by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are still digesting the Federal Reserve’s latest interest rate decision. In sports news, Shohei Ohtani continues his historic season, aiming to become the first player to hit 50 home runs and steal 50 bases in a single year. Today’s Comment will delve into the Fed’s decision to cut rates, explore why the market is not sold on the economy, and provide an update on Germany. Our report will conclude with a roundup of international and domestic news.

Pivot Complete: The Fed launched its easing cycle with a jumbo rate cut but cautioned the market not to expect it to become a trend.

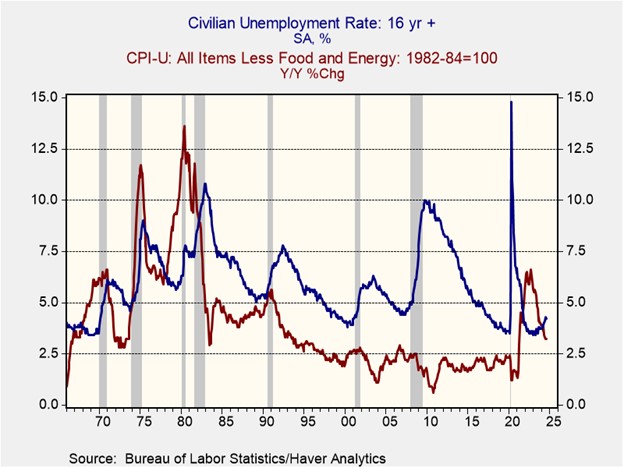

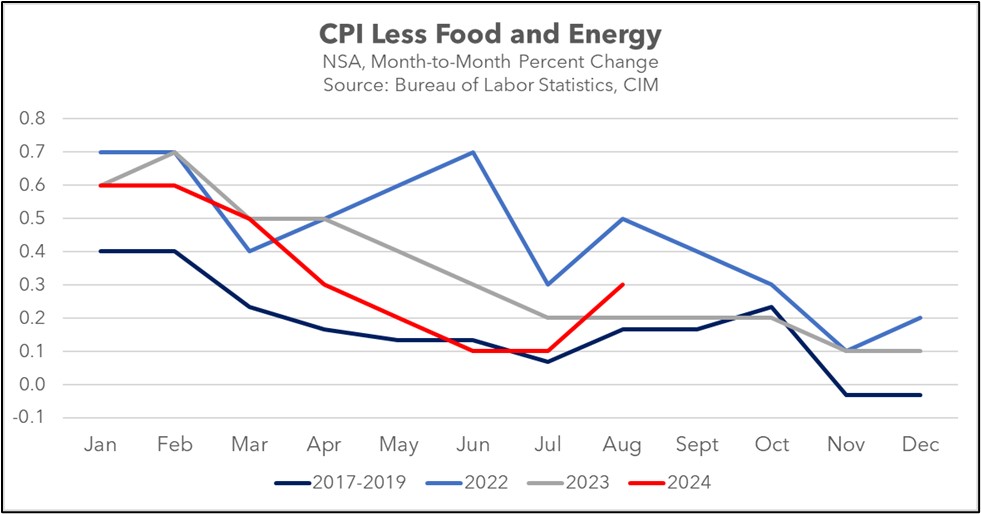

- The Federal Open Market Committee (FOMC) concluded its two-day meeting by reducing its fed funds target rate by 50 basis points to 4.75%-5.00%. While policymakers expressed optimism about inflation’s trajectory toward the 2% target, they also voiced concerns about the cooling labor market. In the subsequent press conference, Fed Chair Jerome Powell indicated that future rate cuts are likely to be smaller going forward, with a 25 bps rate cut expected over the next two meetings.

