Daily Comment (January 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with news that an Iran-backed militant group has killed several U.S. troops in Jordan, boosting the chance that the Israeli-Hamas conflict will broaden. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including the forced liquidation of a major Chinese housing developer and a few words on the Federal Reserve’s policy meeting this week.

Israel-Hamas Conflict: In sympathy for the Hamas militant government now being attacked by Israel in retaliation for its October 7 attacks, an Iran-backed militant group in Syria launched a drone strike against a U.S. military base in northern Jordan yesterday, killing three U.S. troops and injuring dozens. Iran this morning has tried to distance itself from the strike, but the casualties will surely put heavy pressure on the Biden administration to retaliate against Iranian interests, potentially broadening the Israel-Hamas war into a regional conflict.

- Separately, Israeli intelligence reports shared with the U.S. reveal that at least a dozen employees of the United Nations Relief and Work Agency participated in Hamas’s October 7 attacks on Israel. Moreover, the reports indicate that UNRWA, which is the UN’s organization to help Palestinian refugees, is riddled with staff members who have ties to Islamist militant groups.

- Taken together, the U.S. troop casualties and the intelligence reports have ratcheted up investor concerns about a broader Middle East conflict so far this morning. Gold and crude oil prices initially rose on the news, although oil prices are now trading slightly lower for the day.

European Union: Manfred Weber, leader of the center-right European People’s Party (EPP) that is expected to place first in the European Parliament election in June, said in an interview last week that Europe needs to focus more on developing its own, independent military power outside the North Atlantic Treaty Organization, so it could defend itself even if the U.S. refused to come to its aid. Importantly, Weber even suggested that the EU develop its own nuclear weapons, perhaps under the leadership of the U.K. and France, which are already nuclear powers.

- As we have written many times, we think the most likely scenario going forward is that the growing U.S.-China rivalry fractures the world into a U.S.-led bloc consisting mostly of large, rich, highly developed liberal democracies and a few closely related emerging markets, and a China-led bloc consisting largely of authoritarian, commodity-focused emerging markets and frontier markets.

- However, if former President Trump is elected U.S. president in November, his first-term policies suggest he could renege on the U.S.’s alliance commitments, leaving the U.S. isolated and alone or scrambling to rebuild an alternative alliance structure while its former allies turn distrustful and adversaries like China and Russia keep rapidly building their armed forces. In this case, the EU, the non-U.S. NATO countries, Japan, and other former U.S. allies could be cut adrift and feel they’ve been left to defend themselves.

- We think leaders in the Chinese bloc hope for such an outcome, thinking they could then dominate the former U.S. allies, but Weber’s statements show that such a development could backfire on the Chinese bloc. If a dismantling of the U.S. bloc prompts the EU, the U.K., Japan, South Korea, Australia, and other former allies to develop or expand their own nuclear weapons, the Chinese and Russians would suddenly feel they are surrounded by dangerous enemies. The result would likely be a global nuclear arms race.

Germany: The far-right, anti-immigrant Alternative for Germany (AfD) party unexpectedly lost a district election in the state of Thuringia, dashing the fast-rising group’s hope to secure control of a local government for only the second time in its history. Mainstream voters have recently rallied against the AfD following revelations that it has explored a plan for mass deportations of German residents with foreign backgrounds, including citizens. However, the AfD could quickly recover from the Thuringia loss and continue to draw new support.

Japan: As Japanese stocks continue to perform strongly, we think the rise in prices partly reflects unexpectedly strong profits and productivity. Complementing those positive trends, new research shows that the number of Japanese companies offering stock as part of their employee compensation surged to 767 by August 2023, up from just 110 in 2015. If stock-based pay helps increase Japanese workers’ engagement and incentives, the move could be an additional reason for Japanese stocks to keep rising.

China: A court in Hong Kong today ordered the liquidation of giant, highly indebted housing developer China Evergrande (3333.HK, HKD, 0.163), about two years after the company’s default on its dollar bonds kicked off the financial crisis in China’s real estate market. After many years of debt-fueled overbuilding, the resulting heavy debt load and market retrenchment are now a major headwind for China’s economy, and, by extension, global demand.

China-Taiwan: As China continues to ramp up its military, economic, and diplomatic pressure on Taiwan to thwart any independence moves, the Taiwanese military this week inducted its first one-year draftees. To improve the quality of its troops, Taiwan in late 2022 increased its compulsory military service from just four months to one full year. The island is also trying to boost its arsenal of weapons to deter any potential Chinese invasion or blockade.

U.S. Monetary Policy: The Fed this week holds its latest policy meeting, with its decision due on Wednesday at 2:00 PM EST. The policymakers are widely expected to leave the benchmark fed funds interest-rate target unchanged at its current range of 5.25% to 5.50%. The focus for investors will be on the decision statement and Chair Powell’s following press conference, either of which could provide clues as to when the Fed will finally start to cut rates and reduce its balance sheet runoff. Many investors expect those moves as early as March, but we continue to think they’ll come a bit later than that.

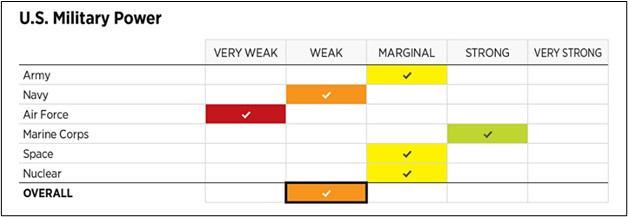

U.S. Military: In its 2024 Index of U.S. Military Strength, the Heritage Foundation has assessed that the country’s military is “not ready to carry out its duties effectively” and that its condition has “worsened over the past two to three years.” Issued last week, the report also faults U.S. leaders for not matching the renewed commitment to defense being demonstrated by allies such as Japan, Germany, Poland, and Lithuania.

- The report comes as all kinds of data also points to the increasing strength and aggressiveness of adversarial countries such as China, Russia, Iran, and North Korea.

- We continue to believe that a growing popular awareness of the global threats and the U.S. military shortcomings could prompt a stronger, more urgent effort to rebuild the country’s defense capability, with positive impacts for stocks in the industrial, technology, and other sectors that focus on selling to the military.

(Source: Heritage Foundation, 2024)

(Source: Heritage Foundation, 2024)