Weekly Energy Update (June 8, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices continue to trade in the lower part of the trading range despite the Saudis’ announcement of a unilateral production cut.

(Source: Barchart.com)

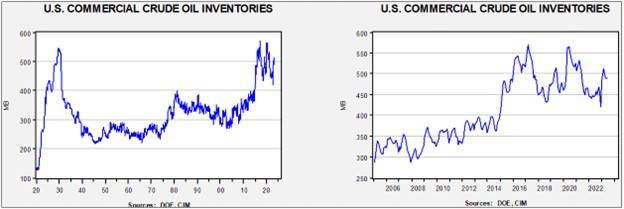

Commercial crude oil inventories fell 0.5 mb when compared to the forecast build of 1.5 mb. The SPR fell 1.9 mb, putting the total draw at 2.3 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 12.4 mbpd. Exports fell 2.4 mbpd, while imports declined 0.8 mbpd. Refining activity jumped 2.7% to 95.8% of capacity.

(Sources: DOE, CIM)

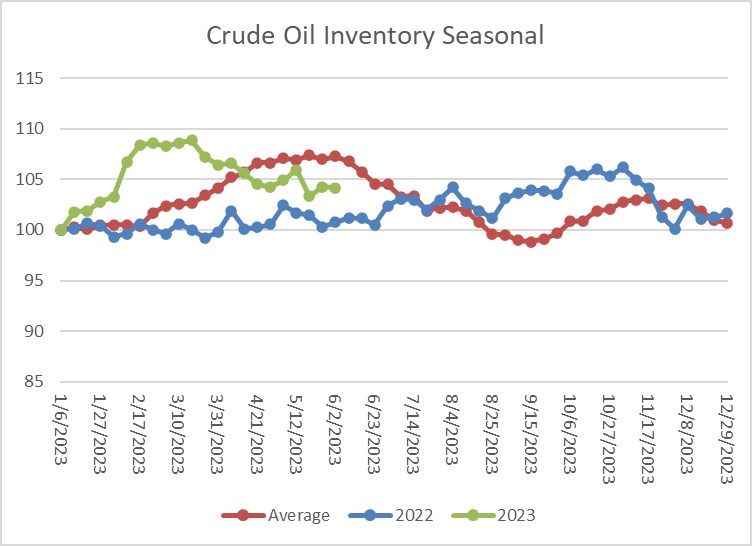

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. As the average line shows, we are nearing the seasonal draw period, although that pattern has become less reliable with the U.S. exporting crude oil.

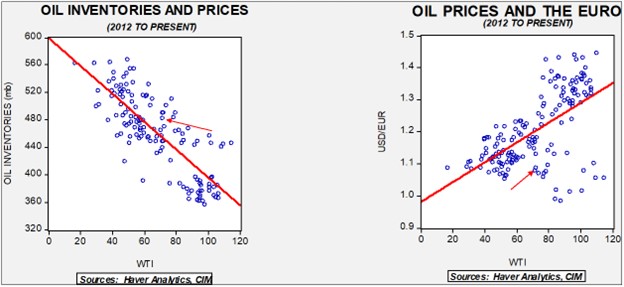

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $59.61. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

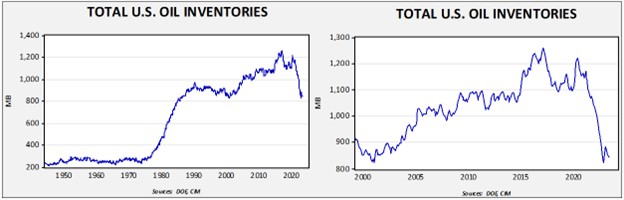

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $93.27.

Market News:

- The outcome of the OPEC+ meeting was that the Kingdom of Saudi Arabia (KSA) announced a large production cut independent of the rest of the cartel. The KSA will lower its output to 9.0 mbpd, and oil prices initially rose on the announcement. Below the surface, there are growing tensions within the cartel. OPEC traditionally sets output quotas based on production capacity. However, transparency on capacity is lacking, meaning that members have an incentive to overstate their capacity, which would then lead to a higher quota. In recent years, the cartel has struggled to meet its production quotas; in fact, their new term is “target,” which is telling. Saudi Arabia was pressing African members to reduce their stated capacity which would mean lower quotas, but naturally they resisted.

- What’s the motive for the KSA to go it alone? We presume there are three reasons behind the decision. First, the IMF estimates that the kingdom needs an oil price of $80 to meet its fiscal requirements. Now, obviously, the IMF is calculating a total revenue number, so lowering production does reduce that calculation unless the price exceeds the lost revenue from the production cut. We suspect the crown prince has a price in mind and the oil minister had to hit it, although it might be the case that the leadership has not thought through the full ramifications. Second, we suspect MBS continues to harbor animosity toward the Biden administration. It’s rather evident that there is a disparity between Washington and Riyadh on oil pricing. The U.S. wants a price below $70 per barrel, while the KSA wants a price north of $80. Higher gasoline prices are politically unpopular and this action has the potential to cause just that. SoS Blinken is in the KSA, so the decision to cut production will surely make talks contentious. We do note Blinken’s trip is centered on the KSA normalizing relations with Israel. Saudi Arabia has indicated that in exchange for recognizing Israel, Riyadh wants Israel to transfer its civilian nuclear technology. Third, the KSA may view the voluntary cut as a way to gain further control over the oil market. If the kingdom is holding onto the bulk of the excess reserves, it will take over the role of swing producer. It’s notable that the Saudis gave up this role in 1985, triggering a near collapse in prices. It may be that the new generation of leadership is simply unaware of this history. The role only works if no other nations expand capacity. It’s interesting that the Saudis didn’t ask Russia or the UAE for cuts, which further isolates the KSA in the cartel.