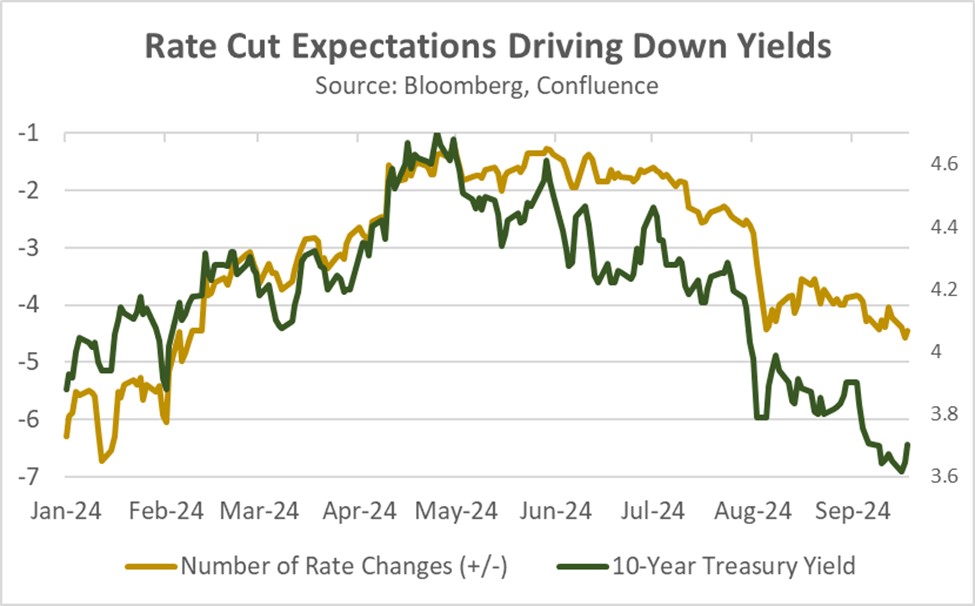

- Following the Fed’s policy pivots, doubts emerged about the central bank’s commitment to controlling inflation. The dot plot revealed lingering concerns among committee members, with nearly half opposing more than one additional cut for the rest of year. Meanwhile, Michelle Bowman was the first governor since 2005 to dissent, having favored a smaller cut. These factors likely contributed to the slight steepening of the yield curve, with the 10-year Treasury yield rising more quickly than the two-year Treasury yield.

- Investors are shifting their attention from solely focusing on the Federal Reserve’s interest rate policy to broader economic factors like growth, inflation, and the national debt. Furthermore, the timing of the Fed’s exit from quantitative tightening could significantly influence bond yields due to its effect on the bond market supply. Despite these factors, we expect limited downward pressure on bond yields in the near term. In fact, upward pressure may emerge if economic indicators suggest rising inflation or stronger job growth.

Why the Gloom? The market offered mixed signals about the path forward for equities following the Fed’s pivot.

