Daily Comment (January 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Wall Street cheers better-than-expected inflation news. Meanwhile, Novak Djokovic’s perfect streak in the Australian Open came to an abrupt end. In our Comment, we explain why optimism should be measured. We also delve into the regulatory storm clouds over Big Tech and dissect the ongoing move toward rate hikes by the Bank of Japan. Plus, we include your usual data for a well-rounded start to your day.

Recession to Paradise? Defying expectations, the economy not only remained in expansion territory in 2023, but it actually accelerated.

- U.S. GDP surged 2.54% in 2023, exceeding analysts’ forecasts and comfortably surpassing the previous year’s 1.9% rise. This robust performance, fueled by strong consumer spending and business investment, has defied fears of recession and has demonstrated the economy’s resilience in the face of tighter monetary policy. Sustained growth coupled with falling inflation have revived hopes for a soft landing, even as geopolitical and trade uncertainties linger. This brighter outlook has fueled a surge in stock prices and expectations for lower interest rates, which have provided a boost to risk assets.

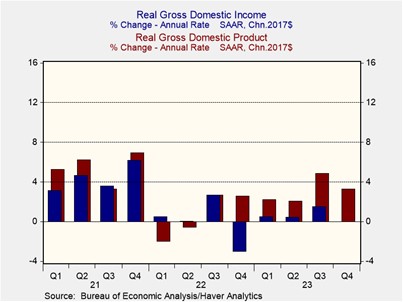

- Thursday’s figures have given investors plenty to cheer about, but beneath the surface, there are still signs that the economy isn’t humming along as smoothly as it might appear. Despite strong job growth headlines, in 2023 revisions lowered payrolls in all but one month, raising concerns about data accuracy. Further casting doubts on the economy’s health, regional Fed data like the Chicago National Activity Index and New York Fed Empire Manufacturing Index revealed weak economic activity. Moreover, Gross Domestic Income, another measure of growth, has consistently lagged behind Gross Domestic Product, suggesting potential underlying issues.

- Recessions can arise unexpectedly, even in the presence of positive indicators. A prime example is the 1973 downturn, which became the third-longest on record, when the U.S. economy added 313,000 jobs during the first month. Similarly, there was positive economic data leading up to the 2008 recession. We anticipate a slowdown in the U.S. economy rather than a full-blown downturn, and we remain optimistic about the potential for equities, particularly small and mid-caps. While recent economic data has been encouraging, it is important for investors to exercise caution and not become overly optimistic.

Regulators Take On AI: Concerns over market dominance have prompted regulators to launch an investigation into the AI practices of major tech firms.

- The FTC has initiated an inquiry into Big Tech’s aggressive acquisition practices concerning smaller AI firms. This investigation will scrutinize how industry giants like Microsoft (MSFT, $404.87), Alphabet (GOOG, $153.64), and Amazon (AMZN, $157.75) exploit their market dominance to procure smaller AI competitors, raising concerns about potential consumer harm and innovation suppression. The agency’s heightened attention to AI aligns with similar probes opened by U.K. and EU regulators, reflecting a growing chorus of concern about the tech giants’ tightening grip on the rapidly evolving AI landscape.

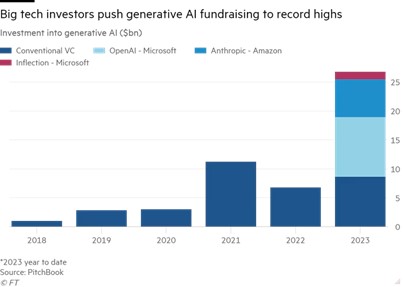

- Emerging language-learning startups, heavily reliant on Microsoft, Alphabet, and Amazon for crucial infrastructure, face an alarming vulnerability to hostile takeovers. These tech giants controlled two-thirds of the funding for AI firms in 2023, according to Pitchfork data, giving them immense leverage over fledgling companies. Big Tech’s control over cloud computing further intensifies the takeover risk for AI startups who heavily rely on these services for their core operations. A study by Deloitte revealed that 70% of companies derive their AI capabilities from cloud-based software, while 65% utilize cloud services to construct AI applications.

- Amidst the prevailing optimism surrounding AI-related enterprises, the outlook may be considerably more nuanced than initially perceived by investors. As major tech companies brace for heightened government scrutiny, with regulatory bodies collaborating to enhance oversight, the impact on tech-stock valuations remains uncertain. While acknowledging the market’s anticipation of potential upside in these stocks over the next few years, we believe that much of this optimism is already priced in. Consequently, while these companies may still present opportunities for capital gains, we foresee other sectors offering potentially superior relative returns in the future.

BOJ’s Hawkish Turn: While most developed central banks are looking to pivot toward dovish policy, the Bank of Japan hints that it may be going in the other direction.

- The Bank of Japan’s latest minutes hint at a possible turning point in monetary policy, as members debated the terms of exiting their ultra-loose quantitative easing (QE) program. Although disagreement persists, growing optimism about hitting their inflation target suggests a shift might be closer than previously thought. While some committee members proposed raising short-term rates and leaving long-term borrowing costs low, others urged caution, citing concerns about market turbulence if the bank stops buying risky assets. This split opinion suggests a gradual exit from QE might be more likely than a sudden shift.

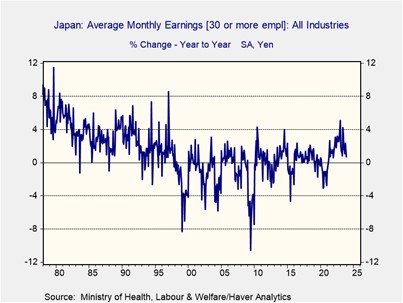

- That said, recent Japanese price data offers mixed signals about the future path of inflation. Tokyo’s core Consumer Price Index (CPI) rose 1.8% year-over-year, well below the central bank’s target of 2.0%. Meanwhile, the annual increase in producer prices reached 2.4% in December, matching the previous month’s nearly nine-year high. With mixed economic signals swirling, policymakers are putting extra weight on sustainable wage increases as a potential indicator of lasting inflation. Ongoing negotiations with Rengo, Japan’s largest union, could be the tipping point. If they secure their sought-after 5% wage hike, then this could be enough to convince policymakers that inflation has truly found its footing.

- Japanese investors, major players in the U.S. and European bond markets, face potential asset relocation if the Bank of Japan tightens monetary policy. This could trigger a domino effect in global debt markets with rising yields and currency fluctuations. However, the BOJ’s delay in this shift offers welcome news for the yen (JPY), potentially strengthening it and boosting returns for dollar-based investors who hold Japanese assets. The April timeline may be etched in market forecasts, but we see a different picture. Our conviction is that the BOJ will postpone its tightening path until summer, giving ample time for domestic data to solidify.

Other News: Despite growing skepticism from U.S. officials, Russian President Putin has hinted at a possible shift toward peace talks with Ukraine. This cautiously optimistic development follows a recent U.S.-China collaboration on AI regulation and Red Sea issues, suggesting a potential thaw in tensions. Meanwhile, Brazil is mediating a territorial dispute between Guyana and Venezuela, offering hope for further conflict reduction in South America. In short, geopolitical risks are starting to ease.