by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a note on Russian President Putin’s decision last week to replace his defense minister with an economist. We next review several other international and US developments with the potential to affect the financial markets today, including a major taxi driver strike in Italy and signs of change in the US labor market.

Russia: After President Putin’s decision last week to replace Defense Minister Shoigu with economist Andrei Belousov, we’ve been hoping to see more evidence of what drove the move, but nothing concrete has shown up. All the same, we agree with the various Russia experts who think the move probably reflects both Putin’s concern about rampant corruption in the military and his realization that the war against Ukraine and its Western backers will be taxing on the Russian economy over the long term.

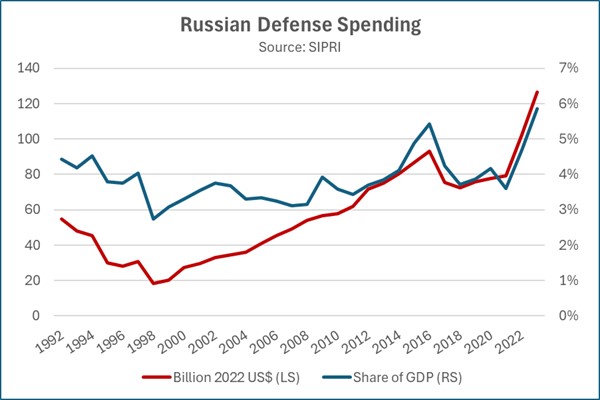

- In its respected estimates of military spending, the Stockholm International Peace Research Institute (SIPRI) believes Russia boosted its military outlays to the equivalent of about $126.5 billion in 2023, some 70% higher than in the three years right before the coronavirus pandemic (excluding price inflation).

- Based on SIPRI’s estimates, Russian military spending last year equaled 5.86% of gross domestic product. That’s Russia’s biggest “defense burden” in its modern history, and it far exceeds the current US defense burden of 3.36% of GDP.

- CIA analysis, which has been replicated by private analysts, indicates economic growth begins to falter at defense burdens above about 10% of GDP. As estimated by SIPRI, the Russian defense burden isn’t quite at that level, but if Russia has large amounts of hidden defense spending like the USSR did, it could be approaching the danger zone. At the very least, even at SIPRI’s calculated defense burden of 5.86% of GDP, we suspect Russia is facing resource constraints and inflation pressures.

- From this perspective, it makes sense for Putin to want an economist at the helm of the Defense Ministry. Chief of the General Staff Gerasimov will still run the war against Ukraine, but by installing an economist as defense minister, Putin is signaling that Russia will keep spending large amounts on its military into the future and will need a defense minister who can manage the defense industry’s interplay with the overall economy.

- Importantly, Belousov has a reputation for favoring heavy state intervention in the economy to promote economic growth and boost particular industries. He therefore could launch a new Russian industrial policy aimed at broadening and improving the country’s ability to produce high-tech weapons en masse. Such a move might convince Western countries to adopt similar measures to expand their defense industries.

Russia-Poland: The Polish government today said it has arrested nine Belarusian, Ukrainian, and Polish citizens for carrying out acts of intimidation and sabotage at the direction of the Russian intelligence services. According to Polish Prime Minister Tusk, the nine were also preparing to conduct sabotage in Lithuania, Latvia, and possibly Sweden. The arrests highlight how Russian intelligence is now on a war footing and aggressively operating across the West.

- Over the weekend, the Polish government also said it would spend about $2.5 billion to build fortifications against Russian attack along Poland’s borders with Belarus and the Russian exclave of Kaliningrad.

- Along with other countries building fortifications, Poland’s effort shows just how serious the Eastern European countries consider the military threat from Russia.

Italy: If you’re heading off to Italy to begin the summer, beware of travel chaos. The country’s politically powerful taxi drivers, who have already greatly limited the operations of ride-hailing apps, have launched a nationwide strike to protest a government minister’s meeting with representatives from Uber. Amid consumer anger over insufficient taxi service, the meeting was taken as a sign that the government may be planning to lower restrictions on firms like Uber and Lyft.