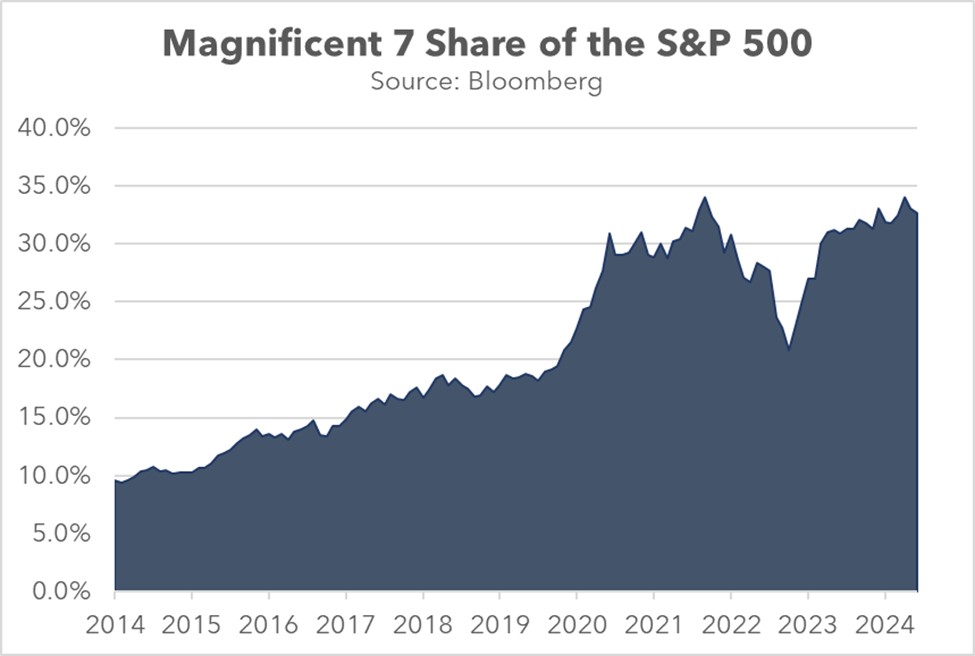

- Despite the initial positive reaction to the Fed’s rate decision, the S&P 500 and Nasdaq Composite indexes both closed slightly lower than the previous day, while the S&P 600 small cap price index experienced only minor gains. While some of this weakness can be attributed to profit-taking by investors who had bet on a specific outcome of the two-day meeting, the overall sentiment suggests underlying skepticism about economic growth. While the central bank expressed optimism about the US economy, the big rate cut does suggest that it is ready to take more aggressive steps if needed.

