Daily Comment (June 13, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with plenty of China news, including signs of an investor exodus from the country and efforts by the central bank to boost economic growth. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including signs of re-industrialization in the European Union and an overview of the latest Federal Reserve policymaking meeting, which begins today.

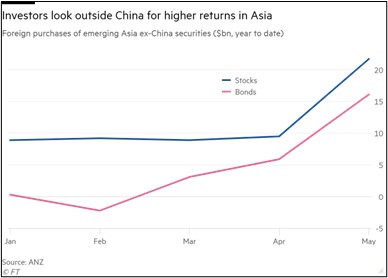

China – Inbound Portfolio Investment: Major asset managers around the world report they are being deluged by client requests for “Asia Ex-China” products, as global investors react to China’s slowing economic growth and increasing geopolitical tensions with the West. As a corollary, the fund managers say they’ve seen an uptick in requests for “Asian ally” products that would invest in Asian countries that are friendly toward the U.S., such as Japan and South Korea. Some clients are also requesting funds that would invest in Asia excluding both China and Japan.

- As we have been arguing for some time now, worsening geopolitical tensions are likely to prompt both the U.S. and China to clamp down on investment flows between the two countries. Tightened rules could come from out of the blue at any time, leading to losses for investors.

- We continue to believe that a safer approach may be for U.S. investors to focus their exposure on the evolving U.S. geopolitical bloc, which will likely consist mainly of today’s rich, highly advanced industrialized countries that are liberal democracies and provide good protections for property rights. The U.S. bloc will also include a number of tightly related emerging markets, such as Taiwan, South Korea, and Mexico.

China – Monetary Policy: Today, in a sign that officials now feel they must address the economy’s slowing growth, the People’s Bank of China unexpectedly cut the interest rate it charges on seven-day reverse repo operations to 1.9%, versus 2.0% previously. The central bank also injected 2 billion CNY ($280 million) into the banking system at the new, lower rate. Analysts expect that China’s other key lending rates will also be cut soon. Nevertheless, faltering confidence by businesses and consumers and weak loan demand mean the policy easing may have little positive effect on growth.

China – Military Policy: According to a recently declassified Intelligence Community report, China’s actual military spending is now equivalent to about $700 billion per year, even more than the $516.1 billion that we estimated in our recent report on Chinese military power and almost three times that of China’s official defense budget. As the Soviets did during the Cold War, the Chinese use a range of budgetary shenanigans to under-report their actual defense spending.

- The Chinese spending of $700 billion still doesn’t match the U.S. defense budget of $824.4 billion in 2022, but China’s spending is concentrated on only about one-quarter of the earth’s surface, whereas the U.S., as the global hegemon, must spread its budget over virtually the entire world.

- With total actual military expenditure of $700 billion per year, China would be spending about $14,200 for every square mile of its core defense sphere (basically, the eastern half of the Northern Hemisphere).

- In contrast, the U.S. defense budget equates to just $4,302 for every square mile of the Earth’s surface excluding Antarctica (which is supposedly neutral).

- Along with China’s aggressive military operations and intensive investment in its weapons arsenal, the lack of transparency in its defense spending should be a major concern for Western defense officials and will likely be an argument against the cooling of tensions being advocated by Western business elites seeking to protect their commercial interests.

European Union: On top of the recent construction data indicating a massive jump in U.S. factory construction, new data suggests re-industrialization is also happening in Europe. The data shows global businesses acquired or leased 9.6 million square feet of industrial space in the region in 2022, marking a 29% increase over the previous year. The uptake of factory buildings comes even as weak consumer growth in the region pushes down contracts for retail and warehousing space.

- Re-industrialization in Europe is probably being driven by many of the same forces as in the U.S. Faced with slower growth in China and the risk that geopolitical tensions will sever their critical global supply chains, firms are cutting their risks by “near shoring” production.

- Nevertheless, the Europeans are probably still not seeing the level of re-industrialization that they could have if they adopted U.S.-style subsidies for green technology, advanced semiconductors, and other key industries. As in the U.S., the EU also probably hasn’t yet seen the full impact of defense spending increases, which will require a build-out of the region’s defense industrial base.

- Illustrating the allure of the new U.S. industrial policy, German semiconductor firm Infineon (IFNNY, $40.84) said it may start producing more of its products in the U.S. so that they would be eligible for subsidies included in last year’s Inflation Reduction Act.

- Infineon is the world’s largest producer of semiconductors for the auto industry.

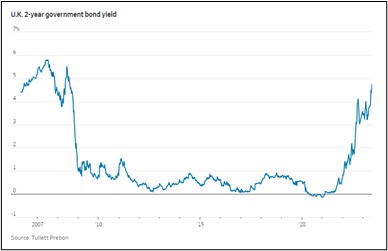

United Kingdom: The unemployment rate in February through April fell to a seasonally adjusted average of 3.8%, rather than rising to 4.0% as anticipated. That means joblessness declined further from the 3.9% rate in January through March. Even more alarming for the Bank of England, average weekly earnings in April were up 7.2% year-over-year, surpassing the expected increase of 7.0% and accelerating from the rise of 6.7% in the previous month.

- The strong labor market data suggests the central bank will be even more inclined to keep hiking interest rates.

- In response, U.K. bonds are slumping so far this morning, driving yields higher. The yield on two-year Gilts has now reached its highest level since 2008.

Global Oil Market: In its monthly market report, the Organization of the Petroleum Exporting Countries said their producers as a whole cut oil production by 464,000 barrels per day in May, down to a total level of 28.07 million bpd. Although the cuts were largely concentrated among a few of OPEC’s biggest producers, the figures suggest the organization is following through with its “voluntary” effort to boost prices by restricting supply. Nevertheless, output increases by some OPEC members will likely mute the impact on global supplies, especially as demand falters in the face of slowing economic growth.

- So far this morning, Brent crude is trading up 2.5% at about $73.60 per barrel.

- All the same, that is sharply lower than the price of $120 per barrel one year ago.

Nigeria: In a sign that he will continue to shift economic policy in a more orthodox direction, newly elected President Bola Tinubu has suspended central bank chief Godwin Emefiele, who had spent billions of dollars of the country’s foreign reserves to prop up the currency. Tinubu has also ended a program of fuel subsidies that cost Nigeria some $10 billion per year. The moves have given a significant boost to Nigerian bonds.

U.S. Monetary Policy: Officials at the Fed begin their latest two-day policy meeting today, with their decision to be released tomorrow at 2:00 PM EDT. Market indicators suggest investors now expect the policymakers to pause their interest-rate hikes and keep the benchmark fed funds rate steady within a range of 5.00% to 5.25%. The officials are also expected to signal an option to resume their rate hikes in the future if consumer price inflation doesn’t moderate as expected.

- On a related note, new data shows U.S. junk-loan defaults are surging as more financially challenged companies with floating loan rates find they can’t meet their debt payments.

- The data shows 18 such defaults in January through May, for a total of $21 billion. That’s more than in the full-years of 2021 and 2022 combined.

U.S. Apartment Market: New figures from rental-listing and property-data companies show that asking rents for new leases have hit a plateau and in some cases are declining. That marks a big slowdown from the double-digit increases one year ago. Of course, the slowdown in asking rents is a positive for apartment dwellers and could soon start pushing down overall consumer price inflation. Nevertheless, weaker-than-expected rent rates could also cause problems for building owners, potentially making the apartment sector another source of concern in the commercial real estate market.