China: A review of earnings reports from top Chinese electric vehicle makers shows they have dramatically slowed their payments to suppliers in recent quarters. For example, top EV maker BYD took an average of 275 days to settle its accounts payable in 2023, versus 219 days in 2022 and 198 days in 2021. Analysts believe the drawn-out payments reflect increasing liquidity problems as EV sales slow. Importantly, weaker domestic demand raises the risk that Chinese EV makers will dump their excess output on global markets, hiking trade tensions.

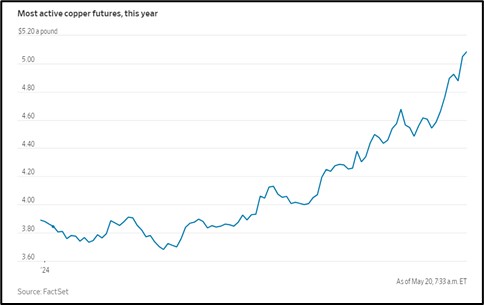

- Separately, the Wall Street Journal today carries an article showing Chinese mining firms are dramatically boosting their global investment and output, pushing down prices for some minerals (such as nickel) and driving some Western producers out of the market.

- The article suggests that China’s tried-and-true strategy to grab global market share in manufacturing is now being used to grab market share in mining. Key elements of that strategy include making massive investments in new, modern facilities to gain scale and cut costs, leveraging cheap labor, and flooding the market with ultra-low cost output to put Western competitors out of business.

- If so, the strategy could make the West even more dependent on the China/Russia bloc for minerals critical to national defense and the new, more electrified economy of the future. That would be consistent with our often-stated belief that the China/Russia bloc will try to weaponize its mineral holdings against the West to achieve global dominance.

Australia: Ahead of elections next year, the ruling center-left Labor Party government has proposed a budget for the coming fiscal year that includes tax cuts and about $5.3 billion in energy rebates and rent subsidies to ease the cost of living for renters and mortgage borrowers. The fiscal help, along with stickier-than-expected consumer price inflation, is expected to preclude the central bank from cutting interest rates anytime soon.

Mexico: With the ruling Morena Party in the pole position to win the July presidential election, the government is reportedly considering a tax hike on banks to rein in the surging budget deficit. Such a move could have big implications for major Spanish banks, which dominate the Mexican market. For example, BBVA reportedly gets almost 50% of its profit from its Mexican operations, while Banco Santander gets about 13% of its profit there.

US Labor Market: The Wall Street Journal carries an article today showing a big shift in the tenor of corporate job postings aimed at new college graduates. Rather than listing a litany of responsibilities and requirements, the listings now emphasize high salaries, opportunities for professional advancement, and perks. The change is consistent with the shortage of younger, relatively lower-skilled workers that we describe in our latest Bi-Weekly Geopolitical Report, “The Great COVID Labor Reform,” published yesterday.

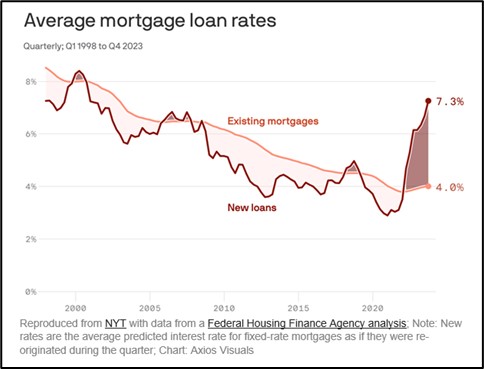

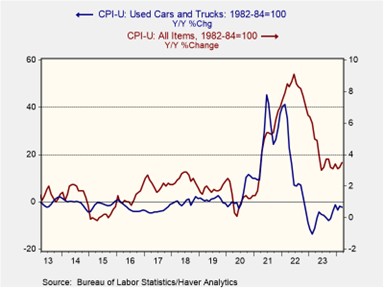

US Housing Market: Axios today carries a useful article laying out how the disparity in new versus existing mortgage rates is handcuffing home sellers. The following chart lays out the situation in stark terms.

US Transportation Industry: The containership that rammed Baltimore’s Francis Scott Key Bridge and made it collapse in March was finally towed away from the crash site yesterday, allowing most cargo traffic in the important port to start flowing again. However, replacing the bridge will take many more months or years.