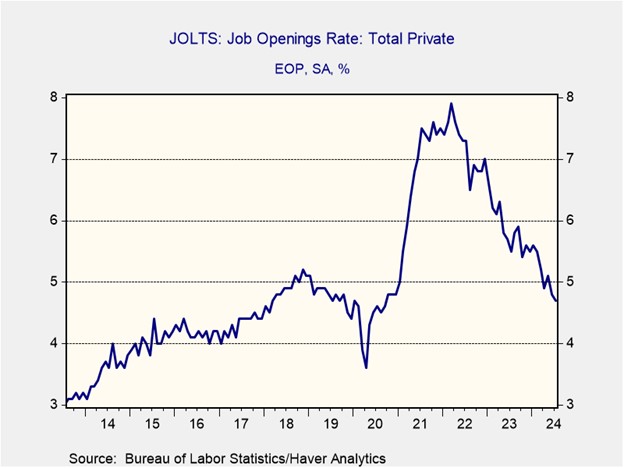

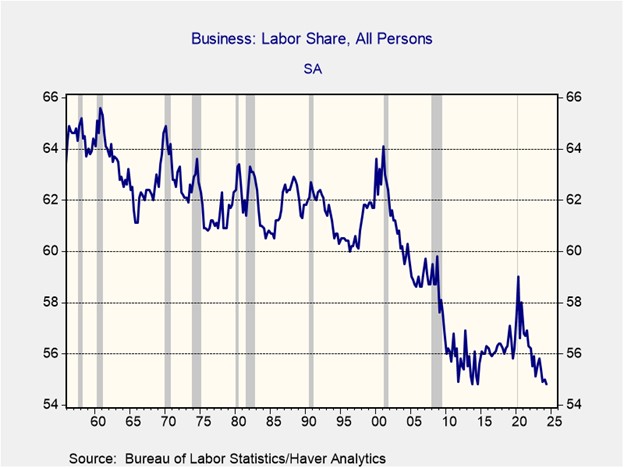

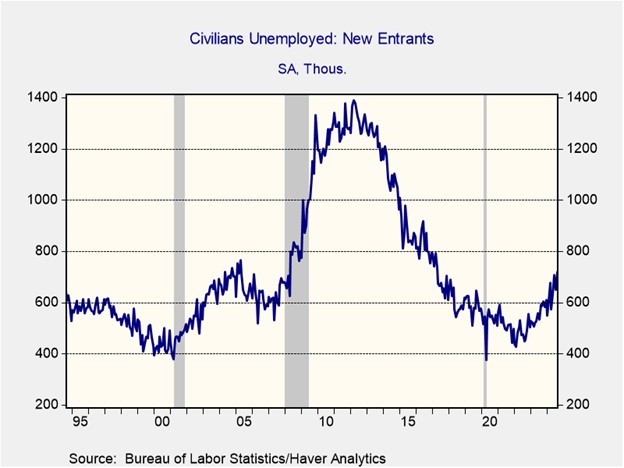

- There is major concern that the labor market might be cooling more rapidly than the central bank realizes. Since the Sahm Rule was triggered in July, there has been mounting evidence suggesting that firms are reducing their hiring. Recent payroll data reveals a significant slowdown in private-sector job creation, with the average for the past three months falling below 100,000 jobs — nearly half the rate that was observed in 2023. Additionally, the number of jobs available has also slipped, with the job vacancy rate falling to its lowest level since 2020.

- Despite recent economic concerns, there are positive signs. Jobless claims remain relatively low, indicating that firms are reluctant to lay off workers. Additionally, the Atlanta Fed’s GDPNow forecast has been revised upward from a week ago, suggesting a strengthening economic outlook. This strong growth suggests that businesses are well-positioned to maintain their current workforce. As a result, the central bank is likely still on track for the ever-elusive soft landing, but we will continue to monitor economic indicators closely.

Europe Growth Problems: The EU’s largest economy is faltering, raising concerns about the region’s overall economic health as it strives to maintain tight monetary policies and curb inflation.

- The German economy may already be in recession, according to the Bundesbank, which warned that growth could “stagnate or decline slightly” in the third quarter. This grim outlook comes after the economy has narrowly avoided the label despite having economic contractions two of the last three quarters. Additionally, firms are struggling as this month Volkswagen decided to halt production at some plants and BMW lowered its 2024 sales and earnings targets. Although the Bundesbank remains hopeful that the downturn won’t be severe, it conceded that industrial activity remains a problem.

