Daily Comment (May 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures are higher as investors await this week’s economic releases. In sports news, the Indiana Pacers were able to tie up the series with the New York Knicks. Today’s Comment explores why declining consumer sentiment may spell bad news for some companies and why small-cap companies are eager for a Fed pivot. We also provide an update on the war in Ukraine. As usual, our report ends with a summary of the latest international and domestic data releases.

Feeling the Squeeze: May saw the biggest one-month drop in consumer sentiment since 2021; however, the pain was not evenly spread.

- The University of Michigan Survey of Consumer Sentiment fell from 77.2 to 67.4, missing expectations of an increase to 78.0. This disappointing report was driven by rising inflation expectations, as households grew increasingly pessimistic about price increases moderating to pre-pandemic levels. The survey showed that consumers expected inflation to increase to 3.5% next year and eventually to moderate to 3.1% in the next five years. Although there is a lack of strong correlation between inflation expectations and indexes like CPI or PCE, the change in sentiment reflects a broadening trend of weak economic data.

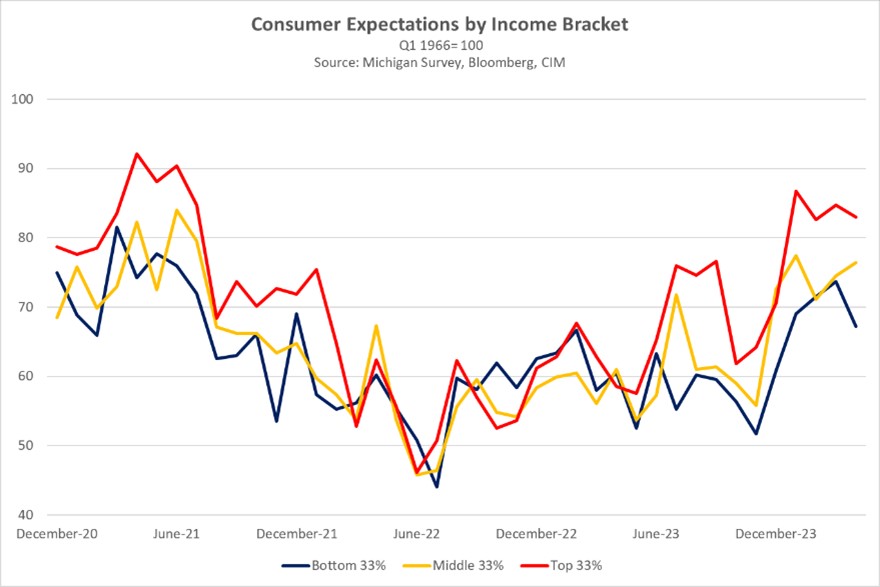

- The recent drop in consumer sentiment reinforces concerns about slowing consumer spending — a trend that many companies hinted at in their latest earnings reports. Despite exceeding expectations, corporate earnings suggest executives are noticing that households are tightening their belts. This cautious spending is particularly evident among discretionary purchases, since companies like McDonald’s, KFC, and Starbucks have reported significant pushback against higher prices. The impact is felt most acutely by low-income households, while higher-income earners have shown greater resilience. In Q2, mentions of low-income consumers by companies have more than doubled when compared to the highest level seen in the past five quarters.

- Although consumer surveys suggest that households are under pressure, it is unclear whether that will lead to a broader consumption pullback. A breakdown by income shows consumer expectations remain relatively optimistic among middle and high-income households. Notably, attitudes of middle-income earners improved from the previous month. However, the sizeable decline in the overall index suggests that low-income earners are feeling less confident in dealing with rising prices. In the short term, there might be a more significant impact on the upcoming election than on the broader economy, but this trend could have long-term consequences.

Small Cap Risk: Despite attractive valuations, investors remain wary of smaller companies, perhaps until the Fed signals an interest rate cut.

- Over 75% of the debt held by companies within the Russell 2000 index needs to be refinanced within the next five years. This is a significantly higher proportion compared to the S&P 500, where nearly 50% of the debt is due at that time. These companies are particularly vulnerable to changes in interest rates because they rely more heavily on floating-rate debt compared to their larger, investment-grade counterparts. As a result, these companies have a heightened dependence on monetary policy decisions as a decrease in policy rates could drastically improve their financial performance.

- Small-cap investors stand to benefit significantly from a successful soft landing by the Fed. These companies are also highly sensitive to fluctuations in the business cycle and real interest rates. Thus, the possibility of declining borrowing costs and improved growth led these companies to outperform their large-cap counterparts toward the end of 2023, for the most part. This relationship is not just a US phenomenon. European small caps have also been able to take off this year due to interest rate cut expectations and signs of an impending economic recovery. The Stoxx Europe Small 200 Price Index has surged 7.5% year-to-date, nearing its 2023 return of 10%.

- Despite some economic setbacks, a strong case can be made for US small and mid-cap companies. Not only do these firms have better valuations when compared to their large-cap counterparts, but their strong domestic focus likely protects their revenue from being significantly impacted by currency fluctuations and geopolitical events. Additionally, while Fed Governor Bowman’s recent comments dampen hopes for a rate cut, the possibility remains for one if inflation eases and unemployment keeps climbing. Nevertheless, this week’s release of the PPI and CPI reports for April could provide crucial clues on the Fed’s path, as inflation is expected to cool from the previous month.

Next Phase in Ukraine: Russian President Vladimir Putin is seeking a new approach as his country faces growing financial pressure from the West.

- Putin replaced Defense Minister Sergei Shoigu with Andrei Belousov, an economist and former first deputy prime minister. This reshuffle highlights Putin’s attempt to re-evaluate Russia’s military strategy, as Russian forces aim to consolidate their gains before Ukraine can leverage additional Western funding. The apparent uneasiness in these moves may also be reflected in Russia’s consideration of lowering the threshold for activating its nuclear weapons and its decision to ramp up recruitment as it recently brought female convicts to serve on the battlefield. These efforts have become more pressing as Putin gets closer to taking over Kharkiv.

- The Russian need for a victory in Ukraine comes amidst growing signs that it is becoming increasingly more costly for Moscow to maintain its war efforts. The European Commission has proposed the first-ever sanctions on Russia’s liquefied natural gas industry, signaling a significant escalation in efforts to sever economic ties with Moscow. Although it would not affect imports, it would prevent EU countries from re-exporting Russian LNG. The measure would complicate purchases of Russian gas for Asian countries like China and India, which have become key buyers since the war began in February.

- Despite waning media attention, the war in Ukraine remains a critical issue, which demands close monitoring. French President Emmanuel Macron’s emphasis on the potential need to send troops to Ukraine underscores the possibility of a wider European conflict. Furthermore, the growing push by the West to restrict Russia’s ability to get help from other countries is likely to exacerbate the trend toward global fracturing and undermine supply-chain security. Therefore, the recent reprieve in gold and oil prices may not hold if European threats continue to escalate.

In Other News: China is expected to hold a major bond sale as it looks to boost its economy. This is a sign that global growth may pick up this year. Meanwhile, more Americans are eying retirement, indicating that the labor market may remain tight for some time. In Spain’s Catalonia region, the Socialist Party dominated recent regional elections. This suggests that the pro-independence movement is losing favor.