- Either the Saudis really need higher oil prices, or they are assuming that other suppliers won’t fill the gap created by the KSA cut.

- The cartel did agree to consider lower production targets for 2024.

- China is starting a deep well project in Xinjiang which is projected to drill down 36k feet; ostensibly, this is a science project, but there is also talk about trying to engage in deep earth oil exploration. Recent comments from President Xi about oil independence are driving these sorts of projects.

- Various dredging projects off the coast of Texas are allowing larger tankers to load up Texas oil for export.

- The U.S. rig count has dropped, raising fears about future U.S. oil production. We also note that operating conditions appear to be deteriorating. At the same time, Exxon (XOM, $105.73) claims that refracking existing U.S. wells could double output.

- Saudi Arabia is looking to invest in Iraq’s natural gas industry.

- Environmentalists are targeting LNG exports by forcing insurance companies to stop providing coverage.

Geopolitical News:

- We have written on the de-dollarization in oil markets. We are now hearing about the downsides since Russia is apparently sitting on billions of INR and is struggling to do something with them. India has capital controls that restrict Russia’s access to India’s capital markets, and it isn’t obvious whether the forex markets can absorb Russia’s sale of its holdings.

- There are reports that Ukraine planned the attack on the Nord Stream pipelines and the U.S. was aware of the plans. This news adds to the likelihood that Ukraine was responsible for the attack. If so, this would likely strain relations with Germany.

- European nations and the U.S. are restarting talks on how to deal with Iran’s nuclear program. Recent reports about Iran’s enrichment program and the hardening of its research sites are leading to an attempt to return to diplomacy.

- The U.S. and U.K. navies responded to a merchant vessel in the Strait of Hormuz that was being harassed by IRGC speedboats. Iran, meanwhile, announced a new regional maritime alliance that would exclude the U.S. We struggle to see why nations like the UAE or Saudi Arabia would join with Iran on such a pact (given that Iran is the instigator of maritime problems in the Gulf), but the announcement is a development that we will be tracking going forward.

- Iran appears to be backing away from the purchase of Su-35s from Russia.

- The UAE is engaging with Iran while at the same time trying to obtain security guarantees from the U.S. The UAE may be trying to determine how far the U.S. will go in providing security to the region, and if the guarantees are seen as lacking, the emirate may decide it needs to have better relations with Tehran.

- Iran has unveiled a missile it claims to be hypersonic. Such missiles can generally evade existing defense systems; thus, the announcement is raising concerns, especially for Israel. In response, the U.S. has added even more sanctions on Iranian and Chinese entities involved in Iran’s missile program.

- Venezuelan President Maduro is visiting the KSA this week to discuss various investment ideas. Venezuela was under sanction, but the Biden administration has eased restrictions to reduce oil prices. The visit, occurring just before SoS Blinken arrives in the KSA, is an interesting juxtaposition.

Alternative Energy/Policy News:

- We have been noting the rise in resource nationalism. Mexico is becoming more aggressive in restricting foreign company access to its mining resources, which could boost prices on key metals.

- Texas is an energy powerhouse. Not only does the state produce the most crude oil but it is also a leading producer in wind, solar, and nuclear power. State lawmakers were considering bills to curb wind and solar projects, but those bills appear to have mostly died. In many respects, Texas is a prime example of the “all of the above” solution to energy issues.

- Climate change concerns are causing some parts of the U.S. to become uninsurable.

- As we have noted over the past few weeks, China dominates the solar energy industry. It has been the low-cost producer of panels and other components. However, the U.S. is now subsidizing this industry and there are signs that firms that have previously struggled to survive against China are now seeing a way forward.

- China’s BYD (BYDDY, $64.40) has moved up in the rankings of suppliers of EV batteries. It is now second only to Contemporary Amperex Technology Co. (300750.SZ, CNY, 207.30) after overtaking LG Electronics (066570.KS, KRW, 125,700). The fact that two Chinese companies dominate the EV battery market highlights the difficulty that the auto industry will have in isolating China. As we have noted in recent reports, China’s EV industry has rapidly become world class, putting the West in a difficult spot. If the goal is rapid adoption of EVs for energy transition purposes, it makes more sense to import Chinese EVs; however, such a policy will likely devastate the auto sector in the West and undermine the re-industrialization process. On the other hand, restricting imports will drive up costs and slow the energy transition. We note that China’s export data for May was disappointing, but one bright spot has been EV exports.

(Source: Capital Economics)

- Hydrogen remains a potential replacement for hydrocarbons. However, the production of hydrogen can come from both “dirty” and “clean” production methods, which has led to a color coding of hydrogen. The Biden administration is trying to create a regulatory path for fostering the development of the fuel that will go along with a subsidy program to boost production. The subsidy program still requires decisions about what will be covered. The industry wants loose standards, while environmentalists are pressing for only the “greenest” of sources. Although we don’t know the outcome yet, this administration tends to try to split the middle on these issues, which will tend to please no specific group.