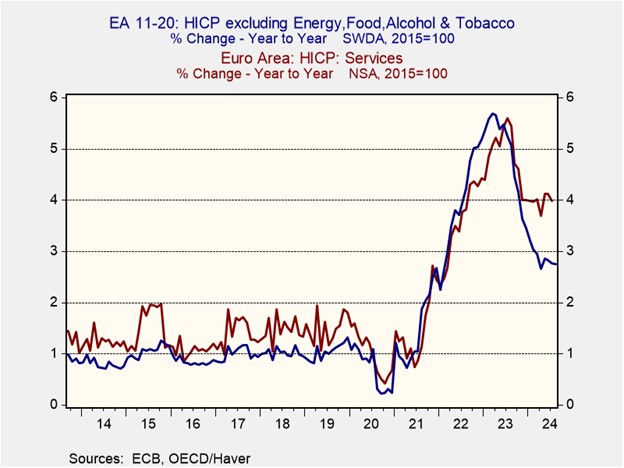

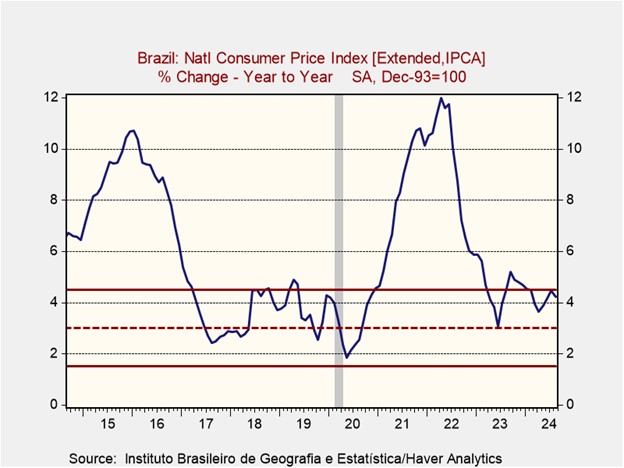

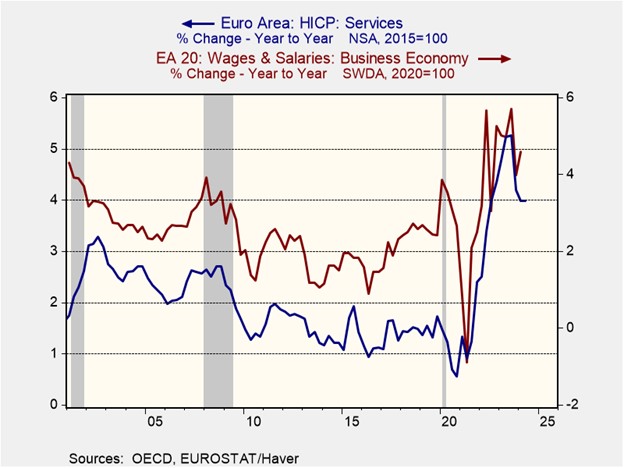

- Economic weakness in Germany could complicate the European Central Bank’s (ECB) efforts to maintain tight monetary policy to bring inflation down to target. Although the region has taken successful steps to reduce price pressures, concerns are growing that this progress is stalling, particularly in the services sector. Overall inflation has fallen from a 2022 peak of over 10.0% to 2.1% in August 2024. However, much of this decline is driven by a slowdown in goods inflation, with services inflation remaining stubbornly high at around 4%.

- The ECB must decide whether to prioritize containing inflation across the region or instead avoiding a severe economic downturn in Germany. Given Germany’s economic weight and influence within the EU, a significant downturn could force the central bank to take more aggressive steps to ease monetary policy. The effectiveness of these measures in combating inflation will depend on whether wage pressures, a major contributor to services inflation, show signs of easing. If worker pay were to accelerate, it would likely put upward pressure on inflation and this could weigh on the euro.

