Daily Comment (May 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity markets are calmer today after yesterday’s investor enthusiasm over the inflation report cooled. In sports news, the Boston Celtics have eliminated the Cleveland Cavaliers and now advance to the Eastern Conference Finals. Today’s Comment will examine the impact that recent economic data will have on Fed policy, explain why the first presidential debate will be historic no matter who wins, and explore rising political violence in Europe as parliamentary elections approach. As usual, the report concludes with a summary of international and domestic data releases.

There Is a Chance: Wednesday’s economic data releases kept the possibility for rate cuts alive by confirming signs that demand is starting to cool.

- Inflation showed signs of cooling, while retail sales lagged. Consumer inflation eased slightly, with the Consumer Price Index (CPI) rising 3.4% year-over-year, down from 3.5% in the previous month. Core CPI, which excludes volatile food and energy prices, also slowed, increasing 3.6% year-over-year, down from 3.8% in the previous month. The slowdown may be related to weak demand. In the same month, real retail sales, which are adjusted for inflation, fell 0.3% from the previous year. Combined, the reports suggest firms may be having trouble moving volume as consumers struggle to absorb price increases.

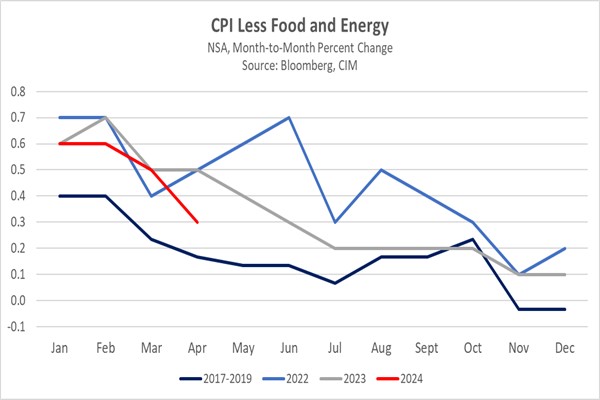

- Weak economic data has likely kept the possibility of interest rate cuts on the table this year, making further hikes a less attractive option. Reinforcing this cautious stance, Minneapolis Fed President Neel Kashkari emphasized the need for stronger evidence that inflation is moving towards the Fed’s 2% target before policymakers would consider a rate cut. So far this year, the non-seasonally adjusted CPI data, which is never revised, is currently showing that prices are trending at a slower pace than the previous two years, but still remain above the trend of the three years before the pandemic.

- The improvement in inflation is likely a welcome sign for Fed officials but not enough for them to consider lowering rates in June. Next week’s FOMC meeting minutes may provide further clues about how committee members viewed inflation in the first quarter. Based on recent speeches, we suspect that at least one official has signaled a preference for a rate hike this year, which is unlikely to change following one month of subpar economic data and a better-than-expected inflation report. However, if this trend continues to hold over the next couple of months, sentiment could favor a September cut.

Presidential Faceoff: Prospective presidential nominees Joe Biden and Donald Trump will have their first debate next month as they look to set the tone for the election cycle.

- This will be the earliest televised presidential debate in history since the tradition began in 1960. Notably, it was announced before some states had even held their primary elections. The decision to fast-track the debate comes at a time when both candidates want to solidify their names as the leaders of their respective parties in hopes of generating more fundraising. Despite the initial bump after the State of the Union address, President Biden’s approval ratings have significantly declined in recent polls. Meanwhile, former President Donald Trump has faced challenges in fundraising, largely due to ongoing legal expenses.

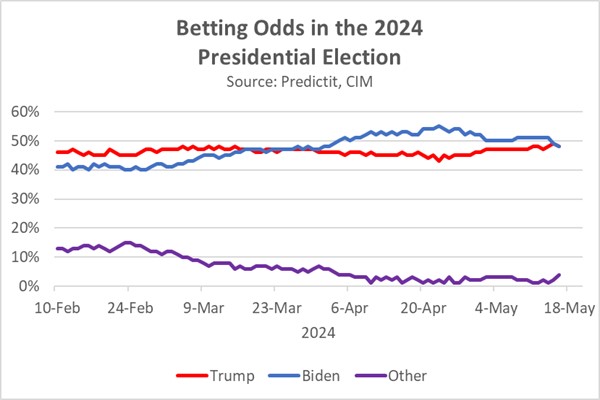

- An earlier debate should make it easier for the market to gauge which presidential candidate holds the advantage going into the election. The Republican candidate will likely capitalize on the perception that they are stronger on the economy and immigration issues, while the Democratic candidate will likely emphasize the strength of the labor market and the protection of women’s reproductive rights. Although polls currently show that former President Trump has an advantage over President Biden in most swing states, the prediction market, which was a more reliable predictor during the 2020 election, indicates a dead heat with Biden holding a 2-point electoral lead.

- This election is likely to be a toss-up, given that these candidates remain quite unpopular. This explains why both candidates are still facing a notable amount of protest votes during the primary contests. As a result, we suspect that the market is still underpricing the threat that a third-party candidate who has been excluded from the debate, Robert Kennedy, Jr., will have on the outcome of the election. His rising popularity, especially among fringe voters, has allowed him to pull votes from both sides. Currently, there is an elevated chance that the two major candidates will not reach the 270 votes needed to secure victory, which could lead to some market uncertainty.

European Violence: Attacks on government officials have started to pick up across Europe as the bloc prepares for parliamentary elections.

- On Wednesday, Slovakian Prime Minister Robert Fico was shot after leaving a government meeting. The politician’s condition appears to be improving following the incident, although he is still considered to be in critical condition. The assassination attempt comes a week after two German lawmakers were attacked at two separate events. These violent acts have likely added another level of complexity to European elections that are set to take place June 6-9. So far, lawmakers have sought to limit the gatherings of extreme groups due to concerns that it may lead to more hostilities.

- Recent violent acts in Europe raise questions about a potential link to the ongoing tensions surrounding the Russia-Ukraine conflict. Notably, Fico has publicly supported Russian President Vladimir Putin and is closely aligned with Hungarian President Viktor Orbán. In contrast, the recently targeted German politicians belonged to a coalition government that endorsed sending weapons to Ukraine. Tensions are high following speculation that Moscow has recruited extremists to launch attacks on European infrastructure.

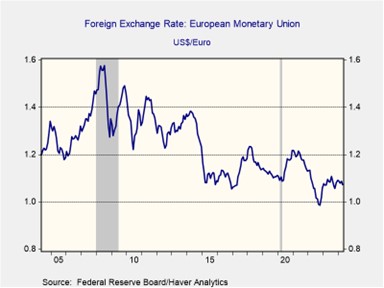

- The potential for rising conflict in Europe, particularly between pro-Moscow and anti-Moscow parties, has been largely ignored. These opposing sides have increasingly resorted to hostile tactics, reflecting the deep divide over Europe’s role in the Ukrainian conflict. While Ukraine’s supporters, particularly those among European leaders, remain vocal, it’s clear that Putin also has allies. As the conflict between Ukraine and Russia extends beyond two years, the situation is likely to deteriorate further. Escalating tensions could weigh heavily on the euro, potentially leading to further supply chain disruptions and raising the specter of a direct confrontation.

In Other News: President Putin and Chinese President Xi Jinping have renewed their vow to cooperate with each other in limiting the US’s influence in the world. While the agreement is nothing new, it serves as a reminder of the two countries’ unshakeable bond. Copper prices surged to a record high in a sign that the global economy may be starting to pick up.