for advanced semiconductors, after a brutal year marked by slumping sales. The Semiconductor Industry Association (SIA) predicts a potential rebound, with chip sales rising 13.1% to $595.3 billion in 2024, following an 8% dip in the previous year. This growth is fueled by the surging demand for advanced chips in artificial intelligence (AI) technology as more companies incorporate it into their products and services. The improved outlook regarding semiconductor sales has helped lift the stock price of chipmakers. So far this year, the Philadelphia Stock Exchange Semiconductor Sector Index (SOX) is currently outpacing the S&P 500.

- While intensifying competition in AI presents exciting opportunities for companies in the space, investors should proceed with caution. Similar to the S&P 500, the SOX index is concentrated, with the top three companies wielding significant influence. Additionally, the index trades at a high valuation, hovering around 30 times earnings. This suggests limited upside potential for established players within the broader index. For investors seeking exposure to AI and chip growth, consider exploring smaller companies. These companies might offer greater room for future growth, while still benefiting from the overall sector momentum.

Other News: Former Fox News host Tucker Carlson’s interview with Russian President Vladimir Putin was released on X on Thursday. Some interpretations, including ours, suggest Putin’s feelings of marginalization by the US were a reason for invading Ukraine. Separately, US President Joe Biden faced heightened scrutiny over his age following a special prosecutor’s warning about Biden’s difficulty recalling details during interrogation over classified documents found at his residence. The renewed criticism is another example of why we think this election will be less predictable than previous cycles.

(Source: Federal Reserve)

(Source: Federal Reserve)