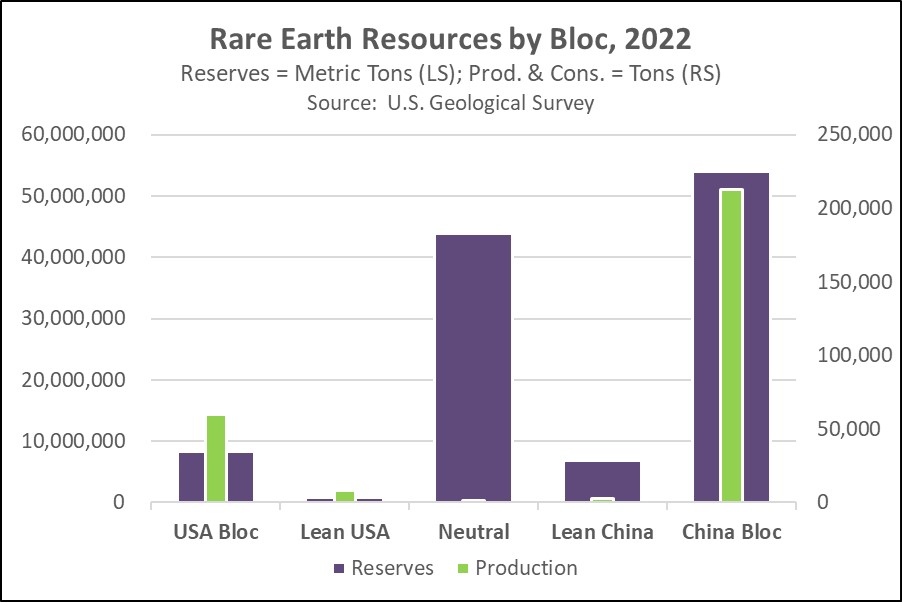

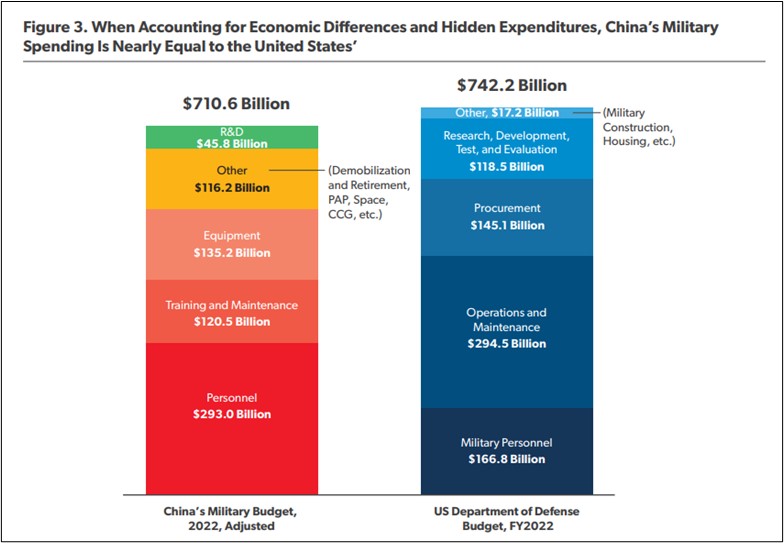

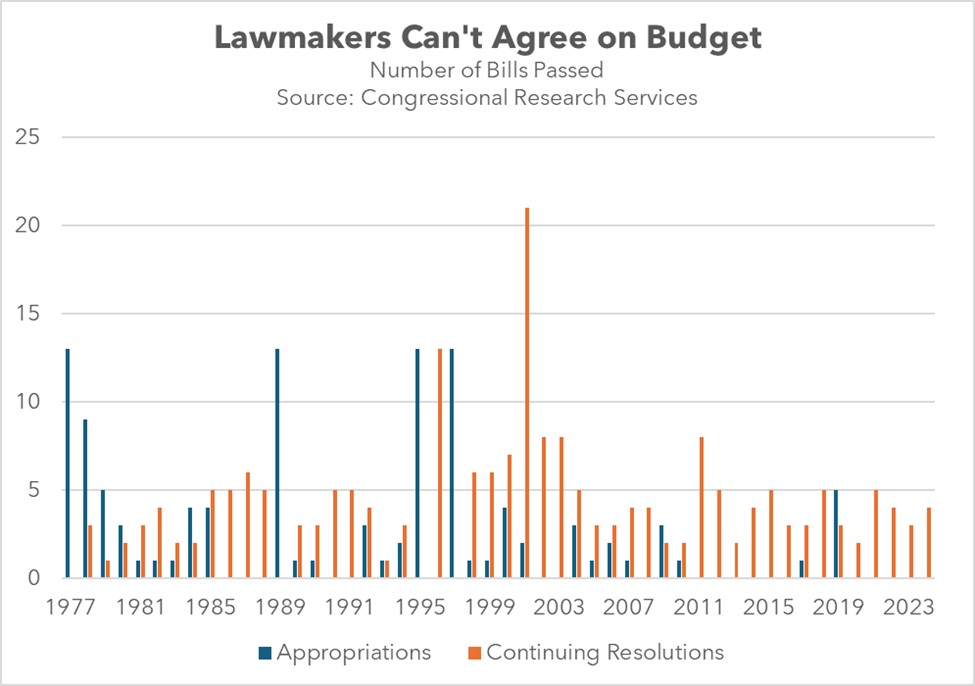

In Other News: Republican House Majority Leader Mike Johnson failed to push through a stopgap funding bill on Wednesday, raising the risk of a government shutdown. The Teamsters union announced it will not endorse any candidate in the upcoming election, signaling labor’s potential shift toward the populist wing of the Republican Party. Meanwhile, Taiwan expressed concerns that China’s increasing military activities are making it harder to detect signs of a possible invasion. The Bank of England decided to keep its rates unchanged at 5.0% for this month but signaled a willingness to ease policy gradually.